Global Healthcare Contract Management Software Market Size, Share, and COVID-19 Impact Analysis, By Component (Software and Services), By Pricing Model (Subscription-Based and Others), By Deployment Model (Cloud-based, On-Premises and Others), By End User (Healthcare Providers, Hospitals, Physicians, Payers, Medical Device Manufacturers, Pharma, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: HealthcareGlobal Healthcare Contract Management Software Market Insights Forecasts to 2033

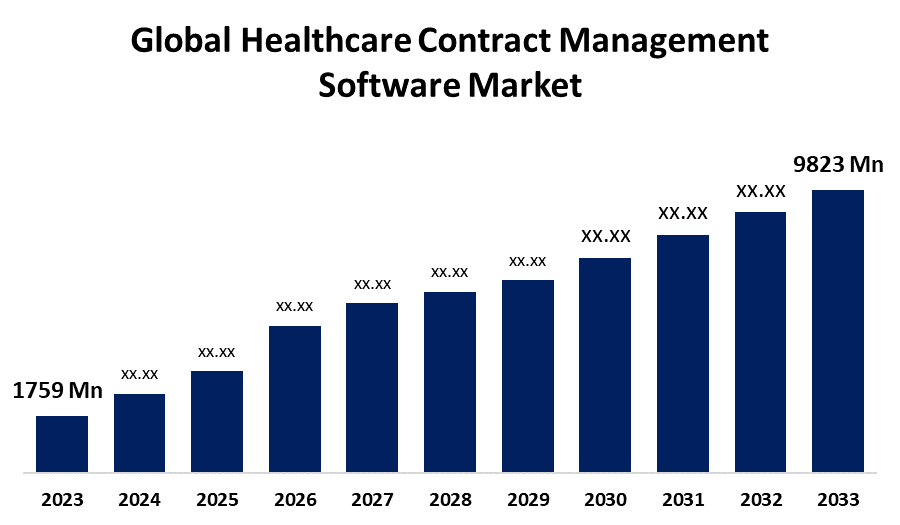

- The Global Healthcare Contract Management Software Market Size was Valued at USD 1759 Million in 2023

- The Market Size is Growing at a CAGR of 18.77% from 2023 to 2033

- The Worldwide Healthcare Contract Management Software Market Size is Expected to Reach USD 9823 Million by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Healthcare Contract Management Software Market Size is Anticipated to Exceed USD 9823 Million by 2033, Growing at a CAGR of 18.77% from 2023 to 2033.

Market Overview

Healthcare contract management software is the process of monitoring the creation, implementation, and evaluation of contracts to optimize an organization's financial and operational performance. Every organization needs contract management, and the healthcare industry is no exception. Hospitals and other healthcare providers need to monitor their operating costs, especially those linked to compliance because healthcare laws are always changing. Everything, including updating patient files, keeping staff databases, and supplier records, and starting with individual files and serving notes, needs to be done with the highest precision. Furthermore, supply chain costs rank second for these companies in terms of expenses behind payroll costs. The market for healthcare contract management software is expanding globally due to factors such as increased technological advancements, a growing need to enhance healthcare operations, and substantial returns on investments. Healthcare contract management software is expected to continue to be in high demand due to rising technological diversifications within the industry and strong sales based on dependent acceptance. The fact that international organizations monitor the best ways to deliver healthcare to close the gaps in the distribution of medical treatment is another factor driving the expansion of digital workflow in the healthcare industry.

Report Coverage

This research report categorizes the market for the global healthcare contract management software market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global healthcare contract management software market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global healthcare contract management software market.

Global Healthcare Contract Management Software Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1759 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 18.77% |

| 2033 Value Projection: | USD 9823 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 246 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Pricing Model, By Deployment Model, By End User, By Region |

| Companies covered:: | Aaveneir, Apptus, CLM Matrix, CobbleStone Software, Conga, Concord, Optum, RIM Logistics Ltd., Trackado, Experian Plc, Agiloft, ScienceSoft, Freshworks, Syra Health, Ultria Inc., and Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The primary drivers of this market are the desire to reduce healthcare costs while maintaining regulatory compliance and the increasing requirement to expedite organizational work processes and administrative responsibilities in the healthcare sector. Due to the time-consuming nature of contract management, efficient and automated contract management solutions are required. With the use of contract management tools, legal advisers can virtually see contracts in formats like PowerPoint, Microsoft word, and Excel, and can get comparable documents from the library for reference.

Restraining Factors

The market for healthcare contract management software is expected to grow slowly due to a lack of internal IT expertise and cyberattacks by healthcare providers against new contract management systems.

Market Segmentation

The global healthcare contract management software market share is classified into component, pricing model, deployment model, and end-user.

- The software segment accounted for the largest revenue share through the forecast period.

