Germany Construction Equipment Market Size, Share, and COVID-19 Impact Analysis, By Equipment (Earthmoving Equipment, Material Handling Equipment, and Heavy Construction Equipment), By Application (Commercial, Residential, and Infrastructure), and Germany Construction Equipment Market Insights, Industry Trend, Forecasts to 2033

Industry: Construction & ManufacturingGermany Construction Equipment Market Insights Forecasts to 2033

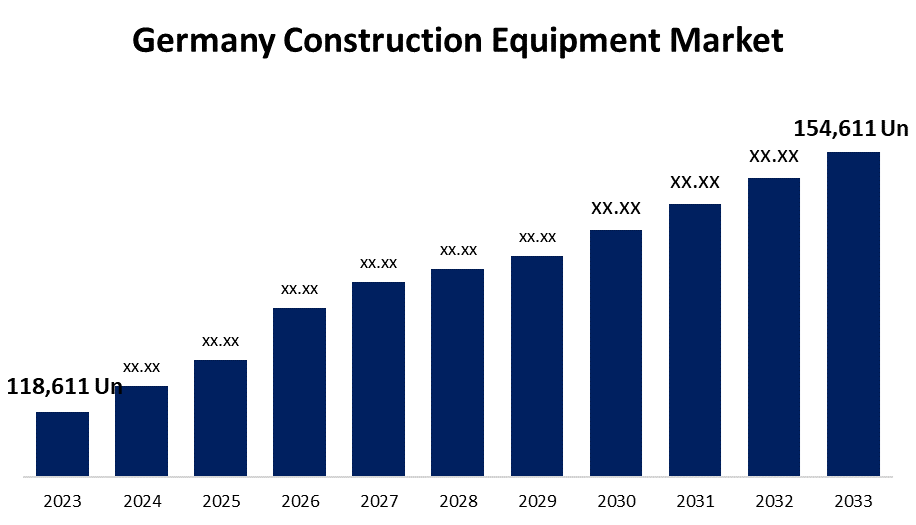

- The Germany Construction Equipment Market Size was valued at 118,611 Units in 2023.

- The Market Size is Growing at a CAGR of 2.69% from 2023 to 2033

- The Germany Construction Equipment Market Size is Expected to Reach 154,611 Units by 2033

Get more details on this report -

The Germany Construction Equipment Market Size is Anticipated to Exceed 154,611 Units by 2033, Growing at a CAGR of 2.69% from 2023 to 2033.

Market Overview

Construction machinery is specifically designed equipment utilized for performing construction operations. These instruments are used for a range of jobs like drilling, moving, digging, laying roads, and leveling. The market consists of a range of sectors such as manufacturing, oil & gas, and construction & infrastructure. The primary emphasis in the design of new equipment is on implementing modifications that will enhance the speed, efficiency, and accuracy of the machines while performing a specific task. These changes aim to improve operator safety and comfort as well as protect the environment through sound control and emission regulation. The BMDV has recognized a notable lack of attention to the railway industry over the past years, leading to a large number of overdue investments. Furthermore, the Ministry of Transport has set aside $1.6 Units for rail in the 2024 budget, which comes from the CO2 surcharge imposed on heavy goods vehicles. It focuses on maintaining the structure of existing networks and reducing congestion on main transportation routes. Around USD 159.1 Billion out of the total USD 302.2 Billion funding until 2030 will be dedicated to upkeep of current networks.

Report Coverage

This research report categorizes the market for the Germany construction equipment market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany construction equipment market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany construction equipment market.

Germany Construction Equipment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | 118,611 Units |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 2.69% |

| 2033 Value Projection: | 154,611 Units |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 199 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Equipment, By Application |

| Companies covered:: | Caterpillar, Komatsu, Volvo CE, Liebherr, JCB, Hitachi Construction Machinery, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Germany's government is putting money into the modernization of infrastructure projects, such as extending ports, train tracks, roads, and highways throughout the nation. An example is the 2030 Transport Infrastructure Plan, which details the transport strategy for the next fifteen years, including improvements and new developments for road, rail, and waterway networks. Ongoing upgrades and maintenance of public infrastructure are anticipated to boost the construction equipment market in Germany in the upcoming period. The German Property Federation (ZIA) estimates that the current shortage of 600,000 apartments in Europe's biggest economy will rise to 830,000 by 2027. The nation has allocated USD 220 Billion until 2026 for helping with industrial transformation, such as climate protection, hydrogen technology, and expanding electric vehicle charging stations. These initiatives are expected to bolster the expansion of the construction equipment market in Germany.

Restraining Factors

The market growth is being hindered by the expensive cost of products. The high cost poses a significant challenge to the market. Construction companies must invest a substantial sum to purchase costly machinery.

Market Segmentation

The Germany construction equipment market share is classified into product, distribution channel, and application.

- The earthmoving equipment segment is expected to hold the largest market share through the forecast period.

The Germany construction equipment market is segmented by equipment into earthmoving equipment, material handling equipment, and heavy construction equipment. Among these, the earthmoving equipment segment is expected to hold the largest market share through the forecast period. Germany is still funding infrastructure projects like roads, bridges, and utilities. Earthmoving machinery like excavators, bulldozers, and loaders play a vital role in the necessary tasks of ground preparation, excavation, and levelling in construction projects.

- The commercial segment dominates the market with the largest market share over the predicted period.

The Germany construction equipment market is segmented by application into commercial, residential, and infrastructure. Among them, the commercial segment dominates the market with the largest market share over the predicted period. The commercial sector is expected to experience consistent growth soon as a result of the increasing commercialization and foreign direct investments in the country for international manufacturing facilities. The expansion of commercial infrastructure in established and country is likely to capture a significant portion of the market in Germany.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany construction equipment market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Caterpillar

- Komatsu

- Volvo CE

- Liebherr

- JCB

- Hitachi Construction Machinery

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In November 2023, the government of Germany offered extended financial guarantees to Siemens Energy, a top wind farm producer based in Munich. This choice is included in a $16.2 Units plan aimed at helping the company during financial difficulties and allowing it to stay engaged in important renewable energy projects.

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Germany Construction Equipment Market based on the below-mentioned segments:

Germany Construction Equipment Market, By Equipment

- Earthmoving Equipment

- Material Handling Equipment

- Heavy Construction Equipment

Germany Construction Equipment Market, By Application

- Commercial

- Residential

- Infrastructure

Need help to buy this report?