Germany Tire Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Passenger Car Tires, Light Commercial Vehicle Tires, Heavy Commercial Vehicle Tires, Off-the-Road Tires, and Two-Wheeler Tires), By Construction (Radial and Bias), By Season (Summer Tires, Winter Tires, and All-season Tires), and Germany Tire Market Insights, Industry Trend, Forecasts to 2033.

Industry: Automotive & TransportationGermany Tire Market Insights Forecasts to 2033

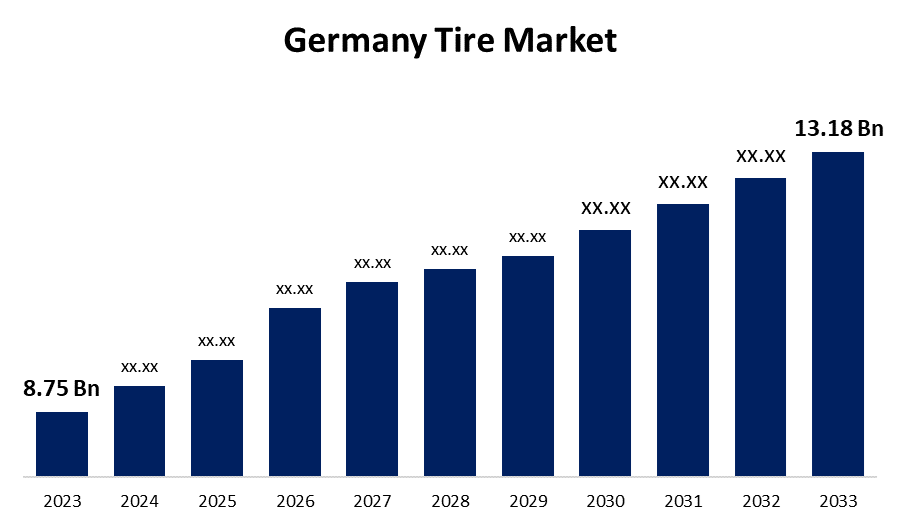

- The Germany Tire Market Size was valued at USD 8.75 Billion in 2023.

- The Market Size is Growing at a CAGR of 4.18% from 2023 to 2033

- The Germany Tire Market Size is Expected to reach USD 13.18 Billion by 2033

Get more details on this report -

The Germany Tire Market Size is Anticipated to Exceed USD 13.18 Billion by 2033, Growing at a CAGR of 4.18% from 2023 to 2033.

Increased passenger vehicle sales are important drivers of industry growth.

Market Overview

An automobile tire is an air-filled circular device with a rim-like shape. It is made from a variety of organic and inorganic elements, including steel, rubber, wire, cotton, glass, silica, and carbon-black-reinforced wire. Tires are durable, flexible rubber casings that are affixed to the rim of a wheel. Tires generate traction and act as a cushion for a vehicle's wheels. The purpose of the tire is to transfer traction, torque, and braking forces to the road surface, maintain the weight of the vehicle, absorb shocks from the road, and maintain and alter the direction of movement. The tire is made of tough rubber and contains pressurized air. The German tire market places a great premium on quality, performance, and safety. German automakers are world-renowned for developing high-performance vehicles, which has increased demand for premium and high-quality tires. The market has a diversified selection of tire producers, including both domestic and foreign brands, responding to a variety of consumer needs and tastes. A major development in the German tire market is the growing use of customized tires built for specific uses.

Report Coverage

This research report categorizes the market for the Germany tire market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany tire market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany tire market.

Germany Tire Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 8.75 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 4.18% |

| 2033 Value Projection: | USD 13.18 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Construction, By Season |

| Companies covered:: | Michelin AG, Goodyear Tire & Rubber Company, Pirelli & C. S.p.A., Hankook Tire & Technology Co., Ltd., Bridgestone Corporation, Yokohama Rubber Company, Limited, Continental AG, Sumitomo Rubber Industries, Ltd., Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The German tire market is significantly impacted by ongoing technological improvements in tire design, materials, and production techniques. Innovations such as silica-enhanced compounds, tread pattern optimization, and run-flat technologies have resulted in increased tire performance, longevity, and safety. German drivers place a high value on safety, and tires are an integral part of a vehicle's overall safety. Environmental sensitivity and regulatory standards play an important influence in defining the German tire market. Germany's distinct seasonal weather patterns fuel need for specialist seasonal tires. Winter tires, which provide superior grip and traction on slippery and snowy roads, are essential during the colder months.

Restraining Factors

Managing production and inventories to fulfill customer demand during seasonal transitions can cause supply chain difficulties and potential shortages if not managed properly. Rapid advances in tire technology necessitate substantial investments in research, development, and manufacturing methods. The German tire market is a highly competitive global marketplace, with domestic and international producers competing for market share.

Market Segmentation

The Germany Tire Market share is classified into product type, construction, and season.

- The passenger car tires segment is expected to hold the largest market share through the forecast period.

The Germany tire market is segmented by product type into passenger car tires, light commercial vehicle tires, heavy commercial vehicle tires, off-the-road tires, and two-wheeler tires. Among these, the passenger car tires segment is expected to hold the largest market share through the forecast period. The increased desire for private vehicle ownership is primarily responsible for the expanding fleet of passenger cars. Automakers are increasing production and import capacity to meet rising customer demand for passenger cars. Tire demand has risen across the country, boosting tire production, distribution, accessibility, and cost.

- The radial tires segment dominates the market with the largest market share over the predicted period.

The Germany tire market is segmented by construction into radial and bias. Among these, the radial tires segment dominates the market with the largest market share over the predicted period. Radial tires are more comfortable since they buffer the rider against shocks, crashes, and bumps. Furthermore, the increased fuel efficiency of radial tires has a considerable impact on consumer demand. Due to they are resistant to heat, wear, and cutting, radial tires are similarly becoming more and more popular.

- The all-season tires segment is expected to hold the largest share of the Germany tire market during the forecast period.

Based on the season, the Germany tire market is divided into summer tires, winter tires, and all-season tires. Among these, the all-season tires segment is expected to hold the largest share of the Germany tire market during the forecast period. The widespread implementation of all-season tires throughout the year, regardless of season, is the primary reason for their market dominance. Winter tires are only recommended during heavy snowfall months and are relatively pricey. Furthermore, the demand and necessity for different tires for each season has declined dramatically since the development of all-season tires.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany tire market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Michelin AG

- Goodyear Tire & Rubber Company

- Pirelli & C. S.p.A.

- Hankook Tire & Technology Co., Ltd.

- Bridgestone Corporation

- Yokohama Rubber Company, Limited

- Continental AG

- Sumitomo Rubber Industries, Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2022, Continental introduced the EcoContact 6, a new tire suited for passenger cars. The EcoContact 6 provides better fuel efficiency and lower CO2 emissions. Continental's latest tire introduction intends to address the growing demand for environmentally friendly products in the German vehicle industry.

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Germany Tire Market based on the below-mentioned segments:

Germany Tire Market, By Product Type

- Passenger Car Tires

- Light Commercial Vehicle Tires

- Heavy Commercial Vehicle Tires

- Off-the-Road Tires

- Two-Wheeler Tires

Germany Tire Market, By Construction

- Radial

- Bias

Germany Tire Market, By Season

- Summer Tires

- Winter Tires

- All-season Tires

Need help to buy this report?