Global Green Hydrogen Market Size, Share, and COVID-19 Impact Analysis, By Technology (Alkaline Electrolysis and PEM Electrolysis), By Renewable Source (Wind Energy, Solar Energy, and Others), By End-User (Chemical, Power, Grid Injection, Industrial, and Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

Industry: Energy & PowerGlobal Green Hydrogen Market Insights Forecasts to 2032

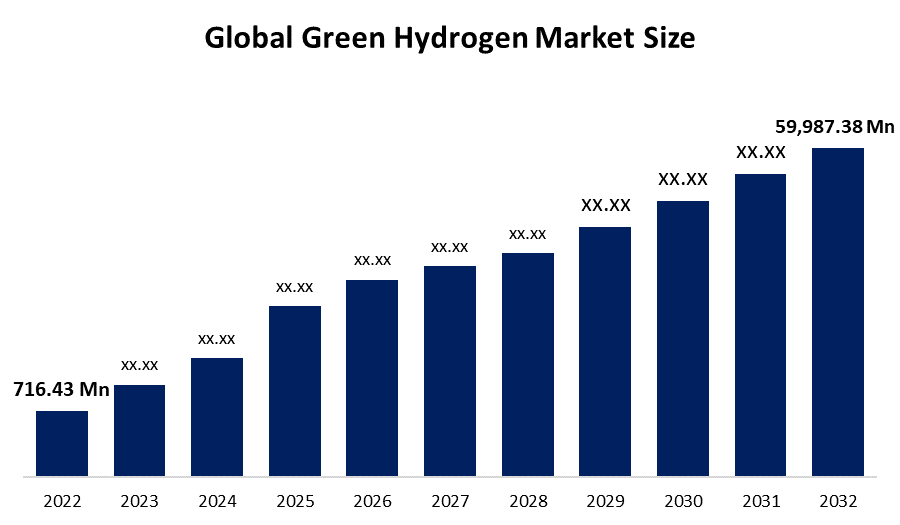

- The Global Green Hydrogen Market Size was valued at USD 716.43 Million in 2022.

- The market is growing at a CAGR of 55.7% from 2023 to 2032

- The global green hydrogen market is expected to reach USD 59,987.38 Million by 2032

- Asia-Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Green Hydrogen Market Size is expected to reach USD 59,987.38 Million by 2032, at a CAGR of 55.7% during the forecast period 2023 to 2032.

Market Overview

Green hydrogen is a type of hydrogen that is produced using renewable energy sources, such as solar, wind, or hydropower, through an electrolysis process that does not generate greenhouse gas emissions. It has gained significant attention as a promising solution for decarbonizing various sectors, including transportation, industry, and power generation. The declining costs of renewable energy, increasing investments in research and development, and supportive policies and regulations are driving the growth of the green hydrogen market. However, challenges such as high initial capital costs and scalability need to be addressed. Despite these challenges, the green hydrogen market is projected to grow as global efforts to reduce carbon emissions intensify, with increasing investments, technological advancements, and policy support leading to wider adoption in industries and sectors, contributing to a more sustainable and low-carbon energy system.

Report Coverage

This research report categorizes the market for green hydrogen market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the green hydrogen market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the green hydrogen market.

Global Green Hydrogen Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 716.43 Million |

| Forecast Period: | 2022 - 2032 |

| Forecast Period CAGR 2022 - 2032 : | 55.7% |

| 2032 Value Projection: | USD 59,987.38 Million |

| Historical Data for: | 2018 - 2021 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 123 |

| Segments covered: | By Technology, By Renewable Source, By End-User, By Region |

| Companies covered:: | Siemens Energy, Nel ASA, ITM Power, Ballard Power Systems, Plug Power, McPhy Energy, Hydrogenics Corporation, Air Products and Chemicals, Inc., Linde PLC, ENGIE, Mitsubishi Power, Enapter, Snam S.P.A., Cummins Inc., Green Hydrogen Systems |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The drivers for the green hydrogen market include declining costs of renewable energy, increased investments in research and development, supportive policies and regulations, and growing demand for decarbonization solutions. As the costs of renewable energy, such as solar and wind, continue to decrease, it becomes more cost-effective to produce green hydrogen through electrolysis. Investments in R&D and pilot projects are driving advancements in green hydrogen technologies and infrastructure. Supportive policies and regulations, such as carbon pricing and renewable energy targets, create a favorable environment for green hydrogen production and use. Additionally, the growing global demand for decarbonization solutions across various sectors, including transportation, industry, and power generation, is increasing the demand for green hydrogen as a clean energy carrier.

