Global Glass Substrate Market Size, Share, and COVID-19 Impact Analysis, By Type (Borosilicate, Silicon, Fused Silica/Quartz, Aluminosilicate, Ceramic), By End-use Industry (Electronics, Automotive, Healthcare, Aerospace & Defense, Energy), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Chemicals & MaterialsGlobal Glass Substrate Market Insights Forecasts to 2033

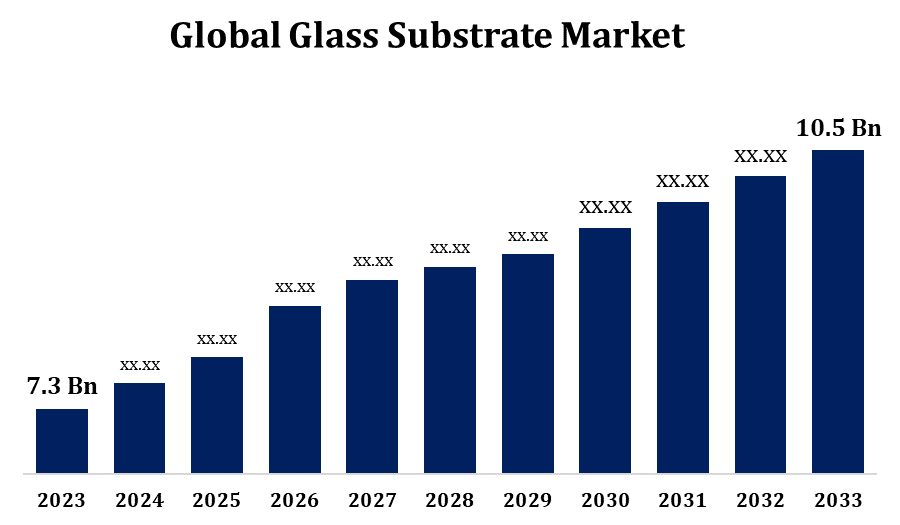

- The Glass Substrate Market Size was valued at USD 7.3 Billion in 2023.

- The Market Size is Growing at a CAGR of 3.70% from 2023 to 2033.

- The Worldwide Glass Substrate Market Size is Expected to reach USD 10.5 Billion by 2033.

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Glass Substrate Market Size is Expected to reach USD 10.5 Billion by 2033, at a CAGR of 3.70% during the forecast period 2023 to 2033.

The glass substrate market is experiencing growth driven by increasing demand across electronics, automotive, and solar industries. Glass substrates, known for their high durability, optical clarity, and chemical stability, are essential in producing flat-panel displays, photovoltaic modules, and automotive displays. Technological advancements in electronics, especially in semiconductors and display technology, are enhancing the need for high-quality glass substrates. The rise of flexible displays and miniaturized devices is also pushing manufacturers toward ultra-thin and lightweight glass substrates. Asia-Pacific dominates the market due to the presence of major electronics and automotive manufacturers, while North America and Europe are witnessing steady growth driven by innovation. However, challenges include high production costs and complex manufacturing processes, although ongoing R&D efforts are aimed at overcoming these barriers.

Glass Substrate Market Value Chain Analysis

The glass substrate market's value chain involves several key stages, from raw material sourcing to end-user application. The process begins with suppliers providing high-purity silica and other essential raw materials to manufacturers. These materials are then processed through melting, forming, and coating stages to produce high-quality glass substrates with specific characteristics, such as thinness and optical clarity, required for various applications. Glass substrate manufacturers cater to sectors like electronics, automotive, and solar energy, collaborating closely with OEMs (original equipment manufacturers) to meet precise specifications. Distributors and retailers play a role in managing logistics and facilitating the supply chain. Technological advancements, including automation and precision engineering, are optimizing the production process. The demand for specialized substrates, such as ultra-thin and flexible glass, is driving innovation across the entire value chain.

Glass Substrate Market Opportunity Analysis

The glass substrate market presents numerous growth opportunities, particularly with the expanding demand in electronics, renewable energy, and automotive industries. As the electronics sector advances, there is a rising need for ultra-thin, lightweight glass substrates in products like OLED displays, smartphones, and wearables. The renewable energy sector, driven by the shift toward clean energy solutions, is creating significant demand for glass substrates in solar photovoltaic (PV) panels, where their durability and transparency enhance energy efficiency. Additionally, the automotive industry's push toward digital dashboards and head-up displays in electric vehicles is bolstering demand for specialized glass substrates. Emerging technologies, such as flexible displays and miniaturized semiconductor devices, further broaden the market potential, prompting manufacturers to innovate in materials, production techniques, and sustainable solutions to capture these evolving opportunities.

Glass Substrate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 7.3 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.70% |

| 2033 Value Projection: | USD 7.3 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 215 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By End-use Industry, By Region |

| Companies covered:: | AGC Inc., SCHOTT, AvanStrate Inc., Dongxu Group Co., Ltd., Irico Group New Energy Company Limited, TECNISCO, LTD., Corning Incorporated., Nippon Electric Glass Co., Ltd., HOYA Corporation., Plan Optik AG, Ohara Inc., and Others v |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Market Dynamics

Glass Substrate Market Dynamics

Growth of the Photovoltaic Sector to propel the market growth

The growth of the photovoltaic (PV) sector is a significant driver for the glass substrate market, as glass substrates play a critical role in enhancing the performance and durability of solar panels. Rising global focus on renewable energy and stringent environmental regulations are pushing for increased solar energy adoption, leading to a greater demand for high-quality glass substrates in PV applications. These substrates improve light transmittance, durability, and resistance to harsh environmental conditions, making them ideal for PV modules. Governments worldwide are supporting solar projects through incentives and subsidies, further fueling demand. Additionally, advancements in PV technology, such as bifacial modules and ultra-thin solar panels, are encouraging manufacturers to produce innovative glass substrates that meet these new standards, ultimately driving market growth and innovation in the sector.

