Germany E-Commerce Market Size, Share, and COVID-19 Impact Analysis, By Product (Clothing & Accessories, Consumer Electronics, Healthcare Products, Home Appliances, Cosmetics, Groceries, Books, Others), By Payment Type (Cash on Delivery, Cards, E-Wallet, Others), By Model Type (Business-to-Consumer [B2C], Business-to-Business [B2B], Consumer-to-Consumer [C2C]), and Forecasts to Forecast2022 - 2032

Industry: Consumer GoodsGermany E-Commerce Market Insights Forecasts to 2032

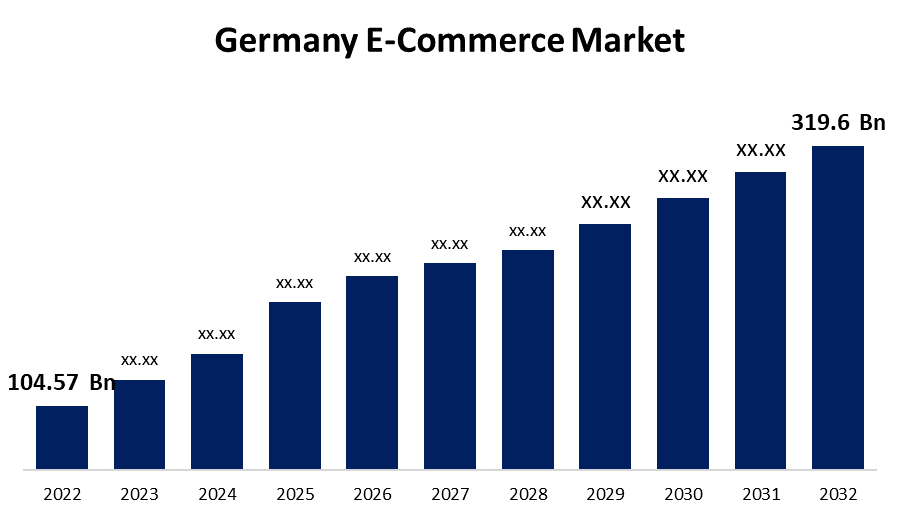

- The Germany E-Commerce Market Size was valued at USD 104.57 Billion in 2022.

- The Market Size is growing at a CAGR of 11.8% from 2022 to 2032.

- The Germany E-Commerce Market Size is expected to reach USD 319.6 Billion by 2032.

Get more details on this report -

The Germany E-Commerce Market Size is expected to reach USD 319.6 Billion by 2032, at a CAGR of 11.8% during the forecast period 2022 to 2032.

Market Overview

Germany has one of Europe's largest e-commerce markets, providing many options for both international online retailers and service providers. The sheer number of e-commerce customers, internet penetration, and average annual spending are all higher than the European average in Germany. The commercial transaction of products and services through the Internet is called e-commerce, sometimes known as electronic commerce. These transactions are largely carried out through several business models, including business-to-customer (B2C), business-to-business (B2B), and customer-to-customer (C2C). E-commerce platforms have several advantages over traditional brick-and-mortar alternatives, including lower inventory costs, higher profit margins, various discounts, hassle-free delivery of goods and services, and many more. In 2021, e-commerce penetration in the German market reached 77%. Due to strong COVID lockdown measures implemented throughout 2020 and 2021, many German consumers boosted their online purchases and purchased things such as groceries and sanitary items online for the first time. Furthermore, Germany's robust e-commerce business can be linked to a sizable proportion of the population owning smartphones. In 2021, smartphones accounted for 59% of all internet transactions. This trend is expected to continue as businesses improve their mobile websites and offer more simple methods to shop on mobile devices.

Report Coverage

This research report categorizes the market for Germany E-Commerce Market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany E-Commerce Market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the Germany E-Commerce Market.

