Global Glass Alternative Materials Market Size, Share, and COVID-19 Impact Analysis, By Type (Polycarbonate, Transparent Wood), By Light Transmission (Up To 80%, >80%-90%, >90%), By Application (Visual Applications, Automotive, Electronic, Construction, Medical Devices, Aviation, Energy, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Advanced MaterialsGlobal Glass Alternative Materials Market Insights Forecasts to 2033

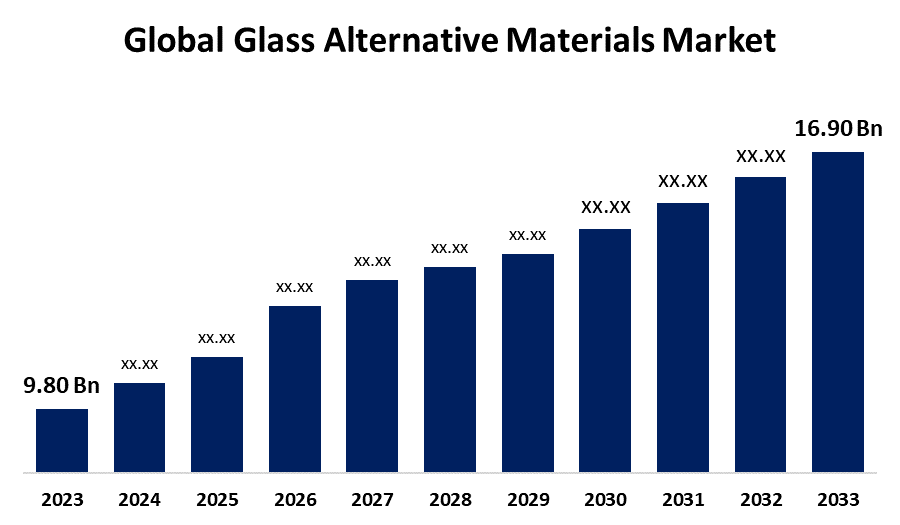

- The Global Glass Alternative Materials Market Size Was Valued at USD 9.80 Billion in 2023

- The Market Size is Growing at a CAGR of 5.60% from 2023 to 2033

- The Worldwide Glass Alternative Materials Market Size is Expected to Reach USD 16.90 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Glass Alternative Materials Market Size is Anticipated to Exceed USD 16.90 Billion by 2033, Growing at a CAGR of 5.60% from 2023 to 2033.

Market Overview

Glass alternative materials replace standard glass in various applications due to their unique qualities, advantages, or functionality. Glass alternatives are frequently pursued because they provide advantages over glass, such as increased durability, lighter weight, cost-effectiveness, or environmental sustainability. Glass alternatives, such as polycarbonate, acrylic, and biodegradable polymers, are increasingly becoming more popular in a variety of industries due to their durability, lightweight nature, and environmental benefits. Glass alternative materials improve construction materials, packaging, automobile parts, electronics, medical equipment, and consumer items by providing practical solutions while minimizing environmental effect.

For Instance, In February 2024, Owens Corning, a global leader in building and construction materials, announced that it had decided to consider strategic alternatives for its global glass reinforcements (GR) business. The decision to look for alternatives for the GR business is consistent with the company's goal of focusing on building and construction supplies.

Report Coverage

This research report categorizes the market for glass alternative materials based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the glass alternative materials market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the glass alternative materials market.

Global Glass Alternative Materials Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 9.80 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 5.60% |

| 2033 Value Projection: | USD 16.90 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 225 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By Light Transmission, By Application, By Region |

| Companies covered:: | Mitsubishi Gas Chemical Company, Inc., Evonik Industries AG, Covestro AG, Arkema Group, Trinseo S.A., 3A Composites GmbH, Lucite International, Sun Acrylam Private Limited, Aristech Surfaces LLC, Asia Poly Industrial Sdn Bhd, Elastin International Corp., Ray Chung Acrylic Enterprise Co., Ltd., Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The glass alternative materials market is driven by a combination of sustainability concerns, cost efficiency, and technological advancements. Growing environmental awareness and regulatory pressures are pushing for more eco-friendly options, while innovations in material science are improving the performance and versatility of alternatives like plastics, composites, and biodegradable materials. Glass alternatives often offer advantages such as lower production costs, greater design flexibility, lightweight properties, and enhanced safety features. As consumer preferences shift towards sustainable products and industries seek energy-efficient solutions, the demand for glass alternatives continues to rise, shaping a dynamic and evolving market.

