Global Green Ammonia Market Size, Share, and COVID-19 Impact Analysis, By Technology (Alkaline Water Electrolysis, Proton Exchange Membrane, Solid Oxide Electrolysis), By End User (Power Generation, Transportation, Fertilizer), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Chemicals & MaterialsGlobal Green Ammonia Market Insights Forecasts to 2033

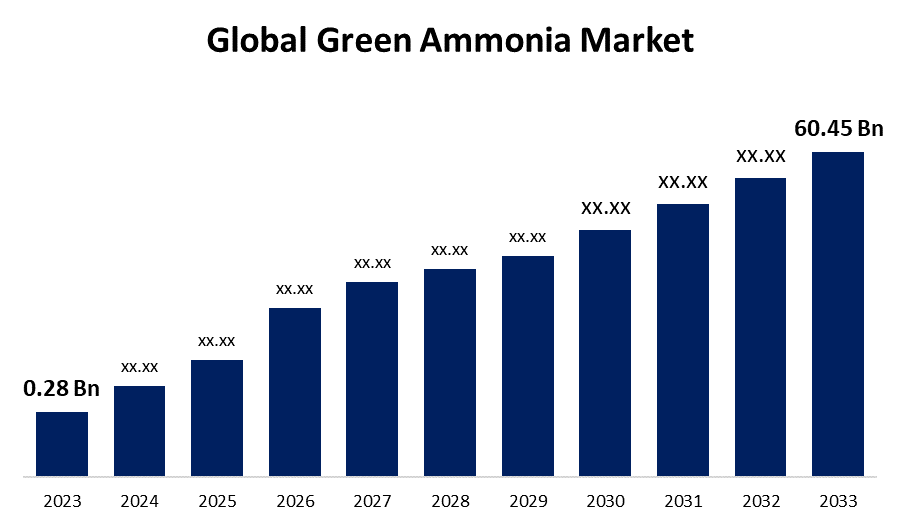

- The Global Green Ammonia Market Size was Valued at USD 0.28 Billion in 2023.

- The Market Size is Growing at a CAGR of 71.1% from 2023 to 2033.

- The Worldwide Green Ammonia Market Size is expected to reach USD 60.45 Billion by 2033.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Green Ammonia Market Size is expected to reach USD 60.45 Billion by 2033, at a CAGR of 71.1% during the forecast period 2023 to 2033.

Green ammonia is generated by the combination of hydrogen from water and nitrogen from the air. It is a multipurpose fuel that can be used in gas turbines, internal combustion engines, generator sets, industrial furnaces, and fuel cells. It is particularly useful for maritime transportation. Green ammonia, often referred to as renewable ammonia, is a form of ammonia produced using renewable energy sources and promoted as an environmentally friendly, free-of-pollutant alternative with many possible uses in industry and other sectors. For instance, the producers of Greenko founded Gentari, the clean energy division of Petronas and AM Green in Malaysia. The division announced that it has signed final agreements with a GIC affiliate to produce 5 million tons per annum (MTPA) of green ammonia by 2030, which is equivalent to about 1 MTPA of green hydrogen. In addition, the demand for organic fertilizers is increasing rapidly. This encourages manufacturers of chemicals to move to environmentally friendly and sustainable products such as green ammonia. Sales of green ammonia will consequently increase as a result of consumers' growing desire for environmentally friendly fertilizers that enhance soil health and lower contamination. Ammonia consumption for fertilizer manufacturing is expected to rise significantly in the upcoming years due to the growing demand for fertilizers.

Report Coverage

This research report categorizes the market for global green ammonia market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global green ammonia market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global green ammonia market.

Global Green Ammonia Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 0.28 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 71.1% |

| 2033 Value Projection: | USD 60.45 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Technology, By End User, By Region |

| Companies covered:: | Nel Hydrogen, Haldor Topsoe, MAN Energy Solutions, ThyssenKrupp AG, ITM Power PLC, Hydrogenics, Green Hydrogen Systems, McPhy Energy, EXYTRON, AquaHydrex, Enapter, BASF SE, Starfire Energy, Queensland Nitrates Pty Ltd, Hiringa Energy, Siemens Energy, Electrochaea, Yara International, ENGIE, Uniper, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact,Challenges,Growth, Analysis. |

Get more details on this report -

Driving Factors

The green ammonia is expected to become an industrial chemical by 2040, with the green ammonia market growing rapidly over the forecasted period. This is a result of increased government initiatives to achieve low to zero carbon emissions. The product will probably emerge as the primary commodity for regionally distributed renewable energy transportation during the forecast period. Growth in the industry is also anticipated to be fueled by the expanding need for green ammonia in several end-use sectors, such as transportation, refrigeration, power generation, and fertilizer. Furthermore, there is a growing need for green ammonia in industrial feedstock products, such as pharmaceuticals. For instance, in December 2023, as part of an international program to lower greenhouse gas emissions for ammonia consumers, Uniper and First Ammonia announced the previous day at the US-German Hydrogen Conference in Berlin that they would be collaborating to supply Uniper with green ammonia. With the aid of this ammonia with no carbon footprint, Uniper will be able to expedite the energy transition for its clients, Germany, and the larger European market.

