Global Glyphosate Market Size, Share, Growth, and Industry Analysis, By Crop Type (Genetically Modified, and Conventional), By Application (Agriculture, Household, and Industrial) and Regional Glyphosate and Forecast to 2033

Industry: Chemicals & MaterialsGlobal Glyphosate Market Size Glyphosate Forecasts to 2033

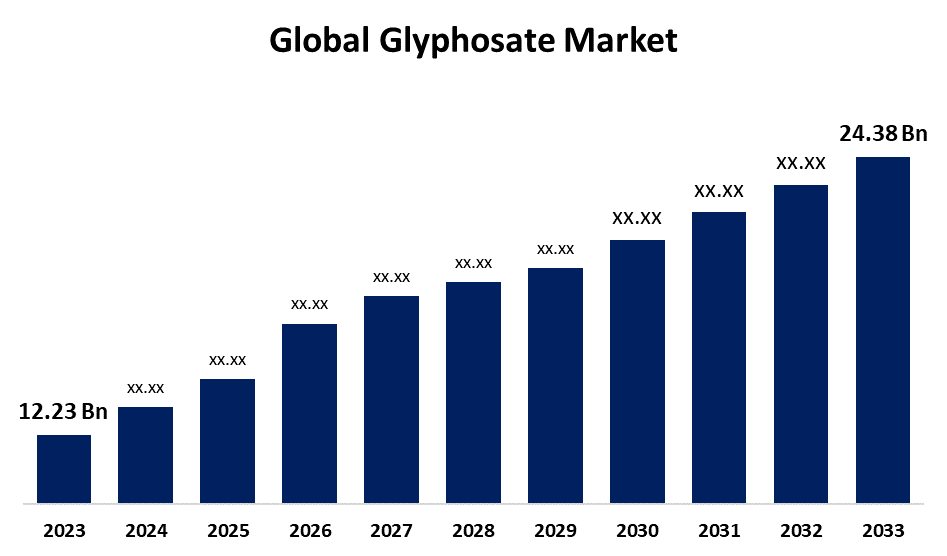

- The Global Glyphosate Market Size was Valued at USD 12.23 Billion in 2023

- The Market Size is Growing at a CAGR of 7.14% from 2023 to 2033

- The Worldwide Glyphosate Market Size is Expected to Reach USD 24.38 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Glyphosate Market Size is Anticipated to Exceed USD 24.38 Billion by 2033, Growing at a CAGR of 7.14% from 2023 to 2033. The application of glyphosate to eradicate various weeds, including chickweed, barnyard grass, dandelion, and others, along with the growing substitution of mechanical weed control in numerous crops, accelerated the market expansion.

GLYPHOSATE MARKET REPORT OVERVIEW

A common herbicide for managing grasses and broadleaf weeds is glyphosate. Glyphosate is applied in the form of sodium salt to control plant growth and promote crop maturity. In the US, glyphosate is one of the herbicides that is most frequently used. It is used for weeds in industrial locations, on lawns and gardens, in forestry, and in agriculture. Certain glyphosate-containing products suppress aquatic vegetation. Glyphosate can be sprayed on areas that are about to be planted with different crops in order to eradicate and suppress the growth of annual and perennial weeds. It can be applied to plantations of grapes and tea, when planting citrus and fruit trees, in water farms and personal subsidiary operations, in forest tree nurseries for targeted soil application, or when applying certain herbicides repeatedly.

It is used for plants for post-emergent control. The herbicide glyphosate is incredibly powerful at controlling a wide range of broadleaves, sedges, and annual and perennial grasses. This herbicide functions as an enzyme inhibitor, preventing the production of certain vital amino acids that are necessary for proper protein synthesis. When these amino acids are most required for new growth, the growing areas of the plant are where glyphosate tends to concentrate. When applied improperly, this nonselective translocating herbicide can easily harm valuable vegetation inadvertently.

Report Coverage

This research report categorizes the market for the global glyphosate market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global glyphosate market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global glyphosate market.

Global Glyphosate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 12.23 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.14% |

| 2033 Value Projection: | USD 24.38 Billion |

| Historical Data for: | 2020-2022 |

| No. of Pages: | 228 |

| Tables, Charts & Figures: | 126 |

| Segments covered: | By Crop Type, By Application, By Regional and COVID-19 Impact Analysis |

| Companies covered:: | Nufarm, Adama Agricultural Solution, Bayer AG, Syngenta, UPL, Sumitomo Chemical, AIMCO PESTICIDES LIMITED, BASF, Dow, DuPont, Nantong Jiangshan Agro, Jiangsu Yangnong Chemical Co.Ltd., Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

DRIVING FACTORS:

The rising concern for glyphosate-resistant crops can boost the market growth.

The growing need for crops resistant to glyphosate is expected to fuel the glyphosate market's growth over the forecast period. The widespread use of genetically modified (GM) crops that are resistant to the herbicide has resulted in a huge increase in the demand for glyphosate. Glyphosate, the most widely used herbicide worldwide, is particularly effective in controlling weeds in genetically modified crops like soybeans, corn, and cotton.