Based on the component, the global healthcare contract management software market is categorized into software and services. Among these, the software segment accounted for the largest revenue share through the forecast period. This is because the healthcare sector is using this software more frequently to guide patients with effective compliance, streamline contract lifecycle procedures, and maintain difficult contract papers in the database. Software for contract lifecycle management (CLM) has shown to be a dependable and efficient substitute for handling the increasing number of contracts for medical professionals, lab technicians, nurses, student physicians, and other professionals.

- The subscription-based segment is anticipated to grow at the fastest CAGR growth through the forecast period.

Based on the pricing model, the global healthcare contract management software market is categorized into subscription-based and others. Among these, the subscription-based segment is anticipated to grow at the fastest CAGR growth through the forecast period. Tier-based subscriptions with features like unlimited users and included implementation are available from vendors such as contract works.

- The cloud-based segment dominates the market with the largest market share through the forecast period.

Based on the deployment model, the global healthcare contract management software market is categorized into cloud-based, on-premises, and others. Among these, the cloud-based segment dominates the market with the largest market share through the forecast period. Cloud-based contract management solutions are a desirable choice for healthcare enterprises of all sizes because they are scalable, provide remote access, and have reduced upfront expenses. The cloud is a network of servers hosted on the internet, teams may store, create, track, and administer contracts in a shared workspace if they have an internet connection. This is made possible by cloud-based software. This concept became popular during the epidemic as artificial intelligence (AI) in healthcare increased.

- The healthcare providers segment is predicted to dominate the global healthcare contract management software market during the forecast period.

Based on the end-user, the global healthcare contract management software market is categorized into healthcare providers, hospitals, physicians, payers, medical device manufacturers, pharma, and others. Among these, the healthcare providers segment is predicted to dominate the global healthcare contract management software market during the forecast period. Healthcare providers and organizations are increasingly using healthcare contract management systems as a result of the growing need to lower operating costs while increasing operational efficiency and adhering to regulatory requirements.

Regional Segment Analysis of the Global Healthcare Contract Management Software Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global healthcare contract management software market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global healthcare contract management software market over the predicted timeframe. The government's Meaningful Use (MU) program and the health insurance portability & accountability act (HIPPA) are also mentioned as having contributed to the rise. The security and privacy of health information, particularly that which is contained in electronic health records, are the main concerns of the HIPPA law. Meaningful Use (MU) allows claims to be submitted electronically, exchanges patient data electronically, and creates electronic patient records (EHR). It is fueled by the well-established healthcare sector, strict regulations related to compliance, and a strong emphasis on cost control.

Asia Pacific is expected to grow at the fastest CAGR growth of the global healthcare contract management software market during the forecast period. Several causes are responsible for this growth, including an increase in outsourcing activities, a growing emphasis on strong data protection, a need for a speedy return on investment, and a growing need for effective digital tools to optimize operations. Most of this increase is being driven by the growing demand for efficient contract management software as well as the increasing requirements for complete transparency, quick rapid return on investment (ROI), and high data security.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global healthcare contract management software market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Aaveneir

- Apptus

- CLM Matrix

- CobbleStone Software

- Conga

- Concord

- Optum

- RIM Logistics Ltd.

- Trackado

- Experian Plc

- Agiloft

- ScienceSoft

- Freshworks

- Syra Health

- Ultria Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2024, Syra Health Corp., a healthcare technology company that uses cutting-edge services and technological solutions to address some of the biggest challenges facing the industry, declared that it has been selected as a subcontractor for a contract that the federal Department of Health and Human Services (HHS), Administration for Families and Children (ACR), Office of Refugee Resettlement (ORR), Medical Staffing and Support, awarded to Caduceus Healthcare, Inc.

- In May 2023, for businesses in the healthcare and life sciences, Aavenir introduced specifically designed industry vertical solutions with Aavenir provider flow. With procedures driven by AI, these systems automate contract administration, performance management, and provider onboarding.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global healthcare contract management software market based on the below-mentioned segments:

Global Healthcare Contract Management Software Market, By Component

- Software

- Services

Global Healthcare Contract Management Software Market, By Pricing Model

- Subscription Based

- Others

Global Healthcare Contract Management Software Market, By Deployment Model

- Cloud-based

- On-Premises

- Others

Global Healthcare Contract Management Software Market, By End User

- Healthcare Providers

- Hospitals

- Physicians

- Payers

- Medical Device Manufacturers

- Pharma

- Others

Global Healthcare Contract Management Software Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the Global healthcare contract management software market?The Global healthcare contract management software market is projected to expand at an 18.77% during the forecast period.

-

2. What are the top key players operating in the global healthcare contract management software market?The Major players in the global healthcare contract management software market are Contract Logix, Concord, Apttus, Coupa Software, Determine (Corcentric), ContractWorks, ContractSafe, Experian Health, Agiloft.

-

3. Which region is holding the largest share of the market?The North America region is expected to hold the highest share of the global healthcare contract management software market.

Need help to buy this report?