Global Hardbanding Services Market Size, Share, and COVID-19 Impact Analysis, By Type (Tungsten Carbide, Chromium Carbide, Titanium Carbide, and Niobium Boride), By Application (Open Hole and Cased Hole), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Energy & PowerGlobal Hardbanding Services Market Insights Forecasts to 2033

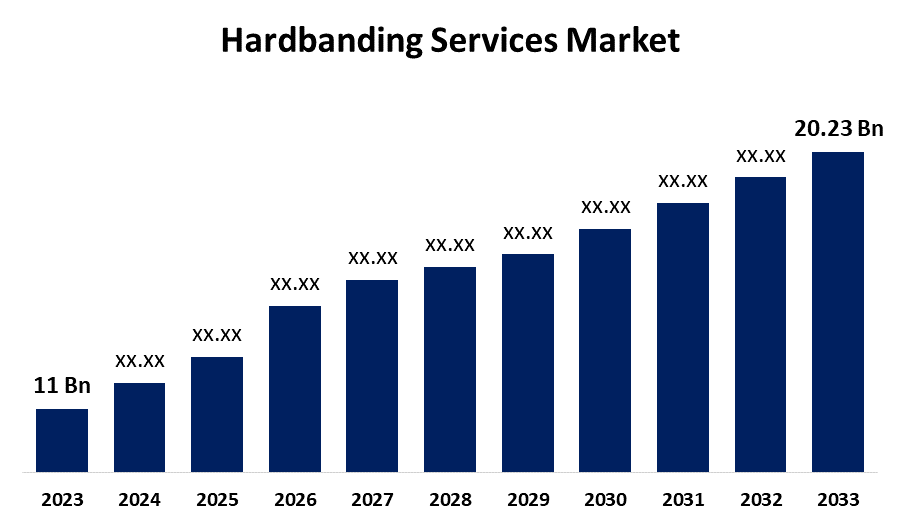

- The Global Hardbanding Services Market Size was Valued at USD 11.00 Billion in 2023

- The Market Size is Growing at a CAGR of 6.28% from 2023 to 2033

- The Worldwide Hardbanding Services Market Size is Expected to Reach USD 20.23 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Hardbanding Services Market Size is Anticipated to Exceed USD 20.23 Billion by 2033, Growing at a CAGR of 6.28% from 2023 to 2033. Increasing use of eco-friendly methods and the need for environmentally friendly hardbanding materials and procedures is being driven by a growing emphasis on sustainability. Businesses are seeking at alternative solutions that preserve performance standards while reducing their negative effects on the environment.

Market Overview

Hardbanding is a weld overlay coating that is applied on the joints of drill pipe tools. The basic material is weaker than this robust metal belt. Its goal is to prolong the drill pipe’s life by shielding it from damage downhole. It is essential to treat downhole friction seriously since it can lead to significant wear and tear and decrease the tool joint's outer diameter (OD). The tool joint shoulder is physically relieved of load when hardbanding is used. The market for hardbanding services is greatly impacted by the oil and gas sector. Drill pipes and downhole instruments need to be strong and resistant to wear as exploration and production activities increase. In challenging conditions, hardbanding adds a layer of protection that prolongs these products' useful life. Hardbanding protects drill pipes from premature wear and equipment failure in demanding drilling conditions, extending their lifespan, lowering maintenance costs, and improving operational efficiency.

Construction and mining, two sectors that depend on hardbanding services, are expanding in emerging nations. Market participants have an opportunity to broaden their reach and acquire new clientele as a result of this expansion into new geographical areas.

Hardbanding service providers may face challenges adhering to strict safety and environmental laws. Managing these legal frameworks could hinder industry expansion by raising operating costs and making service offerings more complex.

Report Coverage

This research report categorizes the market for the hardbanding services market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the hardbanding services market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the hardbanding services market.

Hardbanding Services Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 11.00 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.28% |

| 2033 Value Projection: | USD 20.23 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 255 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Application, and By Region |

| Companies covered:: | Hardfacing Technologies, LLC, Welding Alloys & Services, Inc., Midwest Hardfacing, Inc., Allied Grinding & Machine, Inc., Therm-A-Line Industries, Inc., Arnco Technology, Sharpe Engineering, Postle Industries, ITR International, Welding Specialists, Inc., Hard Steel Lines, LLC, A&A Hardfacing, Inc., Metal Improvement Services, Inc., National Oilwell Varco, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The hardbanding services market is driven by several factors including one of the main forces driving the rapid industrialization and urbanization in emerging markets are increasing the demand for energy generation in order to strengthen the economy and create new revenue opportunities. Consumers' disposable incomes are increasing, allowing them to purchase electronic gadgets such as smartphones, tablets, smart devices with enhanced capabilities, and internet of things technology. Hardbanding services play an important role in increasing the durability of these components by providing wear-resistant coatings that can endure the extreme conditions found in modern drilling.

