Global Health Ingredients Market Size, Share, and COVID-19 Impact Analysis, By Type (Functional Carbohydrates, Vitamins, Minerals, Prebiotics, Probiotics starter culture, Nutritional Lipids, Plant and Fruit Extracts, Enzymes, Proteins), By Source (Plant, Microbial, Animal, Synthetic), By End user (Beverages, Food, Animal feed, Pharmaceuticals, Personal care), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022–2032.

Industry: Food & BeveragesGlobal Health Ingredients Market Insights Forecasts to 2032

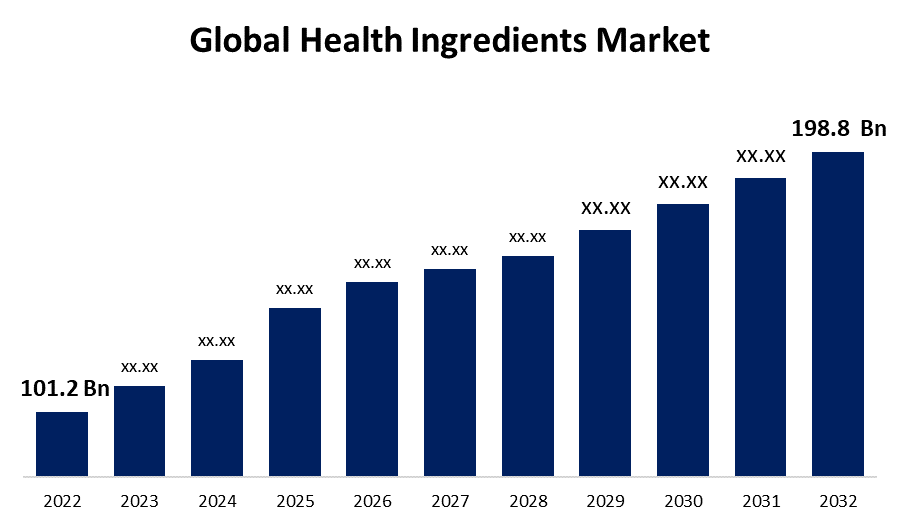

- The Global Health Ingredients Market Size was valued at USD 101.2 Billion in 2022.

- The Market is Growing at a CAGR of 6.9% from 2022 to 2032

- The Worldwide Health Ingredients Market Size is expected to reach USD 198.8 Billion by 2032

- North America is expected To Grow the fastest during the forecast period

Get more details on this report -

The Global Health Ingredients Market is projected to exceed USD 198.8 Billion by 2032, growing at a CAGR of 6.9% from 2022 to 2032. The global health ingredients market is driven by a growing demand for healthier food and beverage options, an increasing prevalence of chronic diseases, and a rising interest in preventive healthcare. The market is projected to continue growing in the coming years, with a focus on natural and organic ingredients and functional food and beverage products.

Market Overview

Health ingredients refer to the market for ingredients that are used in the production of food, beverages, supplements, and pharmaceuticals with the aim of improving health and wellness. These ingredients may include vitamins, minerals, proteins, prebiotics, probiotics, fibers, amino acids, and omega-3 fatty acids, among others. The market for health ingredients is driven by a growing demand for healthier food and beverage options, an increasing prevalence of chronic diseases, and a rising interest in preventive healthcare. The growth of the market can be attributed to several factors, including the increasing awareness of the health benefits of functional food and beverage products, a growing aging population, and rising demand for natural and organic ingredients.

Food and beverage products are the largest application segment of the market, accounting for over 60% of the total market share. This is due to the increasing demand for functional foods and beverages that provide health benefits beyond basic nutrition. Dietary supplements are the second-largest application segment, while pharmaceuticals are a smaller but growing segment of the market.

The global health ingredients market is highly fragmented, with several small and large players operating in the market. Some of the key players in the market include Archer Daniels Midland Company, Cargill, Inc., DuPont de Nemours, Inc., Ingredion Incorporated, Koninklijke DSM N.V., Kerry Group plc, and BASF SE, among others.

Report Coverage

This research report categorizes the market for the global health ingredients market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the health ingredients market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the health ingredients market.

