Global Gluten Free Bakery Market Size, Share, and COVID-19 Impact Analysis, By Product (Biscuits & Cookies, Bread, Cakes), By Distribution Channel (Online, Supermarkets & Hypermarkets), by Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Industry: Food & BeveragesGlobal Gluten Free Bakery Market Insights Forecasts to 2032

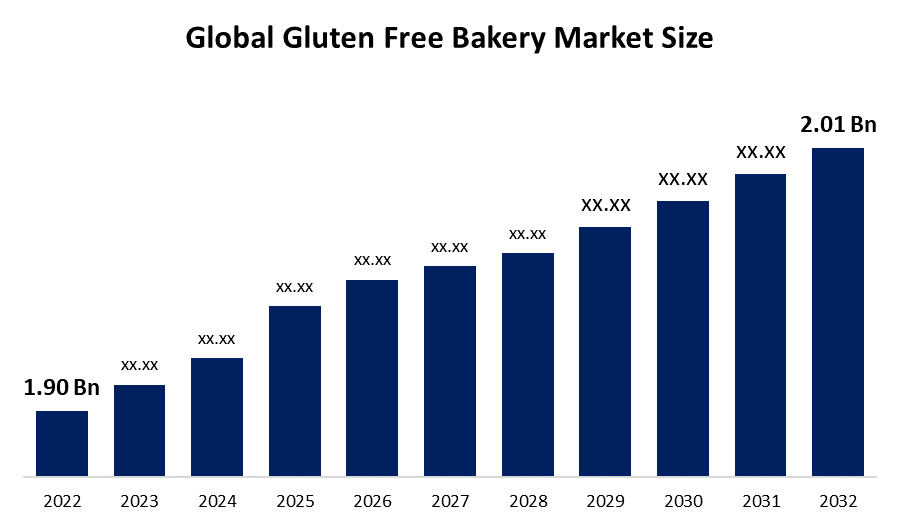

- The Global Gluten Free Bakery Market Size was valued at USD 1.90 Billion in 2022.

- The market is growing at a CAGR of 5.17% from 2022 to 2032

- The global Gluten Free Bakery Market is expected to reach USD 2.01 billion by 2032

- Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Gluten Free Bakery Market Size is expected to reach USD 2.01 billion by 2032, at a CAGR of 5.17% during the forecast period 2022 to 2032.

Pizza, pasta, bread, and cereal are all common examples of foods that contain the protein gluten. Gluten is a component that aids in the texture and form retention of food. For those who have celiac disease or gluten allergies, which lead to small intestine inflammation, gluten-free diets are imperative. Food without gluten benefits the digestion and energetic systems, as well as cholesterol levels.

Impact of COVID 19 On Global Gluten Free Bakery Market

The consumption of gluten products regularly can cause an immune reaction in the body which is termed as celiac disease. Although consuming gluten based products does not cause COVID 19 directly but celiac disease can cause Type 1 diabetes as well as thyroid issues in some patients which makes them vulnerable to adverse effects if it is infected with the COVID 19. Hence, consumers are much aware now and they prefer having gluten free products in their daily diet to avoid such diseases. This has resulted into the increase in the demand of gluten free products.

Key Market Drivers

The increase in the number of celiac disease cases among the young generation more and more people are turning to consuming gluten free Bakery product in order to maintain health and dietary balance. Not only this but also food allergies and intolerances among consumer are going to provide immense benefit in the sale of gluten free Bakery products because they have health benefits to celiac disease patients and at the same time attract other gluten free Bakery products consumers. The globalization, urbanization, and advancement in trade between countries and anticipated to contribute the growth of the gluten free Bakery product market. Moreover, different initiative taken by the government to promote health and Wellness among the consumers are anticipated to attract more people to buy gluten free Bakery products. The change in the lifestyle of the consumer and increasing preference of Health and dietary food products are propelling the growth of the Global gluten free Bakery product market. In addition, the sales and the demand of gluten free products are anticipated to impact the growth of the Global gluten free Bakery market over the upcoming years. We all know that gluten free products come with a shorter shelf life as compared to gluten based foods. But gluten free products now come with longer shelf life due to the advancement made in the field of the Food Industry. Microencapsulation is a new technology which helps the gluten free product to come with the longer shelf life. Hence it is resulting into the growth of the market because of the increasing the number of sales.

Key Market Challenges

The huge cost associated with the gluten free Bakery product is hampering the overall growth of the gluten free Bakery product market. Apart from this the lack of awareness among the people about the concept of gluten is also restraining the growth rate of the market. Gluten free products need to be healthy because their made with gluten free flours such as pasta, pizza, and other Bakery product which are highly refined and are low in fibre. There are times when market players improve the texture and taste of the gluten free product by adding sugar and fats. This may lead to many health issues and act as the another restraining factor of the market growth.

