Global Graphite Electrode Market Size, By Grade (Ultra High Powered (UHP), High Powered (HP), Regular Powered (RP)), By Diameter (< 200mm, 201mm to 400mm, 401mm to 600mm, > 600mm), By Application (Electric Arc Furnace (EAF), Basic Oxygen Furnace (BOF), Non-Steel Application), By Geographic Scope and Forecast, 2022 - 2032

Industry: Chemicals & MaterialsGlobal Graphite Electrode Market Insights Forecasts to 2032

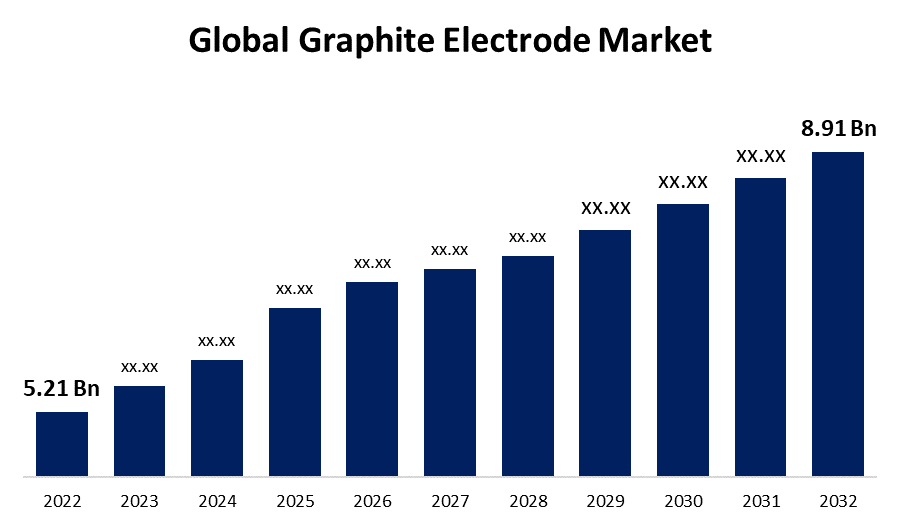

- The Graphite Electrode Market Size was valued at USD 5.21 Billion in 2022.

- The Market is Growing at a CAGR of 5.51% from 2022 to 2032

- The Worldwide Graphite Electrode Market Size is expected to reach USD 8.91 Billion by 2032

- North America is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Graphite Electrode Market Size is expected to reach USD 8.91 Billion by 2032, at a CAGR of 5.51% during the forecast period 2022 to 2032.

Graphite electrodes are an important component in the production of steel in electric arc furnaces (EAFs), as they carry electrical energy from the power source to the steel melt in the EAF bath. These electrodes are often created through calcination employing premium materials such as petroleum coke, needle coke, and coal tar pitch as a binder. They are developed for greater productivity and ultra-high performance, and a variety of electrode sizes are offered for a variety of industrial applications. Graphite rods are used in heat treating to support hearth rails or beams, to allow for thermal expansion of graphite plates, as support posts in fixtures, and for a variety of other purposes. They are also used in the laboratory as electrodes, stir sticks, and for other chemical applications. Furthermore, demand for graphite electrodes is being driven by the expansion of the construction, automotive, infrastructure, aerospace, and defense sectors, which are key users of steel products. Moreover, the increased use of electric vehicles (EVs) and renewable technologies is increasing the demand for graphite electrodes, which are utilized in the production of high-quality steel and other specialty materials.

Market Outlook

Global Graphite Electrode Market Price Analysis

The global graphite electrode market exhibits dynamic pricing influenced by multiple factors. Essential in steel production, graphite electrode prices hinge on raw material costs, primarily derived from petroleum and needle coke. Fluctuations in these inputs, driven by geopolitical events and market trends, impact overall production expenses. Demand mirrors the health of the steel industry, subject to global economic conditions. Additionally, technological advancements and environmental regulations play pivotal roles, altering production processes and costs. Geopolitical factors, including trade tensions, contribute to market volatility. Staying attuned to these multifaceted elements is crucial for understanding and navigating the ever-evolving landscape of the global graphite electrode market.

Global Graphite Electrode Market Distribution Analysis

Distribution channels vary, encompassing direct sales, distributors, and online platforms. Geographical considerations play a vital role, with regions exhibiting varying demand and supply patterns. Efficient distribution relies on understanding market nuances, adapting to regional preferences, and navigating regulatory landscapes. As demand for graphite electrodes is closely tied to steel production, distributors must align strategies with the evolving dynamics of the steel industry to ensure optimal market reach and responsiveness.