Global Health Ingredients Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 101.2 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 6.9% |

| 2032 Value Projection: | USD 198.8 Billion |

| Historical Data for: | 2020-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Source, By End user, By Region. |

| Companies covered:: | Associated British Foods PLC, Kerry Group PLC, Archer Daniels Midland Company (ADM) , BASF SE, Ingredion, Tate & Lyle, Lonza, Glanbia PLC, Probi, International Flavors & Fragrances Inc., DSM, Cargill Incorporated, Arla Foods, Royal FrieslandCampina N.V., CHR Hansen Holdings A/S, Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The trend towards functional foods and beverages that offer specific health benefits, such as weight management, gut health, and immune support, is driving the demand for health ingredients. These products require the addition of specific ingredients to achieve the desired functional properties. As consumers become more health conscious and aware of the benefits of a healthy lifestyle, the demand for health ingredients is increasing. Consumers are willing to pay a premium for products that are natural, organic, and contain health-enhancing ingredients. The global prevalence of chronic diseases such as diabetes, obesity, and heart disease is increasing, which is driving the demand for health ingredients. These ingredients are often added to functional foods and supplements to help manage these conditions. Consumers are increasingly concerned about the potential health risks associated with synthetic ingredients and are seeking natural and organic alternatives. Health ingredients derived from natural sources, such as plants and herbs, are in high demand. The sports nutrition industry is a major consumer of health ingredients, as athletes and fitness enthusiasts require products that can enhance performance and aid in recovery. Health ingredients such as protein, amino acids, and creatine are in high demand in this industry.

Restraining Factors

Many health ingredients are derived from natural sources, and the production process can be expensive due to the need for specialized equipment and expertise. This can lead to high costs for manufacturers, which can be passed on to consumers and limit market growth. The health ingredients market is subject to various regulations that vary by country, region, and product. These regulations can make it difficult and expensive for companies to bring new products to market, particularly in regions where regulations are particularly strict. Additionally, regulatory changes can occur suddenly, causing disruption to the market.

Market Segmentation

The Global Health Ingredients Market share is classified into type, source, and end user.

- The vitamins segment is expected to hold the largest share of the global health ingredients market during the forecast period.

On the basis of the type, the global health ingredients market is segmented into functional carbohydrates, vitamins, minerals, prebiotics, probiotics starter culture, nutritional lipids, plant and fruit extracts, enzymes, and proteins. Among these, the vitamins segment is expected to hold the largest share of the global health ingredients market during the forecast period. The reason behind the growth is, vitamins are essential nutrients that play a vital role in many bodily functions, including immune system function, energy metabolism, and bone health. They are used in a variety of health-promoting products, including dietary supplements, fortified foods, and beverages. The demand for vitamins is driven by increasing consumer interest in preventive healthcare and the growing popularity of dietary supplements.

- The plant segment is expected to grow at the fastest pace in the global health ingredients market during the forecast period.

On the basis of the source, the global health ingredients market is segmented into plant, microbial, animal, and synthetic. Among these, the plant segment is expected to grow at the fastest pace in the global health ingredients market during the forecast period. The growth of plant-based ingredients is driven by increasing consumer interest in natural and organic products, as well as concerns about sustainability and animal welfare. Plant-based ingredients are derived from plant sources, including fruits, vegetables, grains, and legumes. They are used in a variety of health-promoting products, including dietary supplements, functional foods, and beverages.

- The food segment is expected to hold the largest share of the global Health Ingredients market during the forecast period

On the basis of the end user, the global health ingredients market is segmented into beverages, food, animal feed, pharmaceuticals, and personal care. Among these, the food segment is anticipated to hold the largest share of the global health ingredients market during the forecast period. The demand for health ingredients in food is driven by increasing consumer interest in functional foods that offer additional health benefits beyond basic nutrition. The food segment includes health-promoting ingredients used in foods such as snacks, baked goods, and dairy products.

