Global Hazardous Chemical Tanker Market Size, Share, and COVID-19 Impact Analysis, By Vessel Type (IMO Type 1, IMO Type 2, IMO Type 3), By Material (Stainless Steel, Epoxy-Coated Steel, Other Coatings), By Application (Chemicals, Liquid Bulk Cargo), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Automotive & TransportationGlobal Hazardous Chemical Tanker Market Insights Forecasts to 2033

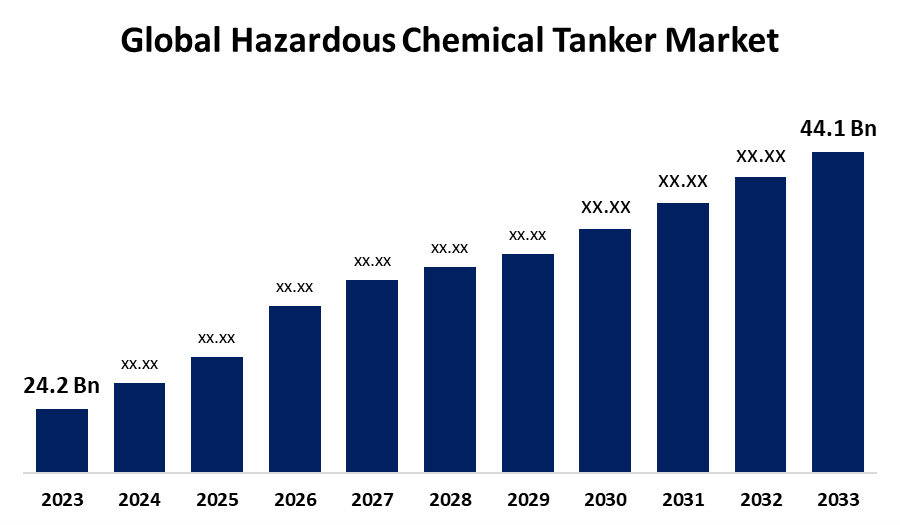

- The Global Hazardous Chemical Tanker Market Size was Valued at USD 24.2 Billion in 2023

- The Market Size is Growing at a CAGR of 6.18% from 2023 to 2033

- The Worldwide Hazardous Chemical Tanker Market Size is Expected to Reach USD 44.1 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Hazardous Chemical Tanker Market Size is Anticipated to Exceed USD 44.1 Billion by 2033, Growing at a CAGR of 6.18% from 2023 to 2033.

Market Overview

A hazardous chemical tanker is a specialized type of ship or transport vehicle designed for the safe transportation of hazardous chemicals in bulk. These tankers are equipped with secure, leak-proof tanks or containers that are specifically constructed to handle corrosive, toxic, flammable, or other dangerous chemicals. Hazardous chemical tankers are crucial for transporting hazardous materials, oils, and gases in industries like petrochemicals, pharmaceuticals, agriculture, and manufacturing. They serve crucial functions in chemical storage, distribution, and emergency response, adhering to international regulations like the IMDG Code and SOLAS, ensuring safe transport, and minimizing environmental and health risks.

The global chemical industry's growth and strict safety regulations have increased the demand for hazardous chemical tankers. These tankers, equipped with advanced safety features like leak-proof tanks and fire suppression systems, ensure safe handling of hazardous materials, minimizing environmental risks and protecting human health.

Report Coverage

This research report categorizes the market for hazardous chemical tanker based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the hazardous chemical tanker market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the hazardous chemical tanker market.

Global Hazardous Chemical Tanker Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 24.2 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.18% |

| 2033 Value Projection: | USD 44.1 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Vessel Type, By Material, By Application, By Region |

| Companies covered:: | Stolt-Nielsen, Odfjell, Navig8 Chemicals, Hafnia, MOL Chemical Tankers Pte, Ardmore Shipping Corporation, Team Tankers International Ltd, Tokyo Marine Asia Pte Ltd, Bahri, MISC Berhad, Ultrabulk, IINO KAIUN KAISHA, Iino Marine Service Co, And Other Key Vendors |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

The hazardous chemical tanker market is propelled by several key factors including the growing demand for chemicals in industries such as petrochemicals, agriculture, and manufacturing, fueled by global industrialization and urbanization. Increased international trade, regulatory pressure for higher safety standards, and advancements in tanker technology also play crucial roles in expanding the market. Furthermore, rising environmental concerns and the need for environmentally safe transportation solutions are prompting the development of more sustainable and compliant tankers. Investment in infrastructure and a heightened focus on safety further support the demand for specialized chemical tankers.

Restraining Factors

The hazardous chemical tanker market faces several restraining factors including high operational costs, stringent regulatory compliance, and the risk of accidents and spills, which can lead to environmental damage and legal liabilities. Volatile fuel prices and geopolitical risks further increase uncertainty in market conditions, while competition from alternative transportation methods like pipelines and rail can reduce the demand for chemical tankers.

Market Segmentation

The hazardous chemical tanker market share is classified into vessel type, material, and, application.

- The IMO type 2 segment is estimated to hold the highest market revenue share through the projected period.

Based on the vessel type, the hazardous chemical tanker market is classified into IMO type 1, IMO type 2, and IMO type 3. Among these, the IMO type 2 segment is estimated to hold the highest market revenue share through the projected period. The segment dominance is primarily due to the broader range of chemicals that IMO type 2 tankers are designed to transport. These vessels are specifically built to carry chemicals with a medium level of hazard, including a variety of liquid chemicals, which makes them essential for many industries, such as chemicals, agriculture, and manufacturing. Furthermore, IMO type 2 tankers benefit from a more versatile design compared to type 1 and type 3, allowing for increased demand and higher operational usage, thereby contributing to their dominant market position.

