Germany Silica Market Size, Share, and COVID-19 Impact Analysis, By Type (Amorphous and Crystalline), By End-Use (Building and Construction, Shale Oil and Gas, Glass Manufacturing, Water Treatment, and Other), and Germany Silica Market Insights, Industry Trend, Forecasts to 2033

Industry: Chemicals & MaterialsGermany Silica Market Insights Forecasts to 2033

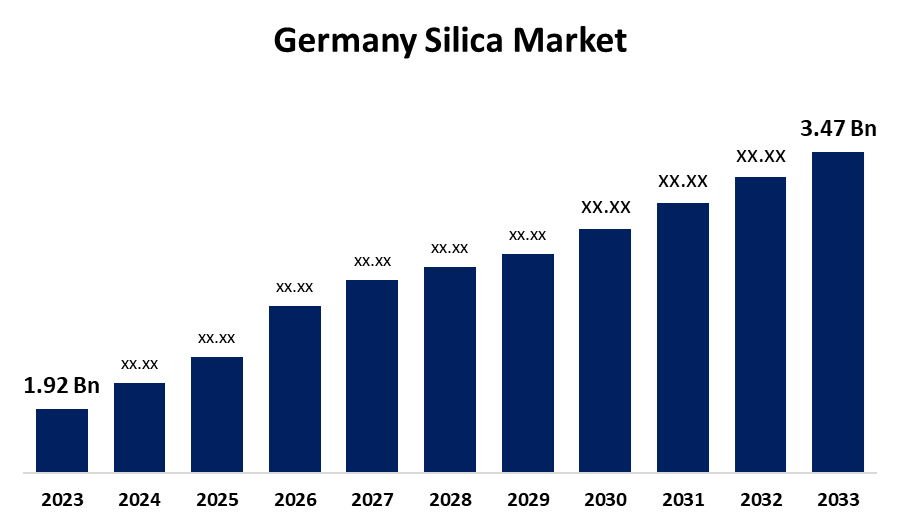

- The Germany Silica Market Size was valued at USD 1.92 Billion in 2023.

- The Market is Growing at a CAGR of 6.10% from 2023 to 2033

- The Germany Silica Market Size is Expected to Reach USD 3.47 Billion by 2033

Get more details on this report -

The Germany Silica Market Size is Anticipated to Reach USD 3.47 Billion by 2033, growing at a CAGR of 6.10% from 2023 to 2033

Market Overview

Silica, commonly referred to as silicon dioxide, is an inorganic compound composed of silicon and oxygen atoms. There are various forms of silica, yet they all share the same chemical structure. This compound is utilized in a wide range of products, such as glass, ceramics, concrete, cleaning agents, and skincare items. In nature, silica occurs in different forms, including within the skeletal frameworks of ferns, grasses, and diatoms. It is present in three kinds of rock: igneous, sedimentary, and metamorphic. The most economically significant deposits are located in pegmatite rocks, veins, and sand. In 2023, Germany exported silica sands and quartz sands to Italy ($11,923.08K, 218,173,000 Kg), China ($11,077.65K, 3,075,200 Kg), Switzerland ($10,084.27K, 125,842,000 Kg), Austria ($6,883.05K, 80,544,500 Kg), and the Netherlands ($6,449.63K, 171,508,000 Kg). In that same year, Germany imported silicon dioxide, or silica, from France ($63,765.35K, 30,840,800 Kg), China ($22,914.54K, 17,848,100 Kg), Finland ($16,957.38K, 8,897,470 Kg), Belgium ($14,135.45K, 3,629,410 Kg), and the United States ($13,716.49K). Furthermore, the hydraulic fracturing technique, which involves creating fissures in rock to enhance oil extraction, has resulted in a growing demand for silica. The increasing need for residential properties in urban areas is driving a rise in construction, which is anticipated to positively influence the silica market in Germany.

Report Coverage

This research report categorizes the market for the German silica market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the German silica market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the German silica market.

