Germany Insulin Drugs and Delivery Devices Market Size, Share, and COVID-19 Impact Analysis, By Device (Insulin Pumps, Insulin Pens, Insulin Syringes, and Insulin Jet Injectors), By Disease Indication (Type 1 and Type 2), and Germany Insulin Drugs and Delivery Devices Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareGermany Insulin Drugs and Delivery Devices Market Insights Forecasts to 2033

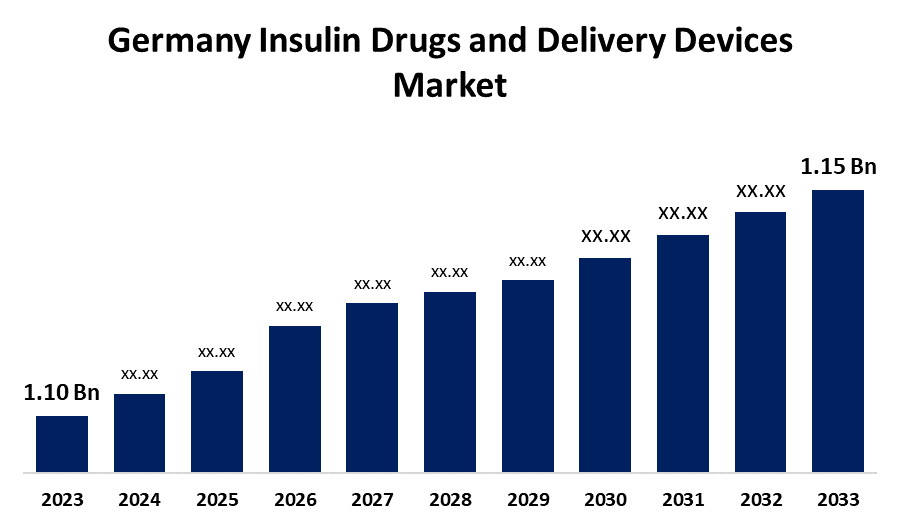

- The Germany Insulin Drugs and Delivery Devices Market Size was valued at USD 1.10 Billion in 2023.

- The Germany Insulin Drugs and Delivery Devices Market Size is Growing at a CAGR of 0.45% from 2023 to 2033

- The Germany Insulin Drugs and Delivery Devices Market Size is Expected to exceed USD 1.15 Billion By 2033

Get more details on this report -

The Germany Insulin Drugs and Delivery Devices Market Size is Anticipated to exceed USD 1.15 Billion by 2033, Growing at a CAGR of 0.45% from 2023 to 2033. The increasing prevalence of diabetes, technological advancements in delivery systems, and awareness about diabetes management are driving the insulin drugs and delivery devices market in the Germany.

Market Overview

Insulin drugs and delivery devices market comprises of demand for insulin medications and devices like insulin pens, pumps, and syringes for administration. The devices range from traditional syringes and pens to advanced pumps and even inhalers that are crucial for managing diabetes, offering various methods for administrating insulin. Insulin delivery devices have become increasingly central to the treatment of diabetes with the continuous advancements in diabetes management technology for offering safer, more convenient, precise, and cost-effective treatment options for diabetes management. Continuous glucose monitoring (CGM) systems integrated with insulin delivery devices for providing real-time glucose monitoring and automated insulin adjustments. The increasing diabetes-related healthcare expenditure along with the emphasis on business expansion by the key market players are creating market opportunities.

Report Coverage

This research report categorizes the market for the Germany insulin drugs and delivery devices market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany insulin drugs and delivery devices market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany insulin drugs and delivery devices market.

Germany Insulin Drugs and Delivery Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.10 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 0.45% |

| 2033 Value Projection: | USD 1.15 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 189 |

| Tables, Charts & Figures: | 96 |

| Segments covered: | By Device, By Disease Indication and COVID-19 Impact Analysis |

| Companies covered:: | Novo Nordisk, Sanofi, Eli Lilly, Biocon, Julphar, Medtronic, Ypsomed, Becton Dickinson, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increased prevalence of diabetes in the country accounting for 5.8 million persons with type 2 diabetes has contributed to propel the market demand. The technological advancements in delivery systems that emphasize the need for efficiency and patient-centric designs in medical technology are driving the market growth for insulin drugs and delivery devices. The awareness about diabetes management with initiatives such as disease management programs (DMPs) and advancements in treatment options such as insulin pumps is promoting market growth.

Restraining Factors

The increased cost of these devices like insulin pumps that limits its adoption is challenging the market growth. Further, the limited reimbursement coverage is impeding the market growth.

Market Segmentation

The Germany insulin drugs and delivery devices market share is classified into device and disease indication.

- The insulin pumps segment is dominating the market with the largest market share in 2023 and is expected to grow at a significant CAGR growth during the projected timeframe.

Based on the device, the Germany insulin drugs and delivery devices market is divided into insulin pumps, insulin pens, insulin syringes, and insulin jet injectors. Among these, the insulin pumps segment is dominating the market with the largest market share in 2023 and is expected to grow at a significant CAGR growth during the projected timeframe. The increasing popularity of insulin pump treatment for insulin delivery of people with type 1 diabetes (T1DM) is propelling the market in the insulin pumps segment.

- The type 1 segment is dominating the market with the largest market share in 2023 and is expected to grow at a significant CAGR growth during the projected timeframe.

Based on the disease indication, the Germany insulin drugs and delivery devices market is divided into type 1 and type 2. Among these, the type 1 segment is dominating the market with the largest market share in 2023 and is expected to grow at a significant CAGR growth during the projected timeframe. The increasing prevalence of type 1 diabetes mellitus, technological advancements in insulin delivery systems, and key player collaboration are driving the market growth for insulin drugs and delivery devices.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany insulin drugs and delivery devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Novo Nordisk

- Sanofi

- Eli Lilly

- Biocon

- Julphar

- Medtronic

- Ypsomed

- Becton Dickinson

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In November 2022, Ypsomed announced that its mylife Loop has authorization to work with the Abbott FreeStyle Libre 3 sensor in Germany. The Ypsomed mylife YpsoPump combines with the CamDiab mylife CamAPS FX algorithm and FreeStyle Libre 3. Together, they form an intelligent and automated insulin delivery (AID) system for people with type 1 diabetes.

- In January 2022, Evotec entered into a drug discovery collaboration for metabolic diseases with Eli Lilly, focusing on kidney disease and diabetes.

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Germany Insulin Drugs and Delivery Devices Market based on the below-mentioned segments:

Germany Insulin Drugs and Delivery Devices Market, By Device

- Insulin Pumps

- Insulin Pens

- Insulin Syringes

- Insulin Jet Injectors

Germany Insulin Drugs and Delivery Devices Market, By Disease Indication

- Type 1

- Type 2

Need help to buy this report?