Germany Biopesticides Market Size, Share, and COVID-19 Impact Analysis, By Type (Bioinsecticides, Biofungicide, Bionematicide, and Others), By Source (Microbials and Biochemicals), By Mode of Application (Foliar Application, Seed Treatment, Soil Application, and Others), and Germany Biopesticides Market Insights, Industry Trend, Forecasts to 2033

Industry: AgricultureGermany Biopesticides Market Insights Forecasts to 2033

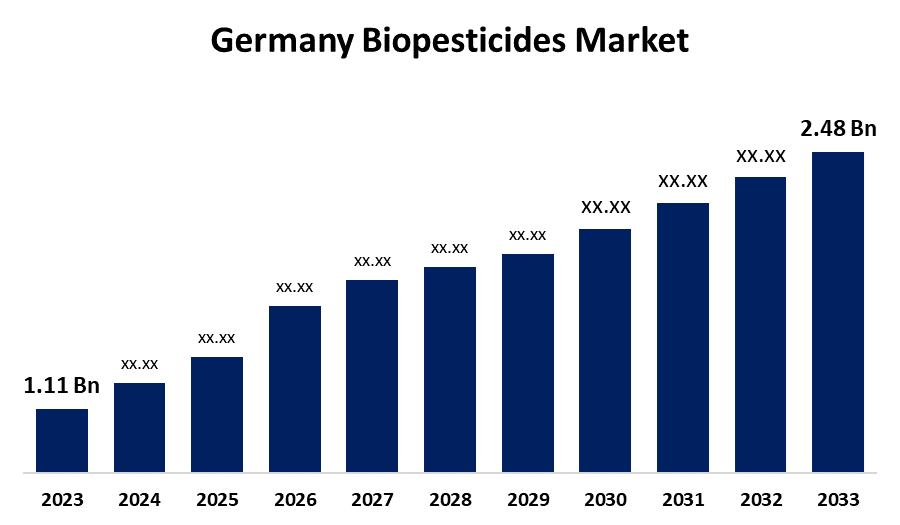

- The Germany Biopesticides Market Size was valued at USD 1.11 Billion in 2023.

- The Germany Biopesticides Market Size is Growing at a CAGR of 8.37% From 2023 to 2033

- The Germany Biopesticides Market Size is Expected to Exceed USD 2.48 Billion By 2033

Get more details on this report -

The Germany Biopesticides Market Size is Anticipated to Exceed USD 2.48 Billion by 2033, Growing at a CAGR of 8.37% From 2023 to 2033. The expansion of area under organic farming, rising environmental concerns, and adoption of new farming technologies are driving the biopesticides market in the Germany.

Market Overview

Biopesticides market is the market encompassing pesticides derived from natural sources like plants, animals, bacteria, and minerals that are used to manage pests in agriculture, forests, and gardens. Biopesticide is a biological substance or organism that damages, kills, or repels organisms seen as pests. It has a huge role to play in the sustainable management of crop pests. There is increasing emphasis on wide applications of biopesticides by the key market players along with the growing investment in the development of a robust agriculture sector. The surging demand for enhancing the cash and food crops in addition to the biopesticide's non-toxic nature and their role in improving soil fertility is responsible for driving the biopesticides market growth. The introduction of integrated pest management (IPM) systems for reducing chemical pesticide usage along with the growing research in biopesticides by institutions and companies are providing lucrative market opportunities.

Report Coverage

This research report categorizes the market for the Germany biopesticides market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany biopesticides market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany biopesticides market.

Germany Biopesticides Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.11 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.37% |

| 2033 Value Projection: | USD 2.48 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Type, By Source, By Mode of Application and COVID-19 Impact Analysis |

| Companies covered:: | Syngenta AG, Andermatt Group AG., Certis Belchim B.V, Bayer AG, Koppert, BASF SE, Valent BioSciences, Trifolio-M GmbH and others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The expanding organic farming in the country is responsible for driving market demand. Germany remains the largest market for organic food in Europe with a turnover of 15.87 billion euro in the year 2021. Biopesticides are biodegradable and minimizes chemical runoff into water bodies. Further, it reduces the risk of non-target species which includes insects like pollinators. The rising environmental concerns lead to the increasing emphasis on integrated pest management as it causes little disturbances to agricultural ecosystems driving the market growth. Further, the adoption of new farming technologies contributes to driving biopesticides market as it is increasingly integrated into new farming technologies as sustainable alternatives which offer effective crop protection and minimize environmental impact.

Restraining Factors

The limited awareness and reduced shelf life of biopesticides are challenging the market growth. The low speed of action of biopesticides than synthetic pesticides may hamper the market demand.

Market Segmentation

The Germany biopesticides market share is classified into type, source, and mode of application.

- The bioinsecticides segment dominated the market with a major market share in 2023 and is expected to grow at a significant CAGR growth during the projected timeframe.

Based on the type, the Germany Biopesticides market is divided into bioinsecticides, biofungicide, bionematicide, and others. Among these, the bioinsecticides segment dominated the market with a major market share in 2023 and is expected to grow at a significant CAGR growth during the projected timeframe. The growing concerns about the pesticide's impact on biodiversity as well as its adoption through government laws and policies are driving the market.

- The microbials segment dominated the market with a major market share in 2023 and is expected to grow at a significant CAGR growth during the projected timeframe.

Based on the source, the Germany biopesticides market is divided into microbials and biochemicals. Among these, the microbials segment dominated the market with a major market share in 2023 and is expected to grow at a significant CAGR growth during the projected timeframe. Microbial biopesticides derived from microorganisms such as bacteria, fungi, and viruses are eco-friendly alternatives with potential significant benefits.

- The foliar application segment dominated the Germany biopesticides market and is expected to grow at a significant CAGR growth during the projected timeframe.

Based on the mode of application, the Germany biopesticides market is divided into foliar application, seed treatment, soil application, and others. Among these, the foliar application segment dominated the Germany biopesticides market and is expected to grow at a significant CAGR growth during the projected timeframe. It involves spraying liquid formulations containing beneficial microorganisms or natural compounds directly onto plant leaves to protect against pests and diseases

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany biopesticides market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Syngenta AG

- Andermatt Group AG.

- Certis Belchim B.V

- Bayer AG

- Koppert

- BASF SE

- Valent BioSciences

- Trifolio-M GmbH

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2023, Bayer and Kimitec announced a new strategic partnership focused on accelerating the development and commercialization of biological crop protection solutions and biostimulants.

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Germany biopesticides market based on the below-mentioned segments:

Germany Biopesticides Market, By Type

- Bioinsecticides

- Biofungicide

- Bionematicide

- Others

Germany Biopesticides Market, By Source

- Microbials

- Biochemicals

Germany Biopesticides Market, By Mode of Application

- Foliar Application

- Seed Treatment

- Soil Application

- Others

Need help to buy this report?