Restraining Factors

The glass alternative materials market is constrained by several challenges, including performance limitations that might not match traditional glass in terms of clarity and durability. High development and production costs, along with difficulties in recycling and disposal, can also impede market growth. Regulatory hurdles and technical challenges in meeting specific performance standards further complicate adoption. Additionally, supply chain issues, intense market competition, and the need for consumer education about the benefits of alternatives pose significant barriers to widespread acceptance and expansion.

Market Segmentation

The glass alternative materials market share is classified into type, light transmission, and application.

- The polycarbonate segment is estimated to hold the highest market revenue share through the projected period.

Based on the type, the glass alternative materials market is classified into polycarbonate and transparent wood. Among these, the polycarbonate segment is estimated to hold the highest market revenue share through the projected period. Polycarbonate is favored for its superior impact resistance, lightweight properties, and high optical clarity, making it suitable for a wide range of applications including construction, automotive, and electronics. Polycarbonate's established manufacturing processes and extensive use in various industries contribute to its dominant market position compared to transparent wood.

- The >90% segment is anticipated to hold the largest market share through the forecast period.

Based on the light transmission, the glass alternative materials market is divided into up to 80%, >80%-90%, and>90%. Among these, the >90% segment is anticipated to hold the largest market share through the forecast period. This segment's dominance is driven by the growing demand for materials that offer high clarity and transparency, which are essential for applications such as advanced optical devices, high-performance windows, and premium displays. The superior optical properties of materials with >90% light transmission make them highly desirable for applications requiring excellent visibility and light performance.Top of FormBottom of Form

- The construction segment dominates the market with the largest market share through the forecast period.

Based on the application, the glass alternative materials market is categorized into visual applications, automotive, electronic, construction, medical devices, aviation, energy, and others. Among these, the construction segment dominates the market with the largest market share through the forecast period. This dominance is driven by the increasing use of alternative materials in building and infrastructure projects due to their benefits such as enhanced durability, improved thermal insulation, and lighter weight compared to traditional glass. These advantages make glass alternatives particularly attractive for applications in windows, facades, and other construction elements where performance and sustainability are crucial.

Regional Segment Analysis of the Glass Alternative Materials Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

