Global Healthcare Education Market Size, Share, and COVID-19 Impact Analysis By Provider (Universities, Educational Platforms, Medical Simulation), By Delivery Mode (Classroom-based, E-Learning), By Application (Academic Education, Neurology, Cardiology, Pediatrics), By End User (Students, Physicians and Non-Physicians), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: HealthcareGlobal Healthcare Education Market Insights Forecasts to 2033

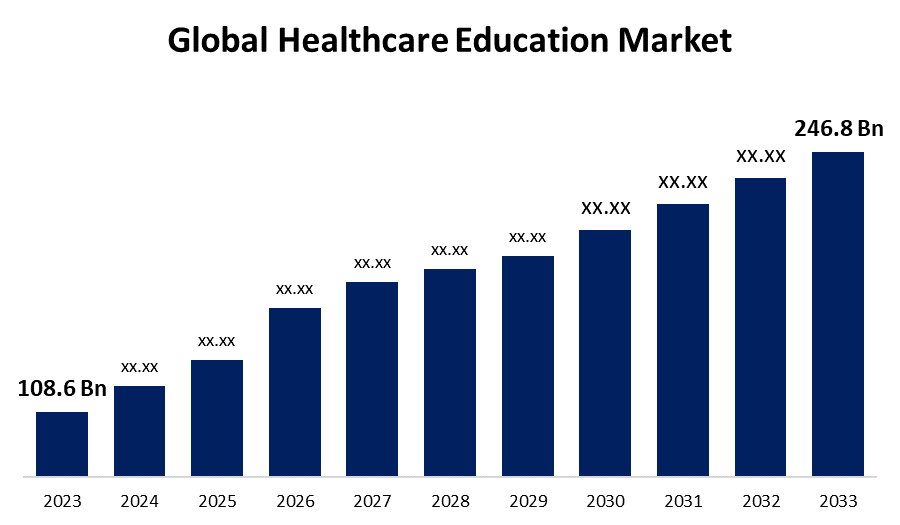

- The Global Healthcare Education Market Size was Valued at USD 108.6 Billion in 2023

- The Market Size is Growing at a CAGR of 8.56% from 2023 to 2033

- The Worldwide Healthcare Education Market Size is Expected to Reach USD 246.8 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Healthcare Education Market Size is Anticipated to Exceed USD 246.8 Billion by 2033, Growing at a CAGR of 8.56% from 2023 to 2033.

Market Overview

The mix of learning opportunities designed to help individuals and societies better their health, whether by improving knowledge or changing attitudes" is known as health education. Through the provision of information about environmental health, physical health, social health, emotional health, intellectual health, dental health, and sexual and reproductive health, health education serves as a means of advancing health promotion and disease preventive services for individuals and groups. In July 2024, the government of India allocated Rs 87,656.90 crore to the health and family welfare department and Rs 3,301.73 to the health research department, as per the Budget presented by Finance Minister Nirmala Sitharaman. The Centre’s flagship scheme, Ayushman Bharat Pradhan Mantri Jan Arogya Yojana has an allocation of Rs 7,300 crore as compared with the previous allocation of Rs 6800 crore.

Several factors drive the industry, including developments in technology, the focus on patient safety and high-quality care, and the scarcity of healthcare providers. Furthermore, key market players include Tryker, UNICEF India, SAP, Adobe, Infor, Oracle, HealthStream, Symplr, Elsevier, Articulate, PeopleFluent, Fujifilm Corporation, and GE Healthcare. The market for healthcare education is growing as a result of the rapid growth of technology in the healthcare education market.

For Instance, in March 2024, To provide healthcare providers with the abilities they need to contribute to the digital transformation of India's healthcare sector, UNICEF India, partners with the International Institute of Health Management Research, New Delhi, and IIT Bombay, launched a digital course. The market will increase due to the rising need for continuing medical education and greater demand for online learning despite restrictive regulatory control. Using contemporary technology to fulfill training requirements will probably boost the growth of health education market.

Report Coverage

This research report categorizes the market for the global healthcare education market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global healthcare education market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global healthcare education market.

Global Healthcare Education Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 108.6 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 8.56% |

| 023 – 2033 Value Projection: | USD 246.8 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 245 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Delivery Mode, By Application, By End User, By Region |

| Companies covered:: | GE Healthcare, DePuy Synthes, Tryker, UNICEF India, Adobe, Infor, Oracle, HealthStream, Symplr, Elsevier, Articulate, PeopleFluent, Fujifilm Corporation, Sodexo, Others |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving Factors

The increasing public awareness of healthcare is driving the need for healthcare education. As people become more proactive about their health, there is an increasing demand for healthcare providers with training in disease management, health promotion, and preventive care. These could expand the market for healthcare education. Government initiatives to develop health education programs are another factor driving the growth of the healthcare education market. The initiatives initiated by the government help to raise awareness of health issues. For instance, in March 2020, The Ministries of Health, Family Welfare, and Human Resource Development collaborated to launch the School Health Programme (SHP) under Ayushman Bharat. As part of the program, educators serve as "Health and Wellness Ambassadors," disseminating important information and leading one-hour, culturally sensitive, activity-based classes for weeks at a time to promote joyful learning. The growing number of strict regulatory requirements associated with CME programs globally is one of the main drivers of market growth.

