Global Hardware in Loop Testing in Automotive Market Size, Share, and COVID-19 Impact Analysis, By Type (Closed-Loop HIL, Open-Loop HIL), By Component (Hardware, Software, Services), By Application (Powertrain, ADAS, Safety, Body, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Automotive & TransportationGlobal Hardware in Loop Testing in Automotive Market Insights Forecasts to 2033

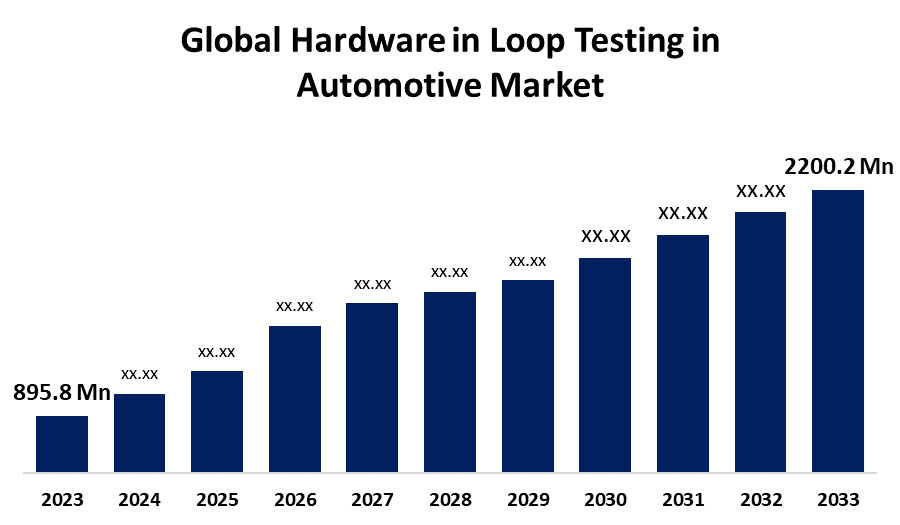

- The Global Hardware in Loop Testing in Automotive Market Size was Valued at USD 895.8 Million in 2023

- The Market Size is Growing at a CAGR of 9.40% from 2023 to 2033

- The Worldwide Hardware in Loop Testing in Automotive Market Size is Expected to Reach USD 2200.2 Million by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Hardware in Loop Testing in Automotive Market Size is Anticipated to Exceed USD 2200.2 Million by 2033, Growing at a CAGR of 9.40% from 2023 to 2033.

Market Overview

Hardware in-loop testing in the automotive industry refers to a method of testing and validating complex software systems on specially equipped test benches that receive data inputs from physical devices such as radars and cameras. As the automotive industry evolves toward the software-defined vehicle, where more features and functions are primarily enabled through software. HIL testing ensures automotive products operate as intended, accelerating development and reducing errors or hardware damages. It helps engineers identify component issues, allowing early changes to mitigate risks, resulting in vehicles with fewer failures and safety hazards. HIL testing will continue to be essential for testing and validating the behavior of EV components in the future.

Hardware in-loop testing is a crucial process in the automotive industry, enabling real-world simulation of vehicle dynamics and fault simulation. It supports control system validation, software development, debugging, and powertrain testing, particularly for hybrid and electric vehicles, and ensures regulatory compliance.

Report Coverage

This research report categorizes the market for hardware in loop testing in automotive based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the hardware in-loop testing in the automotive market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the hardware in loop testing in automotive market.

Global Hardware in Loop Testing in Automotive Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 895.8 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 9.40% |

| 2033 Value Projection: | USD 2200.2 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Component, By Application, By Region and COVID-19 Impact Analysis |

| Companies covered:: | dSPACE GmbH, National Instruments, Robert Bosch, Opal-RT Technologies, Elektrobit, Allion Labs, MathWorks, Aptiv, Hinduja Tech, Spirent and Others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Hardware in loop testing is vital in the automotive market due to its ability to integrate real hardware components with simulation environments, facilitating effective integration testing of complex systems. HIL provides real-time feedback for validating control algorithms under dynamic conditions, which is essential for advanced driver-assistance systems (ADAS) and autonomous vehicles. Furthermore, it helps ensure safety and reliability by identifying potential failures in a controlled environment, supports regulatory compliance, and allows for comprehensive validation of electronic control units (ECUs).

Restraining Factors

Hardware in-loop testing in the automotive market is hindered by several factors including high initial costs for specialized equipment and software can be a barrier, particularly for smaller companies. The complexity of integrating hardware components and ensuring compatibility with simulation models often requires skilled personnel and can be time-consuming.

