Global Graphite Purification Furnace Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Batch Furnaces, Continuous Furnaces, and Others), By Application (Semiconductor, Aerospace, Nuclear, Metallurgy, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Chemicals & MaterialsGlobal Graphite Purification Furnace Market Insights Forecasts to 2033

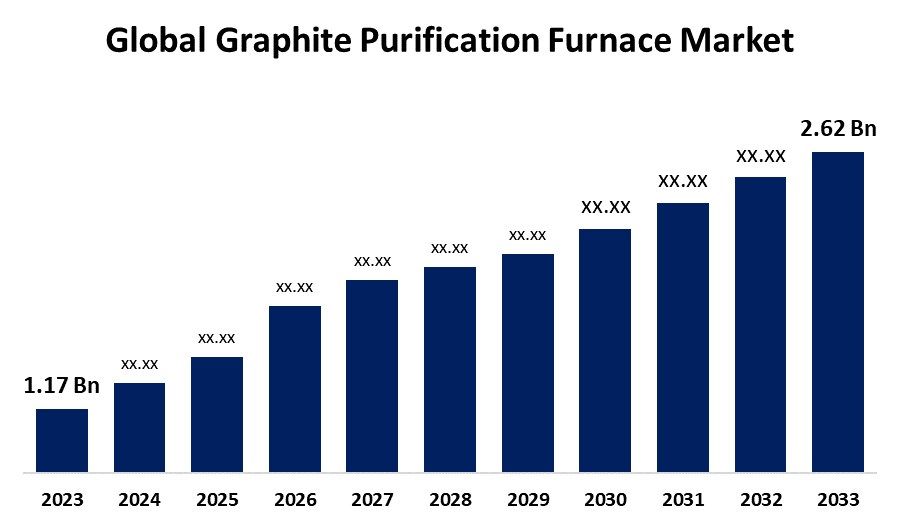

- The Global Graphite Purification Furnace Market Size was Estimated at USD 1.17 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 8.40% from 2023 to 2033

- The Worldwide Graphite Purification Furnace Market Size is Expected to Reach USD 2.62 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Graphite Purification Furnace Market Size is Expected to cross USD 2.62 Billion by 2033, Growing at a CAGR of 8.40% from 2023 to 2033.

Market Overview

The global graphite purification furnace market includes the industry that manufactures, distributes, and uses graphite purification furnaces, which are specialized high-temperature equipment used to purify graphite materials by removing impurities like metal oxides, volatile substances, and other contaminants. These furnaces use high-temperature treatment (usually above 2,000°C) and/or chemical purification processes to produce the ultra-pure graphite necessary for a variety of industrial applications. The graphite purification furnace market offers numerous opportunities, owing to ongoing technological improvements and rising demand for high-purity graphite in a variety of sectors. With continued technological advancements and an increasing need for increasingly advanced and smaller components, the semiconductor sector presents tremendous growth potential. Demand for high-purity graphite in semiconductor fabrication is likely to expand as smart devices and IoT technologies become more prevalent. Furthermore, increasing expenditures in semiconductor infrastructure and the development of production facilities provide significant potential opportunities for the market.

Report Coverage

This research report categorizes the graphite purification furnace market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the graphite purification furnace market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the graphite purification furnace market.

Graphite Purification Furnace Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 1.17 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.40% |

| 2033 Value Projection: | USD 1.17 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 226 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product Type, By Application |

| Companies covered:: | Mersen Group, HEG Limited, Graphite India Limited, SEC Carbon Limited, Tokai Carbon Co., Ltd., SGL Carbon SE, Toyo Tanso Co., Ltd., Schunk Carbon Technology, Nantong Graphite Equipment Plant Co., Ltd., Fangda Carbon New Material Co., Ltd., Nantong Zhongtai Graphite Equipment Co., Ltd., GrafTech International Ltd., Nantong Xingqiu Graphite Co., Ltd., Nippon Carbon Co., Ltd., Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

One of the key growth drivers for the graphite purification furnace market is the growing demand in the semiconductor industry. High-purity graphite is required for the manufacture of semiconductor devices, which are fundamental to modern electronics. Rapid technical breakthroughs and expanded semiconductor manufacturing, fueled by the expansion of smart gadgets and IoT technologies, are driving up demand for purification furnaces. Furthermore, the transition to increasingly sophisticated and smaller semiconductor components needs high-purity materials, which accelerates market growth. The nuclear industry is another important source of market growth. Graphite is widely employed as a moderator to slow neutrons in nuclear reactors, making it critical to the reactor's efficient operation. The necessity for high-purity graphite in nuclear applications is crucial because impurities can have a major impact on reactor performance and safety. As countries invest in the expansion and maintenance of nuclear power facilities to meet their energy needs, the demand for graphite purification furnaces is likely to increase. Government initiatives and regulatory frameworks that promote nuclear energy as a clean and sustainable power source enhance the market.