- The stainless steel segment is anticipated to hold the largest market share through the forecast period.

Based on the material, the hazardous chemical tanker market is divided into stainless steel, epoxy-coated steel, and other coatings. Among these, the stainless steel segment is anticipated to hold the largest market share through the forecast period. The segment prominence is due to the superior corrosion resistance, durability, and ability to withstand aggressive chemicals that stainless steel offers, making it the preferred material for transporting hazardous chemicals. Stainless steel tankers are highly valued for their longevity and minimal maintenance requirements, which are crucial for the safe and efficient transportation of a wide variety of chemicals. As the demand for secure and reliable chemical transport continues to grow, stainless steel remains the material of choice, particularly for high-value or highly corrosive cargoes, further solidifying its dominance in the market.

- The chemicals segment is anticipated to grow at the fastest CAGR growth through the forecast period.

Based on the application, the hazardous chemical tanker market is categorized into chemicals and liquid bulk cargo. Among these, the chemicals segment is anticipated to grow at the fastest CAGR growth through the forecast period. The segment growth is propelled by the increasing demand for the safe and efficient transportation of a wide range of hazardous chemicals, which are crucial to industries such as manufacturing, pharmaceuticals, agriculture, and petrochemicals. As global trade in chemicals continues to expand and stricter regulations on chemical safety are enforced, the need for specialized tankers to transport hazardous chemicals will rise. Furthermore, technological advancements in tanker designs, along with enhanced safety standards, are further supporting the growth of the chemicals segment.

Regional Segment Analysis of the Hazardous Chemical Tanker Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

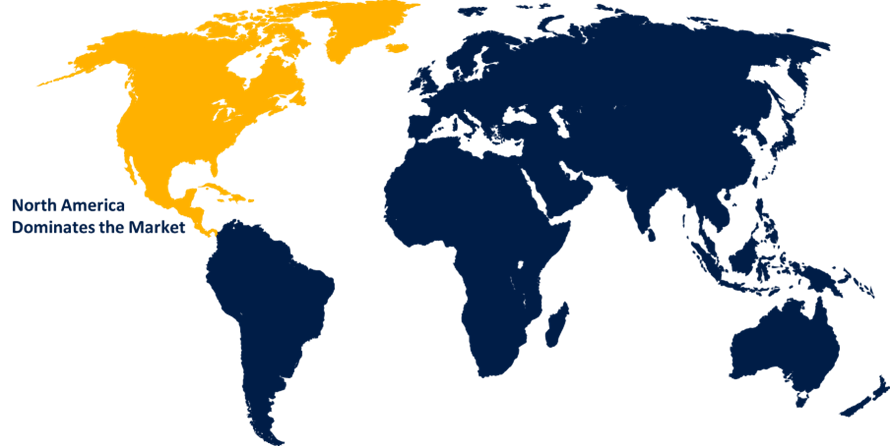

North America is anticipated to hold the largest share of the hazardous chemical tanker market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the hazardous chemical tanker market over the predicted timeframe. The region's dominance can be attributed to several key factors. The region has a highly developed chemical industry, with the United States and Canada being major producers and consumers of chemicals. The growing demand for safe and efficient transportation of hazardous chemicals, driven by industries such as petrochemicals, pharmaceuticals, and agriculture, further supports the market growth in North America. Moreover, the expansion of the U.S. chemical export market, combined with North America's established infrastructure for shipping and transportation, makes it a crucial hub for the hazardous chemical tanker market.

Asia Pacific is expected to grow at the fastest CAGR growth of the hazardous chemical tanker market during the forecast period. The region's expanding chemical industry, particularly in countries like China, India, and Japan, is fueling the demand for safe transportation of hazardous chemicals used in manufacturing, agriculture, and petrochemicals. Increased chemical trade and exports, coupled with stricter safety and environmental regulations, are further boosting the need for specialized tankers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the hazardous chemical tanker market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Stolt-Nielsen

- Odfjell

- Navig8 Chemicals

- Hafnia

- MOL Chemical Tankers Pte

- Ardmore Shipping Corporation

- Team Tankers International Ltd

- Tokyo Marine Asia Pte Ltd

- Bahri

- MISC Berhad

- Ultrabulk

- IINO KAIUN KAISHA

- Iino Marine Service Co

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In November 2024, Hercules Tanker Management and bunker supplier Peninsula announced the addition of six ultra-spec chemical tankers to their fleet, enhancing sustainable maritime operations.

- In June 2024, Fairfield Chemical Carriers and MOL Chemical Tankers, announced a significant milestone in our rebranding journey. The vessel formerly the “Fairchem Blade” has been renamed the “Blade Galaxy,” reflecting our commitment to a unified brand.

- In September 2024, Maersk Tankers, a global leader in the shipping industry, launched a new chemical tanker pool, expanding its services and strengthening its position in the market. The new pool, named Maersk Tankers Chemicals, aims to maximize returns for partners’ J19 vessels by leveraging the company’s extensive experience and expertise in chemical vessel operations.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the hazardous chemical tanker market based on the below-mentioned segments:

Global Hazardous Chemical Tanker Market, By Vessel Type

- IMO Type 1

- IMO Type 2

- IMO Type 3

Global Hazardous Chemical Tanker Market, By Material

- Stainless Steel

- Epoxy-Coated Steel

- Other Coatings

Global Hazardous Chemical Tanker Market, By Application

- Chemicals

- Liquid Bulk Cargo

Global Hazardous Chemical Tanker Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?