Global Halal Foods and Beverages Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Meat, Poultry & Seafood, Dairy Products, Cereal & Grain-based Products, Non-Dairy Beverages, and Fruits, Vegetables & Nuts), By Distribution Channel (Online, Supermarkets, Convenience Stores, Specialty Stores), By End User (Residential, Commercial, Institutional), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Food & BeveragesGlobal Halal Foods and Beverages Market Insights Forecasts to 2033

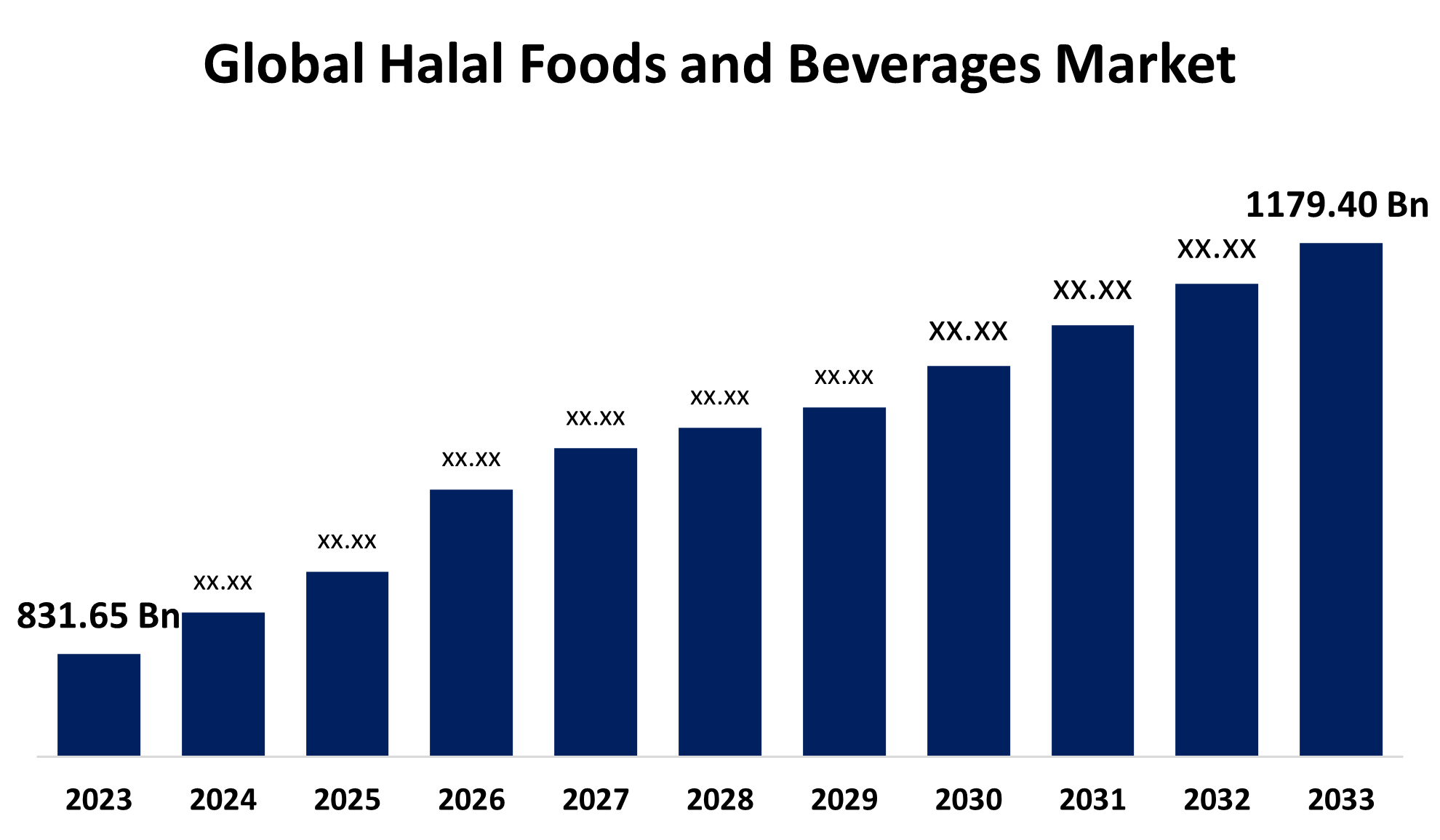

- The Global Halal Foods and Beverages Market Size was estimated at USD 831.65 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 3.56% from 2023 to 2033

- The Worldwide Halal Foods and Beverages Market Size is Expected to Reach USD 1179.40 Billion by 2033

- Europe is expected to grow the fastest during the forecast period.

