Global Health and Wellness Food Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Naturally Healthy Food, Functional Food, Better-for-you (BFY) Food, Organic Food and Others), By Distribution Channel (E-Commerce, Convenience Stores, Supermarkets/Hypermarkets, Specialty Stores and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Food & BeveragesGlobal Health and Wellness Food Market Insights Forecasts to 2033

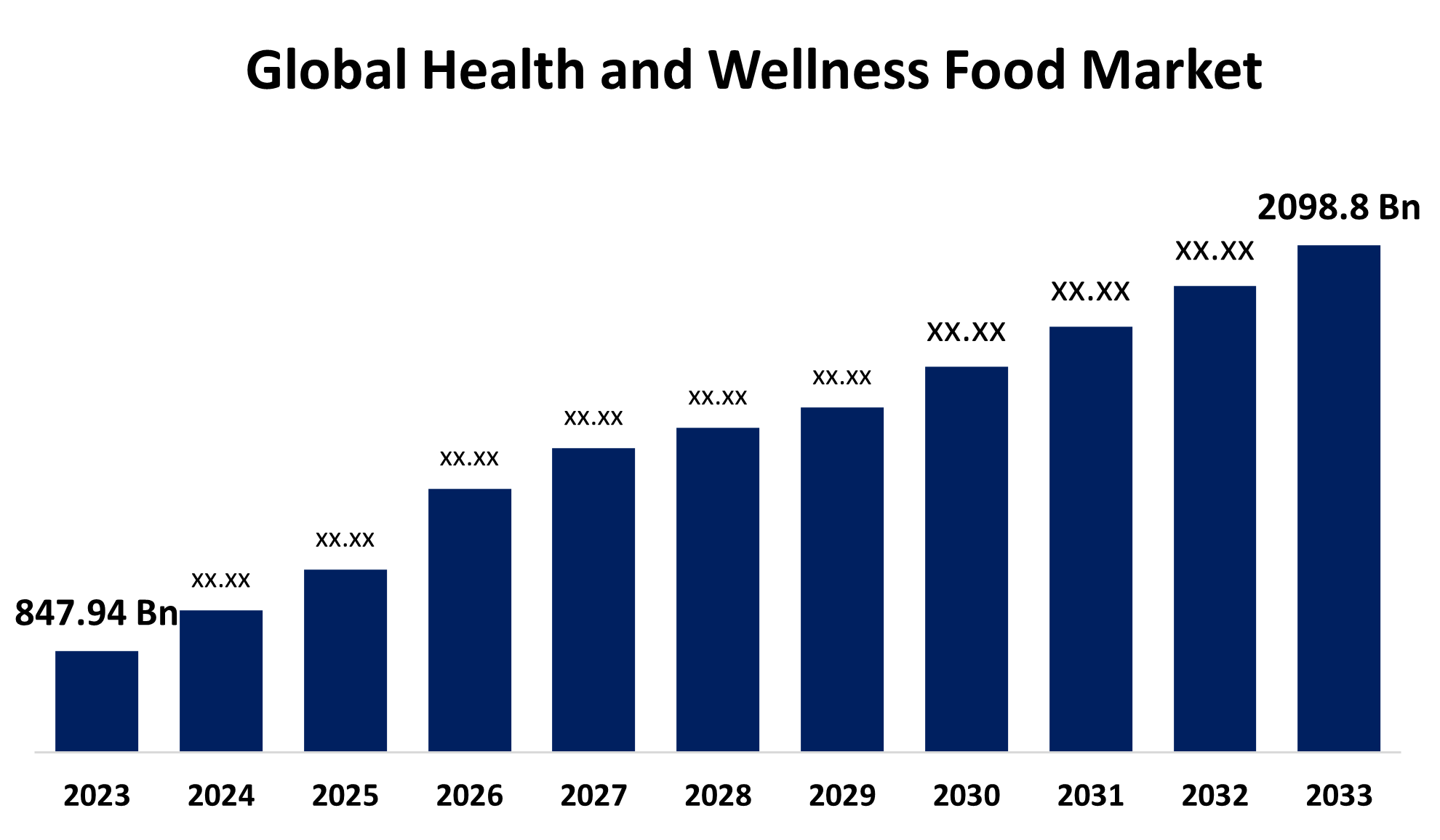

- The Global Health and Wellness Food Market Size was Estimated at USD 847.94 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around of 9.36% from 2023 to 2033

- The Worldwide Health and Wellness Food Market Size is Expected to Reach USD 2098.8 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Health and Wellness Food Market Size is anticipated to exceed USD 2098.8 Billion by 2033, Growing at a CAGR 9.36% from 2023 to 2033.

Market Overview

Health and wellness foods are nourishing options that are usually very good for both health and welfare. Usually, they are packed with nutrients like vitamins, minerals, fibers, and antioxidants while containing very little of unhealthy things like added sugar, saturated fats, and artificial additives. Health and wellness are very much interconnected with food. Lifestyle or diet is directly related to the source of food products and thus affects the health of people. This industry incorporates some of the most preferred products and services, including fortified foods, organic foods, natural supplements, functional beverages, and more. Many of the trend-following companies have jumped straight into the immunity trend and are developing low-calorie and reduced-calorie healthy snacks and beverages. This is part of the initiative to boost their overall health through smart food choices. The food industry has also been challenged to innovate with respect to new, healthier recipes and alternatives that meet the changing demands of health-centric consumers.

Report Coverage

This research report categorizes the market for the health and wellness food market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the health and wellness food market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the health and wellness food market.

