Germany Health Insurance Market Size, Share, and COVID-19 Impact Analysis, Insurance Type (Public and Private), By Policy Type (Corporate Policy and Retail Policy), and Germany Health Insurance Market Insights, Industry Trend, Forecasts to 2033.

Industry: HealthcareGermany Health Insurance Market Insights Forecasts to 2033

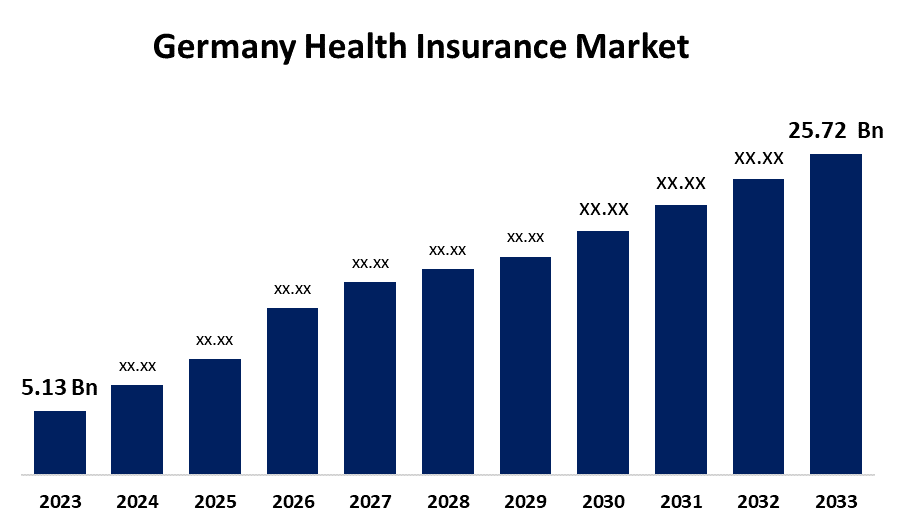

- The Germany Health Insurance Market Size Was Estimated at USD 5.13 Billion in 2023.

- The Market Size is Growing at a CAGR of 17.49% from 2023 to 2033

- The Germany Health Insurance Market Size is Expected to Reach USD 25.72 Billion by 2033

Get more details on this report -

The Germany Health Insurance Market Size is expected to reach USD 25.72 Billion by 2033, Growing at a CAGR of 17.49% from 2023 to 2033.

Market Overview

The German health insurance market includes both private health insurance (PHI) and statutory health insurance (SHI), with SHI covering a greater percentage of the population. The need for both public and private health insurance is being greatly increased by the growing expense of healthcare in Germany. The rising incidence of chronic illnesses, which raises the cost of cutting-edge medical treatments, as well as continuous improvements to the nation's healthcare infrastructure, have all contributed to a steady rise in medical prices. Additionally, technological developments are a major factor influencing the state of health insurance. Germany's health insurance market is changing more and more due to artificial intelligence (AI), which improves accuracy and efficiency across the board. Health insurers may improve member engagement, identify fraud more efficiently, and expedite claims processing by implementing AI. Furthermore, government initiatives aid in market expansion. For instance, in January 2025, Germany's Health Insurance Reforms will be in 2025. Major changes are being made to Germany's healthcare system. These modifications seek to improve overall care, adopt new technologies, and increase equity.

Report Coverage

This research report categorizes the market for Germany health insurance market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany health insurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany health insurance market.

Germany Health Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 5.13 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 17.49% |

| 2033 Value Projection: | USD 25.72 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 215 |

| Tables, Charts & Figures: | 112 |

| Segments covered: | Insurance Type, By Policy Type and COVID-19 Impact Analysis |

| Companies covered:: | Allianz Se, Debeka Krankenversicherungsvere A.g., Generali Deutschland, Gothaer Kv Ag, Hansemerkur Kv Ag, Hallesche Kranken, Süddeutsche Kranken, Axa Konzern Ag, Union Krankenvers., Signal Iduna Kranken, Barmenia Kv Ag, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The need for health and medical insurance is increased by Germany's aging population because older people generally need more coverage and healthcare services. The rise in chronic disease prevalence and the rising cost of healthcare services are the main causes of the health insurance market's expansion. The market is influenced by rising health expenditure, medical costs, disposable incomes, public stress, demand from the healthcare sector, population growth, demographic shifts, and unhealthy lifestyles. Additionally, insurance companies can expedite the patient's payment lifecycle more effectively and prevent fraudulent claim settlement activities by utilizing new technology more frequently to enhance claim management services.

Restraining Factors

The German health insurance market faces obstacles like regulatory complexity, an aging population, and growing healthcare expenses. Furthermore, market expansion is hampered by bureaucratic bottlenecks, little competition, and high private insurance prices, which impact accessibility and affordability.

Market Segmentation

The Germany health insurance market share is classified into insurance type and policy type.

- The public segment accounted for the largest market share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the insurance type, the Germany health insurance market is divided into public and private. Among these, the public segment accounted for the largest market share in 2023 and is expected to grow at a significant CAGR during the forecast period. This segment is growing due to Rising healthcare expenses, an aging population, and growing demand for comprehensive health coverage are the main drivers of this increase. In addition, due to laws requiring enrollment, public health insurance continues to dominate the market, but private insurers are introducing customized plans to appeal to those with greater incomes.

- The retail policy segment accounted for the highest market share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the policy type, the Germany health insurance market is divided into corporate policy and retail policy. Among these, the retail policy segment accounted for the highest market share in 2023 and is expected to grow at a significant CAGR during the forecast period. This segment is expanding due to individuals, independent contractors, freelancers, and foreign nationals who need flexible and all-inclusive health insurance are the main drivers of the retail policy market in Germany. The industry is expanding due to factors such as aging populations, rising healthcare expenses, and growing demand for specialized insurance plans. Additionally, the rise in freelancing and self-employment in Germany is one of the main forces behind retail policy.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany health insurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Allianz Se

- Debeka Krankenversicherungsvere A.g.

- Generali Deutschland

- Gothaer Kv Ag

- Hansemerkur Kv Ag

- Hallesche Kranken

- Süddeutsche Kranken

- Axa Konzern Ag

- Union Krankenvers.

- Signal Iduna Kranken

- Barmenia Kv Ag

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Germany, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Germany health insurance market based on the below-mentioned segments:

Germany Health Insurance Market, By Insurance Type

- Public

- Private

Germany Health Insurance Market, By Policy Type

- Corporate Policy

- Retail Policy

Need help to buy this report?