Germany Banking as A Service Market Size, Share, and COVID-19 Impact Analysis, By Product Type (API- based BaaS and Cloud-based BaaS), By Enterprise Size (Large Enterprise and SME), By End-use (Banks and NBFC), and Germany Banking as A Service Market Insights, Industry Trend, Forecasts to 2033

Industry: Banking & FinancialGermany Banking as A Service Market Insights Forecasts to 2033

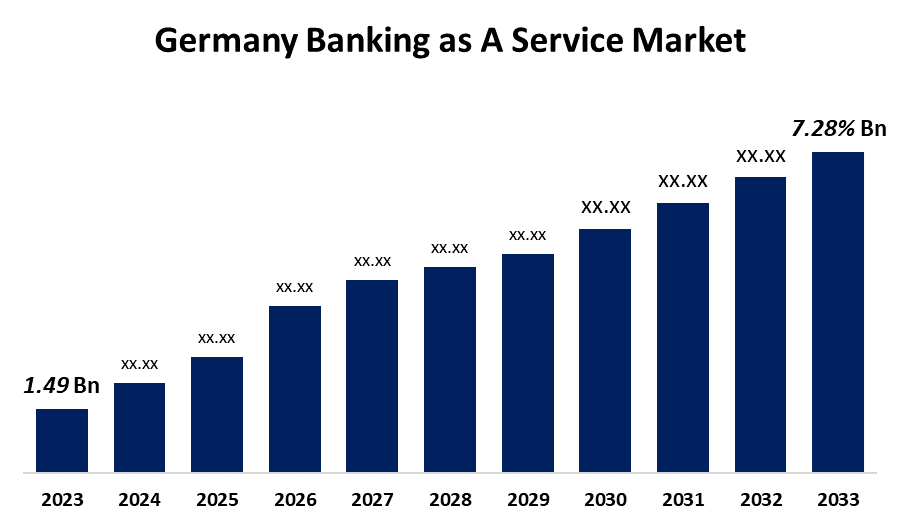

- The Germany Banking as A Service Market Size was valued at USD 1.49 Billion in 2023.

- The Market is growing at a CAGR of 7.28% from 2023 to 2033

- The Germany Banking as A Service Market Size is expected to reach USD 3.01 Billion by 2033

Get more details on this report -

The Germany Banking as A Service Market is anticipated to exceed USD 3.01 Billion by 2033, growing at a CAGR of 7.28% from 2023 to 2033.

Market Overview

A variety of financial services are provided to clients by non-bank businesses in collaboration with authorized banks under the terms of the banking as a service (BaaS) model. These services could involve loan origination, account opening, payment processing, and compliance management. Businesses can offer banking services without requiring a whole banking infrastructure due to BaaS providers' use of technology to integrate banking operations into platforms. Bank as a service (BaaS) involves offering banking products and services through external distributors. BaaS is made possible by the smooth integration of non-banking entities with regulated financial systems, providing unique offerings and accelerating entry to the market. It presents fresh ideas based on precision and flexibility, thus replacing current offerings and breaking down various profitable aspects of the traditional banking value chain. Moreover, while smaller banks and fintech have been leading the market, larger traditional banks are starting to increase investment in innovative API-based platforms. Recent new arrival like BBVA and Goldman Sachs have also launched their own BaaS portal for developers. The main factors driving market growth include increasing need for financial services, fast digitalization, and the presence of application programming interfaces (APIs). There is another cause for the industry's growth: the increasing trend of online banking. Consumer taste is moving towards utilizing online banking for accessing different services, such as money transfers, account statements, and online shopping.

Report Coverage

This research report categorizes the market for the Germany banking as a service market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany banking as a service market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany banking as a service market.

Germany Banking as A Service Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.49 Billion |

| Forecast Period: | 2023 to 2033 |

| Forecast Period CAGR 2023 to 2033 : | 7.28% |

| 2033 Value Projection: | USD 3.01 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Product Type, By Enterprise Size, By End-use and COVID-19 Impact Analysis |

| Companies covered:: | Deutsche Bank, Commerz Bank, KFW Bankgruppe, DZ Bank, HypoVereinsbank, Solaris Bank, and others Key Vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

BaaS supports traditional banks in offering advanced digital services, driving industry expansion during the banking sector's shift to digitalization. Enhanced competition and better customer interactions will drive sales growth. Collaboration between banks and fintech companies to offer innovative financial services and products through BaaS platforms. The expansion of digital banking services is fueling the growth of the banking-as-a-service (BaaS) market. The increasing prevalence of online banking has led traditional banks to collaborate with BaaS providers in order to remain competitive in the digital environment. BaaS allows these banks to rapidly incorporate cutting-edge digital capabilities and services into their products, improving customer experiences and keeping up with the growing need for online and mobile banking solutions.

Restraining Factors

The lack of standardized protocols and interoperability frameworks in the Germany banking industry hinders smooth integration and cooperation between financial institutions and BaaS platforms.

Market Segmentation

The Germany banking as a service market share is classified into product type, enterprise size and end use.

- The cloud-based BaaS segment is expected to hold the largest market share through the forecast period.

The Germany banking as a service market is segmented by product type into API-based BaaS and cloud-based BaaS. Among them, the cloud-based BaaS segment is expected to hold the largest market share through the forecast period. In addition to quickly introducing new digital features to users, the BaaS cloud offers other benefits. Enforcing policy consistently, provisioning automatically, and monitoring traffic can help digital businesses better meet their strict service commitments. Using cloud technology to improve digital operations can reduce damage to a company's reputation caused by service interruptions, leading to new growth opportunities in that industry segment.

- The large enterprise segment dominates the market with the largest market share over the predicted period.

The Germany banking as a service market is segmented by enterprise size into large enterprise and SME. Among them, the large enterprise segment dominates the market with the largest market share over the predicted period. Many major corporations are investing in banking services to offer consumers additional financial options. Furthermore, BaaS improves the platforms and products businesses utilize on a daily basis by providing contextualized, integrated banking services that are expected to boost segment growth.

- The banks segment dominates the market with the largest market share over the predicted period.

The Germany banking as a service market is segmented by end-use into banks and NBFC. Among them, the banks segment dominates the market with the largest market share over the predicted period. BaaS can help banks cut costs and increase revenue. Banks do not have to invest in technological development. As a result, they can take advantage of partnerships with other organizations since they already have access to pre-made solutions. Banks are expecting strategic partnerships to assist in future investment endeavours and profit forecasts. Additionally, the control can be credited to the banks' large funding capacity and their customers' trust.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany banking as a service market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Deutsche Bank

- Commerz Bank

- KFW Bankgruppe

- DZ Bank

- HypoVereinsbank

- Solaris Bank

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2023, DEUTSCHE Bank introduced DB Investment Partners (DBIP), a fresh investment manager catering to institutional clients and high-net-worth investors, with a focus on private credit opportunities. DBIP will focus on different types of private debt tactics, such as corporate, real estate, asset-backed, infrastructure, and renewable finance loan opportunities.

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Germany Banking as A Service Market based on the below-mentioned segments:

Germany Banking as A Service Market, By Product Type

- API- based BaaS

- Cloud-based BaaS

Germany Banking as A Service Market, By Enterprise Size

- Large Enterprise

- SME

Germany Banking as A Service Market, By End-use

- Banks

- NBFC

Need help to buy this report?