Germany Digital Remittance Market Size, Share, and COVID-19 Impact Analysis, By Type (Inward and Outward), By End-Use (Migrant Labor Workforce, Personal, Small Businesses, and Others), and Germany Digital Remittance Market Insights, Industry Trend, Forecasts to 2033.

Industry: Banking & FinancialGermany Digital Remittance Market Insights Forecasts to 2033

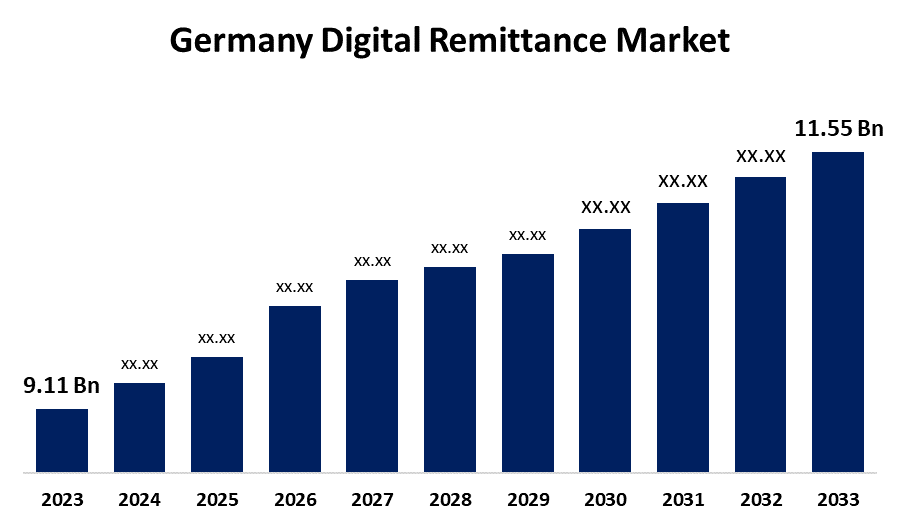

- The Germany Digital Remittance Market Size was valued at USD 9.11 Billion in 2023.

- The Market Size is Growing at a CAGR of 2.40% from 2023 to 2033

- The Germany Digital Remittance Market Size is Expected to Reach USD 11.55 Billion by 2033.

Get more details on this report -

The Germany Digital Remittance Market Size is Anticipated to Exceed USD 11.55 Billion by 2033, Growing at a CAGR of 2.40% from 2023 to 2033.

Market Overview

The electronic transmission of money across international borders between an individual or corporation is referred to as a "digital remittance." This strategy bypasses traditional banking channels and physical money transfer intermediaries by using digital platforms, most commonly internet services or mobile applications, to facilitate the transfer. Remittances enable foreign workers to transfer billions of dollars annually to support their families' medical and educational needs back home. Remittances account for 5% of the GDP in more than 60 low-income nations. Traditional remittances, which might be a time-consuming and expensive process, usually entailed physical transactions until recently. The pandemic arrived with digital remittances already beginning to gain traction, but lockdowns, locked borders, and isolation restrictions sped up the process. There was a rise in electronic transactions for established wire transfer businesses like Western Union and MoneyGram Digital remittance enhances the flow of money, encourages financial inclusion, reduces transaction costs, and supports economic growth.

Report Coverage

This research report categorizes the market for the Germany digital remittance market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany digital remittance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany digital remittance market.

Germany Digital Remittance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 9.11 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 2.40% |

| 2033 Value Projection: | USD 11.55 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 178 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By End-Use |

| Companies covered:: | Deutsche Bank, Citigroup Inc., JPMorgan Chase & Co., PayPal, RIA Financial Services Ltd., Barclays Plc, WorldRemit, Credit Agricole, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

Over the past two years, companies that specialize in digital money transfers have seen rapid growth. In April 2020, for instance, World Remit increased by 150% year over year. Younger migrant workers who may send money home to unbanked friends and family now choose mobile payments over other digital remittance methods. The German market for digital remittances is heavily influenced by the cross-border payments industry, which is anticipated to increase by 53% by the end of the decade and reach a market value of $190.1 trillion in 2023. In the last year, remittances to Ukraine have increased significantly due to the conflict there; according to the most recent data from the German Federal Bank, the countries receiving the largest amounts of money are Turkey, Romania, Poland, and Syria, in that order. A lot of online money transfer companies are concentrating on providing their customers with services that are easy to use. These platforms facilitate easy site navigation for clients.

Restraining Factors

High remittance costs and a lack of knowledge about digital remittance services are predicted to impede market expansion. Furthermore, during the course of the projected period, security obstacles including money laundering and the funding of terrorism could have an adverse impact on the market's growth prospects.

Market Segmentation

The Germany digital remittance market share is classified into type and end-use.

- The outward services segment is expected to hold a significant market share through the forecast period.

The Germany digital remittance market is segmented by type into inward and outward. Among these, the outward services segment is expected to hold a significant market share through the forecast period. Banks can now provide services to both their resident and non-resident clients thanks to this technology. Wire transfer services are the most popular, quickest, and safest ways of sending money overseas, thus migrant workers are concentrating on using them for inward remittances.

- The personal segment is expected to dominate the Germany digital remittance market during the forecast period.

Based on the end-use, the Germany digital remittance market is divided into migrant labor workforce, personal, small businesses, and others. Among these, the personal segment is expected to dominate the Germany digital remittance market during the forecast period. Employees looking to send money home are anticipated to use digital remittance services more frequently as a result of increased international mobility.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany digital remittance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Deutsche Bank

- Citigroup Inc.

- JPMorgan Chase & Co.

- PayPal

- RIA Financial Services Ltd.

- Barclays Plc

- WorldRemit

- Credit Agricole

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2024, Visa and Western Union have established a 7-year partnership. Customers of Western Union will now be able to transfer money to approved bank accounts and Visa cards in 40 countries across five regions for their friends and family.

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Germany Digital Remittance Market based on the below-mentioned segments:

Germany Digital Remittance Market, By Type

- Inward

- Outward

Germany Digital Remittance Market, By End-Use

- Migrant Labor Workforce

- Personal

- Small Businesses

- Others

Need help to buy this report?