Global Grain Mill Products Market Size, Share, and COVID-19 Impact Analysis, By Type (Wheat, Rice, and Others), By End-Use (Commercial and Residential), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Consumer GoodsGlobal Grain Mill Products Market Insights Forecasts to 2033

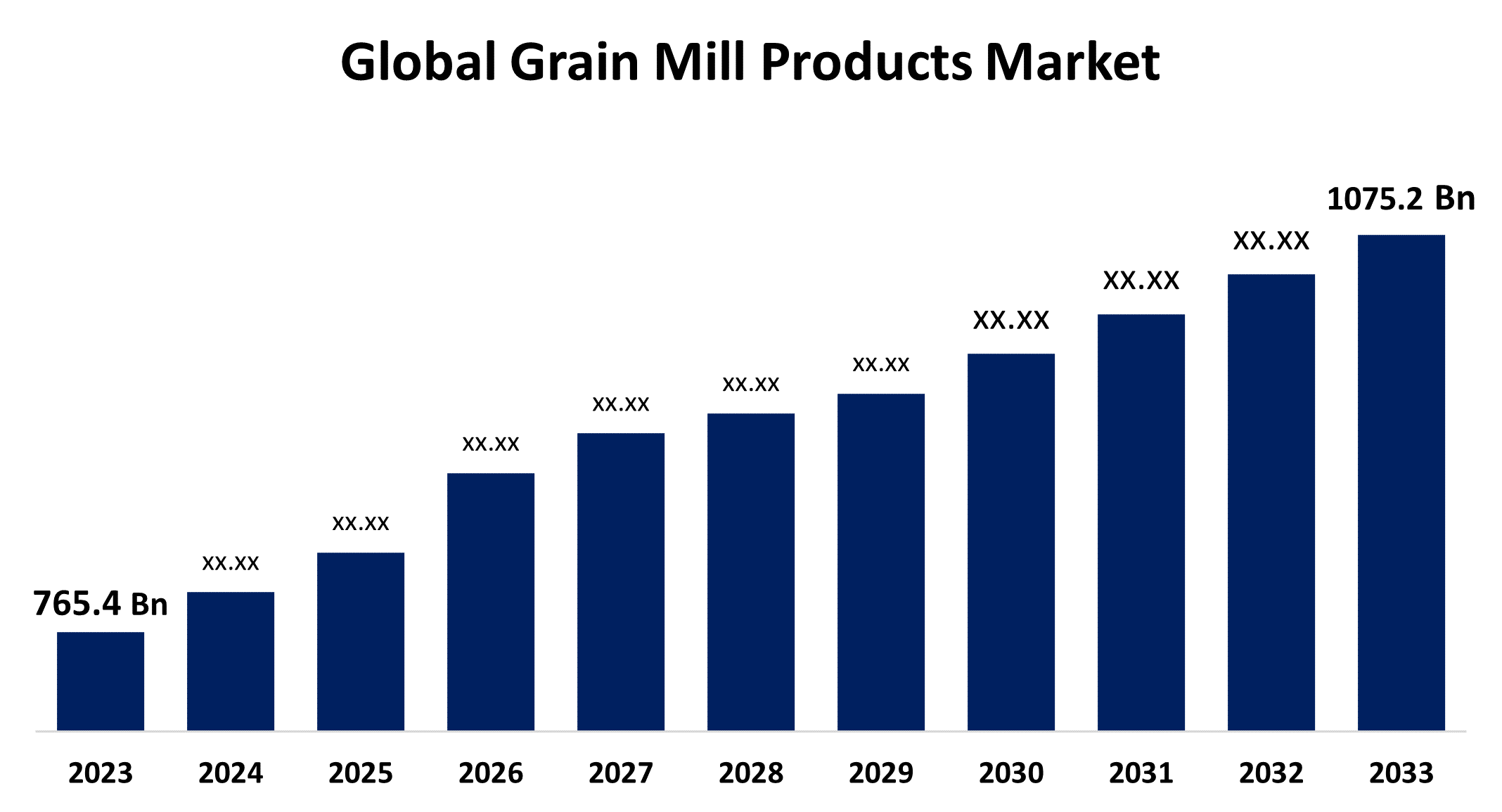

- The Global Grain Mill Products Market Size was Valued at USD 765.4 Billion in 2023

- The Market Size is Growing at a CAGR of 3.46% from 2023 to 2033

- The Worldwide Grain Mill Products Market Size is Expected to Reach USD 1075.2 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Grain Mill Products Market Size is Anticipated to Exceed USD 1075.2 Billion by 2033, Growing at a CAGR of 3.46% from 2023 to 2033.

