Global SiC Wafer Polishing Market Size By Product Type (Abrasive Powders, Polishing Pads, Diamond Slurries, Colloidal Silica Suspensions), By Application (Power Electronics, Light-emitting diodes (LEDs), Sensors and detectors, Rf and microwave devices, Others), By Region, And Segment Forecasts, By Geographic Scope And Forecast

Industry: Semiconductors & ElectronicsGlobal SiC Wafer Polishing Market Insights Forecasts to 2032

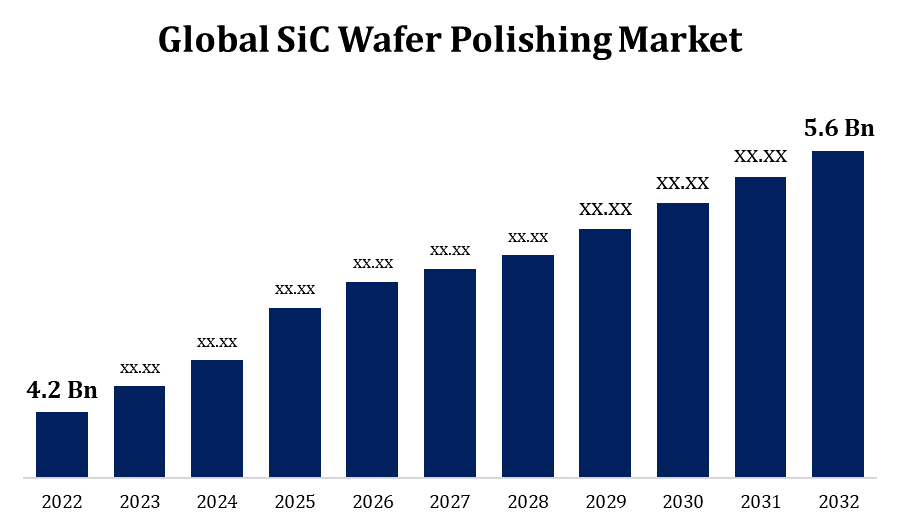

- The Global SiC Wafer Polishing Market Size was valued at USD 4.2 Billion in 2022.

- The Market Size is Growing at a CAGR of 6.7% from 2022 to 2032.

- The Worldwide SiC Wafer Polishing Market Size is expected to reach USD 5.6 Billion by 2032

- Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The Global SiC Wafer Polishing Market Size is expected to reach USD 5.6 Billion by 2032, at a CAGR of 6.7% during the forecast period 2022 to 2032.

The market for SiC (silicon carbide) wafers is growing, particularly in power electronics and automotive applications. For reaching the appropriate surface finish and quality, the polishing procedure is critical. The growing demand for high-performance semiconductors in numerous industries has boosted the demand for SiC wafers. As technology progresses, so does the demand for more efficient and durable materials such as silicon carbide. Polishing is essential for improving the flatness, smoothness, and overall quality of wafer surfaces. It's intriguing to see how these seemingly insignificant operations contribute to the overall functionality of electrical equipment.

SiC Wafer Polishing Market Value Chain Analysis

The fundamental raw ingredient, silicon carbide (SiC), is used to start the value chain. This requires the extraction or synthesis of SiC powder. SiC powder is then formed into ingots or boules using procedures such as sublimation or the modified Lely method. Diamond wire saws or other cutting processes are used to slice these ingots into wafers. Wafers undergo lapping and grinding procedures to produce a desired thickness and flatness. Here comes the SiC wafer polishing into play. Chemical mechanical polishing (CMP) is a popular technique for smoothing out surface imperfections. Wafers are thoroughly cleaned after polishing to remove any polishing residue. Quality standards are met through inspection processes. The wafers are sold to semiconductor device manufacturers, who use them to make a variety of electronic components. The finished products are used in industries such as power electronics, automotive, aerospace, and others.

SiC Wafer Polishing Market Opportunity Analysis

Determine which industries and applications are driving demand for SiC wafers. Power electronics, automobile, telecommunications, and renewable energy are frequently included. Investigate potential created by developments in polishing technology. Innovations that increase productivity, save prices, or improve the quality of polished wafers can be powerful drivers. Investigate novel and emerging applications for SiC wafers. SiC wafers may find applications outside of typical semiconductor manufacture as technology advances. Examine market expansion potential in various regions. As industries around the world adopt SiC technology, there may be untapped sectors with rising demand. Analyse the supply chain to discover potential flaws and chances for improvement. Maintaining a resilient and efficient supply chain might be critical to market success.

Global SiC Wafer Polishing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 4.2 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 6.7% |

| 2032 Value Projection: | USD 5.6 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Product Type, By Application, By Region, By Geographic Scope And Forest |

| Companies covered:: | Kemnet International (UK), Entegris (US), Ijin Diamond (US), Fujimi Corporation (Japan), Saint-Gobain (US), JSR Corporation (Japan), Engis Corporation (US), Ferro Corporation (US), 3M (US), SKC (South Korea), DuPont Incorporated (US), Fujifilm Holding America Corporation (US), and others. |

| Pitfalls & Challenges: | Covid-19 Empact,Challenges,Growth, Analysis. |

Get more details on this report -

Market Dynamics

SiC Wafer Polishing Market Dynamics

Technological development in SiC Wafer Polishing Market growth

Abrasive material and tool advancements in the polishing process contribute to finer surface finishes and increased consistency. This can result in increased yields and better wafer quality. Automation and robotics integration in polishing operations improves efficiency and consistency. Real-time monitoring and correction can be provided by automated systems, decreasing human error and increasing total productivity. In-situ metrology and monitoring technologies provide real-time examination of the polishing process. This aids in keeping accurate control of settings, optimising polishing results, and reducing faults. Slurry chemistry advances, such as the development of customised abrasive particles and chemical compositions, help to improve material removal rates and surface quality during polishing. Precision grinding technology advancements aid in the initial shape of SiC wafers.

