Germany Recycled Plastics Market Size, Share, and COVID-19 Impact Analysis, By Type (Polyethylene (PE), Polyvinyl Chloride (PVC), Polyethylene Terephthalate (PET), Polypropylene (PP), Polystyrene (PS), and Others), By End-Use (Packaging, Automotive, Construction, Textile, Electrical & Electronics, and Others), and Germany Recycled Plastics Market Insights, Industry Trend, Forecasts to 2033.

Industry: Chemicals & MaterialsGermany Recycled Plastics Market Insights Forecasts to 2033

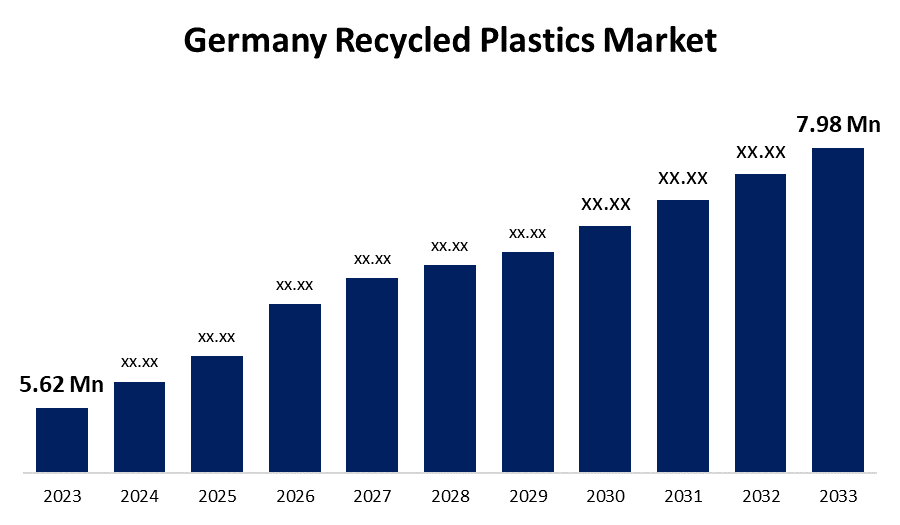

- The Germany Recycled Plastics Market Size was valued at USD 5.62 Million in 2023.

- The Market is Growing at a CAGR of 3.57% from 2023 to 2033

- The Germany Recycled Plastics Market Size is Expected to Reach USD 7.98 Million by 2033

The Germany Recycled Plastics Market is Anticipated to Exceed USD 7.98 Million by 2033, growing at a CAGR of 3.57% from 2023 to 2033. The demand for packaging materials, especially plastics, is rising in conjunction with the growth in online commerce.

Get more details on this report -

Market Overview

Recycled plastics are synthetic materials made from scrap or waste plastic. Plastic trash is recycled into valuable goods while maintaining their physical and chemical qualities. Plastic recycling is the process of converting plastic waste into different products. Recycling can help to minimize waste in landfills, preserve resources, and safeguard the environment from plastic pollution and greenhouse gas emissions. Every year, more than 300 million tons of plastic are consumed worldwide, with more than half of it intended for single-use applications. Plastics' rising ubiquity has not come without drawbacks. The majority of single-use plastics (SUPs) end up in landfills, incinerators, or the ocean. It is believed that 10-12 million tons of plastic are dumped into the oceans each year, killing up to 1 million aquatic species. Ineffective plastics management and the take-make-waste cycle have placed a significant strain on ecosystems, resulting in the release of toxic chemicals into the environment, damaging soil, subterranean water, and air. This emphasizes the need of prioritizing investments in the global recycled plastic sector.

Report Coverage

This research report categorizes the market for the Germany recycled plastics market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany recycled plastics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany recycled plastics market.

Germany Recycled Plastics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 5.62 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.57% |

| 2033 Value Projection: | USD 7.98 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By End-Use |

| Companies covered:: | Muller-Guttenbrunn Group, MBA Polymers, Inc., Paprec Group, Morssinkhof Rymoplast, ALBA Group, PreZero, Veolia Deutschland, Remondis SE & Co. KG, Suez Germany, Interseroh, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

As online shopping grows in popularity, so does the demand for packaging materials such as plastic. Many items purchased online necessitate protective packaging, such as bubble wrap, air pillows, and plastic envelopes. As e-commerce volumes increase, so does demand for packaging materials, including recycled plastics. Furthermore, the use of recycled plastics in packaging helps to reduce the environmental impact caused by online retail. Plastics are used extensively in modern car interior trimmings, such as the instrument cluster, door linings, glove compartment, and seating. As car production increases, so does the demand for these plastic components. Using recycled plastics in interior components enables automotive manufacturers to satisfy sustainability goals while also reducing their environmental impact. Furthermore, plastic is utilized to manufacture engine compartments in automobiles, such as engine hoods, air intake systems, and covers.

Restraining Factors

Recycling techniques are more expensive than making new plastics, which has an impact on the revenue of the recycled plastics business. Nonetheless, there is potential for developing affordable recycling technologies and increasing stakeholder collaboration to improve recycling infrastructure and capacities.

Market Segmentation

The Germany recycled plastics market share is classified into type and end-use.

- The polyethylene terephthalate segment is expected to hold the largest market share through the forecast period.

The Germany recycled plastics market is segmented by type into polyethylene (PE), polyvinyl chloride (PVC), polyethylene terephthalate (PET), polypropylene (PP), polystyrene (PS), and others. Among these, the polyethylene terephthalate segment is expected to hold the largest market share through the forecast period. PET is lightweight, clear, strong, and fully recyclable. Its non-toxicity, low weight, and simplicity of recycling make it a highly desired material for use in food and beverage packaging. Government laws enacted globally have forced producers of bottled water and other beverages to use recycled PET instead of virgin PET when making packaging bottles.

- The packaging segment is expected to dominate the Germany recycled plastics market during the forecast period.

Based on the end-use, the Germany recycled plastics market is divided into packaging, automotive, construction, textile, electrical & electronics, and others. Among these, the packaging segment is expected to dominate the Germany recycled plastics market during the forecast period. Packaging solutions for consumer goods, electronics, and food and drink are using it more and more. The expansion of this market is aided by growing consumer knowledge of recycling and packaging trash disposal, as well as increased environmental concerns.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany recycled plastics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Muller-Guttenbrunn Group

- MBA Polymers, Inc.

- Paprec Group

- Morssinkhof Rymoplast

- ALBA Group

- PreZero

- Veolia Deutschland

- Remondis SE & Co. KG

- Suez Germany

- Interseroh

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2023, GreenDot has launched a strategic relationship with Italian recycler Synextra. This collaboration will speed up the development of their activities in sorting and enhancing high-quality plastic recycling on a large scale.

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Germany Recycled Plastics Market based on the below-mentioned segments

Germany Recycled Plastics Market, By Type

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Polypropylene (PP)

- Polystyrene (PS)

- Others

Germany Recycled Plastics Market, By End-Use

- Packaging

- Automotive

- Construction

- Textile

- Electrical & Electronics

- Others

Need help to buy this report?