Market Overview

The process of grinding grain or vegetable meal into flour, cleaning, and polishing rice, and using these finished products to make flour mixtures or doughs. The production of starch and starch derivatives, along with the wet milling of maize and vegetables. Grain mill machinery is frequently used to crush pulses or cereals. Grain mill products are generated by cutting, grinding, or crushing solid materials into smaller bits. Growing health concerns have increased demand for high-protein flour, which has in turn driven flour millers to develop innovative gluten-free flour substitutes such as corn flour, rice flour, soy flour, and maize flour. The rapid modern lifestyle's increasing need for quick and easy meals has a big impact on the grain milling industry. Research and development along with innovations in the grain mill sector have a favorable impact on the market. Technological developments in milling are leading to higher output and improved efficiency. The grain mill products market will be growing as a result of the introduction of cutting-edge grain milling equipment with useful and affordable features.

Report Coverage

This research report categorizes the market for the grain mill products market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the grain mill products market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the grain mill products market.

Global Grain Mill Products Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 765.4 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.46% |

| 2033 Value Projection: | USD 1075.2 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 215 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By End-Use, By Region |

| Companies covered:: | Archer Daniels Midland Company, Ardent Mills, Conagra Brands, Inc., Oy Karl Fazer Ab, King Arthur Flour Company, Inc., ITC LIMITED, Goodman Fielder., Grain Millers, Inc., Hayden Flour Mills, LLC., Jas Enterprises, Flora Appliances, Hodgson Mill, Cargill, Incorporated, General Mills Inc., and Others key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the grain mill products market is fueled by several factors including the growing popularity of baked products and confections in addition to the growing use of different kinds of flour in the fast food sector. The market for grain mill products is expected to expand due to the rising demand for natural and organic meals and wholesome, nutrient-dense foods. In addition, growing dietary concerns, evolving customer tastes and preferences, and an increase in the need for packaged and ready-to-eat foods may significantly drive the market value growth of grain mill products.

Restraining Factors

The main obstacles facing the grain mill products industry participants are the requirement to supply qualified labour, the high initial cost of equipment investment, and the growing demands of consumers in terms of quality and variety.

Market Segmentation

The grain mill products market share is classified into type and end-use.

- The wheat segment holds the largest market share through the forecast period.

Based on the type, the grain mill products market is categorized into wheat, rice, and others. Among these, the wheat segment holds the largest market share through the forecast period. This dominance is due to the popularity of wheat as a staple food throughout the world appears first. Asia's nations including China and India, whose high wheat consumption greatly drives up demand for this crop, are especially notable for their broad appeal. Wheat is remarkably versatile, in addition to being used often to produce flour for bread, pastries, and baked products.

- The commercial segment is anticipated to grow at the highest CAGR during the forecast period.

Based on the end-use, the grain mill products market is categorized into commercial and residential. Among these, the commercial segment is anticipated to grow at the highest CAGR during the forecast period. The rising demand for processed foods and increasing awareness of the advantages of consuming flour are going to be the main drivers of commercial grain mills. A commercial grain mill can process a lot of grain at once; customers can guarantee a steady supply of products such as flour. A fine powder that is easily absorbed by both humans and animals can be produced by a commercial grain mill.

Regional Segment Analysis of the Grain Mill Products Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

