Global Healthcare Logistics Market Size, Share, and COVID-19 Impact Analysis, By Service (Transportation, Warehousing & Storage, and Others), By Product (Biopharmaceutical, Medical Device, and Pharmaceutical), By End-Users (Pharmaceutical & Biotechnological Companies, Medical Device Companies, Healthcare Facilities, and Others) By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: HealthcareGlobal Healthcare Logistics Market Insights Forecasts to 2033

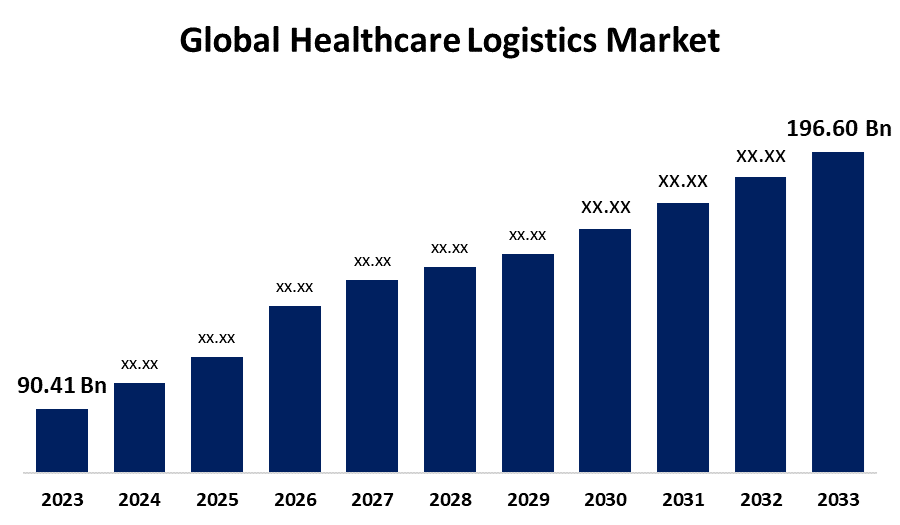

- The Global Healthcare Logistics Market Size was estimated at USD 90.41 Billion in 2023

- The Market Size is expected to grow at a CAGR of around 8.08% from 2023 to 2033

- The Worldwide Healthcare Logistics Market Size is Expected to Reach USD 196.60 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Healthcare Logistics Market Size is Anticipated to Reach USD 196.60 Billion by 2033, Growing at a CAGR of 8.08% from 2023 to 2033.

Market Overview

Healthcare logistics is the industry that deals with coordinating transportation, warehousing, and distribution of products to health industries across the world. These products may include drugs, medical instruments, and vaccines, among others. Raw materials from the point of origin are carried to a manufacturing site and later on to a plant. Healthcare transport can be offered in any form of transport such as trucks, trains, boats, airplanes, temperature-controlled trucks, and cars. The ever-growing medical facilities and infrastructure across the world are the drivers for growth in the healthcare logistics market. The global healthcare logistics market presents significant opportunities based on the rising demand for cold chain logistics to support biologics, vaccines, and temperature-sensitive pharmaceuticals. Emerging market expansion with ever-increasing healthcare infrastructures provides the opportunity for untapped growth. Gains in the e-commerce sector and telemedicine continue to spur increased demand for efficiency in last-mile delivery solutions. Advances in IoT, blockchain, and AI have expanded tracking, improved security, and optimized operations related to logistics, and an increasingly strong emphasis on pandemic preparedness highlights the need for scalable and dependable logistics systems. Other opportunities include the initiatives to promote sustainability as the company can embrace eco-friendly packaging and green logistics practices for environment-friendly operations.

Report Coverage

This research report categorizes the market for the healthcare logistics market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the healthcare logistics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the healthcare logistics market.

Global Healthcare Logistics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | 90.41 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.08% |

| 2033 Value Projection: | 196.60 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 107 |

| Segments covered: | By Product , By End-Users, By Region |

| Companies covered:: | Maersk, United Parcel Service of America, Inc., AWL India Private Limited, Noatum Logistics, DHL Group, CEVA Logistics, AmerisourceBergen, FedEx Corporation, Kuehne + Nagel, DB Schenker UPS, DSV, Farmasoft, Alloga, NextPharma Logistics GmbH, GEODIS, FM Logistic, Others, |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The global healthcare logistics market is also driven by rising demand for efficient transportation and warehousing of drugs, vaccines, as well as pharmaceuticals, and medical appliances. The increasing need for a healthcare supply chain capable of handling such chronic diseases among the population while the population also ages has caused a surge. The increase in biologics and temperature-sensitive products has come to highlight a need for cold-chain logistics. Technological advancements in IoT, AI, and blockchain are improving real-time tracking, transparency, and operational efficiency. E-commerce and online pharmacies have increased demand for last-mile delivery solutions. Emerging markets are also investing in healthcare, and reliable logistics solutions during health crises like pandemics propel the market forward.

Restraining Factors

High operational costs, stringent regulatory requirements, inefficiencies in last-mile delivery, inadequate infrastructure in emerging regions, and the risk of supply chain disruptions due to geopolitical tensions or natural disasters are the key challenges in the global healthcare logistics market.

Market Segmentation

The healthcare logistics market share is classified into service, product, and end-user.

