Germany Automotive Third-Party Logistics (3PL) Market Size, Share, and COVID-19 Impact Analysis, By Service Type (Dedicated Contract Carriage, Domestic Transportation Management, International Transportation Management, Warehousing and Distribution, Value Added Logistics Services), By End User (Manufacturing, Retail, Healthcare, Automotive, Others), Analysis and Forecast 2023 - 2033

Industry: Automotive & TransportationGermany Automotive Third-Party Logistics (3PL) Market Insights Forecasts to 2033

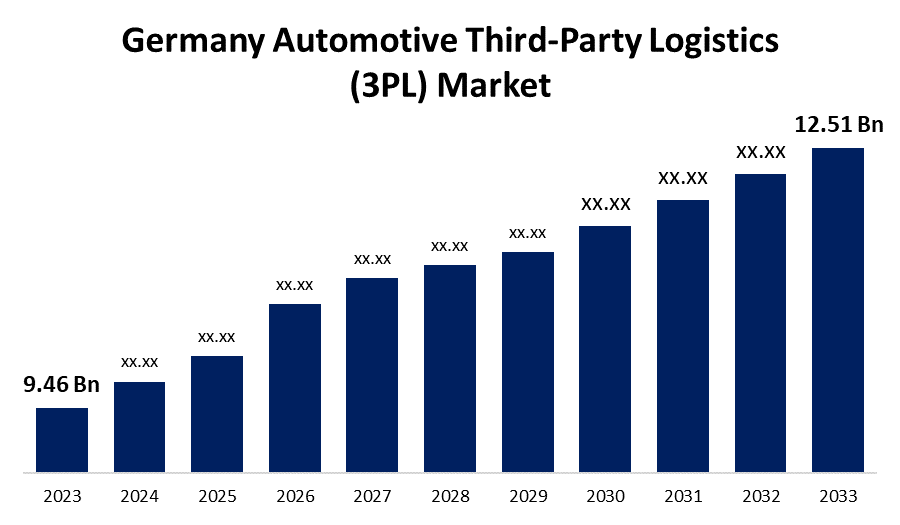

- The Germany Automotive Third-Party Logistics (3PL) Market Size was valued at USD 9.46 Billion in 2023.

- The Market Size is Growing at a CAGR of 2.83% from 2023 to 2033.

- The Germany Automotive Third-Party Logistics (3PL) Market Size is expected to reach USD 12.51 Billion by 2033.

Get more details on this report -

The Germany Automotive Third-Party Logistics (3PL) Market Size is expected to reach USD 12.51 Billion by 2033, at a CAGR of 2.83% during the forecast period 2023 to 2033.

Third-party logistics (3PL) is the practice of outsourcing supply chain management and logistics activities to specialized external firms. Companies use 3PL to manage transportation, warehousing, inventory management, and order fulfilment. Businesses that use 3PL can focus on their core competencies, increasing efficiency, lowering costs, and providing better service to their customers. 3PL providers have the expertise, technology, and resources to optimize logistics operations, ensuring seamless coordination among manufacturers, suppliers, and retailers. Collaboration with a 3PL partner allows for greater flexibility, scalability, and rapid adaptation to market changes, all of which contribute to the company's growth and success. The use of 3PL has become widespread in a variety of industries, demonstrating its importance in modern business techniques. Germany is Europe's second most populous country, with the largest economy. The country technically has 74 ports, with the major ones being Hamburg, Duisburg, Rostock, and others. Cars are one of the most traded goods in the world, and Germany, based on its reputation in the automotive industry, has always experienced consistent growth in this segment. In July, export expectations in Europe's largest economy's manufacturing sector increased, with the automotive industry benefiting the most.