RESTRAINING FACTORS

The glyphosate market can be restricted by stringent government regulation.

Research has linked glyphosate to a number of environmental problems, including harm to pollinators, degradation of water supplies, and increased risk of cancer. These concerns have led to restrictions or outright bans on the use of glyphosate in several countries. These bans and restrictions are expected to have a major effect on the glyphosate market.

Market Segmentation

The glyphosate market share is classified into crop type and application.

The segment with the largest proportion of genetically modified crops over the forecast period.

Based on crop type, the glyphosate market is classified into genetically modified, and conventional. Modern pesticides and herbicides are needed to cultivate genetically modified crops, which are created by inserting new DNA into plant cells. Thus, as attention turns more and more to the cultivation of genetically modified crops, the need for glyphosate rises. It is also expected that consumers who use genetically modified crops to meet their daily nutrient needs such as glyphosate for high-nutritious crop pest and insect control would use more of these crops, such as cornstarch, corn syrup, corn oil, soybean oil, canola oil, or granulated sugar, as well as fresh produce like potatoes, summer squash, apples, papayas, and pink pineapples. Weed resistance to glyphosate started to rise after several years of extensive usage of GM HT (tolerant to glyphosate) crop technology. This is explained by the way glyphosate was initially applied to genetically modified hybrid crops. Many early consumers of GM hybrid crops employed glyphosate as their only weed management solution because of its extremely potent, broad-spectrum post-emergence activity.

The agriculture segment accounted for the largest share of the market during the forecast period.

Based on application, the glyphosate market is classified into agriculture, household, and industrial. The rising population of the world needs high demand for food and agricultural products can anticipated to boost the market growth. Farmers use glyphosate to safeguard plants and crops by managing and eliminating unwanted vegetation. With an increasing population comes a greater demand for food and agricultural products. To meet this demand, glyphosate is used to suppress weeds and allow crops to develop more quickly by keeping them from competing with the crops. It is essential for sustainable environmental practices, a safe food supply, and efficient weed management. A tried-and-true method for keeping damaging weeds from overtaking crops is to apply glyphosate to fields, especially when growing glyphosate-tolerant crops.

Regional Segment Analysis of the Global Glyphosate Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia-Pacific is having the biggest share of the glyphosate market throughout the forecast period.

Get more details on this report -

One of the main drivers of glyphosate use and market expansion in India is the proportion of employment in agriculture. A high rate of glyphosate usage in farming and agricultural activities is expected given the region's predominance in agriculture, which is indicated by the high employment rate. The region's vast agricultural landmass is another driving force behind the widespread use of glyphosate in the production of food and agricultural goods. Other variables that are expected to contribute to growth include expenditures in research & development as well as GDP growth along with increased chemical consumption. Overall the current population and population growth are higher in this region. Food is therefore in great demand, and it is unacceptable for weeds to reduce agricultural output. In addition, the region is more receptive to the use of genetically modified crops than other markets. The market would also be driven by the expansion of biofuel's application possibilities and the rise in crop feeding of animals.

North America is the fastest-growing region during the projected timeframe.

Growing consumer demand for genetically modified crops and growing use of contemporary agricultural products are expected to be the primary drivers of market expansion over the course of the projected period. Furthermore, it is expected that the requirement for glyphosate for soil enhancement and the quickly expanding agriculture sector would both favorably impact market expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global glyphosate market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nufarm

- Adama Agricultural Solution

- Bayer AG

- Syngenta

- UPL

- Sumitomo Chemical

- AIMCO PESTICIDES LIMITED

- BASF

- Dow

- DuPont

- Nantong Jiangshan Agro

- Jiangsu Yangnong Chemical Co.Ltd.

- Others

Key Market Developments

- In March 2022, BASF and Corteva Agriscience reached an agreement to cross-license soybean features and create complementary herbicide technologies (such as tolerance to glyphosate) so that both businesses could provide farmers with innovative weed management options for soybeans globally.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global glyphosate market based on the below-mentioned segments:

Global Glyphosate Market, By Crop Type

- Genetically Modified

- Conventional

Global Glyphosate Market, By Application

- Agriculture

- Household

- Industrial

Global Glyphosate Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global glyphosate market over the forecast period?The global glyphosate market size is expected to grow from USD 12.23 Billion in 2023 to USD 24.38 Billion by 2033, at a CAGR of 7.14% during the forecast period 2023-2033.

-

2. Which region is expected to hold the highest share in the global glyphosate market?Asia-Pacific is projected to hold the largest share of the global glyphosate market over the forecast period.

-

3. Who are the top key players in the glyphosate market?Nufarm, Adama Agricultural Solution, Bayer AG, Syngenta, UPL, Sumitomo Chemical, AIMCO PESTICIDES LIMITED, BASF, Dow, DuPont, Nantong Jiangshan Agro, Jiangsu Yangnong Chemical Co.Ltd., and Others.

Need help to buy this report?