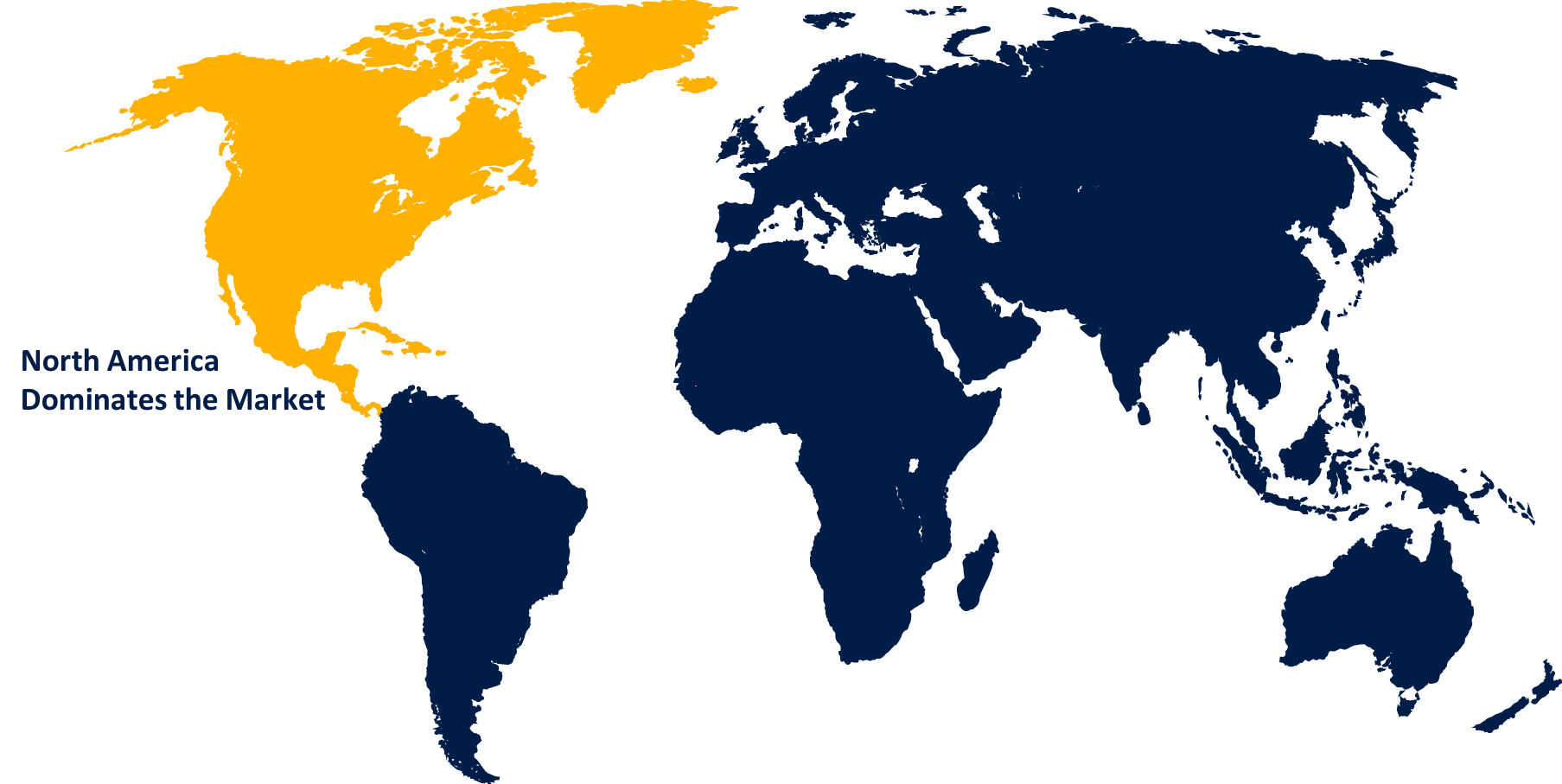

North America is anticipated to hold the largest share of the grain mill products market over the predicted timeframe.

Get more details on this report -

North America is projected to hold the largest share of the grain mill products market over the predicted timeframe. The grain mill products market in the North America region is being driven by the increase in demand for bakery and bread products and the growing awareness of gluten-free cuisine. People's busy lives and need for quick and easy meals have led to a surge in demand in North America for bakery products that can be speedily cooked at home or consumed on the move. The market for processed grain products is relatively large in North America due to the region's huge and wealthy population. As ready-to-eat foods, desserts, and quick dinners are so popular in the area, there is still a large demand for flour, cornmeal, and other milled grains.

Asia Pacific is expected to grow at the fastest CAGR growth in the grain mill products market during the predicted timeframe. This dominance is due to the increasing demand for flour and other food products manufactured from grains is driving the growth of the grain mill products market in Asia Pacific. A significant portion of the population in the area makes grains a mainstay of their diet. Grain mill grinders are used to turn a variety of grains into flour, and because they can yield a higher-quality result, these devices are gaining popularity in nations that include China and India.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the grain mill products market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Archer Daniels Midland Company

- Ardent Mills

- Conagra Brands, Inc.

- Oy Karl Fazer Ab

- King Arthur Flour Company, Inc.

- ITC LIMITED

- Goodman Fielder.

- Grain Millers, Inc.

- Hayden Flour Mills, LLC.

- Jas Enterprises

- Flora Appliances

- Hodgson Mill

- Cargill, Incorporated

- General Mills Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2024, King Arthur Baking Company announced a new Regeneratively Grown Climate Blend Meal, all of its flour from regeneratively grown wheat by 2030. This effort aimed to improve soil health through sustainable farming practices.

- In April 2022, Ardent Mills, a prominent flour-milling and component firm, released new approved gluten-free and Keto-friendly flour blends for the Canadian market.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the grain mill products market based on the below-mentioned segments:

Global Grain Mill Products Market, By Type

- Wheat

- Rice

- Others

Global Grain Mill Products Market, By End-Use

- Commercial

- Residential

Global Grain Mill Products Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global grain mill products market over the forecast period?The global grain mill products market is to expand at 3.46% during the forecast period.

-

2. Which region is expected to hold the highest share in the global grain mill products market?The North America region is expected to hold the largest share in the global grain mill products market.

-

3. Who are the top key players in the grain mill products market?The key players in the global grain mill products market are Archer Daniels Midland Company, Ardent Mills, Conagra Brands, Inc., Oy Karl Fazer Ab, King Arthur Flour Company, Inc., ITC LIMITED, Goodman Fielder, Grain Millers, Inc., Hayden Flour Mills, LLC, Jas Enterprises, Flora Appliances, Hodgson Mill, Cargill, Incorporated, General Mills Inc., and others.

Need help to buy this report?