Global Green Finance Market Size, Share, and COVID-19 Impact Analysis, By Type (Equity, Fixed Income, Mixed Allocation), By Transaction (Green Bond, Social Bond, Mixed-Sustainability Bond), By End- User (Utilities, Transport and Logistics, Chemicals, Food and Beverage, Government, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Banking & FinancialGlobal Green Finance Market Insights Forecasts to 2033

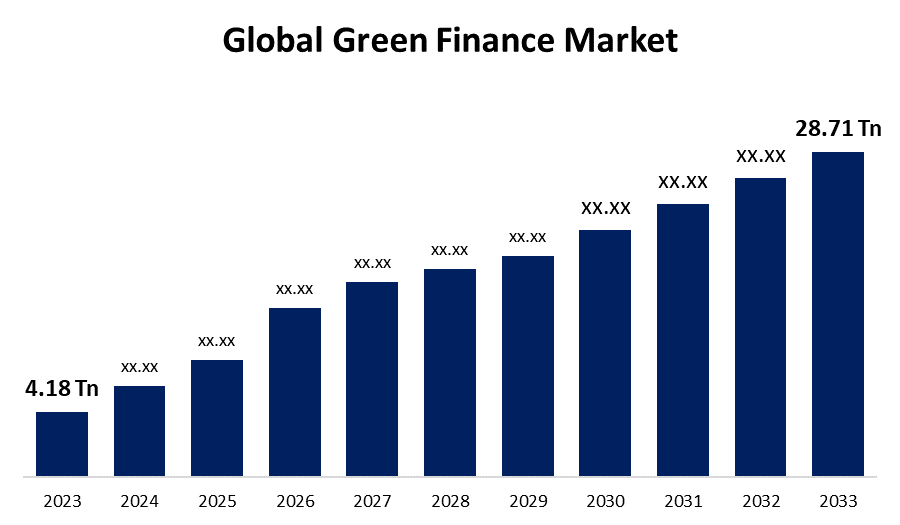

- The Global Green Finance Market Size was valued at USD 4.18 Trillion in 2023.

- The Market Size is Growing at a CAGR of 21.25% from 2023 to 2033.

- The Worldwide Green Finance Market Size is expected to reach USD 28.71 Trillion by 2033.

- Asia Pacific Sustainable Finance Market Size is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Green Finance Market Size is expected to reach USD 28.71 Trillion by 2033, at a CAGR of 21.25% during the forecast period 2023 to 2033.

The green finance market is also called sustainable finance market. The green finance term referring to the financing process, and for promoting environmental and social factors related to the sustainable finance market. The green finance focused on environmental issue, such as decarbonization, and biodiversity loss. In green finance include activities like grouped within socio- environmental financing, which directs financing toward social and environmental issues.it also include array or financing vehicles that channel capital into green- labels projects, climate change mitigation or adaptation efforts. Furthermore, the green finance gave service in increasing the long-term investment and they provide higher returns to investors. Any organization can aids saving some cost by utilizing fewer resources, they can retain best people using fewer resources. The green finance is beneficial in controlling inflows and outflows of money and they can offer business insights. Since, green finance is widely used in utility, logistic & transport, food & beverage (F&B), chemicals industries across the global. The innovation in forecast period for sustainable financial products, such as green bonds, sustainability- linked loans, and impact investment vehicles. Furthermore, the financial institutions are expected to introduce novel instruments, such as attracting investors and expanding the market green finance market growth in the forecast period.

Report Coverage

This research report categorizes the market for the global green finance market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global sustainable finance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global green finance market.

Global Green Finance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 4.18 Trillion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 21.25% |

| 2033 Value Projection: | USD 28.71 Trillion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By Transaction, By End-User, By Region |

| Companies covered:: | BNP Paribas, Clarity AI, Refinitiv, Starling Bank, Stripe, Inc., Triodos Bank UK Ltd., KPMG International, Pwc, Acuity Knowledge Partners, Arabesque Partners, Goldman Sachs, NOMURA HOLDINGS, INC., and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact,Challenges,Growth, Analysis. |

Get more details on this report -

Driving Factors

The growing awareness of social concern such as rights of labour, difference between income, access to healthcare and education, inclusion and diversity. The stakeholders, including employees and communities, demand for accountability and responsible for business practices. Furthermore, governments and some organizations are implementing policies worldwide and regulations to address finance challenges. The promoting renewable energy, requiring ESG disclosures and penalties such factors are encouraging investments in these projects.