Market Segmentation

The hardware in loop testing in automotive market share is classified into type, component, and application.

- The closed-loop HIL segment is estimated to hold the highest market revenue share through the projected period.

Based on the type, the hardware in loop testing in automotive market is classified into closed-loop HIL and open-loop HIL. Among these, the closed-loop HIL segment is estimated to hold the highest market revenue share through the projected period. The closed-loop HIL method provides real-time interaction between the simulated environment and the actual hardware. The system can respond dynamically, allowing for comprehensive testing of performance under various conditions. The closed-loop HIL segment is expected to dominate the market revenue share due to its ability to accurately simulate real-world scenarios and ensure system reliability and safety.

- The hardware segment is anticipated to hold the largest market share through the forecast period.

Based on the component, the hardware in loop testing in automotive market is divided into hardware, software, and services. Among these, the hardware segment is anticipated to hold the largest market share through the forecast period. The hardware segment includes the physical components used in HIL testing setups, such as real-time simulation platforms, interface devices, and signal conditioning hardware. The increasing complexity of automotive systems, particularly with the rise of electric and autonomous vehicles, demands high-performance hardware capable of accurately simulating real-world scenarios. As automotive manufacturers invest in advanced testing infrastructure, the demand for hardware segment is probable to grow.

- The ADAS segment is anticipated to grow at the fastest CAGR growth through the forecast period.

Based on the application, the hardware in loop testing in automotive market is categorized into powertrain, ADAS, safety, body, and others. Among these, the ADAS segment is anticipated to grow at the fastest CAGR growth through the forecast period. The segment's rapid growth is propelled by the increasing complexity of ADAS technologies, which require extensive validation to ensure safety and reliability. As vehicles incorporate more advanced features like adaptive cruise control and automated parking, the demand for effective testing becomes crucial. Furthermore, HIL testing offers cost-efficient solutions by enabling early detection of issues and reducing the demand for physical prototypes.

Regional Segment Analysis of the Hardware in Loop Testing in Automotive Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the hardware in loop testing in automotive market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the hardware in loop testing in automotive market over the predicted timeframe. The North American region's dominance is propelled by a robust automotive industry featuring major manufacturers and suppliers, a strong focus on innovation especially in electric and autonomous vehicles, and significant investments in research and development. Furthermore, stringent regulatory standards in the region require manufacturers to adopt comprehensive testing methods like HIL to ensure safety and performance.

Asia Pacific is expected to grow at the fastest CAGR growth of the hardware in loop testing in automotive market during the forecast period. The region's rapid growth is fueled by the presence of major automotive manufacturers, rising adoption of advanced technologies such as electric vehicles and autonomous driving systems, and significant investments in research and development aimed at fostering innovation.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the hardware in loop testing in automotive market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- dSPACE GmbH

- National Instruments

- Robert Bosch

- Opal-RT Technologies

- Elektrobit

- Allion Labs

- MathWorks

- Aptiv

- Hinduja Tech

- Spirent

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2024, Rohde & Schwarz Technology and IPG Automotive Software collaborated to develop a comprehensive hardware-in-the-loop (HIL) automotive radar testing solution. The solution combines IPG Automotive's CarMaker simulation software, Rohde & Schwarz's AREG800A radar object simulator, and QAT100 advanced antenna array to allow vehicle designers to mimic ADAS/AD scenarios.

- In June 2022, VI-grade, a simulation and driving simulator firm that accelerates product creation by bridging the simulation and physical testing gap, announced the release of Autohawk, a new Hardware-in-the-Loop (HiL) solution for automotive applications.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the hardware in loop testing in automotive market based on the below-mentioned segments:

Global Hardware in Loop Testing in Automotive Market, By Type

- Closed-Loop HIL

- Open-Loop HIL

Global Hardware in Loop Testing in Automotive Market, By Component

- Hardware

- Software

- Services

Global Hardware in Loop Testing in Automotive Market, By Application

- Powertrain

- ADAS

- Safety

- Body

- Others

Global Hardware in Loop Testing in Automotive Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the hardware in loop testing in automotive market over the forecast period?The hardware in loop testing in automotive market is projected to expand at a CAGR of 9.40% during the forecast period.

-

2. What is the market size of the hardware in loop testing in automotive market?The Global Hardware in Loop Testing in Automotive Market Size is Expected to Grow from USD 895.8 Million in 2023 to USD 2200.2 Million by 2033, Growing at a CAGR of 9.40% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the hardware in loop testing in automotive market?North America is anticipated to hold the largest share of the hardware in loop testing in automotive market over the predicted timeframe.

Need help to buy this report?