Global GI Stool Testing Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Consumables, Analyzers), By Test Type (Occult Blood Tests, Ova and Parasites Test, Fecal Biomarkers Tests), By Application (Infection, Inflammatory Bowel Disease, Gastroesophageal Reflux Disease, Cancer, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: HealthcareGlobal GI Stool Testing Market Insights Forecasts to 2033

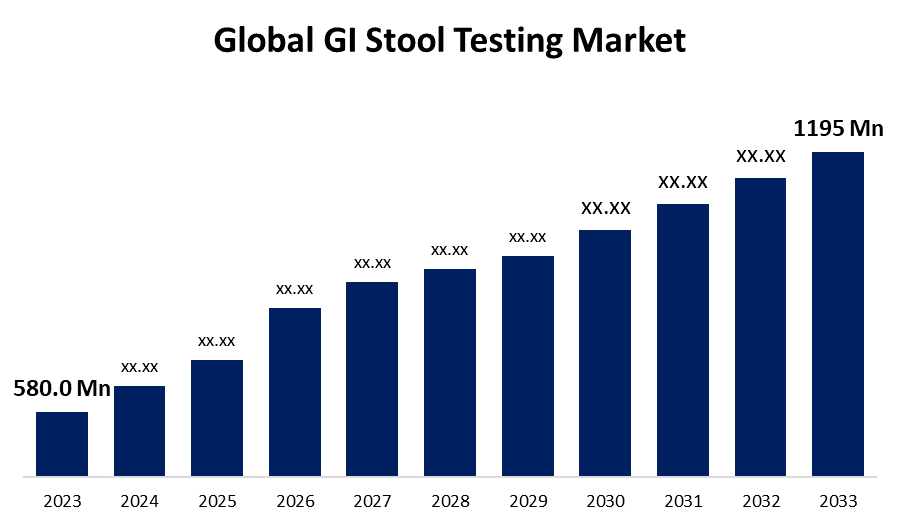

- The Global GI Stool Testing Market Size was Valued at USD 580.0 Million in 2023

- The Market Size is Growing at a CAGR of 7.50% from 2023 to 2033

- The Worldwide GI Stool Testing Market Size is Expected to Reach USD 1195 Million by 2033

- Aisa Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global GI Stool Testing Market Size is Anticipated to Exceed USD 1195 Million by 2033, Growing at a CAGR of 7.50% from 2023 to 2033.

Market Overview

GI stool testing is the process of diagnosing disorders or infections of the digestive tract using stool or feces samples. Gastrointestinal (GI) diseases are very common in the general population and can have serious consequences for digestive health. GI issues include diseases like malabsorption, colon inflammation, and malignancy, among others. The GI stool tests are conducted to diagnose GI tract diseases and assist in the diagnosis of parasite infection and bleeding blockage. A gastrointestinal infections (GI) panel screens a stool sample for bacteria, viruses, and parasites, which are typical causes of GI illnesses. Healthcare providers utilize stool tests to help diagnose colon cancer, infections, inflammatory bowel disease, gastroesophageal reflux disease (GERD), and other gastrointestinal illnesses. GI stool testing tools include an occult blood test, parasites test, bacteria test, and fecal biomarkers test, among others, which are used to detect and treat specific gastrointestinal diseases.

Report Coverage

This research report categorizes the market for the GI stool testing market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the GI stool testing market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the GI stool testing market.

Global GI Stool Testing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 580.0 Million |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 7.50% |

| 2033 Value Projection: | USD 1195 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 280 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Test Type, By Application, By Region |

| Companies covered:: | Abbott Laboratories, Genova Diagnostics, Danaher Corporation, bioMerieux SA, Cardinal Health, Diasorin, Conegenics Corporation, Epitope Diagnostics Inc., Cardinal Health, CTKBiotech Inc., ScheBO Biotech AG, MERIDIAN BIOSCIENCE INC., and Others |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

GI stool testing market growth is thriving due to the increasing prevalence of gastrointestinal illnesses. The growing baby boomer demographic suffering from gastrointestinal infections has increased the demand for diagnostic methods, thus propelling the market landscape. Gastrointestinal problems such as digestive tract bleeding, ulcers, chronic pancreatitis, ulcerative colitis (UC), inflammatory bowel disease (IBD), and aberrant GI tract growth all contribute to a significant illness burden. These disorders increase healthcare expenses and lower quality of life. Furthermore, the increased prevalence of chronic disorders, including gastrointestinal cancer, leads to a huge number of patients seeking a stool test for diagnosis. For instance, the American Cancer Society forecasts that there will be around 106,590 new cases of colorectal cancer in the United States in 2024, including 54,210 men and 52,380 women.

Restraining Factors

The restraining factors in the GI stool testing market include limited awareness among users and healthcare providers, cost and reimbursement challenges, technical complexity, regulatory hurdles, competition from alternative diagnostics, variability in test accuracy, patient comfort issues, limited adoption in developing regions, and privacy concerns related to humiliation.

Market Segmentation

The GI stool testing market share is classified into product type, test type, and application.

- The consumables segment dominates the market with the largest market share through the forecast period.

