Germany Pet Insurance Market Size, Share, and COVID-19 Impact Analysis, By Coverage Type (Accident & Illness and Accident Only), By Animal Type (Dogs, Cats, and Others), By Sales Channel (Agency, Broker, Direct, Bancassurance, and Others), and Germany Pet Insurance Market Insights, Industry Trend, Forecasts to 2033.

Industry: HealthcareGermany Pet Insurance Market Insights Forecasts to 2033

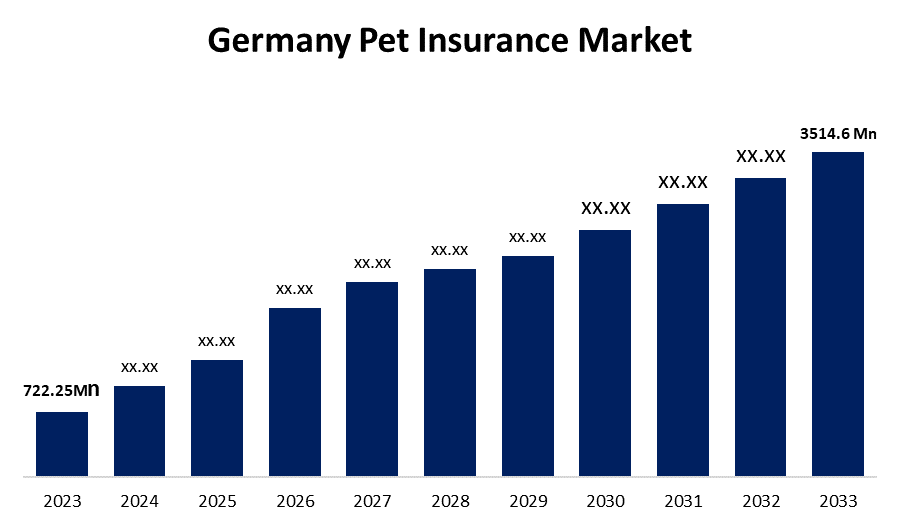

- The Germany Pet Insurance Market Size was valued at USD 722.25 Million in 2023.

- The Market is growing at a CAGR of 17.14 % from 2023 to 2033

- The Germany Pet Insurance Market Size is expected to reach USD 3514.6 Million by 2033

Get more details on this report -

Germany Pet Insurance Market is anticipated to exceed USD 3514.6 Million by 2033, growing at a CAGR of 17.14 % from 2023 to 2033.

Market Overview

Pet insurance covers a portion of the cost of veterinary care for animals in the event of illness or injury. Pet insurance usually reimburses the pet owner for a percentage of the veterinary bill following treatment, much like human health insurance does. This can cover issues, including diseases, accidents, operations, prescription drugs, and occasionally even preventive care, such as yearly physicals and immunizations. Pet owners can afford to give their animals the best care possible by having financial security and peace of mind from pet insurance. The expansion of the regional market is expected to be driven by factors such as rising pet ownership, the humanization of pets, supporting policies, and market player activities. According to the German Pet Trade Association (ZZF), 10.6 million dogs and 15.2 million cats lived in German homes in 2022. About 30% of dog owners and twenty-three percent of cat owners currently have comprehensive pet health insurance, according to a recent Nordlight Research research. Furthermore, just 18% of cat owners and 27% of dog owners have insurance that particularly covers pet surgeries.

Report Coverage

This research report categorizes the market for the Germany pet insurance market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the pet insurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the pet insurance market.

Germany Pet Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 722.25 Million |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 17.14 % |

| 2033 Value Projection: | USD 3514.6 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Coverage Type,By Animal Type , By Sales Channel |

| Companies covered:: | Trupanion, Inc., Figo Pet Insurance, LLC, Deutsche Familienversicherung AG (DFV), Direct Line, Gothaer Group, Nationwide Mutual Insurance Company, Petplan (Allianz), Embrace Pet Insurance Agency, LLC, Pinnacle Pet Group, and DEVK |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

Dog owners are now required to have liability insurance in several German states, including Brandenburg, Hamburg, Berlin, Lower Saxony, Thüringen, Niedersachsen, and Schleswig-Holstein, which is propelling market expansion. Pet liability insurance is predicted to become more popular as a result of this and the growing need to lessen the financial burden associated with damages brought on by pets. Furthermore, driving market growth is the rising disposable income of pet owners, particularly in emerging nations, which has reduced the cost and increased accessibility of pet insurance.

Restraining Factors

Many insurance companies are offering a broad range of coverage options, making the pet insurance market more and more competitive. Because of this saturation of the market, insurers may find it difficult to set themselves apart from the competition and draw in new clients. Price wars and margin pressure are a possibility as additional players join the market, which could affect profitability and present challenges for the industry. These factors hinder the growth of the market.

Market Segmentation

The Germany pet insurance market share is classified into coverage type, animal type, and sales channel.

- The accident & illness segment is expected to hold the largest market share through the forecast period.

The Germany pet insurance market is segmented by coverage type into accident & illness and accident only. Among these, the accident & illness segment is expected to hold the largest market share through the forecast period. This is because pet ownership is growing in Germany, veterinarian expenditures are high, and accident and illness coverage is thorough. The most advantageous coverage for young animals and the one that encourages adoption rates is the complete accident and illness policy, which essentially covers all illnesses in addition to accidents.

- The dogs segment dominates the market with the largest market share over the predicted period.

The Germany pet insurance market is segmented by animal type into dogs, cats, and others. Among these, the dogs segment dominates the market with the largest market share over the predicted period. The need to reduce financial risk, the prevalence of chronic diseases in pets, the high cost of veterinary care, and the rise in companion animal populations are the causes of this. Dogs require more expensive veterinary care than cats do because of their larger size, unique medical requirements, and possible breed-related health problems.

- The direct segment is expected to hold the largest share of the Germany pet insurance market during the forecast period.

Based on the sales channel, the Germany pet insurance market is divided into agency, broker, direct, bancassurance, and others. Among these, the direct segment is expected to hold the largest share of the Germany pet insurance market during the forecast period. For example, Deutsche Familienversicherung AG stated in its 9M investor report that direct insurance income increased by 7.6% between 2022 and 2023. In comparison to the prior year, the company also claimed a rise in internet sales.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany pet insurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Trupanion, Inc.

- Figo Pet Insurance, LLC

- Deutsche Familienversicherung AG (DFV)

- Direct Line

- Gothaer Group

- Nationwide Mutual Insurance Company

- Petplan (Allianz)

- Embrace Pet Insurance Agency, LLC

- Pinnacle Pet Group

- DEVK

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2023, to effectively promote its new line of pet health insurance products, DFV Deutsche Familienversicherung AG has employed innovative advertising techniques, including captivating television commercials and vibrant social media campaigns.

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Germany pet insurance market based on the below-mentioned segments:

Germany Pet Insurance Market, By Coverage Type

- Accident & Illness

- Accident Only

Germany Pet Insurance Market, By Animal Type

- Dogs

- Cats

- Others

Germany Pet Insurance Market, By Sales Channel

- Agency

- Broker

- Direct

- Bancassurance

- Others

Need help to buy this report?