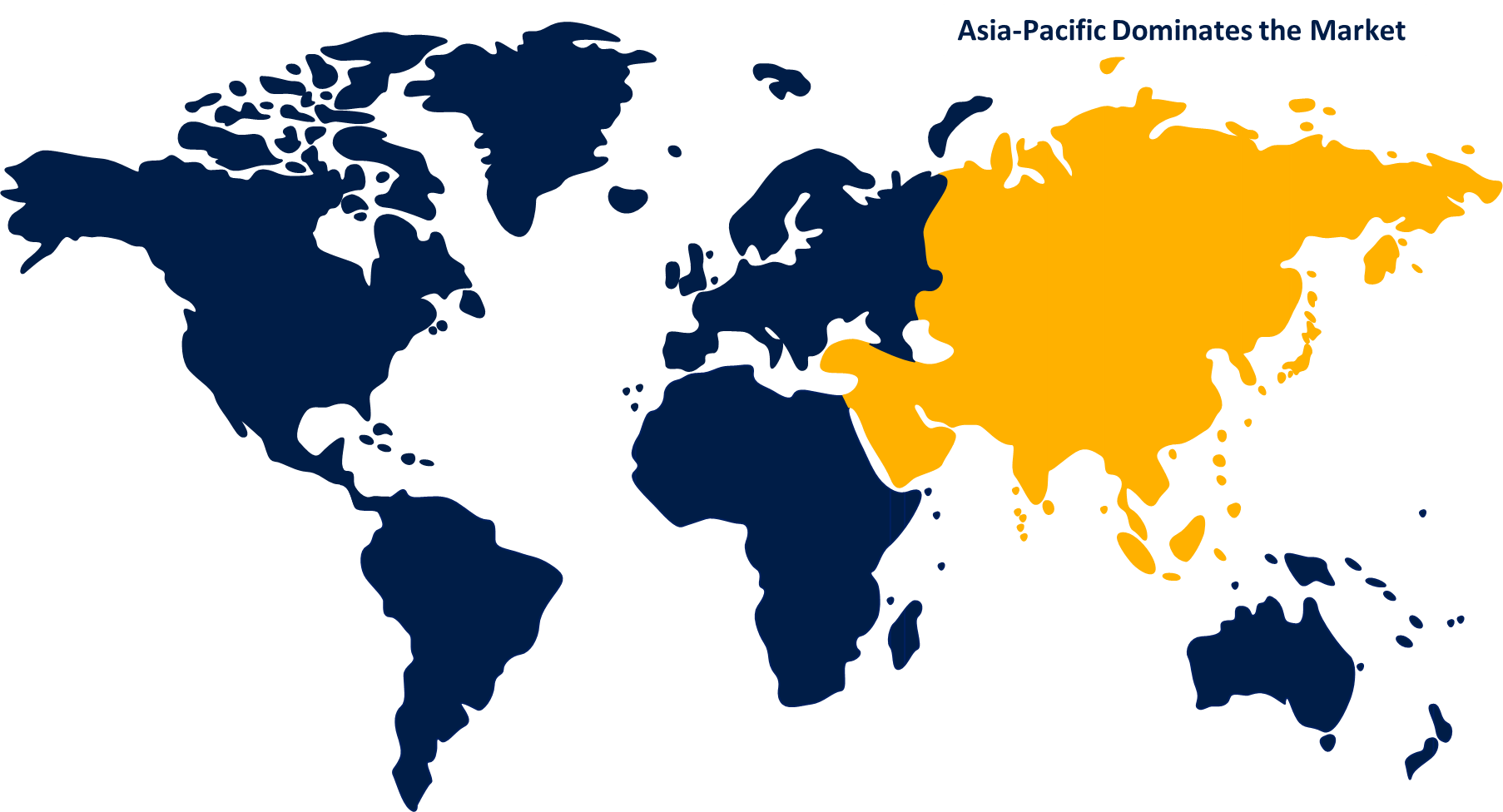

Asia Pacific is anticipated to hold the largest share of the glass alternative materials market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the glass alternative materials market over the predicted timeframe. Top of FormThis dominance is due to the region's rapid industrialization, urbanization, and growing construction and automotive sectors, which drive demand for innovative and cost-effective materials. Additionally, Asia Pacific's large population and expanding consumer base contribute to increased demand for various applications of glass alternatives, including in electronics and medical devices. The region's strong manufacturing capabilities and investments in research and development further support its leading position in the market.

North America is expected to grow at the fastest CAGR growth of the glass alternative materials market during the forecast period. This rapid growth is driven by several factors, including increased investments in advanced technologies, a strong focus on sustainability and environmental regulations, and a high level of innovation in materials science. The region's robust construction and automotive industries, coupled with rising demand for high-performance and energy-efficient materials, contribute to this accelerated growth. Additionally, the presence of key market players and ongoing research and development activities further enhance North America's position as a leading and rapidly expanding market for glass alternative materials.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the glass alternative materials market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mitsubishi Gas Chemical Company, Inc.

- Evonik Industries AG

- Covestro AG

- Arkema Group

- Trinseo S.A.

- 3A Composites GmbH

- Lucite International

- Sun Acrylam Private Limited

- Aristech Surfaces LLC

- Asia Poly Industrial Sdn Bhd

- Elastin International Corp.

- Ray Chung Acrylic Enterprise Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2024, Estee Lauder Companies (ELC) announced a collaboration with Strategic Materials (SMI) to promote packaging sustainability. The duo had completed a multi-year study to explore strategies to improve the recyclability of cosmetic glass packaging and the availability of recycled materials.

- In April 2024, SCHOTT launched pilot projects on glass ceramics and specialized glass for a circular economy.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the glass alternative materials market based on the below-mentioned segments:

Global Glass Alternative Materials Market, By Type

- Polycarbonate

- Transparent Wood

Global Glass Alternative Materials Market, By Light Transmission

- Up To 80%

- >80%-90%

- >90%

Global Glass Alternative Materials Market, By Application

- Visual Applications

- Automotive

- Electronic

- Construction

- Medical Devices

- Aviation

- Energy

- Others

Global Glass Alternative Materials Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the glass alternative materials market over the forecast period?The glass alternative materials market is projected to expand at a CAGR of 5.60% during the forecast period.

-

2.What is the market size of the glass alternative materials market?The Global Glass Alternative Materials Market Size is Expected to Grow from USD 9.80 Billion in 2023 to USD 16.90 Billion by 2033, at a CAGR of 5.60% during the forecast period 2023-2033.

-

3.Which region holds the largest share of the glass alternative materials market?Asia Pacific is anticipated to hold the largest share of the glass alternative materials market over the predicted timeframe.

Need help to buy this report?