Global Healthcare Compliance Software Market Size, Share, and COVID-19 Impact Analysis, By Product Type (On-premise and Cloud-based), By Category (Policy & Procedure Management, Medical Billing & Coding, Auditing Tools, License, Certificate, & Contract Tracking, and Training Management & Tracking), By End-user (Hospitals, Specialty Clinics, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: HealthcareGlobal Healthcare Compliance Software Market Insights Forecasts to 2033

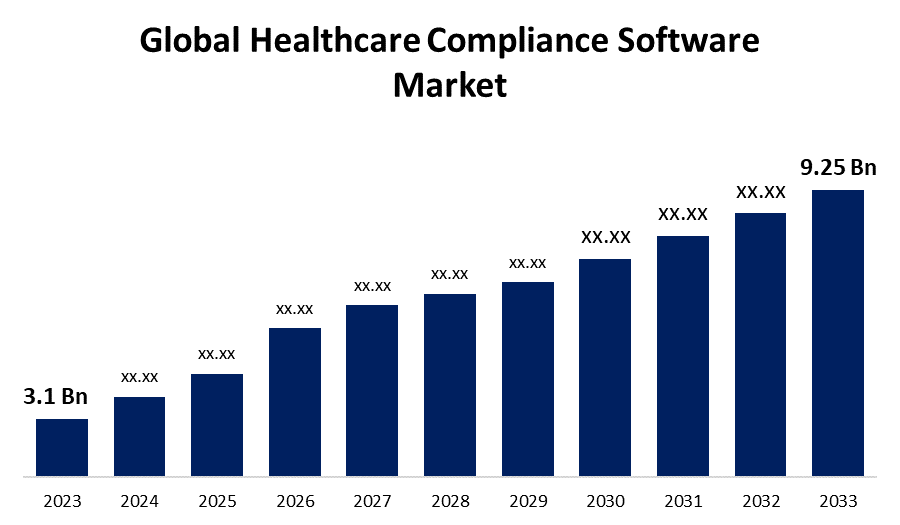

- The Global Healthcare Compliance Software Market Size was Valued at USD 3.1 Billion in 2023

- The Market Size is Growing at a CAGR of 11.55% from 2023 to 2033

- The Worldwide Healthcare Compliance Software Market Size is Expected to Reach USD 9.25 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Healthcare Compliance Software Market Size is Anticipated to Exceed USD 9.25 Billion by 2033, Growing at a CAGR of 11.55% from 2023 to 2033.

Market Overview

Healthcare compliance software is a collection of online resources designed to support healthcare organizations adhering to industry norms, laws, and internal policies to ensure morality, legality, and operational compliance. Software for managing compliance in the healthcare industry simplifies tasks including risk assessment, medical billing, coding, testing, and control evaluation. Policy administration, risk assessment, auditing, and reporting features are frequently included in these software packages to facilitate compliance processes. The demand for these software is anticipated to increase due to the move away from manual healthcare compliance procedures and toward automated compliance software, as well as the advantages of using healthcare compliance software. Healthcare compliance software simplifies handling regulatory requirements easier, reduces the chance of fines for noncompliance, and boosts operational effectiveness, all driving to market growth.

For instance, in February 2023, A health tech business called Integral launched end-to-end collaboration software that automates data compliance in the medical field, promoting patient-centric analysis and improving the capacity to assess medical data.

Report Coverage

This research report categorizes the healthcare compliance software market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the healthcare compliance software market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the healthcare compliance software market.

Global Healthcare Compliance Software Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 3.1 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 11.55% |

| 2033 Value Projection: | USD 9.25 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 231 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Category, By End-user, By Region |

| Companies covered:: | CenTrak, Integral, RLDatix, HealthStream, Atlantic.net, HEALTHICITY, LLC, ByteChek, ConvergePoint Inc., Compliancy Group, Accountable HQ, Complinity, Sprinto, Radar Healthcare, Beacon Healthcare Systems, and Others |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

Data privacy issues, the desire to reduce compliance risks in the healthcare sector, and the complexity of regulations all contribute to the increasing need for healthcare compliance software. The cost-effectiveness or subscription-based pricing model, along with improved safety and scalability, is the primary driver of the market growth. In addition, encouraging government assistance is fostering growth in healthcare compliance software market. Due to the rising frequency of data breaches in the healthcare sector, compliance software that provides the availability, security, and integrity of patient data is becoming increasingly in demand. These technologies support both market growth and healthcare providers' compliance with data privacy rules.

