Germany Butadiene Market Size, Share, and COVID-19 Impact Analysis, By Application (Polybutadiene, Chloroprene, Styrene-Butadiene, Nitrile Rubber, SB Latex, Acrylonitrile Butadiene Styrene, and Others), By End-Use (Plastic and Polymer, Tire and Rubber, Chemical, and Others), and Germany Butadiene Market Insights, Industry Trend, Forecasts to 2033.

Industry: Chemicals & MaterialsGermany Butadiene Market Insights Forecasts to 2033

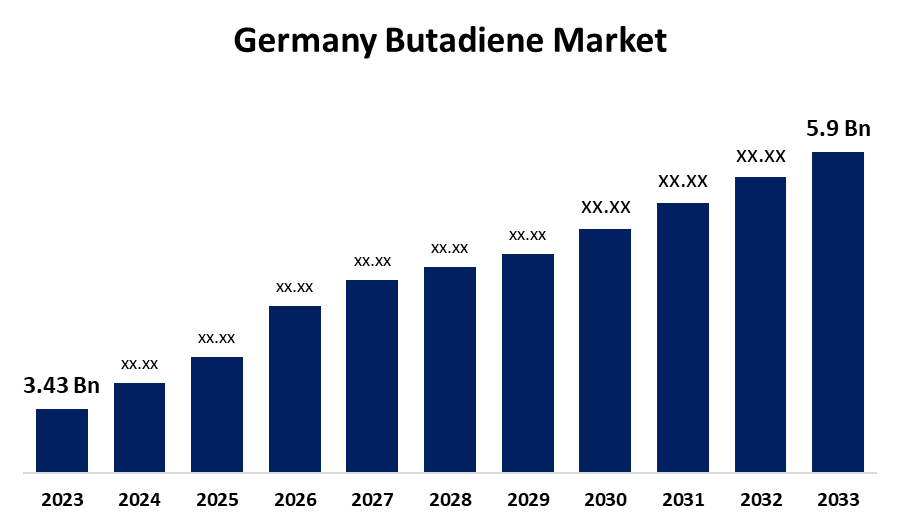

- The Germany Butadiene Market Size was valued at USD 3.43 Billion in 2023.

- The Market is Growing at a CAGR of 5.57% from 2023 to 2033

- The Germany Butadiene Market Size is Expected to Reach USD 5.9 Billion by 2033

Get more details on this report -

The Germany Butadiene Market is Anticipated to Reach USD 5.9 Billion by 2033, growing at a CAGR of 5.57% from 2023 to 2033

Market Overview

Butadiene can be found in gasoline, cigarette smoke, and wood fires. It is primarily present in synthetic rubber products such as rubber gloves, hoses, and tires. This chemical compound is mainly utilized in the polymer industry, particularly for manufacturing synthetic rubbers. It plays a role in creating rubbers, plastics, and elastomers, which are subsequently used in the production of various items like tires. In Germany, the predominant method of butadiene production is through the steam cracking of hydrocarbons, mainly derived from naphtha and ethane. The nation possesses a well-established chemical sector, with leading firms engaged in the production and processing of butadiene. Germany has sophisticated facilities for butadiene production, often generated as a by-product during ethylene manufacturing. Furthermore, Germany houses significant automotive manufacturers, which substantially elevates the demand for synthetic rubber utilized in tires and other components. The country boasts one of the largest chemical industries in Europe, with numerous companies engaged in the production of butadiene and its derivatives, fostering innovation and increasing capacity. Ongoing investments in research and development yield more efficient production technologies and processes, which improve both the yield and quality of butadiene.

Report Coverage

This research report categorizes the market for the Germany butadiene market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany butadiene market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany butadiene market.

Germany Butadiene Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 3.43 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.57% |

| 2033 Value Projection: | USD 5.9 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Application, By End-Use |

| Companies covered:: | BASF SE, INEOS Olefins & Polymers Europe, Evonik Industries AG, Lanxess, JSR, INEOS Group Limited, And Other Key Players. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

The Germany butadiene market is mainly influenced by several significant factors, such as strong demand from the automotive and rubber sectors, where butadiene plays a vital role as a feedstock for synthetic rubber production. The expanding automotive industry, especially with the rise of electric and hybrid vehicles, drives the necessity for high-performance tires and various rubber components. Furthermore, improvements in petrochemical technologies and production techniques have boosted the efficiency of butadiene extraction, leading to increased supply. Additionally, environmental regulations and a move towards sustainable materials may impact market trends, encouraging manufacturers to explore greener alternatives. In summary, the interaction of industrial demand, technological progress, and regulatory influences defines the butadiene market landscape in Germany.

Restraining Factors

The butadiene market in Germany faces various challenges that could impede its growth. One major issue is the fluctuation in raw material prices, especially for crude oil and natural gas, which can influence production costs and profitability. Furthermore, stringent environmental regulations designed to reduce emissions and encourage sustainable practices may restrict butadiene production or raise operational expenses for manufacturers.

Market Segmentation

The Germany butadiene market share is classified into application and end-use.

- The styrene-butadiene segment is expected to hold the largest market share through the forecast period.

The Germany butadiene market is segmented by application into polybutadiene, chloroprene, styrene-butadiene, nitrile rubber, SB latex, acrylonitrile butadiene styrene, and others. Among these, the styrene-butadiene segment is expected to hold the largest market share through the forecast period. The segmental growth due to its exceptional performance traits have established it as a fundamental material across various sectors. SBR excels in applications that demand high resistance to abrasion, strong aging properties, and outstanding handling performance. Throughout processing and throughout its usable life, it retains good tensile strength and resistance to tearing. The material offers remarkable flexibility, even in low-temperature conditions, making it ideal for tires and rubber products designed for colder environments.

- The tire and rubber segment is expected to dominate the Germany butadiene market during the forecast period.

Based on the end-use, the Germany butadiene market is divided into plastic and polymer, tire and rubber, chemical, and others. Among these, the tire and rubber segment is expected to dominate the Germany butadiene market during the forecast period. The increasing number of vehicles and the demand for high-performance tires has led to a significant rise in butadiene consumption. As a key raw material used in tire tread and sidewall materials, butadiene's usage in the tire sector has surged dramatically. Styrene butadiene rubber (SBR), produced from butadiene, forms the foundation of contemporary tire technology, making up more than 30% of an average passenger tire.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany butadiene market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BASF SE

- INEOS Olefins & Polymers Europe

- Evonik Industries AG

- Lanxess

- JSR

- INEOS Group Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2022, Synthos announces that it has reached a major milestone in the development of advanced bio-butadiene technology. After completing a successful feasibility study in 2021, Synthos, Lummus Technology and its Green Circle business have concluded that the bio-butadiene technology is ready for implementation, and the companies have agreed to move into the engineering and design phase of the project.

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Germany Butadiene Market based on the below-mentioned segments:

Germany Butadiene Market, By Application

- Polybutadiene

- Chloroprene

- Styrene-Butadiene

- Nitrile Rubber

- SB Latex

- Acrylonitrile Butadiene Styrene

- Others

Germany Butadiene Market, By End-use

- Plastic and Polymer

- Tire and Rubber

- Chemical

- Others

Need help to buy this report?