Global Graphite Electrode Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 5.21 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 5.51% |

| 2032 Value Projection: | USD 8.91 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Grade, By Diameter, By Application, By Geographic Scope. |

| Companies covered:: | GrafTech International, Zhongze Group, Dan Carbon, Showa Denko, Tokai Carbon, Graphite India Ltd., Resonac Holdings Corporation, Fangda Carbon New Material Co., Ltd., Sangraf International, SEC Carbon, Ltd., Nippon Carbon, EPM Group, Nantong Yangzi Carbon Co. Ltd., Misano Group, Kaifeng Carbon Co., Ltd. and other key vendors. |

| Growth Drivers: | Higher demand for high-quality steel |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Graphite Electrode Market Dynamics

Higher demand for high-quality steel

Increased infrastructure spending may raise demand for graphite electrodes, a key component in the smelting process that produces high-quality steel. As a result, steel manufacturers are benefiting from rapid industrialization and urbanization in both developed and emerging countries. Graphite electrodes are increasingly being used in steel manufacturing due to qualities such as strong electrical conductivity, the capacity to persist higher heat loss, and excellent tensile strength. During the projection period, however, the rapid expansion in steel consumption from major end-users such as construction, automobile, aircraft, mechanical machinery, and oil & gas sectors would enhance demand for graphite electrodes.

Restraints & Challenges

The fluctuation of prices in raw materials is most significant impediment to market expansion

Raw material price fluctuations can have a major effect on the projected development of the global graphite electrode market. Petroleum needle coke, a type of carbon material, is used to make graphite electrodes. Prices for needle coke and other raw materials required in the production of graphite electrodes, such as coal tar pitch, can fluctuate due to a variety of reasons such as demand and supply dynamics, political turmoil, tweaks in government laws, and global economic conditions. Raw material price fluctuations can put considerable cost pressures on graphite electrode makers. Price increases in needle coke and other essential raw materials can result in increased production expenses.

Regional Forecasts

Get more details on this report -

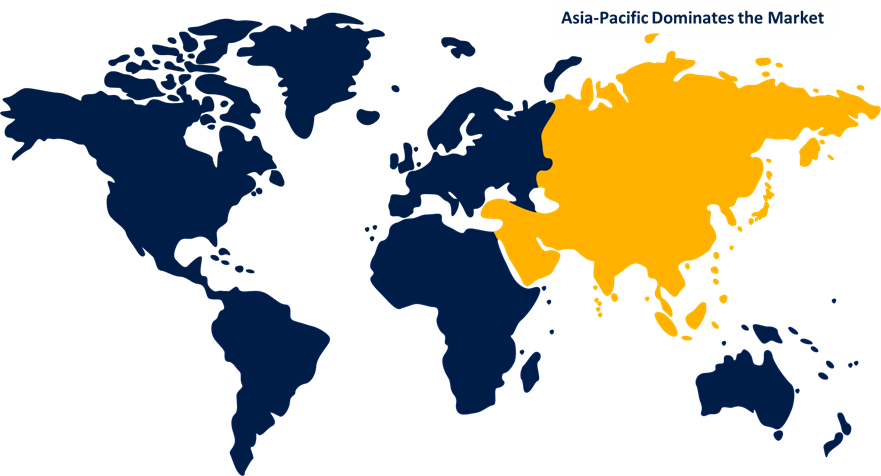

Asia Pacific Market Statistics

Asia Pacific is anticipated to dominate the graphite electrode market from 2022 to 2032. This is attributable to the region's burgeoning economy, rising industrialization, and high energy prices. In addition, the long-standing steel and aluminum sectors are propelling market expansion. Also, the region's broadening adoption of electric vehicles is likely to increase demand for graphite electrodes for lithium-ion battery production. In terms of consumption and manufacturing capacity of graphite electrodes in Asia Pacific, China leads the way, followed by India and Japan. Furthermore, growing urbanization and industrialization have increased construction activity, pushing total market demand in this region. Growing environmental awareness has resulted in a preference for green materials over the traditional method of using petroleum-derived coke. As a result, all of these variables are likely to contribute to rapid infrastructure growth, which is likely to fuel market development over the projected time frame.

North America Market Statistics

North America is witnessing the fastest market growth between 2023 to 2032. The region's steel sector is undergoing technological breakthroughs with a particular emphasis on long-term sustainability, which has resulted in a surge in demand for carbon-neutral steel manufacturing processes and, eventually, higher market demand. Furthermore, natural graphite reserves and established industrial infrastructure contribute significantly to the growth of the graphite electrode market, particularly in North America. Access to extensive natural graphite sources in North America helps the region's graphite electrode manufacturers compete by ensuring a steady supply of raw materials at affordable rates. The availability of resources facilitates the graphite electrode market to flourish by offering a constant and long-term resource base.