Germany E-Commerce Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 104.57 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 11.8% |

| 2032 Value Projection: | USD 319.6 Billion |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 177 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | COVID-19 Impact Analysis, By Product, By Payment Type, By Model Type |

| Companies covered:: | Lidl Stiftung & Co. KG, Zalando SE, MediaMarkt, Amazon, OBI GmbH & Co., Deutschland KG, Otto GmbH & Co KG, Idealo (Axel Springer SE), Tchibo GmbH, Musikhaus Thomann, eBay Kleinanzeigen, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The high internet penetration in Germany, combined with the increasing usage of smart devices, is primarily fueling the market for e-commerce platforms. Additionally, to rising urbanization, many traditional brick-and-mortar firms are turning to e-commerce platforms to increase their consumer base, control overhead expenses, and boost product sales. Furthermore, the growing tendency of online shopping, particularly among Generation Y and metropolitan communities, for increased convenience and doorstep delivery is boosting the country's market size. Aside from that, rising consumer awareness of the numerous benefits of e-commerce platforms, such as easy access to product information, real-time deliveries and shipping status, encrypted payment gateways, different rebates and reimbursement promotions, and other such features, is propelling market growth. The Germany e-commerce market is expected to be driven by a number of other factors, including the integration of online platforms with cutting-edge technologies like live tracking, artificial intelligence (AI), statistical analysis, and so forth, and an evolving trend toward e-commerce platforms. Furthermore, the increasing acceptance of m-commerce in Germany is helping to the expansion of the country's e-commerce business. This trend is projected to keep growing as retailers upgrade their mobile websites and offer even more convenient mobile shopping options.

Market Segment

- In 2022, the clothing & accessories segment is witnessing a higher growth rate over the forecast period.

Based on the product, the Germany E-Commerce Market is segmented into clothing & accessories, consumer electronics, healthcare products, home appliances, cosmetics, groceries, books, and others. Among these, the clothing & accessories segment is witnessing a higher growth rate over the forecast period. The market for these products has grown rapidly due to the convenience of online buying, a wide selection, and simple return policies. Local and international brands have increased their internet presence. Furthermore, the convenience of online buying, combined with the wide range of accessible options, makes it the most popular segment among online shoppers.

- In 2022, the cards segment accounted for the largest revenue share of more than 37.8% over the forecast period.

On the basis of payment type, the Germany E-Commerce Market is segmented into cash on delivery, cards, e-wallet, and others. Among these, the cards segment is dominating the market with the largest revenue share of 37.8% over the forecast period. Credit and debit card payments are common online payment options in Germany. Because of the incorporation of anti-fraud measures and ease of use, many consumers find them convenient. Furthermore, many card issuers offer loyalty points, cashback, or discounts for online purchases, bolstering segment demand in the Germany e-commerce market.

- In 2022, the Business-to-Consumer [B2C] segment accounted for the largest revenue share of more than 64.2% over the forecast period.

On the basis of model type, the Germany E-Commerce Market is segmented into Business-to-Consumer [B2C], Business-to-Business [B2B], Consumer-to-Consumer [C2C]. Among these, the Business-to-Consumer [B2C] segment is dominating the market with the largest revenue share of 64.2% over the forecast period. Companies in the B2C segment sell directly to consumers. Major internet merchants such as Amazon.de, Zalando, and Otto are examples. Individual consumers are driving a significant share of e-commerce operations, thanks to the increase in online buying, which has been hastened by situations such as the COVID-19 epidemic. The dominance of this market is heavily influenced by major global and local e-commerce shops catering to individual buyers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany E-Commerce Market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Lidl Stiftung & Co. KG

- Zalando SE

- MediaMarkt

- Amazon

- OBI GmbH & Co.

- Deutschland KG

- Otto GmbH & Co KG

- Idealo (Axel Springer SE)

- Tchibo GmbH

- Musikhaus Thomann

- eBay Kleinanzeigen

- Other key vendors

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- On April 2023, Germany-based Zalando, a renowned European online fashion and leisure marketplace, has launched the first beta version of a fashion assistant powered by ChatGPT on its app and web platforms. This will enable Zalando to realize the full potential of generative artificial intelligence (AI) to improve the online clothes discovery and shopping experience.

- On April 2023, The German rival company The Stryze Group has been acquired by Razor Group, a well-known worldwide aggregator of e-commerce consumer goods companies. The Razor Group plans to use the Stryze purchase as part of its strategy to further capitalize on the macroenvironment that currently supports market consolidation.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the Germany E-Commerce Market based on the below-mentioned segments:

Germany E-Commerce Market, By Product

- Clothing & Accessories

- Consumer Electronics

- Healthcare Products

- Home Appliances

- Cosmetics

- Groceries

- Books

- Others

Germany E-Commerce Market, By Payment Type

- Cash on Delivery

- Cards

- E-Wallet

- Others

Germany E-Commerce Market, By Model Type

- Business-to-Consumer [B2C]

- Business-to-Business [B2B]

- Consumer-to-Consumer [C2C]

Need help to buy this report?