- The warehousing & storage segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the service, the healthcare logistics market is categorized as transportation, warehousing & storage, and others. Among these, the warehousing & storage segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. This is because of the growing demand for specialized storage solutions for temperature-sensitive products, including biologics and pharmaceuticals. Additionally, the growth was driven by the demand for secure, climate-controlled environments to maintain product integrity and comply with regulatory standards, as well as the expansion of distribution networks that require advanced warehousing capabilities.

- The biopharmaceutical segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the product, the healthcare logistics market is categorized as biopharmaceutical, medical device, and pharmaceutical. Among these, the biopharmaceutical segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. This is due to the increased demand for vaccines, plasma-derived products, and other biologics that require strict temperature control and specialized handling. The growth of the segment was driven by increased investments in advanced therapies and the need for robust cold chain logistics to ensure product efficacy and safety throughout the supply chain.

- The pharmaceutical & biotechnological companies segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the end-user, the healthcare logistics market is categorized as pharmaceutical & biotechnological companies, medical device companies, healthcare facilities, and others. Among these, the pharmaceutical & biotechnological companies segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. This is due to the increasing demand for such complex, temperature-sensitive products like biologics, vaccines, and plasma-derived medicines. Such companies require customized logistics solutions to preserve the integrity of the product, meet strict regulatory standards, and ensure timely delivery.

Regional Segment Analysis of the Healthcare Logistics Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

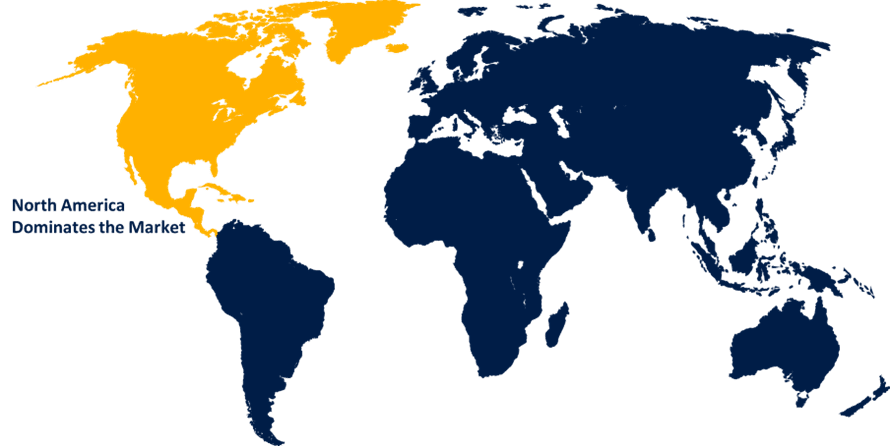

North America is anticipated to hold the largest share of the healthcare logistics market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the healthcare logistics market over the forecast period. The growth is mainly triggered by the region's advanced healthcare facilities and increased need for pharmaceuticals and biologics. This region is characterized by having a strict regulatory system, among others, to guarantee well-established standards which, in turn, ensure all medical products will undergo high-quality security until they reach the consumer. Major pharmaceutical and biotech corporations, like Pfizer and Johnson & Johnson, invested heavily in this region, such that these corporations cemented their position in the industry. Besides, heavy investment in logistics technology, such as automation and real-time tracking systems, increases operational efficiency and reliability in healthcare logistics, which in turn allows the timely delivery of critical medical supplies.

Asia Pacific is expected to grow at the fastest CAGR growth in the healthcare logistics market during the forecast period. Rapid urbanization, an increase in healthcare expenditure, and a surging demand for healthcare services across countries like China, India, and Japan fuel this growth. Improvements in infrastructure and logistics networks, enhancing the efficiency of healthcare supply chains, further drive the region's pharmaceutical and biopharmaceutical sectors.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the healthcare logistics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Maersk

- United Parcel Service of America, Inc.

- AWL India Private Limited

- Noatum Logistics

- DHL Group

- CEVA Logistics

- AmerisourceBergen

- FedEx Corporation

- Kuehne + Nagel

- DB Schenker UPS

- DSV

- Farmasoft

- Alloga

- NextPharma Logistics GmbH

- GEODIS

- FM Logistic

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2024, UPS Healthcare strengthened its footprint throughout Europe through an expanded number of pickup locations at which to drop specimens for easy logistics and also debuted UPS Premier Platinum, for tracking shipments in greater detail, especially in real-time. This includes temperature, light, and humidity tracking indicators so it can rapidly detect delays or departures.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the healthcare logistics market based on the below-mentioned segments:

Global Healthcare Logistics Market, By Service

- Transportation

- Warehousing & Storage

- Others

Global Healthcare Logistics Market, By Product

- Biopharmaceutical

- Medical Device

- Pharmaceutical

Global Healthcare Logistics Market, By End-Users

- Pharmaceutical & Biotechnological Companies

- Medical Device Companies

- Healthcare Facilities

- Others

Global Healthcare Logistics Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global healthcare logistics market?The global healthcare logistics market is projected to expand at 8.08% during the forecast period.

-

2. Who are the top key players in the global healthcare logistics market?The key players in the global healthcare logistics market are Maersk, United Parcel Service of America, Inc., AWL India Private Limited, Noatum Logistics, DHL Group, CEVA Logistics, AmerisourceBergen, FedEx Corporation, Kuehne + Nagel, DB Schenker UPS, DSV, Farmasoft, Alloga, NextPharma Logistics GmbH, GEODIS, FM Logistic, and Others.

-

3. Which region holds the largest share of the healthcare logistics market?North America is anticipated to hold the largest share of the healthcare logistics market over the predicted timeframe.

Need help to buy this report?