Germany Automotive industry Market Size, Share, and COVID-19 Impact Analysis, By Propulsion Type (Electric Vehicle Engine, Internal Combustion Engine Vehicle), By Vehicle Type (Commercial Vehicles, Passenger Vehicles), and Germany Automotive Industry Market Analysis and Forecast 2023 - 2033

Industry: Automotive & TransportationGermany Automotive Industry Market Insights Forecasts to 2033

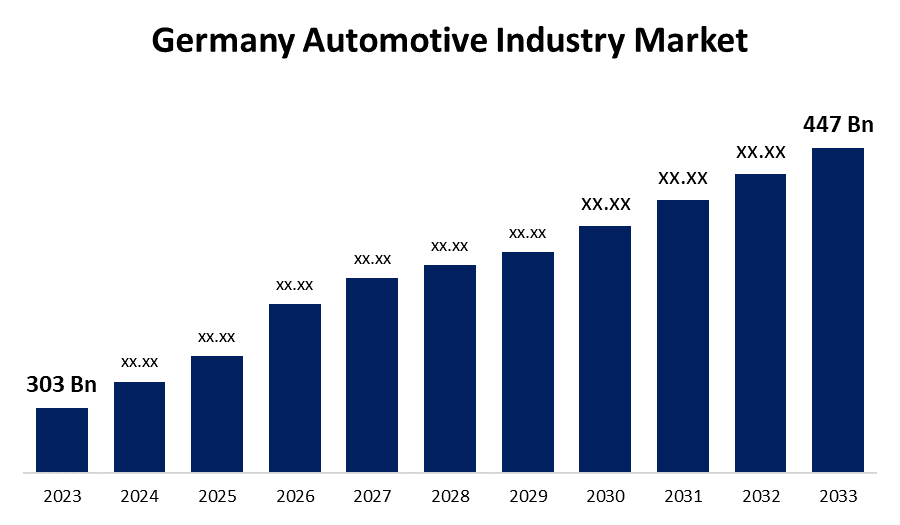

- The Germany Automotive Industry Market Size was valued at USD 303 Billion in 2023.

- The Market Size is Growing at a CAGR of 3.96% from 2023 to 2033.

- The Germany Automotive Industry Market Size is expected to reach USD 447 Billion by 2033.

Get more details on this report -

The Germany Automotive Industry Market Size is expected to reach USD 447 Billion by 2033, at a CAGR of 3.96% during the forecast period 2023 to 2033.

An Automotive is a wheeled vehicle capable of self-propulsion over long and short distances. The primary purpose of an Automotive is to transports materials, animals, or people from one location to another on land. The market deals with the design, manufacturing, distribution, and after-sales services of various types of automotive s, including larger vehicles like trucks and buses and more compact vehicles like cars and motorcycles. Germany is internationally renowned for its automotive industry and engineering excellence. According to Asia to the Americas, German cars are highly valued. Values for innovation, dependability, safety, and design. Germany dominates Europe's production and sales market. The country's automotive industry is globally recognized for its world-class R&D infrastructure, industry value chain integration, and highly qualified workforce. This allows companies to create innovative technologies that meet future mobility needs. Germany is Europe's largest automotive market, accounting for approximately 25% of passenger car production and nearly 20% of total sales. New registrations. Germany has the highest concentration of OEM plants in Europe. There are 44 OEM sites in Germany. In 2021, German OEMs dominated the EU market, accounting for over 55%. Thus, such factors are fuelling the automotive industry market growth in the forecast period.

Germany Automotive industry Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 303 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.96% |

| 2033 Value Projection: | USD 447 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Propulsion Type, By Vehicle Type |

| Companies covered:: | Mercedes, Porsche, Smart, Volkswagen (VW), Audi, BMW, Artega Automobile, Apollo Automobile, Eisenacher Motorenwerk, MAN SE, Borgward, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact,Challenges,Growth, Analysis. |

Get more details on this report -

Driving Factors

The German Association of the Automotive Industry (VDA) reports that Germany's automotive industry ranks first in global innovation rankings. Volkswagen, BMW and Daimler are among the top three global suppliers, alongside Bosch, Schaffler, and ZF. The industry intends to invest EUR 150 billion in digitalization, electric mobility, drive systems, hydrogen technology, and transportation safety in the forecast period. Future mobility growth will be driven by carbon emission reduction targets, smart traffic management, and the government's electric mobility initiative. Impressive developments have development has been made in developing smaller, highly charged "homogeneous combustion" engines and dual-clutch transmissions. Some manufacturers will use optimized combustion engines with synthetic fuels as a short-term solution until the European Union mandates emissions-free vehicles by 2035.

Restraining Factors

Commercializing them in the mass market is one of the main barriers to the market for automotive motors. Automobiles with more advanced features are currently in high demand in the mid-priced and luxury segments. They have more features than a decade ago and use more automotive motors than standard car models.

Market Segmentation

The electric vehicle engine segment dominates the market with the largest revenue share over the forecast period.

On the basis of the propulsion type, the Germany automotive industry market is segmented into electric vehicle engine, and internal combustion engine vehicle. Among these, the electric vehicle engine segment is dominating the market with the largest revenue share over the forecast period. An electric vehicle has a much lower running cost than a comparable gasoline or diesel vehicle. Electric vehicles are more efficient, and when combined with the cost of electricity, charging an electric vehicle is less expensive than filling up with gasoline or diesel for your transportation needs. Using renewable energy sources can make driving electric vehicles more environmentally friendly. The cost of electricity can be further reduced if charging is done using renewable energy sources installed at home, such as solar panels.

The commercial vehicles segment is witnessing significant CAGR growth over the forecast period.

On the basis of vehicle type, the Germany automotive industry market is segmented into commercial vehicles, and passenger vehicles. Among these, the commercial vehicles segment is witnessing significant growth over the forecast period. Commercial vehicles often have more cargo space, making them ideal for transporting goods and equipment, as well as assisting with personal belongings relocation. In this article, we will look at the advantages and disadvantages of owning a commercial vehicle as a personal vehicle, weighing the potential benefits and drawbacks. Commercial vehicles usually have advanced safety features such as increased frames, sturdy construction, and additional airbags. These features improve passenger safety, making them an excellent choice for families with young children or those who value safety in their daily commutes.

List of Key Market Players

- Mercedes

- Porsche

- Smart

- Volkswagen (VW)

- Audi

- BMW

- Artega Automobile

- Apollo Automobile

- Eisenacher Motorenwerk

- MAN SE

- Borgward

- Others

Key Market Developments

- In July 2023, HCLTech, a leading global technology company, announced today that it has reached a definitive agreement to acquire a 100% equity stake in ASAP Group, an automotive engineering services service provider. The transaction is subject to regulatory approvals and is scheduled to close in September 2023.

- In October 2022, The Volkswagen GOLF Model now includes a new safety feature, the center airbag, which helps to prevent possible contact between the heads of passengers sitting in the front seats in the event of a side collision. An additional standard lap belt tensioner for the front row has been installed to improve safety even further.

Market Segment

This study forecasts revenue at regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Germany Automotive Industry Market based on the below-mentioned segments:

Germany Automotive Industry Market, Propulsion Type Analysis

- Electric Vehicle Engine

- Internal Combustion Engine Vehicle

Germany Automotive Industry Market, Vehicle Type Analysis

- Commercial Vehicles

- Passenger Vehicles

Need help to buy this report?