Global Gout Therapeutics Market Size, Share, and COVID-19 Impact Analysis, By Drug Class (Non-steroidal Anti-Inflammatory Drugs (NSAIDs), Corticosteroids, Colchicine, anti-hyperuricemic Agents (Urate-Lowering Drugs), By Disease Condition (Acute Gout, Chronic Gout), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032.

Industry: HealthcareGlobal Gout Therapeutics Market Insights Forecasts to 2032

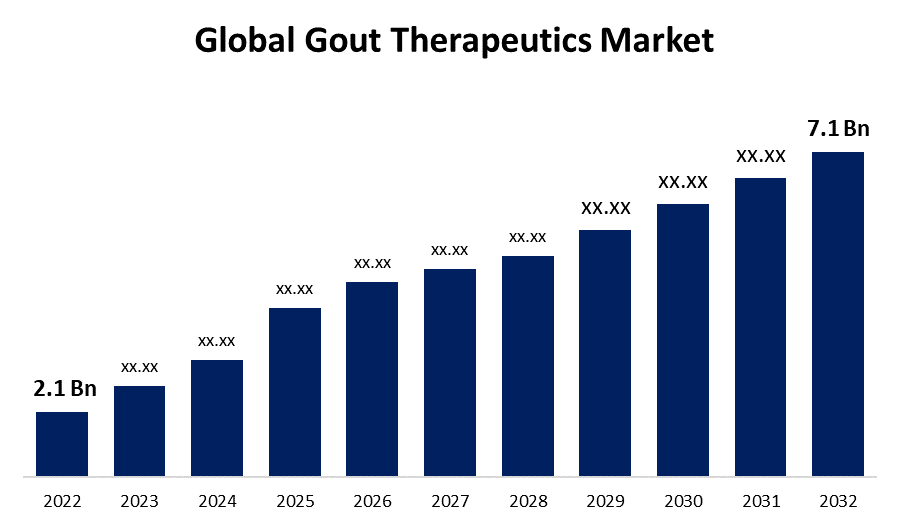

- The Global Gout Therapeutics Market Size was valued at USD 2.1 Billion in 2022.

- The Market is Growing at a CAGR of 12.7 % from 2022 to 2032.

- The Worldwide Gout Therapeutics Market Size is expected to reach USD 7.1 Billion by 2032.

- Europe is expected To Grow the fastest during the forecast period.

Get more details on this report -

The Global Gout Therapeutics Market Size is expected to reach USD 7.1 billion by 2032, at a CAGR of 12.7 % during the forecast period 2022 to 2032. The rising prevalence of gout with increased alcohol consumption, as well as technological advancements in imaging modalities that improved understanding of gout, are factors attributed to the market's growth.

Market Overview

Gout is an inflammatory disease that affects males over 40 who have a high uric acid level in their blood. The chemical, by creating needle-like crystals, can cause considerable discomfort, inflammation, and stiffness in joints. Gout is a complicated kind of arthritis that causes extreme pain, stiffness, and redness in the joints. Gout symptoms can vary from person to person and there are numerous techniques to treat and avoid symptoms. NSAIDs or corticosteroids can be used to relieve pain and inflammation caused by the condition. It is defined by intense pain, swelling, redness, and sensitivity in one or more joints, most often the big toe. In women, it usually happens after menopause. Men are three times more likely than women to get it because they have greater uric acid levels during the majority of their life. These uric acid levels are reached in women following menopause.

Report Coverage

This research report categorizes the global gout therapeutics market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global gout therapeutics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global gout therapeutics market. Technological innovation and advancement will further optimize the performance of the product, enabling it to acquire a wider range of applications in the downstream market.

Global Gout Therapeutics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 2.1 Billion |

| Forecast Period: | 2022–2032 |

| Forecast Period CAGR 2022–2032 : | 12.7 % |

| 022–2032 Value Projection: | USD 7.1 Billion |

| Historical Data for: | 2020-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Drug Class, By Disease Condition, By Region. |

| Companies covered:: | Lannett Company, Inc, Boehringer Ingelheim, GlaxoSmithKline PLC, Horizon Therapeutics plc, Viatris, Novartis International AG, Regeneron Pharmaceuticals, Romeg Therapeutics, LLC., Takeda Pharmaceutical Company Ltd, Teijin Pharma Ltd. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increased prevalence of gout as a result of changing lifestyle habits and an aging population is driving the gout treatment industry. Globally, people's life expectancy is rising, which has increased the elderly population. This tendency has resulted in a larger prevalence of this ailment and per capita demand for its medicines, which has benefited their business. Biologics including Krystexxa, Canakinumab, and Rilonacept have recently entered the market. Moreover, the market is expected to be driven by increasing acceptance of these biologics due to their potential to create a significant anti-inflammatory effect throughout the projected period. Furthermore, numerous other medications that are now in clinical studies are predicted to be introduced throughout the projection period, possibly propelling the business. Rising R&D expenditure to create innovative products is another element driving market revenue growth.

