Germany Payment Gateway Market Size, Share, and COVID-19 Impact Analysis, By Type (Hosted and Non Hosted), By Enterprise Size (Large Enterprise and Small & Medium Enterprise), and Germany Payment Gateway Market Insights, Industry Trend, Forecasts to 2033.

Industry: Electronics, ICT & MediaGermany Payment Gateway Market Insights Forecasts to 2033

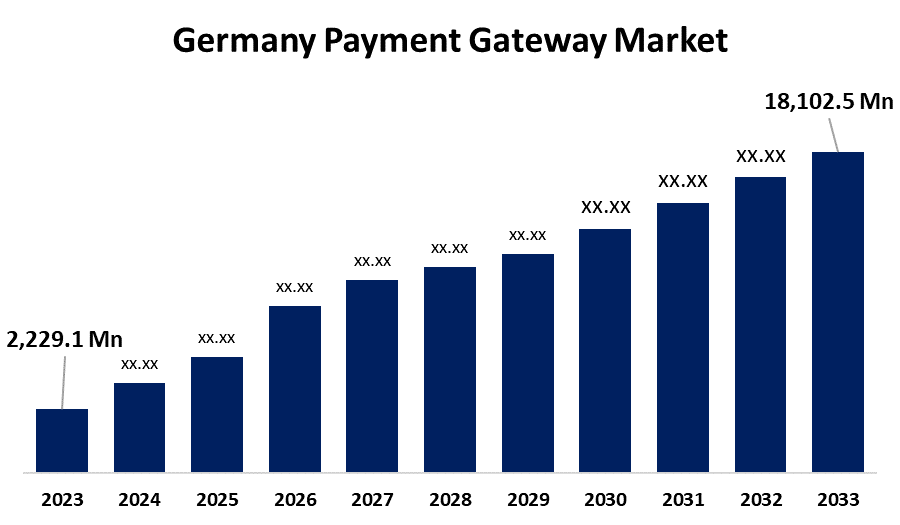

- The Germany Payment Gateway Market Size was valued at USD 2,229.1 Million in 2023.

- The Market Size is Growing at a CAGR of 23.3% from 2023 to 2033

- The Germany Payment Gateway Market Size is Expected to Reach USD 18,102.5 Million by 2033

Get more details on this report -

The Germany Payment Gateway Market Size is anticipated to reach USD 18,102.5 Million by 2033, growing at a CAGR of 23.3% from 2023 to 2033.

Market Overview

Germany payment gateway market is the system that helps businesses accept online payments securely. It connects customers and businesses to process payments using credit cards, digital wallets, and other methods. With the rise of e-commerce, mobile shopping, and digital wallets, the demand for secure and efficient payment solutions has increased. This market offers opportunities for innovation, especially with the adoption of technologies like artificial intelligence, blockchain, and contactless payments. The German government has been supportive of this growth, implementing initiatives like the PSD2 directive to enhance payment security and promote competition in the payment services industry. Additionally, Germany's focus on digitalization and financial inclusion presents further opportunities for payment gateways to expand their reach and improve services. With increasing investments in fintech and digital infrastructure, the market is poised for continued growth and modernization.

Report Coverage

This research report categorizes the market for the Germany payment gateway market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany payment gateway market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany payment gateway market.

Germany Payment Gateway Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2,229.1 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 23.3% |

| 2033 Value Projection: | USD 18,102.5 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 225 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By Enterprise Size |

| Companies covered:: | Adyen NV, Amazon.com Inc, PayPal Holdings Inc, Francisco Partners, JPMorgan Chase & Co, and Others |

| Pitfalls & Challenges: | COVID-19 impact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rapid increase in e-commerce and mobile shopping is a major contributor, as consumers increasingly prefer the convenience of online transactions. The rise of digital wallets and mobile payment solutions like Apple Pay and Google Pay is further boosting demand for secure payment gateways. Additionally, advancements in technology, such as AI and blockchain, are enhancing the security, speed, and efficiency of payment processes, making them more appealing to both businesses and consumers.

Restraining Factors

Despite advancements in security technology, maintaining trust and ensuring data protection remain critical issues for businesses and consumers.

Market Segmentation

The Germany payment gateway market share is classified into type and enterprise size.

- The hosted segment accounted for the largest market share in 2023 and is expected to grow at a remarkable CAGR during the forecast period.

The Germany payment gateway market is segmented by type into hosted and non hosted. Among these, the hosted segment accounted for the largest market share in 2023 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven because hosted payment gateways are easier to integrate and offer enhanced security, as they manage all the transaction processes on their servers. They are particularly popular among small and medium-sized businesses due to their cost-effectiveness and convenience.

- The large enterprise segment accounted for a major market share in 2023 and is expected to grow at a significant CAGR during the forecast period.

The Germany payment gateway market is segmented by enterprise size into large enterprises and small & medium enterprises. Among these, the large enterprise segment accounted for a major market share in 2023 and is expected to grow at a significant CAGR during the forecast period. The growth in segment is driven because large enterprises typically have greater financial resources, allowing them to invest in advanced payment gateway solutions that offer high scalability, security, and customization.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany payment gateway market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Adyen NV

- Amazon.com Inc

- PayPal Holdings Inc

- Francisco Partners

- JPMorgan Chase & Co

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2024, Adyen and Billie have indeed joined forces to offer a seamless Buy Now, Pay Later (BNPL) solution for businesses across Europe. This partnership allows Adyen's merchants to integrate Billie's B2B BNPL payment method into their checkout systems effortlessly. With this feature, business buyers can defer payments for up to 30 days, while merchants receive payment upon shipment. This collaboration aims to improve cash flow management, reduce credit risks, and enhance the overall purchasing experience.

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Germany payment gateway market based on the below-mentioned segments:

Germany Payment Gateway Market, By Type

- Hosted

- Non Hosted

Germany Payment Gateway Market, By Enterprise Size

- Large Enterprise

- Small and Medium Enterprise

Need help to buy this report?