Germany Power EPC Market Size, Share, and COVID-19 Impact Analysis, By Power Status (Transmission and Distribution), By Equipment (Boilers, Control Systems, Steam Turbines, Gas Turbines, and Others), and Germany Power EPC Market Insights, Industry Trend, Forecasts to 2033

Industry: Energy & PowerGermany Power EPC Market Insights Forecasts to 2033

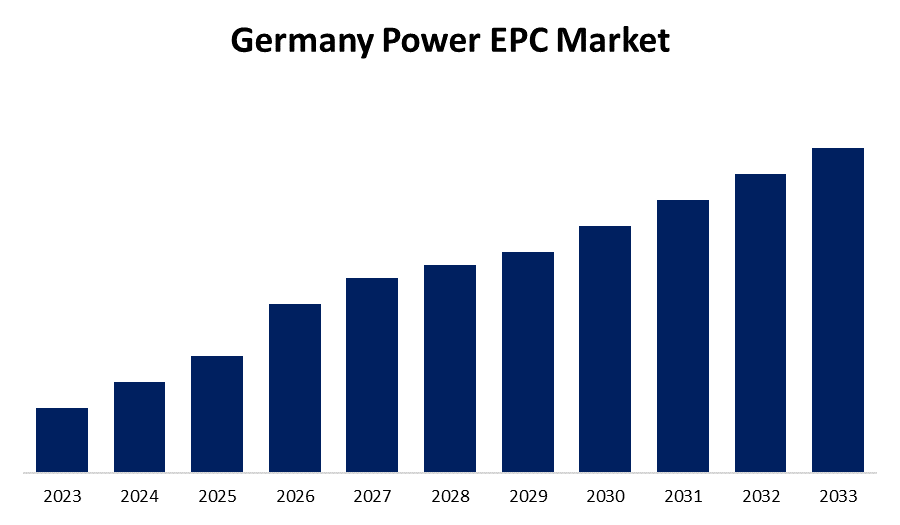

- The Market Size is growing at a CAGR of 5.89% from 2023 to 2033

- The German Power EPC Market Size is Expected to Hold a Significant Share by 2033

Get more details on this report -

The Germany Power EPC Market is Anticipated to Hold a Significant Share by 2033, growing at a CAGR of 5.89% from 2023 to 2033.

Market Overview

In the power industry, a contracting service known as "power EPC" (Engineering, Procurement, and Construction) assumes responsibility for the entire project lifecycle of a power plant, starting with the design and engineering stage and ending with the construction and commissioning of the plant after purchasing equipment and materials. It is the contractor's responsibility to make sure the project is finished on schedule, within the allotted money, and to the required quality. The power industry frequently uses the power EPC model for projects involving both conventional and renewable energy sources. It makes project management and coordination easier and lowers overall risk by giving the project owner a single point of contact for the duration of the project. A number of factors, such as the need to modernize the current power infrastructure and the growing demand for electricity and renewable energy, are driving the global market for engineering, procurement, and construction, or EPC, or power engineering.

Report Coverage

This research report categorizes the market for the Germany power EPC market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany power EPC market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany power EPC market.

Germany Power EPC Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.89% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Power Status, By Equipment |

| Companies covered:: | Fluor Ltd, McDermott International Inc., Wärtsilä Oyj Abp, EPC Engineering & Technologies GmbH, General Electric Company, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The power EPC market is expanding as a result of rising energy and power consumption. Building infrastructure for power generation, transmission, and distribution is becoming more and more necessary as energy demands rise in a variety of sectors, including infrastructure development, commercial, industrial, and residential. Organizations and governments are prompted to invest in updating their current infrastructure and increasing their electricity capacity due to the increased demand. The German Federal Government's aggressive plans to cut carbon emissions are anticipated to open up a lot of chances for the Germany power EPC Market's renewable energy sector. The International Renewable Energy Agency reports that Germany installed 148.37 GW of renewable energy in 2022, a 7% increase in installed capacity year over year over 2021.

Restraining Factors

One of the biggest challenges associated with power EPC is the high setup and installation costs, which frequently cause major EPC projects in the market to be delayed or abandoned.

Market Segmentation

The Germany power EPC market share is classified into power status and equipment.

- The distribution snacks segment is expected to hold the largest market share through the forecast period.

The Germany power EPC market is segmented by power status into transmission and distribution. Among them, the distribution snacks segment is expected to hold the largest market share through the forecast period. This is necessary for the distribution network's last-mile infrastructure which includes residences, businesses, and industries to be able to supply power to end consumers.

- The steam turbines segment dominates the market with the largest market share over the predicted period.

The Germany power EPC market is segmented by equipment into boilers, control systems, steam turbines, gas turbines, and others. Among them, the steam turbines segment dominates the market with the largest market share over the predicted period. Steam turbines are frequently utilized because of their dependability, low vibration levels, and high output power capability. Furthermore, steam turbines need fewer parts, which lessens their dependency on outside resources to produce energy. As a result, steam turbines have a high power-to-weight ratio and are useful instruments for energy production, leading to market expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany power EPC market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Fluor Ltd

- McDermott International Inc.

- Wärtsilä Oyj Abp

- EPC Engineering & Technologies GmbH

- General Electric Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2023, Germany's Economy Ministry declared that auctions would be used to guarantee the construction of new gas power plants, which the government believes are essential to guarantee supply when renewable energy sources are unable to provide enough electricity. By 2030, the German government intends to increase the alternative capacity of coal-fired power plants by 25 gigawatts.

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Germany Power EPC Market based on the below-mentioned segments:

Germany Power EPC Market, By Power Status

- Transmission

- Distribution

Germany Power EPC Market, By Equipment

- Boilers

- Control Systems

- Steam Turbines

- Gas Turbines

- Others

Need help to buy this report?