Restraining Factors

The market growth is being restricted by the high cost of healthcare compliance software. A different approach is a lack of internal IT expertise. It is anticipated that market growth will be restricted by the reluctance to adopt new technology in compliance software.

Market Segmentation

The healthcare compliance software market share is classified into product type, category, and end user.

- The cloud-based segment is estimated to hold the largest market revenue share through the projected period.

Based on the product type, the healthcare compliance software market is classified into on-premise and cloud-based. Among these, the cloud-based segment is estimated to hold the largest market revenue share through the projected period. The high availability and adoption rate of cloud-based software is the reason for the high share. The increasing popularity of cloud-based solutions can be attributed to their accessibility and ability to facilitate remote collaboration.

- The policy & procedure management segment is estimated to hold the largest market revenue share through the projected period.

Based on the category, the healthcare compliance software market is classified into policy & procedure management, medical billing & coding, auditing tools, license, certificate, & contract tracking, and training management & tracking. Among these, the policy & procedure management segment is estimated to hold the largest market revenue share through the projected period. The policy and procedure management sector due to the positive effects of this software, which include decreased liability, improved internal interaction and processes, and patient safety.

- The hospitals segment is anticipated to hold the largest market share through the forecast period.

Based on the end user, the healthcare compliance software market is divided into hospitals, specialty clinics, and others. Among these, the hospitals segment is anticipated to hold the largest market share through the forecast period. Hospitals are using improved compliance software to simplify regulatory reporting, safeguard patient data, and handle complicated requirements for compliance.

For instance, in January 2023, Radar Healthcare and Circle Health Group collaborated to supply risk management and compliance software to Circle Health Group's 54 hospitals.

Regional Segment Analysis of the Healthcare Compliance Software Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the healthcare compliance software market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the healthcare compliance software market over the predicted timeframe. North America as a result of the region's growing need for healthcare compliance software for medical billing and coding as well as the laws and policies about healthcare changing frequently. In addition, the market's demand is anticipated to be driven by the existence of significant companies in the region. To offer their ideas, these players are working with local organizations.

Asia Pacific is expected to grow at the fastest CAGR growth of the healthcare compliance software market during the forecast period. The need for these software solutions has surged due to the increasing frequency of cyberattacks and breaches involving healthcare data in the region. A study by the Cyberpeace Foundation indicates that between January 2022 and November 2022, there were almost 1.9 million cyberattacks in India's healthcare sector. These factors are expected to boost the healthcare compliance software market in Asia Pacific during the forecast period.

Europe is anticipated to hold a significant share of the healthcare compliance software market over the predicted timeframe. Healthcare companies are required by Europe's strict General Data Protection Regulation (GDPR) to uphold the highest standards of personal data protection. Due to the new regulatory landscape, there is a greater need for healthcare compliance software that complies with GDPR while handling patient data, which is driving market expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the healthcare compliance software market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- CenTrak

- Integral

- RLDatix

- HealthStream

- Atlantic.net

- HEALTHICITY, LLC

- ByteChek

- ConvergePoint Inc.

- Compliancy Group

- Accountable HQ

- Complinity

- Sprinto

- Radar Healthcare

- Beacon Healthcare Systems

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2024, The RLDatix Safety Institute is a recently launched Patient Safety Organization (PSO) that will conduct research on best practices for reducing risk in healthcare delivery and safety design. RLDatix is the leading global provider of connected healthcare operations software and services.

- In January 2023, To lessen the amount of human documentation required at every level of clinical treatment, CenTrak announced the launch of WorkflowRT, a scalable, cloud-based platform that automates workflow and communications.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the healthcare compliance software market based on the below-mentioned segments:

Global Healthcare Compliance Software Market, By Product Type

- On-premise

- Cloud-based

Global Healthcare Compliance Software Market, By Category

- Policy and Procedure Management

- Medical Billing and Coding

- Auditing Tools

- License, Certificate, and Contract Tracking

- Training Management and Tracking

Global Healthcare Compliance Software Market, By End User

- Hospitals

- Specialty Clinics

- Others

Global Healthcare Compliance Software Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the healthcare compliance software market over the forecast period?The healthcare compliance software market is projected to expand at a CAGR of 11.55% during the forecast period.

-

2. What is the market size of the healthcare compliance software market?The Global Healthcare Compliance Software Market Size is Expected to Grow from USD 3.1 Billion in 2023 to USD 9.25 Billion by 2033, at a CAGR of 11.55% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the healthcare compliance software market?North America is anticipated to hold the largest share of the healthcare compliance software market over the predicted timeframe.

Need help to buy this report?