Global Healthcare CMO Market Size, Share, and COVID-19 Impact Analysis By Service (Pharmaceutical Contract Manufacturing Services and Medical Device Contract Manufacturing Services), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: HealthcareGlobal Healthcare CMO Market Insights Forecasts to 2033

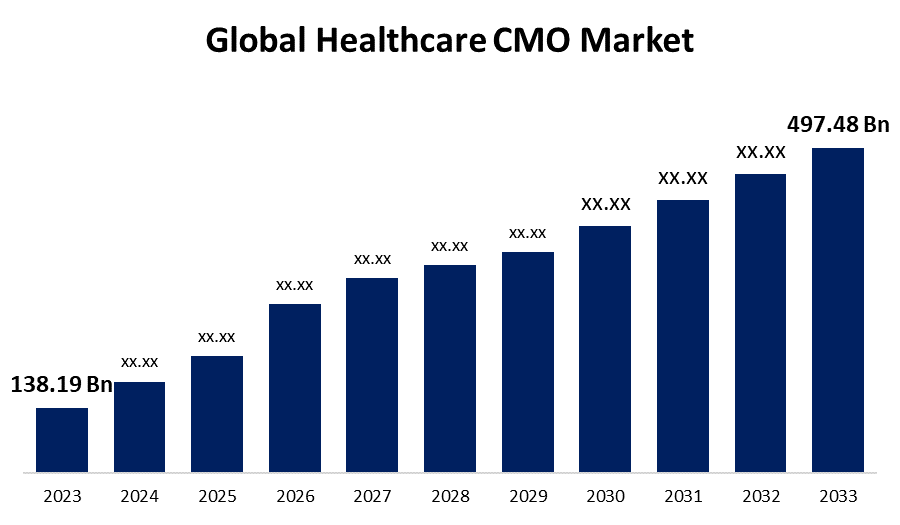

- The Global Healthcare CMO Market Size was Valued at USD 138.19 Billion in 2023

- The Market Size is Growing at a CAGR of 13.67% from 2023 to 2033

- The Worldwide Healthcare CMO Market Size is Expected to Reach USD 497.48 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Healthcare CMO Market Size is Anticipated to Exceed USD 497.48 Billion by 2033, Growing at a CAGR of 13.67% from 2023 to 2033.

Market Overview

The pharmaceutical, biotechnology, medical device, and diagnostic industries as well as other sectors of the healthcare business that provide contract manufacturing services are known as the healthcare CMO (Contract Manufacturing Organization) market. Healthcare organizations can use the knowledge, resources, and scalability of CMOs to bring products to market more quickly and affordably while concentrating on their core capabilities, which include marketing, R&D, and regulatory affairs. The need for contract manufacturing organization (CMO) services in the biopharmaceutical and biologics industries is rising as a result of breakthroughs in biotechnology and novel therapeutics.

Several factors drive the industry, including cost-effectiveness, customized treatment, and growing demand from biotech and pharmaceutical companies. Furthermore, key market players include Accellent, Inc., Boehringer Ingelheim GmbH, Catalent Pharma Solutions, Inc., DSM, Fareva, Greatbatch, Inc., Lonza Group, Patheon, Inc., Piramal Healthcare, and Cytovance Biologics. The market is concentrated on growing their company through partnerships and acquisitions, which has driven the demand for the expansion of the healthcare CMO market.

For instance, in January 2023, the development of RNA-based anticancer gene therapy for liver cancer patients will now begin due to a cooperation between Rznomics Inc. and Charles River Laboratories International Inc. was launched. Charles River can use this cooperation as a springboard to further establish itself in the global CDMO market. Drug patent expirations are anticipated to drive the global healthcare CMO market growth.

Report Coverage

This research report categorizes the market for the global healthcare CMO market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global healthcare CMO market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global healthcare CMO market.

Global Healthcare CMO Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 138.19 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 13.67% |

| 2033 Value Projection: | USD 497.48 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Service, By Region |

| Companies covered:: | Pharmascience, Rznomics, Royal DSM, Boehringer Ingelheim International GmbH, Recipharm AB, Kühne Holding AG, Piramal Enterprises Ltd, Dr. Reddys Laboratories Ltd, Almac Group, FAMAR Health Care Services, Accellent Inc, Catalent Pharma Solutions Inc, Lonza Group AG, Cytovance Biologics Inc, and other key companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Growing biotech and pharmaceutical businesses' need for CMOs has spurred the target market's expansion. Additionally, outsourcing offers benefits including lower investment risks, specialized knowledge, cutting-edge tools and technology, increased productivity and efficiency, and decreased labor work, and is perfect for small and startup firms, all of which have contributed to the expansion of the healthcare CMO industry. For instance, in May 2020, To continue concentrating on coronavirus vaccines, Pfizer Inc. decided to outsource a portion of its drug production. Pfizer used its network of 200 outside contractors, including Lonza Group and Catalent Inc., to significantly contribute to the development of its current drug line.