Get more details on this report -

The global halal foods and beverages market size was worth around USD 831.65 billion in 2023 and is predicted to grow to around USD 1179.40 billion by 2033 with a compound annual growth rate (CAGR) of 3.56 % between 2023 and 2033. The halal foods and beverages market is being driven by an increasing Muslim population, rising awareness and acceptance, improved quality control and certification, culinary diversity, and innovation and Europe is an emerging key growth region.

Market Overview

The halal foods and beverages market refer to the worldwide industry concerned with producing and selling food and beverages that conform to Islamic dietary laws, also called halal regulations. In Islam, the word halal refers to "permissible" or "lawful," and food or drink that is halal-certified follows certain rules concerning its origin, preparation, and consumption. Halal drinks have no restricted ingredients, like yeast or products from animals, insects, or meat extracts, such as beef extract in beverages that have vitamins. Halal food includes meats such as beef, chicken, lamb, and fish, and milk and yogurt-like dairy products. Fruits, vegetables, cereals (like wheat and rice), eggs, legumes, and nuts are also halal. Furthermore, technological advancements in halal food items are key popular trends in the halal market. As the demand for halal foods increases, halal laboratories become more involved in food safety, analysis of food products to sustain quality detection for porcine materials or alcohol, and blockchain and the Internet of Things (IoT); these technological advancements strengthen the market. For instance, in February 2024, Industronics Bhd, an electronics manufacturer, entered the halal food and beverage and halal convenience store market in Hong Kong. The company acquired a dormant Hong Kong firm from Datuk Chu Boon Tiong and has rebranded the entity as Halal Group Ltd. (HGL) for the new undertaking.

Report Coverage

This research report categorizes the halal foods and beverages market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the halal foods and beverages market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the halal foods and beverages market.

Global Halal Foods and Beverages Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 831.65 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.56% |

| 2033 Value Projection: | USD 1179.40 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Distribution Channel, By End User, By Region |

| Companies covered:: | Nestlé S.A, Cargill, Incorporated, Unilever, American Halal Company, Inc., Al-Falah Halal Foods, Prima Agri-Products, One World Foods Inc., Midamar Corporation, QL Foods, Rosen’s Diversified Inc., and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Increased consciousness among Muslim and non-Muslim consumers regarding halal products is driving the market's growth. Numerous non-Muslim consumers currently prefer halal products, linking them with superior quality, ethical origin, and healthier choices. There is a growing trend of consuming such products for ethical and safety purposes among non-Muslim consumers. Lifestyle changes globally have been largely seen in the transformation of shopping, cooking, and eating habits. The increasing realization of the diet and health relationship and the growing demand for processed convenience foods have created new subsectors of the food market that drive the growth of the halal food and beverages market.

Restraining Factors

Halal certification can be an expensive and tiresome thing for food processors with auditing, inspections, and managing halal-compliant operations, which might deter small and medium-sized businesses from reentering the market. Those costs can also restrict access to the market, especially for smaller producers.

Market Segmentation

The halal foods and beverages market share is classified into product type, distribution channel, and end user.

- The meat, poultry & seafood segment dominated the market in 2023 and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the halal foods and beverages market is divided into meat, poultry & seafood, dairy products, cereal & grain-based products, non-dairy beverages, and fruits, vegetables & nuts. Among these, the meat, poultry & seafood segment dominated the market in 2023 and is projected to grow at a substantial CAGR during the forecast period. The growth is attributed to consumers increasingly becoming healthful and wealthy, with demand for such packaged processed meat products regarded as hygienic and premium. Major producers are investing in sophisticated technologies to preserve meat to respond to the rising consumer demand for fresh and wholesome processed meat products. Meat, poultry, and seafood sectors have well-established halal supply chains, certification bodies, and overseas distribution, so halal meat products are highly available in various regions.

- The supermarkets segment accounted for the majority share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the halal foods and beverages market is divided into online, supermarkets, convenience stores, and specialty stores. Among these, the supermarkets segment accounted for the majority share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The growth is driven by many supermarkets having a variety of halal-certified products, including meat and poultry packaged foods, snacks, dairy, and beverages, functioning as one-stop places for halal consumers. Halal supermarkets in areas where Muslims are in abundance usually have sections or aisles dedicated to halal products so that consumers can easily find halal alternatives.

- The residential segment accounted for a significant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period.