Global Gluten Free Bakery Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 1.90 Billion |

| Forecast Period: | 2022 - 2032 |

| Forecast Period CAGR 2022 - 2032 : | 5.17% |

| 2032 Value Projection: | USD 2.01 Billion |

| Historical Data for: | 2018 - 2021 |

| No. of Pages: | 212 |

| Tables, Charts & Figures: | 123 |

| Segments covered: | By Product, By Distribution Channel, By Region |

| Companies covered:: | Amy's Kitchen, Bob’s Red Mill Natural Foods, Inc., Dawn Food Products, The Hain Celestial Group, Dr. Schar AG, Freedom Nutritional Products Ltd., General Mills, Conagra Brands, Valeo Foods Ltd., WGF Bakery Products, Europastry S.A., Kelkin |

Get more details on this report -

Market Segmentation

Product Insights

The bread segment holds the highest market share over the forecast period

On the basis of product, the global gluten free bakery market is segmented into Biscuits & Cookies, Bread, Cakes. Among these, the bread segment holds the largest market share over the forecast period. Due to the numerous health advantages of low-carb gluten-free, rye, wheat-free, and other types of bread, there is a huge demand for them on the market. Gluten-free bread satisfies the desire for fast and convenient nourishment, especially among people who work. The ability to customise bread to fulfil certain demands is another factor that will likely fuel the segment's expansion. Patients with celiac disease are increasingly consuming gluten-free bread, which accelerates market growth.

The biscuits and cookies segment, on the other hand is witnessing the fastest market growth over the forecast period. The shift of the consumer foot preference and evolving trend toward Healthy lifestyle are promoting the demand of the product across the world. Moreover, the busy lifestyle and increasing health and Wellness concerns among the people is anticipated to drive healthy snacking habit and promote industry growth over the forecast period. The increasing demand for the consumption of healthy cookies among children is also contributing towards the segmental growth.

Distribution Channel Insights

Supermarkets and Hypermarkets segment is dominating the market over the forecast period.

On the basis of distribution channel, the global gluten free bakery market is segmented into Online, Supermarkets and Hypermarkets. The Supermarkets and Hypermarkets segment is dominating the market with the largest market share over the forecast period. The availability of a large variety of products and the ability for customers to learn about products before buying at supermarkets and hypermarkets both contributed to the segment's rise. Additionally, the robust offline retail chains in several major economies, including the U.S., China, and India, contributed to the rise in sales of gluten-free baked goods at hypermarkets and supermarkets. The overall sales of gluten-free baked goods have increased as a result of the increased availability of healthy food products in supermarkets and hypermarkets. Customers also favour shopping at conventional supermarkets since they are convenient and provide a wide selection of goods, which contributes to the segment's continued expansion.

The online segment, on the other hand is estimated to witness the fastest market growth over the forecast period. The growth is attributed to the increasing trend of online shopping for healthy Bakery product among the people across the world. The advantages of purchasing from the comfortability of home, free shipping, dot, and lots of discounts and mainly attracting the people especially the younger generation to prefer the online shopping portals. Over the past few years, the food and beverages industry has witness the potential of e-commerce and this is the reason they have offends there individual shopping websites to get more and more customers and orders to generate maximum profit.

Regional Insights

North America is dominating the market with the largest market share over the forecast period

Get more details on this report -

North America is dominating the Gluten Free Bakery market over the forecast period. The growth is attributed to the increasing prevalence of celiac diseases among people in the region. According to the survey done by the Celiac Disease Foundation, about 0.6% of the overall population are suffering celiac disease in the United States. Apart from this, the increasing demand among people for healthy diet is propelling the growth of the region.

Asia Pacific, on the other hand is witnessing the fastest market growth over the forecast period. The growth of the Asia Pacific region is mainly attributed to the increasing awareness related to the health benefit of the gluten free food products in countries like China, Japan and India. Apart from this the increasing concern related to various diseases is anticipated to boost the demand of the market growth.

Recent Market Development

- In January 2022, MYBREAD Gluten Free Bakery has made an announcement about the launch of original flatbreaf pitas at selected Walmart stores across the U.S.

- In June 2021, Dawn Foods has introduced injected muffins and chocolate brownis made with the gluten free mixes and fillings.

List of Key Companies

- Amy's Kitchen

- Bob’s Red Mill Natural Foods, Inc.

- Dawn Food Products

- The Hain Celestial Group

- Dr. Schar AG

- Freedom Nutritional Products Ltd.

- General Mills

- Conagra Brands

- Valeo Foods Ltd.

- WGF Bakery Products

- Europastry S.A.

- Kelkin

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global Gluten Free Bakery Market based on the below-mentioned segments:

Gluten Free Bakery Market, Product Analysis

- Bread

- Biscuits & Cookies

- Others

Gluten Free Bakery Market, Distribution Channel Analysis

- Supermarkets and Hypermarkets

- Online

- Others

Gluten Free Bakery Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?