Restraining Factors

CMOs interact with numerous barriers such as intense rivalry, cost pressure, consolidation, and ongoing technology advancements that restrict market growth. A poor customer experience could result from selecting the incorrect innovative CMO solution provider, and discrepancies in customer service standards could cause issues with quality. In addition, it might result in less control over the production process, which would be a difficulty and disadvantage for CMOs and might restrict the growth of the healthcare CMO market.

Market Segmentation

The global healthcare CMO market share is classified into service.

- The pharmaceutical contract manufacturing services segment is expected to hold the largest share of the global healthcare CMO market during the forecast period.

Based on the service, the global healthcare CMO market is divided into pharmaceutical contract manufacturing services and medical device contract manufacturing services. Among these, the pharmaceutical contract manufacturing services segment is expected to hold the largest share of the global healthcare CMO market during the forecast period. Pharmaceutical manufacturing services are expanding as a result of pharmaceutical corporations' significant investments in R&D efforts by the rising incidence of diseases. The fabrication of final dosage forms, packaging, and active pharmaceutical ingredients (API) are further categories for pharmaceutical contract manufacturing services. Pharmaceutical contract manufacturing organizations, or CMOs, are crucial to the supply of end-to-end services, from development to production, to pharmaceutical and biopharmaceutical firms. For instance, in July 2022, In Stein, Switzerland, Lonza intended to invest $518 million to build a sizable fill-finish manufacturing facility. It is anticipated that a new production facility will be finished in 2026. With the addition of the drug production manufacturing facility, this factory will provide comprehensive, integrated CDMO services.

Regional Segment Analysis of the Global Healthcare CMO Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global healthcare CMO market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global healthcare CMO market over the predicted timeframe. A well-regulated healthcare system, favorable conditions, and growth in the pharmaceutical, biopharmaceutical, and medical device industries are driving the growth of the healthcare CMO market in North America. The US is the pharmaceutical and biopharmaceutical industry's largest market. When it comes to biopharmaceutical research and development, the US is regarded as the global leader. In addition, government support improves pharmaceutical and biopharmaceutical contract manufacturing. Moreover, a rise in the production of sophisticated devices has freed the company from daily worries and allowed it to concentrate more of its resources on its core technology, which accelerates market expansion in the region.

Asia Pacific is expected to grow at the fastest pace in the global healthcare CMO market during the forecast period. The biotechnology and pharmaceutical industries in Asia Pacific are growing due to changes in population, economic growth, rising spending, and improvements to public healthcare systems. With strong economic indicators and changing demographics driving biotech/pharma synergies, this region is a major contributor to the global healthcare CMO market's sales growth. It also has important market influencers that support its position as the region with the largest market share in terms of market size.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global healthcare CMO market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Pharmascience

- Rznomics

- Royal DSM

- Boehringer Ingelheim International GmbH

- Recipharm AB

- Kühne Holding AG

- Piramal Enterprises Ltd

- Dr. Reddys Laboratories Ltd

- Almac Group

- FAMAR Health Care Services

- Accellent Inc

- Catalent Pharma Solutions Inc

- Lonza Group AG

- Cytovance Biologics Inc

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2024, The South Korean biopharma company Rznomics announced two noteworthy developments in their quest to create a brand-new anticancer treatment. Through the use of Charles River's adenoviral vector contract development and manufacture (CDMO) experience, their lead clinical candidate, RZ-001, is created. This viral vector is designed to deliver a proprietary RNA-based trans-splicing ribozyme.

- In February 2024, The biggest pharmaceutical business owned by Canadians, Pharmascience, announced plans to expand its sterile injectable production plant at its Candiac location by $120 million. The company is now pleased to announce the launch of a new business unit devoted to injectable products as part of the expansion of its contract development and manufacturing organization (CDMO) services, after this significant milestone.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global healthcare CMO market based on the below-mentioned segments:

Global Healthcare CMO Market, By Service

- Pharmaceutical Contract Manufacturing Services

- Medical Device Contract Manufacturing Services

Global Healthcare CMO Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?