Germany Automotive Third-Party Logistics (3PL) Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 9.46 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 2.83% |

| 2033 Value Projection: | USD 12.51 |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Service Type, By End User |

| Companies covered:: | DHL Post, Kuehne + Nagel International AG, Dachser, Honold, DSV Panalpina, Rhenus Logistics, Hellmann Worldwide Logistic, Rudolph Logistics Group, DB Schenker, Geodis, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact,Challenges,Growth, Analysis. |

Get more details on this report -

Driving Factors

Third-party logistics are in high demand in Germany, primarily due to the country's expanding e-commerce industry. To improve the customer experience, e-commerce retailers are quickly adopting third-party logistics services that are reliable, fast, and cost-effective. The use of advanced technologies such as AI, data analytics, and machine learning by service providers is helping to grow the German third-party logistics (3PL) market. Such technologies give clients more control over the supply chain and delivery by providing services like tracking, real-time query resolution, and delivery time optimization to improve and streamline logistics services.

Restraining Factors

While direct replacements for 3PL services are not widely available, there are several alternative approaches and technologies that can be employed. These include internal supply chain management, or in-house logistics management, and the emergence of 4PL providers, which offer improved supply chain coordination and management. Thus, such factors are hampering the market growth in the forecast period.

Market Segmentation

The domestic transportation management segment dominates the market with the largest revenue share over the forecast period.

On the basis of the service type, the Germany automotive third-party logistics (3PL) market is segmented into dedicated contract carriage, domestic transportation management, international transportation management, warehousing & distribution, and value-added logistics services. Among these, the domestic transportation management segment is dominating the market with the largest revenue share over the forecast period. Domestic transportation management in the third-party logistics (3PL) industry is being driven by e-commerce's continued growth. This has increased the need for effective domestic shipping solutions, resulting in increased demand for 3PL services. Enhanced technological integration, including tools such as real-time tracking and automated routing, has resulted in increased efficiency and transparency in domestic logistics. Government policies, infrastructure improvements, and consumer expectations for faster delivery all influence the market, requiring more responsive and flexible transportation management.

The manufacturing segment is witnessing significant CAGR growth over the forecast period.

On the basis of end user, the Germany automotive third-party logistics (3PL) market is segmented into manufacturing, retail, healthcare, automotive, and others. Among these, the manufacturing segment are witnessing significant growth over the forecast period. The Germany market is being impacted by the growing demand for a complex, integrated logistics network, making 3PL services essential for bridging the gap between production and market reach. The push for just-in-time manufacturing necessitates precise timing and coordination, both of which 3PL providers excel at. Automation and real-time tracking are examples of technological advancements that have increased manufacturing logistics efficiency and transparency. Environmental regulations have also resulted in a shift toward greener logistics solutions, with 3PL providers adopting sustainable practices.

List of Key Market Players

- DHL Post

- Kuehne + Nagel International AG

- Dachser

- Honold

- DSV Panalpina

- Rhenus Logistics

- Hellmann Worldwide Logistic

- Rudolph Logistics Group

- DB Schenker

- Geodis

- Others

Key Market Developments

- In February 2023, Samvardhana Motherson Automotive Systems Group BV (SMRPBV), a 100% subsidiary of Samvardhana Motherson International (SAMIL), has agreed to acquire a 100% stake in SAS Autosystemtechnik GmbH (Germany) (SAS) from Faurecia, a FORVIA Group company. SAS is a top global provider of assembly and logistics services to the automotive industry. It has long-standing customer relationships with leading European and American OEMs, some dating back nearly three decades.

- In October 2023, AD Ports Group, a leading logistics, industry, and trade facilitator, has acquired Sesé Auto Logistics, the Finished Vehicles Logistics (FVL) business of Grupo Logístico Sesé, for a total purchase consideration (EV) of EUR 81 million. The transaction is expected to be completed in Q1 2024, subject to regulatory approval.

Market Segment

This study forecasts revenue at regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Germany Automotive Third-Party Logistics (3PL) Market based on the below-mentioned segments:

Germany Automotive Third-Party Logistics (3PL) Market, Service Type Analysis

- Dedicated Contract Carriage

- Domestic Transportation Management

- International Transportation Management

- Warehousing & Distribution

- Value Added Logistics Services

Germany Automotive Third-Party Logistics (3PL) Market, End User Analysis

- Manufacturing

- Retail

- Healthcare

- Automotive

- Others

Need help to buy this report?