Restraining Factors

Green ammonia is 1.5 times more expensive than natural gas-powered ammonia facilities. The growth of the market will be hampered if general ammonia producers cannot afford to convert from traditional ammonia production to green ammonia production until the cost of electrolyzers and renewable energy generation falls even further.

Market Segmentation

By Technology Insights

The proton exchange membrane segment dominates the market with the largest revenue share over the forecast period.

Based on technology, the global green ammonia market is segmented into alkaline water electrolysis, proton exchange membrane, and solid oxide electrolysis. Among these, the proton exchange membrane segment is dominating the market with the largest revenue share over the forecast period. Which due to increased public awareness of the benefits of the proton exchange membrane technology, which has an electric efficiency of more than 90% and high current densities at low voltage. Through consumers putting pressure on manufacturers to go green with their production processes, proton exchange membrane technology helps producers turn the chemical compound into green ammonia by decarbonizing it effectively. The demand for products can be further increased by favourable government incentives for the production of clean, green energy and by increased research and development on fuel cell technologies.

By End User Insights

The transportation segment is witnessing significant CAGR growth over the forecast period.

Based on the end user, the global green ammonia market is segmented into power generation, transportation, and fertilizer. Among these, the transportation segment is witnessing significant growth over the forecast period. Its high percentage can be attributed to the global fuel and energy crisis, which has increased demand for green fuel. Renewable sources like green ammonia and others are taking the place of conventional sources. Fuel from these sources is efficient, eco-friendly, and clean. The world's focus is turning to issues that are becoming more and more pressing, such as carbon emissions and environmental protection. These issues are contributing factors to the reason the product is becoming very popular in the transportation sector. In comparison to other fuels, the product is feasible due to its low storage volume requirements and its liquid state at room temperature.

Regional Insights

Europe dominates the market with the largest market share over the forecast period.

Get more details on this report -

Europe is dominating the market with the largest market share over the forecast period. The product is particularly sought after in Germany and Spain as a result of the growing application of technological advancements. Europe is home to many ammonia production facilities and offers booming potential for manufacturers as the industry becomes more concentrated there. Furthermore, the European green ammonia market with the biggest market share belonged to Germany, while the market with the fastest growth was Spain. The development of the European market is characterized by a rise in the manufacturing of green electricity for small-scale applications in rural areas, as well as green fuel, due to increased demand for fuel cell vehicles.

Asia Pacific is expected to grow the fastest during the forecast period. Malaysia's Gentari and Singapore's GIC collaborate with Greenko founders to create one of the world's largest green ammonia platforms. The partnership's primary goal is to produce green ammonia in several locations throughout India. This should expedite efforts to meet net zero targets in both India and the OECD's markets. To promote the use of electric vehicles there, the Indian government has extended subsidies. In addition, the green ammonia market in China had the biggest market share, while the market in India had the fastest rate of growth in the Asia-Pacific area.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global green ammonia market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market

List of Key Market Players

- Nel Hydrogen

- Haldor Topsoe

- MAN Energy Solutions

- ThyssenKrupp AG

- ITM Power PLC

- Hydrogenics

- Green Hydrogen Systems

- McPhy Energy

- EXYTRON

- AquaHydrex

- Enapter

- BASF SE

- Starfire Energy

- Queensland Nitrates Pty Ltd

- Hiringa Energy

- Siemens Energy

- Electrochaea

- Yara International

- ENGIE

- Uniper

- Others

Key Market Developments

- In April 2023, Yara Clean Ammonia (Yara), a fertilizer and chemical company owned by Yara International ASA, and VNG, a gas company based in Leipzig, intend to collaborate closely in the field of clean ammonia, actively supporting the ambitious implementation plans outlined in the German Hydrogen Strategy.

- In November 2022, an industrial-scale ammonia cracker prototype, intended to combat climate change and lower carbon emissions, was developed by Siemens Energy in collaboration with Fortescue Future Industries, a manufacturer of green hydrogen, and GeoPura, a provider of renewable energy, electric vehicle charging, and emission-free electricity. 200 kg of hydrogen per day, or enough to power five to ten hydrogen fuel cell electric buses, would be delivered by the prototype using ammonia.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Global Green Ammonia Market based on the below-mentioned segments:

Green Ammonia Market, Technology Analysis

- Alkaline Water Electrolysis

- Proton Exchange Membrane

- Solid Oxide Electrolysis

Green Ammonia Market, End User Analysis

- Power Generation

- Transportation

- Fertilizer

Green Ammonia Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Global Green Ammonia Market?The Global Green Ammonia Market is expected to grow from USD 0.28 Billion in 2023 to USD 60.45 Billion by 2033, at a CAGR of 71.1% during the forecast period 2023-2033.

-

2. Which region is dominating the Global Green Ammonia market?Europe is dominating the market with the largest market share over the forecast period.

-

3. Which are the key companies in the market?Nel Hydrogen, Haldor Topsoe, MAN Energy Solutions, ThyssenKrupp AG, ITM Power PLC, Hydrogenics, Green Hydrogen Systems, McPhy Energy, EXYTRON, AquaHydrex, Enapter, BASF SE, Starfire Energy, Queensland Nitrates Pty Ltd, Hiringa Energy, Siemens Energy, Electrochaea, Yara International, ENGIE, Uniper, and Others.

Need help to buy this report?