Restraining Factors

The restraints for the green hydrogen market include high initial capital costs, limited scalability, and competition from other low-carbon alternatives. The capital costs associated with setting up green hydrogen production facilities, including electrolyzers and renewable energy infrastructure, can be significant, making it challenging for some projects to obtain financing. The limited scalability of green hydrogen production due to technological constraints and infrastructure limitations also poses a challenge.

Market Segmentation

- In 2022, the alkaline electrolysis segment accounted for around 68.4% market share

On the basis of the technology, the global green hydrogen market is segmented into alkaline electrolysis and PEM electrolysis. The alkaline electrolysis segment is dominating the market with the largest market share in 2022, due to its established and mature technology, lower capital costs compared to other electrolysis methods, and adaptability to intermittent renewable energy sources. Alkaline electrolysis involves using an electrolyte solution to split water into hydrogen and oxygen, making it a popular choice for large-scale hydrogen production. Its dominance in the market can be attributed to its favorable economic and technological maturity, making it a preferred choice for many green hydrogen projects globally.

- In 2022, the solar energy segment dominated the with around 52.7% revenue share

Based on renewable energy, the global green hydrogen market is segmented into solar energy, wind energy, and others. Out of this, the solar energy segment is dominating the market with the largest market share in 2022, due to its abundant availability, scalability, and renewable nature. Solar energy, harnessed through photovoltaic (PV) panels or concentrated solar power (CSP) systems, is used to generate electricity, which can then be used to power electrolyzers for green hydrogen production. Solar energy's dominance in the market is driven by its potential to provide a sustainable and carbon-free energy source for hydrogen production, with favorable economic and environmental benefits. Solar energy is expected to continue its strong presence in the green hydrogen market, contributing to the overall growth of the industry.

Regional Segment Analysis of the Green Hydrogen Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Europe dominated the market with more than 51.4% revenue share in 2022.

Get more details on this report -

Europe has emerged as a dominant market in the green hydrogen sector, driven by ambitious renewable energy targets, supportive policies, and increasing investments. European countries, such as Germany, France, and the Netherlands, have implemented favorable regulations, financial incentives, and funding programs to accelerate the development and deployment of green hydrogen technologies. Europe also benefits from its well-established renewable energy infrastructure, including significant solar and wind resources. Moreover, collaborations and partnerships among governments, research institutions, and industry players in Europe have fostered innovation and knowledge exchange, further propelling the region's leadership in the green hydrogen market.

Recent Developments

In June 2022, Air Liquide S.A. and Siemens Energy have joined forces in a Franco-German partnership, combining the expertise of two leading firms in their respective fields to drive the development of a sustainable hydrogen economy in Europe. This collaboration aims to establish a robust ecosystem for electrolysis and hydrogen technologies, with production expected to commence in the second half of 2023. The partnership has set an ambitious target of achieving a capacity of three gigatons of hydrogen production per year by 2025, showcasing their commitment to advancing the adoption of green hydrogen as a key solution for decarbonization in Europe.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global green hydrogen market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- Siemens Energy

- Nel ASA

- ITM Power

- Ballard Power Systems

- Plug Power

- McPhy Energy

- Hydrogenics Corporation

- Air Products and Chemicals, Inc.

- Linde PLC

- ENGIE

- Mitsubishi Power

- Enapter

- Snam S.P.A.

- Cummins Inc.

- Green Hydrogen Systems

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global green hydrogen market based on the below-mentioned segments:

Green Hydrogen Market, By Technology

- Alkaline Electrolysis

- PEM Electrolysis

Green Hydrogen Market, By Renewable Source

- Wind Energy

- Solar Energy

- Others

Green Hydrogen Market, By End-Use

- Chemical

- Power

- Grid Injection

- Industrial

- Others

Green Hydrogen Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?