Germany Silica Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.92 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.10% |

| 2033 Value Projection: | USD 3.47 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By End-Use, |

| Companies covered:: | QUARZWERKE GMBH, NORDDEUTSCHE STEINZEUGWERKE GMBHhome icon, SDNFGEBRUDER DORFNER GMBH & CO, GEBRUDER DORFNER GMBH CO, STROBEL QUARZSAND GMBH, MERCK KGAA, Wacker Chemie AG, Evonik Industries AG, And Other Key Vendors |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

The market for silica in Germany is influenced by several factors, one of which is the increasing demand for silica in concrete due to a rise in construction activities across the country. Silica is incorporated into cosmetics, toothpaste, and skin care products for its absorbent and abrasive qualities. Furthermore, silica enhances tire performance by improving grip, fuel efficiency, and durability. High-purity silica is utilized to enhance scratch resistance, anti-corrosion, and weathering characteristics. In semiconductor manufacturing and optical fiber production, high-purity fused silica is employed. Its non-toxic and eco-friendly nature, along with more stringent environmental regulations, promotes the use of high-purity silica. Advances in extraction and purification technology have made high-purity silica easier to obtain and have lowered its costs.

Restraining Factors

There are significant barriers affecting the silica market in Germany. The inhalation of silica dust during mining and processing can result in silicosis, a serious lung condition, leading to strict workplace safety regulations that could hinder market expansion due to health concerns for workers. Stringent environmental regulations regarding emissions and waste handling may raise production costs for silica companies, especially when they need to upgrade facilities to comply. In various applications, alternative materials might be considered in place of silica, which could influence the demand for silica products in some industries.

Market Segmentation

The German silica market share is classified into type and end-user.

- The amorphous segment is expected to hold the largest market share through the forecast period.

The German silica market is segmented by type into amorphous and crystalline. Among these, the amorphous segment is expected to hold the largest market share through the forecast period. Amorphous silica is produced in various forms, such as silica gels, precipitated silica, fumed silica, and colloidal silica. The creation of fumed silica, also known as pyrogenic silica, involves the process of vapor-phase hydrolysis. This is achieved through the high-temperature hydrolysis of silicon tetrachloride (SiCl4) in an oxygen (O2), nitrogen (N2), or hydrogen (H2) flame. Fumed silica serves as a reinforcement that enhances the toughness of different materials, allowing for their use in a broader range of applications. Pyrogenic (fumed) silica is employed as a thickening and thixotropic agent in various organic systems, including unsaturated polyesters, coatings, paints, printing inks, adhesives, and sealants.

- The building and construction segment is expected to dominate the German silica market during the forecast period.

Based on the end-user, the German silica market is divided into building and construction, shale oil and gas, glass manufacturing, water treatment, and others. Among these, the building and construction segment is expected to dominate the German silica market during the forecast period. Silica is one of the primary components in many construction and building materials. Whole-grain silica finds application in flooring, mortars, specialty cement, roofing shingles, asphalt mixtures, and slip-resistant surfaces, contributing to increased tensile strength and structural integrity. Furthermore, most silica sand, which contains over 95% SiO2, is used as construction aggregates in the building industry. The main sources of silica sand production include poorly cemented sandstones and loosely consolidated sand deposits.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany silica market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- QUARZWERKE GMBH

- NORDDEUTSCHE STEINZEUGWERKE GMBHhome icon

- SDNFGEBRUDER DORFNER GMBH & CO

- GEBRUDER DORFNER GMBH CO

- STROBEL QUARZSAND GMBH

- MERCK KGAA

- Wacker Chemie AG

- Evonik Industries AG

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2024, German chemical company Evonik opened a facility for its dispersion technology focused on fumed silica at its site in Rheinfelden, Germany. This enhances the specialty chemicals company's standing in silicas from the Aerosil range. The new system is designed specifically for producing Easy-to-Disperse (E2D) products. This technology facilitates the easier integration of silica as a rheology additive in paint and coating formulations.

Market Segment

This study forecasts revenue at German, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the German silica Market based on the below-mentioned segments:

Germany Silica Market, By Type

- Amorphous

- Crystalline

Germany Silica Market, By End-User

- Building and Construction

- Shale Oil and Gas

- Glass Manufacturing

- Water Treatment

- Other

Need help to buy this report?