Based on the end user, the halal foods and beverages market is divided into residential, commercial, and institutional. Among these, the residential segment accounted for a significant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period. The segmental growth is due to the consumption of halal food being, for many Muslims, an Islamic requirement; hence, households will favor halal products over those considered non-halal. Most of the consumption of halal products is by Muslim households since halal dietary laws are a prime consideration in their food choices.

Regional Segment Analysis of the Halal Foods and Beverages Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

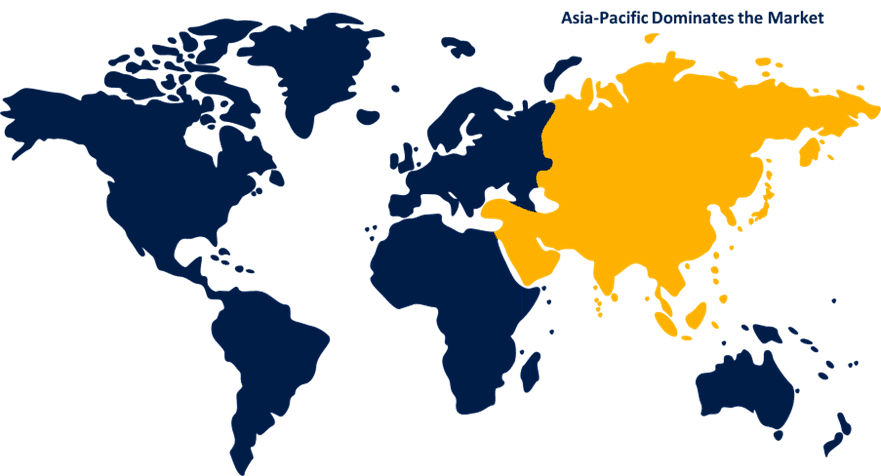

Asia Pacific is anticipated to hold the largest share of the halal foods and beverages market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the halal foods and beverages market over the predicted timeframe. The countries having the highest Islamic populations, Pakistan, India, Indonesia, and Bangladesh, have thus made the Asia Pacific prominently flourishing with the halal foods industry. The growing levels of discretionary income and consumer concern for animal welfare are the basis for the lucrative condition of the halal market in the region. Increasing awareness of safety and quality in food further raises the demand for halal products among non-Muslim consumers. Increasing income levels also induced newly identified demand for novelties in halal product offerings, creating further opportunities for food & beverage manufacturers and market growth opportunities in APAC.

Europe is expected to grow at a rapid CAGR in the halal foods and beverages market during the forecast period. With a rapidly growing consumer base, Europe encompasses the fastest-growing countries, such as the UK, France, Germany, and the Netherlands, all operating under rising halal consumption from the increased Muslim population and demand for halal products from Muslim and non-Muslim consumers alike. Halal food is increasingly marketed as a premium, ethical option. The growth of our halal food arena is stimulated by the rising number of halal restaurants and the availability of halal products through supermarket and online retail channels.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the halal foods and beverages market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nestlé S.A

- Cargill, Incorporated

- Unilever

- American Halal Company, Inc.

- Al-Falah Halal Foods

- Prima Agri-Products

- One World Foods Inc.

- Midamar Corporation

- QL Foods

- Rosen's Diversified Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2024, CJ Foods introduced its first halal Bibigo Mandu products. The company aims to bring authentic Korean Mandu taste to Malaysian consumers: the Mandu market in South Korea, the United States, and Vietnam.

- In April 2023, Individual frozen halal chicken thighs from Crescent Foods were sold in five-pound re-sealable bags and cooked from frozen to USDA-recommended temperatures.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the halal foods and beverages market based on the below-mentioned segments:

Global Halal Foods and Beverages Market, By Product Type

- Meat, Poultry & Seafood

- Dairy Products

- Cereal & Grain-based Products

- Non-Dairy Beverages

- Fruits, Vegetables & Nuts

Global Halal Foods and Beverages Market, By Distribution Channel

- Online

- Supermarkets

- Convenience Stores

- Specialty Stores

Global Halal Foods and Beverages Market, By End User

- Residential

- Commercial

- Institutional

Global Halal Foods and Beverages Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

What is the CAGR of the halal foods and beverages market over the forecast period?The global halal foods and beverages market is projected to expand at a CAGR of 3.56% during the forecast period.

-

What is the market size of the halal foods and beverages market?The global halal foods and beverages market size is expected to grow from USD 831.65 billion in 2023 to USD 1179.40 billion by 2033, at a CAGR of 3.56% during the forecast period 2023-2033.

-

Which region holds the largest share of the halal foods and beverages market?Asia Pacific is anticipated to hold the largest share of the halal foods and beverages market over the predicted timeframe.

Need help to buy this report?