Restraining Factors

The green finance market is hampered by the lack of recognized definitions in globally, reporting a framework for sustainability and lack of standardized. To conquer the restrain factors, new efforts are taking to develop standards and frameworks.

Market Segmentation

By Type Insights

The fixed income segment dominates the market with the largest revenue share over the forecast period.

On the basis of type, the global green finance market is segmented into equity, fixed income, and mixed allocation. Among these, the fixed income segment is dominating the market with the largest revenue share over the forecast period. The green and sustainability bonds are the fixed income instruments, they are widely adopted in the resent years. Fixed income allows issuers to raise money for green and ecofriendly projects.

By Transection Insights

The green bond segment is witnessing significant CAGR growth over the forecast period.

On the basis of transection, the global green finance market is segmented into green bond, social bond, and mixed-sustainability bond. Among these, the green bond segment is witnessing significant growth over the forecast period. The green bonds can deliver a number of benefits to both investors & issuers. The expansion of the financier base and benefits. There are some evidences for the pricing from some issuers, all these terms driven by financier demand and limited supply. For Instance, the research also makes international comparisons, finding that China and the US have the world’s largest green bond markets, representing 13.6% and 11.6% respectively of total global green bond issuance over 2012-21. The expansion of the green bond has a diversified and more mainstream investor base.

By End- User Insights

The government segment is expected to hold the largest share of the global green finance market during the forecast period.

Based on the end user, the global green finance market is classified into utilities, transport and logistics, chemicals, food and beverage, government, and others. Among these, the government segment is expected to hold the largest share of the green finance market during the forecast period. Expanding global awareness of environmental and social issues, like social inequality and climate change, has prompted people to look for investment opportunities with positive social impact. Additionally, information is now more easily accessible in government websites and technological advancements have given to government sectors, the ability to easily research and access sustainable investment products.

Regional Insights

Europe dominates the market with the largest market share over the forecast period.

Europe green finance market is dominating the market with the largest market share over the forecast period. The green finance has grown rapidly from a base. In United Kingdom, the global finance related services ecosystems, these services offer wide range of green finance products and services. For example, the European Union's Sustainable Finance Action Plan seeks to redirect capital flows to sustainable projects while also aligning financial markets with sustainability goals. Furthermore, the EU Taxonomy Regulation offers a uniform structure for categorizing sustainable economic endeavors, augmenting transparency and legitimacy in sustainable finance methodologies throughout Europe.

Asia Pacific green finance market is expected to grow the fastest during the forecast period. Businesses and governments in the area are beginning to understand the value of sustainable development and tackling social and environmental issues. A favourable climate for sustainable finance has been created by the implementation of ambitious sustainability goals and initiatives by nations like China, Japan, and South Korea. Furthermore, investors in the Asia Pacific area are becoming more conscious of and in demand for sustainable investment products.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global green finance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Sustainable Finance Market List of Key Market Players

- BNP Paribas

- Clarity AI

- Refinitiv

- Starling Bank

- Stripe, Inc.

- Triodos Bank UK Ltd.

- KPMG International

- Pwc

- Acuity Knowledge Partners

- Arabesque Partners

- Goldman Sachs

- NOMURA HOLDINGS, INC.

- Others

Key Market Developments

- In January 2023, the largest asset manager in the world, BlackRock, declared that by 2025, 500 billion USD of its assets would be invested in sustainable projects.

- In June 2022, in order to make sustainability data and insights more accessible to investors, Ortec Finance announced a partnership with ESG Book. By improving the accessibility and usability of ESG (Environmental, Social, and Governance) data, the partnership hopes to empower investors to make better choices when it comes to sustainable finance.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the global Green Finance Market based on the below-mentioned segments:

Green Finance Market, Type Analysis

- Equity

- Fixed Income

- Mixed Allocation

Green Finance Market, Transection Analysis

- Green Bond

- Social Bond

- Mixed-Sustainability Bond

Green Finance Market, End User Analysis

- Utilities

- Transport and Logistics

- Chemicals

- Food and Beverage

- Government

- Others

Green Finance Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?