Restraining Factors

Hardbanding services can be costly, specifically for small and medium-sized businesses. Initial expenditure in hardbanding technology and equipment may dissuade certain businesses from embracing these services, hence limiting market growth.

Market Segmentation

The hardbanding services market share is classified into type and application.

- The tungsten carbide segment dominates the market with the highest market share through the forecast period.

Based on the type, the hardbanding services market is categorized into tungsten carbide, chromium carbide, titanium carbide, and niobium boride. Among these, the tungsten carbide segment dominates the market with the highest market share through the forecast period. Tungsten carbide coatings, which are well-known for their remarkable hardness and resistance to wear, offer strong defense against erosion, abrasion, and other wear-related problems that arise during drilling. These coatings work especially well in abrasive formations and hard drilling conditions. Tungsten carbide is a common material for hardbanding applications in the oil and gas sector because of its longevity and resilience, which lower maintenance downtime and operating expenses.

- The open hole segment is expected to hold the largest share of the hardbanding services market during the forecast period.

Based on the application, the hardbanding services market is categorized into open hole and cased hole. Among these, the open hole segment is expected to hold the largest share of the hardbanding services market during the forecast period. The market is dominated by the Open Hole application segment, which is especially significant in the exploratory and early drilling phases. An open hole occurs when the wellbore is drilled prior to the casing being installed.

Regional Segment Analysis of the Hardbanding Services Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the hardbanding services market over the predicted timeframe.

Get more details on this report -

Asia Pacific is projected to hold the largest share of the hardbanding services market over the predicted timeframe. This dominance is attributed due to Asia Pacific is located to several of the world's top oil and gas producers, including China, India, and Indonesia. The region's extensive oil and gas exploration and production operations result in a high demand for hardbanding services. As drilling operations become more intense, the requirement to protect drill pipe tool joints from wear and abrasion grows, fueling the demand for hardbanding to extend the lifespan of machinery and improve operational efficiency. In the financial year 2024–2025, it is anticipated that Oil and Natural Gas Corporation (ONGC), Indian Oil Corporation Limited, and various other oil Public Sector Undertakings (PSUs) are going to spend approximately US$ 143.6 billion in petrochemicals, refineries, pipeline construction, and oil and gas exploration to attempt fulfill India's rapidly increasing energy needs.

North America is expected to grow at the fastest CAGR growth in the hardbanding services market during the forecast period. North America's favorable geographic position at the crossroads of important global commerce routes makes it easier for products and machinery to move around. This logistical advantage facilitates the effective transportation of drill pipes and other equipment to and from the region, which further supports the region's growth in the worldwide hardbanding services market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the hardbanding services market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hardfacing Technologies, LLC

- Welding Alloys & Services, Inc.

- Midwest Hardfacing, Inc.

- Allied Grinding & Machine, Inc.

- Therm-A-Line Industries, Inc.

- Arnco Technology

- Sharpe Engineering

- Postle Industries

- ITR International

- Welding Specialists, Inc.

- Hard Steel Lines, LLC

- A&A Hardfacing, Inc.

- Metal Improvement Services, Inc.

- National Oilwell Varco

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2024, SONATRACH awarded Baker Hughes a substantial contract to improve gas production at Algeria's Hassi R'Mel gas field. The agreement is part of a bigger order that Baker Hughes and Tecnimont, a subsidiary of the engineering and technology group MAIRE, granted to a partnership.

- In February 2023, Hardfacing Technologies, LLC collaborated with Welding Alloys & Services, Inc. to provide a broader range of hardbanding services to their customers. This collaboration allows the two organizations to pool their expertise and resources in order to give the finest possible hardbanding solutions to their consumers.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the hardbanding services market based on the below-mentioned segments:

Global Hardbanding Services Market, By Type

- Tungsten Carbide

- Chromium Carbide

- Titanium Carbide

- Niobium Boride

Global Hardbanding Services Market, By Application

- Open Hole

- Cased Hole

Global Hardbanding Services Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global hardbanding services market over the forecast period?The global hardbanding services market is to expand at 6.28% during the forecast period.

-

2. Which region is expected to hold the highest share of the global hardbanding services market?The Asia Pacific region is expected to hold the largest share of the global hardbanding Services Market.

-

3. Who are the top key players in the hardbanding services market?The key players in the hardbanding services market are Hardfacing Technologies, LLC, Welding Alloys & Services, Inc., Midwest Hardfacing, Inc., Allied Grinding & Machine, Inc., Therm-A-Line Industries, Inc., Arnco Technology, Sharpe Engineering, Postle Industries, ITR International, Welding Specialists, Inc., Hard Steel Lines, LLC, A&A Hardfacing, Inc., Metal Improvement Services, Inc., National Oilwell Varco, and Others.

Need help to buy this report?