Based on the product type, the GI stool testing market is classified into consumables and analyzers. Among these, the consumables segment dominates the market with the largest market share through the forecast period. The consumables segment is attributed to significant growth in demand for GI disease diagnostic reagents and test kits, which are used to diagnose and screen a variety of GI-health conditions such as infection, inflammatory bowel disease, and cancer, among others. Market participants are focusing on developing reagents to meet the expanding and changing needs for GI testing in diagnostic centers and hospitals. The current R&D operations are focused on providing superior quality and excellent performance consumables that are used in GI stool testing for the most demanding applications.

- The occult blood tests segment is estimated to hold the highest market revenue share through the projected period.

Based on the test type, the GI stool testing market is divided into occult blood tests, ova and parasite tests, and fecal biomarkers tests. Among these, the occult blood tests segment is estimated to hold the highest market revenue share through the projected period. This segment's dominant position is driven by its broad use in identifying gastrointestinal bleeding, a prevalent symptom in numerous digestive illnesses and malignancies, contributing significantly to market revenue. This is mostly due to a significant increase in the preference for early diagnosis and improved therapy outcomes among patients suffering from gastrointestinal disorders such as cancer, polyps, ulcers, or hemorrhoids. The presence of blood in the stool sample shows bleeding in the digestive tract and is considered the first stage of colorectal cancer. Polyps, hemorrhoids, diverticulosis, ulcers, and colitis are some of the most common causes of bleeding in the bladder.

- The gastroesophageal reflux disease segment is anticipated to grow at the fastest CAGR growth through the forecast period.

Based on the application, the GI stool testing market is categorized into infection, inflammatory bowel disease, gastroesophageal reflux disease, cancer, and others. Among these, the gastroesophageal reflux disease segment is anticipated to grow at the fastest CAGR growth through the forecast period. This is due to the increasing occurrence of GI infections, as well as a demand for technologically improved GI diagnostic tests, among other factors. Furthermore, benefits connected with testing, such as improved illness screening reliability and reduced infection severity through better diagnosis, are expected to have a beneficial impact on industry growth.

Regional Segment Analysis of the GI Stool Testing Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the GI stool testing market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the GI stool testing market over the predicted timeframe. The dominance of the North American region is likely due to factors such as advanced healthcare infrastructure, the presence of major industry players, high adoption rates of diagnostic technologies, and a significant population requiring gastrointestinal testing. Furthermore, key players in the country, such as Abbott Laboratories, Cardinal Health, and Meridian Bioscience Inc., are engaged in new product research and commercialization, facilitating industrial expansion in the United States. The rising prevalence of gastrointestinal disorders in the US increases demand for the GI stool testing market. For instance, according to the report of the American Cancer Society 2024, estimated 152,810 new cases of colorectal cancer. Men will account for 81,540 instances, while women will account for 71,270, according to estimates. There will be 106,590 instances of colon cancer and 46,220 cases of rectal cancer.

Asia Pacific is expected to grow at the fastest CAGR growth of the GI stool testing market during the forecast period. The growth is driven by increasing healthcare expenditure, improvements in healthcare infrastructure, rising awareness about gastrointestinal health, technological advancements in diagnostics, and a higher prevalence of gastrointestinal disorders in the region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the GI stool testing market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Abbott Laboratories

- Genova Diagnostics

- Danaher Corporation

- bioMerieux SA

- Cardinal Health

- Diasorin

- Conegenics Corporation

- Epitope Diagnostics Inc.

- Cardinal Health

- CTKBiotech Inc.

- ScheBO Biotech AG

- MERIDIAN BIOSCIENCE INC.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2024, The FDA approved ColoSense a noninvasive, multitarget stool RNA test as a screening tool for persons 45 years and older who are at average risk of having colorectal cancer (CRC).

- In November 2023, Sun Genomics' precision probiotics brand Floré launched a "next-generation" full stool analysis test as part of its clinical program.

- In October 2022, Thermo Fisher Scientific developed the CE-IVD-marked TaqPath Enteric Bacterial Select Panel, which detects common gastrointestinal (GI) bacteria, allowing doctors to quickly identify the root cause of an infection and deliver the most appropriate medication to their patients.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the GI stool testing market based on the below-mentioned segments:

Global GI Stool Testing Market, By Product Type

- Consumables

- Analyzers

Global GI Stool Testing Market, By Test Type

- Occult Blood Tests

- Ova and Parasites Test

- Fecal Biomarkers Tests

Global GI Stool Testing Market, By Application

- Infection

- Inflammatory Bowel Disease

- Gastroesophageal Reflux Disease

- Cancer

- Others

Global GI Stool Testing Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the GI stool testing market over the forecast period?The GI stool testing market is projected to expand at a CAGR of 7.50% during the forecast period.

-

2. What is the market size of the GI stool testing market?The Global GI Stool Testing Market Size is Expected to Grow from USD 580.0 Million in 2023 to USD 1195 Million by 2033, at a CAGR of 7.50% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the GI stool testing market?North America is anticipated to hold the largest share of the GI stool testing market over the predicted timeframe.

Need help to buy this report?