Regional Segment Analysis of the Global Health Ingredients Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

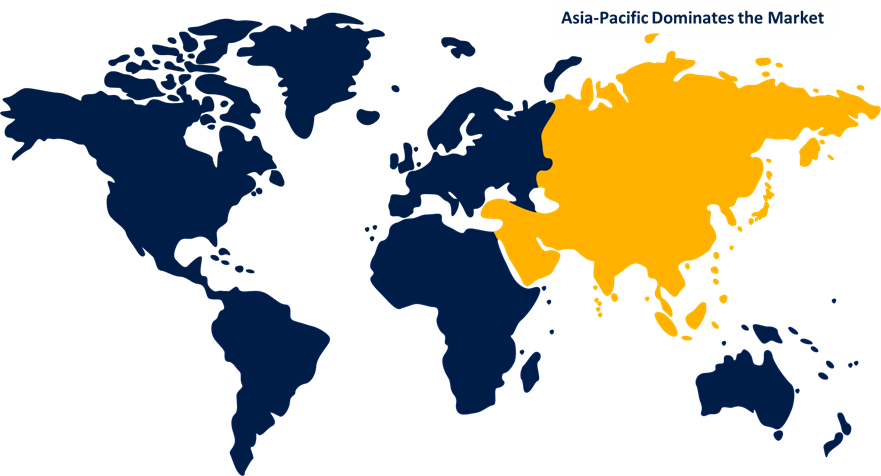

Asia Pacific is estimated to hold the largest share of the global health ingredients market over the predicted timeframe.

Get more details on this report -

Asia Pacific is expected to hold the largest share of the global health ingredients market during the forecast period. The Asia-Pacific region is the largest market for health ingredients, driven by increasing urbanization and rising disposable income levels. China, India, and Japan are the major contributors to the market in this region. The growth of the health ingredients market in this region can be attributed to an increase in the consumption of dietary supplements as people become more aware of the health benefits of taking them because they contain nutrients, primarily minerals, and vitamins.

North America is expected to grow at the fastest pace in the global health ingredients market during the forecast period. The North American region is the fastest growing market for health ingredients, driven by increasing consumer demand for natural and organic products. The United States and Canada are the major contributors to the market in this region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global health ingredients along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Associated British Foods PLC

- Kerry Group PLC

- Archer Daniels Midland Company (ADM)

- BASF SE

- Ingredion

- Tate & Lyle

- Lonza

- Glanbia PLC

- Probi

- International Flavors & Fragrances Inc.

- DSM

- Cargill Incorporated

- Arla Foods

- Royal FrieslandCampina N.V.

- CHR Hansen Holdings A/S

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In August 2022, ADM announced a collaboration with food technology company Benson Hill to scale innovative soy ingredients to meet the demand for plant-based proteins. This collaboration will serve a number of plant-based food and beverage markets. ADM will process and commercialise a portfolio of proprietary ingredients derived from Benson Hill Ultra-High Protein (UHP) soybeans through an exclusive North American licencing partnership. This collaboration will broaden the brand's product portfolio.

- In July 2022, BASF SE has announced the expansion of vitamin A formulation capacity at its Verbund site in Ludwigshafen. Increasing capacity for vitamin A powder in conjunction with increased capacity for vitamin A acetate production. This expansion would boost the company's revenue and market share for vitamin A in animal nutrition.

- In April 2022, At Vita-Foods, Bioberica announced the launch of a new ingredient and products. The former company is a pioneer in life sciences, and their announcement introduced two near-health-area food coverage digestive health upliftment and skin and beauty enhancement. A new class of functional ingredients for food applications has been introduced, including one that aids in the improvement of type II collagen ingredient joint health.

- In February 2022, International Flavors & Fragrances Inc. disclosed the acquisition of Health Wright Products, LLC, which produces custom formulations and provides probiotic encapsulation and packaging. This strategic acquisition will give IFF's Health & Biosciences probiotics, natural extracts, and botanicals businesses the ability to formulate.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Health Ingredients Market based on the below-mentioned segments:

Global Health Ingredients Market, By Type

- Functional Carbohydrates

- Vitamins

- Minerals

- Prebiotics

- Probiotics starter culture

- Nutritional Lipids

- Plant and Fruit Extracts

- Enzymes

- Proteins

Global Health Ingredients Market, By Source

- Plant

- Microbial

- Animal

- Synthetic

Global Health Ingredients Market, By End user

- Beverages

- Food

- Animal feed

- Pharmaceuticals

- Personal care

Global Health Ingredients Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?