Restraining Factors

Gout is frequently misdiagnosed or underdiagnosed, resulting in delayed or poor treatment. Also, lack of information about the signs and repercussions of gout among both patients and healthcare providers might restrain demand for gout medications. Gout is also connected to lifestyle variables including food, alcohol consumption, and obesity. However, initiating and maintaining lifestyle changes can be difficult for individuals, affecting their capacity to manage and control gout. This may lessen the necessity for particular gout preventive medicines. Furthermore, some gout drugs, particularly long-term urate-lowering regimens, may have unwanted side effects or pose safety risks. Adverse effects, such as gastrointestinal problems or allergic responses, might influence patient acceptability and usage of these therapies, resulting in lower demand.

Market Segmentation

- In 2022, the anti-hyperuricemic agents (urate lowering Agents) segment is influencing the market with the largest market share over the forecast period.

On the basis of drug class, the global gout therapeutics market is segmented into different segments such as non-steroidal anti-inflammatory drugs (NSAIDs), corticosteroids, colchicine, anti-hyperuricemic Agents (Urate-Lowering Drugs). Among these segments, the anti-hyperuricemic Agents (urate-lowering agents) segment accounted for the largest revenue share during the forecast period. Antihyperuricemic medications are often known as antigout medications. The anti-hyperuricemic agent sector is predicted to rise considerably during the forecast period due to factors such as the increased usage of these medications to treat gout. Antihyperuricemic medications lower blood uric acid levels by either increasing urine uric acid excretion or preventing the production of extra uric acid. Salicylates, pyrazinamide, ethambutol, nicotinic acid, cyclosporin, 2-ethylamino-1,3,4-thiadiazole, fructose, and cytotoxic medicines are examples of pharmaceuticals that cause hyperuricemia.

- In 2022, the chronic segment is dominating the largest market growth during the forecast period.

Based on the disease condition, the global gout therapeutics market is segmented into acute gout and chronic gout. Among these, the chronic segment is predicted to account for the biggest revenue share during the projection period. Urate-lowering medicines such as xanthine oxidase inhibitors and uricosuric drugs are included in this category. The introduction of urate-lowering medications, as well as the anticipated entrance of pipeline pharmaceuticals, are predicted to propel the market at the quickest rate throughout the forecast period.

Regional Segment Analysis of the gout therapeutics market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America Dominates the Market growth over the forecast Period

Get more details on this report -

North America accounted for the largest share of all the regions, due to the rising prevalence of gout, the presence of well-established healthcare infrastructure, and the growing healthcare expenditure. According to the Organization for Economic Cooperation and Development (OECD), in June 2022, healthcare spending in the United States was 17.8% of total GDP. This is also due to the existence of significant participants on a local level, the widespread use of gout treatment, and the high cost of branded medications in the United States. Because of the anticipated launch of urate-lowering medicines in the region, the region is predicted to continue its dominance over the forecast period.

Asia Pacific is expected to develop the fastest in the next years due to an increasing patient pool, increased investment by major competitors in the area, and greater gout treatment use. Furthermore, increased smoking prevalence, alcohol intake, and a stressful lifestyle are predicted to increase the incidence of gout during the projected period.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the global gout therapeutics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Lannett Company, Inc

- Boehringer Ingelheim

- GlaxoSmithKline PLC

- Horizon Therapeutics plc

- Viatris

- Novartis International AG

- Regeneron Pharmaceuticals

- Romeg Therapeutics, LLC.

- Takeda Pharmaceutical Company Ltd

- Teijin Pharma Ltd

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In August 2022, Synlogic, Inc., a clinical-stage biotechnology company that uses its proprietary synthetic biology approach to develop medicines for metabolic and immunological diseases, announced the development of a new drug candidate for the treatment of gout in collaboration with Ginkgo Bioworks, a leading horizontal platform for cell programming.

- In March 2022, Atom Bioscience revealed encouraging findings from a randomized double-blind, placebo-controlled Phase 2a clinical study of ABP-671 for the treatment of persistent gout.

- In March 2022, Strides Pharma's Colchicine tablets USP, 0.6 mg, have been authorized by the US Food and Drug Administration for the treatment and prevention of gout.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2022 to 2032. Spherical Insights has segmented the Global Gout Therapeutics Market based on the below-mentioned segments:

Global Gout Therapeutics Market, By Drug Class

- Non-steroidal Anti-Inflammatory Drugs (NSAIDs)

- Corticosteroids

- Colchicine

- anti-hyperuricemic Agents (Urate-Lowering Drugs)

Global Gout Therapeutics Market, By disease condition

- Acute Gout

- Chronic Gout

Gout Therapeutics Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?