Restraining Factors

The high initial cost of graphite purification furnaces is a substantial obstacle to market growth. These furnaces are expensive because to the advanced technology and materials utilized, which presents a hurdle for small and medium-sized firms (SMEs) and research institutions with limited budgets. Furthermore, the intricacy of the purifying process, as well as the requirement for specialized knowledge and skills, can present difficulties for end users, thereby limiting market acceptance.

Market Segmentation

The graphite purification furnace market share is classified into product type and application.

- The continuous furnaces segment held the greatest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the product type, the graphite purification furnace market is divided into batch furnaces, continuous furnaces, and others. Among these, the continuous furnaces segment held the greatest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. This is due to its ability to accommodate large-scale, high-efficiency industrial processes. These furnaces allow for continuous processing, which reduces downtime and increases production in industries that require high-purity graphite, such as semiconductors, lithium-ion batteries, and metallurgy. Their extensive automation capabilities provide constant quality and cheaper operational costs than batch furnaces.

- The semiconductor segment accounted for the majority of the share in 2023 and is estimated to grow at a remarkable CAGR during the projected timeframe.

Based on the application, the graphite purification furnace market is divided into semiconductor, aerospace, nuclear, metallurgy, and others. Among these, the semiconductor segment accounted for the majority of the share in 2023 and is estimated to grow at a remarkable CAGR during the projected timeframe. This is due to the growing need for high-purity graphite in the semiconductor industry. Graphite components are vital in processes such as crystal growth, wafer fabrication, and etching equipment, which require ultra-pure materials to prevent contamination and assure optimal performance. The fast expansion of the electronics sector, the rise of artificial intelligence (AI), 5G technology, and high-performance computing have all contributed to the need for pure graphite.

Regional Segment Analysis of the Graphite Purification Furnace Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the graphite purification furnace market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the graphite purification furnace market over the predicted timeframe. This is attributed to the region's supremacy in semiconductor, electronics, and battery manufacture. Major semiconductor foundries in China, Japan, South Korea, and Taiwan, including TSMC, Samsung, and SMIC, require ultra-pure graphite components for chip manufacture. Furthermore, the rapid growth of China's electric vehicle (EV) industry, as well as rising demand for lithium-ion batteries, are pushing the demand for refined graphite for use in battery anodes.

North America is expected to grow at the fastest CAGR in the graphite purification furnace market during the forecast period. The region's strong aerospace and semiconductor sectors, combined with significant investments in R&D, are driving demand for high-purity graphite and purification furnaces. The presence of top technological businesses and research universities contributes to market growth. Furthermore, the growing emphasis on energy efficiency and sustainability is pushing the use of high-purity graphite in a variety of applications, boosting the market in the area.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the graphite purification furnace market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mersen Group

- HEG Limited

- Graphite India Limited

- SEC Carbon Limited

- Tokai Carbon Co., Ltd.

- SGL Carbon SE

- Toyo Tanso Co., Ltd.

- Schunk Carbon Technology

- Nantong Graphite Equipment Plant Co., Ltd.

- Fangda Carbon New Material Co., Ltd.

- Nantong Zhongtai Graphite Equipment Co., Ltd.

- GrafTech International Ltd.

- Nantong Xingqiu Graphite Co., Ltd.

- Nippon Carbon Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the graphite purification furnace market based on the below-mentioned segments:

Global Graphite Purification Furnace Market, By Product Type

- Batch Furnaces

- Continuous Furnaces

- Others

Global Graphite Purification Furnace Market, By Application

- Semiconductor

- Aerospace

- Nuclear

- Metallurgy

- Others

Global Graphite Purification Furnace Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the graphite purification furnace market over the forecast period?The graphite purification furnace market is projected to expand at a CAGR of 8.40% during the forecast period.

-

2. What is the market size of the graphite purification furnace market?The Global Graphite Purification Furnace Market Size is Expected to Grow from USD 1.17 Billion in 2023 to USD 2.62 Billion by 2033, at a CAGR of 8.40% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the graphite purification furnace market?Asia Pacific is anticipated to hold the largest share of the graphite purification furnace market over the predicted timeframe.

Need help to buy this report?