Restraints & Challenges

The production of high-quality glass substrates involves precise handling and advanced technologies, resulting in high production costs that can limit affordability and restrict market expansion. Additionally, raw material costs, particularly for high-purity silica, are subject to fluctuations, impacting overall production expenses. Environmental concerns and regulations regarding emissions from manufacturing processes add another layer of complexity, requiring investments in sustainable practices. The rapid pace of technological advancements also pressures manufacturers to continuously upgrade equipment and innovate, which can be capital-intensive. Finally, competition from alternative materials like plastic substrates in flexible applications poses a potential threat, requiring glass manufacturers to differentiate their offerings.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Glass Substrate Market from 2023 to 2033. The region’s focus on technological innovation and advanced manufacturing has spurred the adoption of high-quality glass substrates in products like high-resolution displays, semiconductors, and photovoltaic panels. The growing interest in electric vehicles (EVs) and the subsequent rise in digital dashboard displays are bolstering demand in the automotive industry. In addition, the United States and Canada are investing in solar energy initiatives, increasing the need for durable and efficient glass substrates in photovoltaic (PV) applications. However, high production costs and competition from lower-cost regions pose challenges. To remain competitive, North American manufacturers are focusing on R&D to produce innovative, cost-effective, and sustainable glass substrate solutions.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. High demand for consumer electronics, such as smartphones, tablets, and OLED displays, drives the need for advanced glass substrates with qualities like thinness, durability, and optical precision. The region is also a major hub for solar energy production, with significant investments in photovoltaic (PV) infrastructure, further propelling the market for glass substrates used in PV modules. Competitive production costs and skilled labor contribute to Asia-Pacific’s market leadership. However, rising environmental regulations and the challenge of maintaining quality standards in mass production are pushing manufacturers to invest in sustainable practices and advanced technologies to enhance production efficiency and meet global standards.

Segmentation Analysis

Insights by Type

The borosilicate segment accounted for the largest market share over the forecast period 2023 to 2033. The borosilicate segment in the glass substrate market is experiencing robust growth, primarily due to its superior thermal and chemical resistance. Known for its high durability and low thermal expansion, borosilicate glass is ideal for applications in high-temperature environments, such as in laboratory equipment, semiconductor production, and photovoltaics. Its stability under extreme conditions makes it well-suited for use in solar panels, where it enhances longevity and performance in varying weather. Electronics manufacturers increasingly prefer borosilicate substrates for display technologies, including advanced smartphones and tablets, as they provide both clarity and resistance to thermal shock. With ongoing innovations and demand for high-performance materials in sectors like automotive, renewable energy, and electronics, the borosilicate segment is expected to expand, solidifying its importance within the glass substrate market.

Insights by End User

The automotive segment accounted for the largest market share over the forecast period 2023 to 2033. Glass substrates are essential in producing digital displays, HUDs (head-up displays), and touch screens, all increasingly standard in modern vehicles. As automotive manufacturers incorporate more infotainment systems and digital interfaces, the demand for durable, high-quality glass substrates with scratch resistance, clarity, and heat tolerance is surging. Electric vehicles (EVs) and luxury cars, in particular, emphasize sleek, high-tech displays, which require thin and optically clear substrates. Additionally, the expansion of smart and connected car technologies is increasing the need for sensors and screens, further fueling demand for specialized glass substrates. Overall, this trend positions the automotive segment as a major contributor to market growth.

Recent Market Developments

- On November 2023, AUO Corp., a supplier of flat panels, has commenced the second phase of operations for its sixth-generation Low-Temperature Polycrystalline Silicon (LTPS) LCD fabrication facility in Kunshan, China, to boost glass substrate production.

Competitive Landscape

Major players in the market

- AGC Inc.

- SCHOTT

- AvanStrate Inc.

- Dongxu Group Co., Ltd.

- Irico Group New Energy Company Limited

- TECNISCO, LTD.

- Corning Incorporated.

- Nippon Electric Glass Co., Ltd.

- HOYA Corporation.

- Plan Optik AG

- Ohara Inc.

- Others

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Glass Substrate Market, Type Analysis

- Borosilicate

- Silicon

- Fused Silica/Quartz

- Aluminosilicate

- Ceramic

Glass Substrate Market, End Use Analysis

- Electronics

- Automotive

- Healthcare

- Aerospace & Defense

- Energy

Glass Substrate Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Glass Substrate Market?The global Glass Substrate Market is expected to grow from USD 7.3 billion in 2023 to USD 10.5 billion by 2033, at a CAGR of 3.70% during the forecast period 2023-2033.

-

2. Who are the key market players of the Glass Substrate Market?Some of the key market players of the market are AGC Inc., SCHOTT, AvanStrate Inc., Dongxu Group Co., Ltd., Irico Group New Energy Company Limited, TECNISCO, LTD., Corning Incorporated., Nippon Electric Glass Co., Ltd., HOYA Corporation., Plan Optik AG, Ohara Inc .

-

3. Which segment holds the largest market share?The automotive segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Glass Substrate Market?North America dominates the Glass Substrate Market and has the highest market share.

Need help to buy this report?