Restraints & Challenges

Silicon carbide is well-known for its brittleness and hardness. Polishing hard and brittle materials is difficult because it demands accuracy to obtain the appropriate surface polish while avoiding flaws. During polishing, the abrasive nature of SiC wafers can cause tool wear and abrasion. Manufacturers face a constant struggle in maintaining the reliability and endurance of polishing tools. The danger of adding faults such as scratches or surface damage while polishing is a challenge. Furthermore, edge exclusion (preserving the quality of the wafer's exterior edges) can be difficult. Consumables, such as polishing slurries and abrasive powders, can be expensive. Finding cost-effective solutions without sacrificing quality is a balancing act that manufacturers must master. It is critical to rely on a robust supply network for raw resources.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the SiC Wafer Polishing Market from 2023 to 2032. Demand in North America is being driven by the rising use of SiC wafers in power electronics applications such as inverters and power modules. This is especially important in the renewable energy sector and the production of electric vehicles (EVs). The increased emphasis on electric vehicles in North America has resulted in an increase in demand for SiC wafers, which are essential in the development of efficient power electronics in electric vehicles. SiC wafers are used in aerospace, telecommunications, and defence industries in addition to power electronics. North America's broad industrial landscape contributes to the market's resiliency. Because of its capacity to tolerate high temperatures, SiC is well suited for use in severe environments. Aerospace and defence industries in North America, which require high-temperature resistance, contribute to the demand for SiC wafers.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2032. Asia-Pacific, particularly Japan, South Korea, and Taiwan, is a global semiconductor manufacturing hub. The region's substantial presence in the electronics and semiconductor industries helps to drive demand for SiC wafers. The Asia-Pacific region dominates the electric vehicle market. As the automobile industry switches to electric mobility, the need for SiC wafers in the fabrication of power electronics for EVs is increasing. Asia-Pacific countries are actively investing in renewable energy sources. SiC wafers are essential in power circuits for solar inverters and wind energy systems, fueling need for polishing technology. Southeast Asia's emerging markets are seeing increased industrialization and infrastructure development.

Segmentation Analysis

Insights by Product Type

Diamond slurries segment accounted for the largest market share over the forecast period 2023 to 2032. Diamond particles are well-known for their extreme hardness. The use of diamond slurries as abrasives in the polishing process allows for more efficient material removal from SiC wafers, resulting in a smoother, more uniform surface. Diamond slurries help to provide a better surface quality on SiC wafers. Diamond abrasives reduce surface flaws and scratches, improving the overall quality of the polished wafers. Manufacturers frequently create customised formulas of diamond slurries to fulfil specific polishing needs. This customization enables the polishing process to be optimised depending on characteristics such as particle size, concentration, and carrier fluid.

Insights by Application

Power Electronics segment accounted for the largest market share over the forecast period 2023 to 2032. The rising demand for high-power electronic devices, particularly in areas such as electric vehicles, renewable energy, and industrial automation, is driving SiC wafer usage in power electronics. A important aspect is the automobile industry's shift towards electric vehicles (EVs) and hybrid electric vehicles (HEVs). SiC wafers are critical in the development of EV power electronics, leading to the expansion of the power electronics industry. Power electronics based on SiC are widely employed in renewable energy applications such as solar inverters and wind turbines. Demand for SiC wafers in power electronics is being driven by the growing emphasis on clean energy solutions.

Recent Market Developments

- In February 2023, Hindalco Industries Limited, India's largest nonferrous metals firm, and Novelis Inc., the world's leading maker of aluminium rolled products, signed a definitive agreement under which Hindalco will purchase Novelis.

Competitive Landscape

Major players in the market

- Kemnet International (UK)

- Entegris (US)

- Ijin Diamond (US)

- Fujimi Corporation (Japan)

- Saint-Gobain (US)

- JSR Corporation (Japan)

- Engis Corporation (US)

- Ferro Corporation (US)

- 3M (US)

- SKC (South Korea)

- DuPont Incorporated (US)

- Fujifilm Holding America Corporation (US)

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2032.

SiC Wafer Polishing Market, Product Type Analysis

- Abrasive Powders

- Polishing Pads

- Diamond Slurries

- Colloidal Silica Suspensions

SiC Wafer Polishing Market, Application Analysis

- Power Electronics

- Light-emitting diodes (LEDs)

- Sensors and detectors

- Rf and microwave devices

- Others

SiC Wafer Polishing Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Questions (FAQ)

-

1.What is the market size of the SiC Wafer Polishing Market?The global SiC Wafer Polishing Market is expected to grow from USD 4.2 Billion in 2023 to USD 5.6 Billion by 2032, at a CAGR of 6.7% during the forecast period 2023-2032.

-

2.Who are the key market players of the SiC Wafer Polishing Market?Some of the key market players of market are Kemnet International (UK), Entegris (US), Ijin Diamond (US), Fujimi Corporation (Japan), Saint-Gobain (US), JSR Corporation (Japan), Engis Corporation (US) Ferro Corporation (US), 3M (US), SKC (South Korea), DuPont Incorporated (US), Fujifilm Holding America Corporation (US).

-

3.Which segment holds the largest market share?Diamond slurries segment holds the largest market share and is going to continue its dominance.

-

4.Which region is dominating the SiC Wafer Polishing Market?North America is dominating the SiC Wafer Polishing Market with the highest market share.

Need help to buy this report?