Restraining Factors

The market for healthcare education can be slowed significantly by rural areas' distaste for this area of study. Due to the poor reaction and interest from people in rural areas, the educational institution might decide to cease offering healthcare education. As a result, the market for healthcare education would slow down and people in rural areas are unlikely to know of healthcare education.

Market Segmentation

The global healthcare education market share is classified into provider, delivery mode, application and end user.

- The universities segment is expected to hold the largest share of the global healthcare education market during the forecast period.

Based on the provider, the global healthcare education market is divided into universities, educational platforms, and medical simulation. Among these, the universities segment is expected to hold the largest share of the global healthcare education market during the forecast period. Universities' expansion in the healthcare education solutions market is driven by several factors, including the need for qualified healthcare workers, the necessity of ongoing education in a field that is changing quickly, alliances with healthcare organizations, and a focus on patient-centered care and interprofessional collaboration.

- The e-learning segment is expected to hold the largest share of the global healthcare education market during the forecast period.

Based on the delivery mode, the global healthcare education market is divided into classroom-based, and e-learning. Among these, the e-learning segment is expected to hold the largest share of the global healthcare education market during the forecast period. The digitization of health care, the flexibility and accessibility that e-learning solutions provide, their affordability, and technological improvements that improve the quality of the learning experience are the main factors driving the rise of e-learning solutions in the healthcare education market.

- The academic education segment is expected to hold the largest share of the global healthcare education market during the forecast period.

Based on the application, the global healthcare education market is divided into academic education, neurology, cardiology, and pediatrics. Among these, the academic education segment is expected to hold the largest share of the global healthcare education market during the forecast period. The market for healthcare education solutions experiences growth in the academic education segment due to several factors, including the need for highly qualified healthcare professionals, the integration of new medical technology and research, the significance of evidence-based practice, and the focus on interdisciplinary collaboration.

- The students segment is expected to hold the largest share of the global healthcare education market during the forecast period.

Based on the end user the global healthcare education market is divided into students, physicians, and non-physicians. Among these, the students segment is expected to hold the largest share of the global healthcare education market during the forecast period. Student prospects have increased due to the growing availability and accessibility of healthcare education alternatives, especially online and distant learning options. Students can learn whenever and wherever they want, at their speed, with the help of digital resources and online platforms.

Regional Segment Analysis of the Global Healthcare Education Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the global healthcare education market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the global healthcare education market over the predicted timeframe. The working class expands in Asia Pacific countries like China, India, and South East Asia, there is an increasing demand for better healthcare services. Governments in the Asia-Pacific region are investing heavily in infrastructure related to healthcare, education, and worker development. Initiatives including skill development programs, scholarships, and financial help for healthcare education are contributing to the sector's growth. For Instance, in January 2024, Fujitsu launched the beginning of a comprehensive health education program aimed at motivating its roughly 70,000 workers in Japan to take proactive measures to preserve and enhance their oral and dental health. Achieving better oral and dental health is essential to improving overall well-being and quality of life.

North America is expected to grow at the fastest pace in the global healthcare education market during the forecast period. North America, particularly the United States and Canada, has highly developed healthcare systems and an extensive infrastructure that supports medical education and training. This includes several notable universities, medical schools, and research facilities. In addition, the region devotes a significant amount of its budget to medical research and teaching. For Instance, in June 2023, to improve access for surgeons and benefit more patients all over the United States, GE Healthcare (US) and DePuy Synthes (US) collaborated to make GE Healthcare's OEC 3D Imaging System more widely available in addition to DePuy Synthes' extensive product line.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global healthcare education market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- GE Healthcare

- DePuy Synthes

- Tryker

- UNICEF India

- Adobe

- Infor

- Oracle

- HealthStream

- Symplr

- Elsevier

- Articulate

- PeopleFluent

- Fujifilm Corporation

- Sodexo

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2024, Effective Leadership and Governance in Medical Institutions of Higher Education, a book published by Elsevier, was launched by GITAM University in Hyderabad. K.R. Sethuraman, a former vice-chancellor of SBV, accepted the first copy of the book.

- In April 2024, Sodexo and ART announced a partnership to install thousands of state-of-the-art hot food robotic kiosks in Sodexo-served facilities across the United States, marking an inventive move that will transform hot meal robotic technology. This partnership will establish new benchmarks for the automated mining sector, bringing together the global leadership of Sodexo and the robotics and artificial intelligence innovations of ART.

- In January 2023, Introducing in a state-of-the-art, cloud-based continuing education management system for healthcare organizations and providing creative solutions in the form of Software-as-a-Service, HealthStream (US) acquired Electronic Education Documentation System, LLC (US). This acquisition will broaden Healthstream's ecosystem.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global healthcare education market based on the below-mentioned segments:

Global Healthcare Education Market, By Provider

- Universities

- Educational Platforms

- Medical Simulation

Global Healthcare Education Market, By Delivery Mode

- Classroom-based

- E-Learning

Global Healthcare Education Market, By Application

- Academic Education

- Neurology

- Cardiology

- Pediatrics

Global Healthcare Education Market, By End User

- Students

- Physicians

- Non-Physicians

Global Healthcare Education Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?