Germany Diabetes Devices Market Size, Share, and COVID-19 Impact Analysis, By Type (BGM Devices and Insulin Delivery Devices), By End-Use (Hospitals, Diagnostic Centers, and Homecare), and Germany Diabetes Devices Market Insights, Industry Trend, Forecasts to 2033

Industry: Advanced MaterialsGermany Diabetes Devices Market Insights Forecasts to 2033

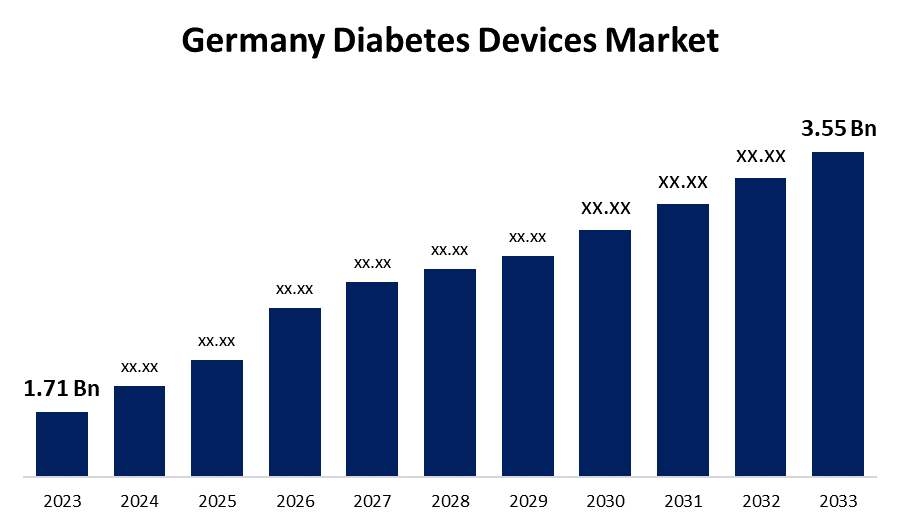

- The Germany Diabetes Devices Market Size was valued at USD 1.71 Billion in 2023.

- The Market Size is Growing at a CAGR of 7.58% from 2023 to 2033

- The Germany Diabetes Devices Market Size is Expected to Reach USD 3.55 Billion by 2033

Get more details on this report -

The Germany Diabetes Devices Market Size is Anticipated to Reach USD 3.55 Billion by 2033, growing at a CAGR of 7.58% from 2023 to 2033.

Market Overview

Diabetes devices are tools that assist people with diabetes in managing their condition, such as by monitoring blood sugar levels or delivering insulin. The diabetes devices market in Germany is conducive to technologically innovative startups. Approximately 80% of the medical device manufacturers in the country, including those producing diabetes devices, are small and medium-sized enterprises (SMEs). The industry is also influenced by major market players. Moreover, factors driving the diabetes device industry in Germany include increasing obesity rates, a growing prevalence of diabetes, and higher levels of physical inactivity. Equipment used for monitoring diabetes includes ketone meters, blood glucose meters, continuous glucose meters, insulin pumps, smart insulin pens, and software for managing diabetes. These glucose monitoring devices help patients manage and regulate their glucose levels, thereby improving their overall well-being.

Report Coverage

This research report categorizes the market for the Germany diabetes devices based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany diabetes devices market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany diabetes devices market.

Germany Diabetes Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.71 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 7.58% |

| 2033 Value Projection: | USD 3.55 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 178 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By End-Use. |

| Companies covered:: | Ypsomed Holding AG, DexCom Inc,Arkray, B. Braun, Novo Nordisk A/S ADR, Bayer AG,Insulet Corp, Roche Holding AG , Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Germany diabetes device market is growing due to the increasing number of people with diabetes, which is leading to higher healthcare spending. The rising adoption of continuous glucose monitoring (CGM) systems is also a major factor driving the German diabetes device market. CGM devices monitor blood glucose levels continuously, giving patients real-time data to help them manage their condition more effectively. This technology has been shown to improve control of blood sugar levels, reduce episodes of low blood sugar, and enhance the quality of life for patients. As diabetes becomes more common, there is expected to be a greater demand for these devices, which will further boost the market for diabetes devices in Germany.

Restraining Factors

Some factors that restrain the growth of the Germany diabetes devices market include the cost of diabetes devices, especially insulin pumps, is high, and reimbursement coverage is low. Access to diabetes devices is limited, which can hinder widespread use. Issues with accuracy and reliability can create skepticism among users. Stringent government regulations and rules governing the product approval process can hinder Germany diabetes device market growth.

Market Segmentation

The Germany diabetes devices market share is classified into type and end-use.

- The insulin delivery devices segment is expected to hold the largest market share through the forecast period.

The Germany diabetes devices market is segmented by type into BGM devices, and insulin delivery devices. Among these, the insulin delivery devices segment is expected to hold the largest market share through the forecast period. The insulin delivery devices provide an effective and advanced solution for patients to manage diabetes. Insulin delivery devices are medical tools designed to administer insulin, into the body. These devices are used by individuals with diabetes, particularly those who require insulin therapy to manage their condition. Insulin delivery devices provide a convenient and controlled way to deliver insulin, which is critical for maintaining proper blood glucose levels and preventing complications related with diabetes.

- The hospitals segment is expected to dominate the Germany diabetes devices market during the forecast period.

Based on the end-use, the Germany diabetes devices market is divided hospitals, diagnostic centers, and homecare. Among these, the hospitals segment is expected to dominate the Germany diabetes devices market during the forecast period. The increase in hospital admissions among diabetes patients is increasing demand for the diabetes devices sector. Individuals with diabetes are three times more likely to be hospitalized than those without diabetes. In recent years, diabetes technology has advanced rapidly, with a focus on improving diabetes care in medical facilities. As a result, there has been a significant increase in the use of insulin pumps in hospitals and clinics.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany diabetes devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ypsomed Holding AG

- DexCom Inc

- Arkray

- B. Braun

- Novo Nordisk A/S ADR

- Bayer AG

- Insulet Corp

- Roche Holding AG

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2023, DexCom has launched the Dexcom G6 Real-Time Continuous Glucose Monitoring System (rt-CGM), which is compatible with the Omnipod 5 automated insulin delivery (AID) System in Germany.

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Germany Diabetes Devices Market based on the below-mentioned segments:

Germany Diabetes Devices Market, By Type

- BGM Devices

- Insulin Delivery Devices

Germany Diabetes Devices Market, By End-Use

- Hospitals

- Diagnostic Centers

- Homecare

Need help to buy this report?