Global Health and Wellness Food Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 847.94 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 9.36% |

| 023 – 2033 Value Projection: | USD 2098.8 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 256 |

| Tables, Charts & Figures: | 107 |

| Segments covered: | By Product Type, By Distribution Channel By Regional Analysis |

| Companies covered:: | Arla Foods, Danone SA, Chr. Hansen A/S, Albert’s Organics, Blue Diamond Growers, AgriPure Holding plc, Genius Foods, Big Oz Industries, Dean Foods, BioGaia AB, Eden Foods, Dr. Schär, General Mills, Gardenburger, Farmo S.P.A, and Other Key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing number of healthy eaters is making some waves in quite a few transforming eating habits around the world. Among others, those are the main things driving the growth of the global market for health and wellness food. As the population continues to grow older, a greater share of their spending within the health and wellness food market is being directed toward healthier options. More mature members of the consumer population are keen on allowing healthy and active aging, for which they would like to seek out food that could suffice specific nutrition needs. Healthier options commonly include nutrient-dense food that addresses age-related health concerns such as bones, brain, and immunity, and this preference indicates the demand for such products meant to enhance well-being and longevity.

Restraining Factors

Short life spans of fresh products can pose a challenge to the health and wellness food market in terms of wastage and availability. Fresh foods are popular among health-conscious consumers for their high nutrient value and flavor. However, they require quick consumption or refrigeration because they are subject to spoilage, making them less available and possibly increasing production costs. Such short shelf lives also result in waste arising from unsold inventories, which take a toll on profits, sustainability efforts, and market growth. Furthermore, not all consumers are fully aware of the nutritional value or health benefits attached to some foods, contributing to misunderstandings and ill-advised choices. The lack of knowledge on the health benefits therefore presents a great challenge in terms of growth in the market of health and wellness foods.

Market Segmentation

The health and wellness food market share is classified into product type and distribution channel.

- The organic food segment is expected to hold the largest share through the forecast period.

Based on the product type, the health and wellness food market is categorized into Naturally Healthy Food, Functional Food, Better-for-you (BFY) Food, Organic Food, and Others. Among these, the organic food segment is expected to hold the largest share through the forecast period. The growth is attributed to the rising awareness amongst consumers about the health benefits of organic foods, which are considered free from synthetic pesticides, genetically modified organisms (GMOs), and artificial additives, has brought about an increase in demands for such products even when it was previously known that they could cost much more. This knowledge further affects the willingness to pay for organic foods in more affluent economies where the population is more informed and has greater per capita disposable income. Association with healthier lifestyles significantly impacts purchasing decisions relating to organic foods.

- The supermarket and hypermarket segment holds the highest revenue share through the forecast period.

Based on the distribution channel, the health and wellness food market is categorized into e-commerce, convenience stores, supermarkets/hypermarkets, specialty stores, and others. Among these, the supermarket and hypermarket segments hold the highest revenue share through the forecast period. The growth is driven due to supermarkets and hypermarkets having played very significant roles in terms of promoting health and wellness foods. They serve as major distribution channels for health and wellness foods with diversity in product types, all of which can be found under one roof, since health and wellness foods are only accessed through a channel seen as time-saving for consumers who need to reach out so quickly to their nutritious options and make healthy foods part of their diets, this kind of diversity speaks to different dietary needs and personal preferences.

Regional Segment Analysis of the Health and Wellness Food Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the health and wellness food market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the health and wellness food market over the forecast period. Awareness has increased very highly, and this has caused a shift in dietary habits to actively searching for functional foods, relaying, more generally, a trend in healthy living. Increasingly common health issues like obesity and diabetic conditions make consumers dwindle even more towards nutrition. The prevalence of obesity is higher among people in North America and thus causes them to look for healthier food choices. This is also another push factor for the market in the increasing popularity of plant-based diets.

Asia Pacific is expected to grow at the fastest CAGR in the health and wellness food market during the forecast period. Growing demand in countries like China, India, and Japan. This rapid urbanization taking place within several Asian countries has led to changes in lifestyle as well as diet or food habits. The upcoming middle-class population, with disposable incomes higher than before, is now paying more attention to healthy food products, contributing towards market growth. Culturally strong influences in Asian countries exert the most influence over what people eat, thus promoting further growth of the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the health and wellness food market. It also includes a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Arla Foods

- Danone SA

- Chr. Hansen A/S

- Albert's Organics

- Blue Diamond Growers

- AgriPure Holding plc

- Genius Foods

- Big Oz Industries

- Dean Foods

- BioGaia AB

- Eden Foods

- Dr. Schär

- General Mills

- Gardenburger

- Farmo S.P.A

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2022, Oreo launched a range of gluten-free Oreos in the United States; Oreo Zero was released in China, while Lacta Intense and Cara Milk goods were launched in Brazil and Australia, respectively. All are part of a new collection of innovative and health-minded formulas the company is pursuing further to keep health and wellness at the center of its continued innovations.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the health and wellness food market based on the below-mentioned segments:

Global Health and Wellness Food Market, By Product Type

- Naturally Healthy Food

- Functional Food

- Better-for-you (BFY) Food

- Organic Food

- Others

Global Health and Wellness Food Market, By Distribution Channel

- E-Commerce

- Convenience Stores

- Supermarkets/Hypermarkets

- Specialty Stores

- Others

Global Health and Wellness Food Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global health and wellness food market?The global Health and wellness food market is projected to expand at 9.36% during the forecast period.

-

2. Who are the top key players in the global health and wellness food market?The key players in the global health and wellness food market are Arla Foods, Danone SA, Chr. Hansen A/S, Albert's Organics, Blue Diamond Growers, AgriPure Holding plc, Genius Foods, Big Oz Industries, Dean Foods, BioGaia AB, Eden Foods, Dr. Schär, General Mills, Gardenburger, Farmo S.P.A.

Need help to buy this report?