Segmentation Analysis

Insights by Grade

The high-powered segment accounted for the largest market share over the forecast period 2023 to 2032. High-power electrodes are essential, particularly in applications requiring increased current-carrying capabilities and endurance. Given their efficacy and environmental benefits, EAFs are becoming more popular as global steel consumption develops, boosting the demand for high-powered electrodes. They are also meant to increase energy efficiency, cutting total operational costs. Incorporating digital technologies, sensors, and data analytics into electric arc furnace processes increases electrode efficiency while decreasing wear and tear, potentially improving electrode lifespan.

Insights by Diameter

The 401mm to 600mm segment accounted for the largest market share over the forecast period 2023 to 2032. Graphite electrodes with diameters ranging from "401mm to 600mm" are commonly used in steel production in electric arc furnaces (EAFs). It is a versatile line that can comply with a wide range of steelmaking requirements. This diameter segment is suitable for a wide range of steel manufacturing applications because it strikes a balance between power capacity, performance, and cost-effectiveness. The "401mm to 600mm" diameter range enables flexibility in meeting a wide range of steel production requirements, including large- and medium-scale steel manufacturing operations. The versatility of this product has enhanced its market dominance.

Insights by Application

The electric arc furnace (EAF) segment accounted for the largest market share over the forecast period 2023 to 2032. The growing utilization of EAFs in steel production is driving segment expansion primarily because of their lower environmental impact compared to other manufacturing techniques. In addition, strict environmental restrictions promoted the use of electric arc furnaces. This regulatory effort will increase demand for electric arc furnace products. EAF steelmaking with graphite electrodes has the potential to be a lot cheaper than traditional blast furnaces. It uses scrap steel as the primary raw material, reducing the need for iron and coke. In steel manufacturing plants, this can result in cost savings and lower capital expenditure. Furthermore, the incorporation of digital technology into electric arc furnaces, such as sensors and data analytics, has increased demand, boosting global market expansion.

Competitive Landscape

Major players in the market

- GrafTech International

- Zhongze Group

- Dan Carbon

- Showa Denko

- Tokai Carbon

- Graphite India Ltd.

- Resonac Holdings Corporation

- Fangda Carbon New Material Co., Ltd.

- Sangraf International

- SEC Carbon, Ltd.

- Nippon Carbon

- EPM Group

- Nantong Yangzi Carbon Co. Ltd.

- Misano Group

- Kaifeng Carbon Co., Ltd.

Recent Market Developments

- On October 2023, TMS International has formed a joint venture with Nippon Carbon Co., Ltd to become the sole North American distributor of graphite electrodes. The exclusive relationship will go into effect on January 1, 2024. TMS and Nippon Carbon will also collaborate to improve services to the North American graphite electrode market and develop green and low-carbon solutions to create a model of comprehensive scrap steel utilization, which will benefit the development of the North American steel industry.

- On August 2023, HEG Limited announced plans to expand its graphite electrode production capacity from 80,000 to 100,000 tons. The company hoped to begin commercial production of graphite electrodes at the new expansion location in early 2023.

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2032.

Graphite Electrode Market, Grade Analysis

- Ultra High Powered (UHP)

- High Powered (HP)

- Regular Powered (RP)

Graphite Electrode Market, Diameter Analysis

- < 200mm

- 201mm to 400mm

- 401mm to 600mm

- > 600mm

Graphite Electrode Market, Application Analysis

- Electric Arc Furnace (EAF)

- Basic Oxygen Furnace (BOF)

- Non-Steel Application

Graphite Electrode Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Questions (FAQ)

-

1. Who are the key market players of the graphite electrode market?GrafTech International, Zhongze Group, Dan Carbon, Showa Denko, Tokai Carbon, Graphite India Ltd., Resonac Holdings Corporation, Fangda Carbon New Material Co., Ltd., Sangraf International, SEC Carbon, Ltd., Nippon Carbon, EPM Group, Nantong Yangzi Carbon Co. Ltd., Misano Group, Kaifeng Carbon Co., Ltd.

-

2. Which segment holds the largest market share?Electric Arc Furnace (EAF) segment holds the largest market share and is going to continue its dominance.

-

3. Which region is dominating the graphite electrode market?Asia Pacific is dominating the graphite electrode market with the highest market share.

Need help to buy this report?