Global Hedge Fund Market Size, Share, and COVID-19 Impact Analysis, By Investment Strategies (Long And Short Equity, Macro, Event-Driven, Credit, Relative Value, Niche, Multi-Strategy, Managed Futures/CTA Strategies, and Others), By Type (Offshore, Offshore Hedge Funds, Fund of Funds, Domestic), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Banking & FinancialGlobal Hedge Fund Market Insights Forecasts to 2033

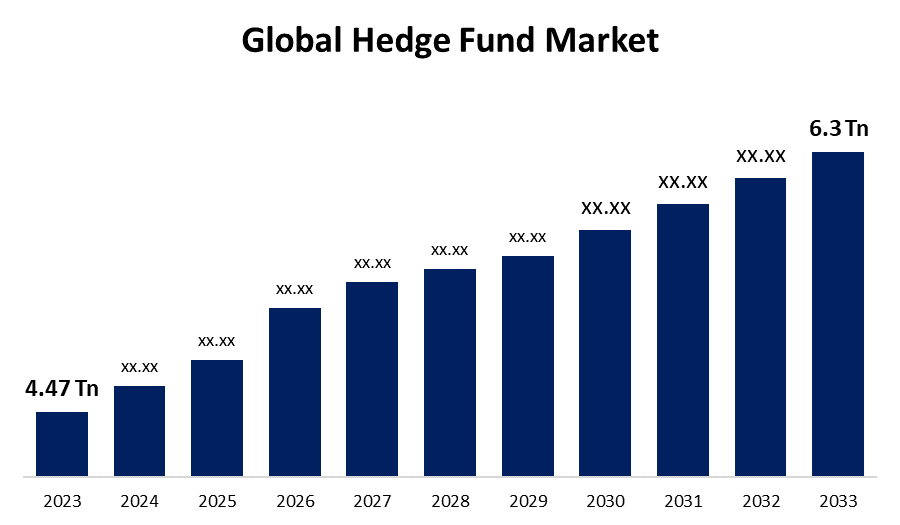

- The Global Hedge Fund Market Size was Valued at USD 4.47 Trillion in 2023

- The Market Size is Growing at a CAGR of 4.84% from 2023 to 2033

- The Worldwide Hedge Fund Market Size is Expected to Reach USD 6.3 Trillion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Hedge Fund Market Size is Anticipated to Exceed USD 6.3 Trillion by 2033, Growing at a CAGR of 4.84% from 2023 to 2033.

Market Overview

A hedge fund is a limited partnership where funds are pooled together and managed by professional fund managers. These fund managers invest in various securities and other investments. The investment strategy involves hedging techniques to reduce portfolio volatility. Hedge funds are organized as private investment partnerships or offshore investment corporations and are less regulated than mutual funds, making them more flexible to pursue higher-risk investments. The hedge fund firms target high-net-worth individuals and large institutional investors, such as pension funds or accredited investors, who meet specific income or asset requirements. The benefits of hedge funds include expert management, risk mitigation, portfolio diversification, and the potential for high returns.

Several factors drive the growth of the hedge fund market, such as algorithmic trading and advanced analytics, which enhance decision-making and performance. Additionally, emerging markets present lucrative prospects for asset management firms aiming to capture growth in regions with increasing economic development and wealth accumulation. Market trends indicate a shift towards more transparent and cost-effective fee structures. The regulations also encourage greater scrutiny and robustness in fund operations.

Additionally, there are many recent developments in the global hedge fund market. For instance, in September 2024, Analog Century Management, the New York-based tech-focused hedge fund founded by Val Zlatev, joined the growing roster of external firms to secure capital from Izzy Englander’s Millennium Management, with the multi-strat major making a $1bn allocation, according to a report by Bloomberg.

Report Coverage

This research report categorizes the market for the global hedge fund market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global hedge fund market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global hedge fund market.

Global Hedge Fund Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 4.47 Trillion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 4.84% |

| 2033 Value Projection: | USD 6.3 Trillion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 269 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Investment Strategies, By Type, By Region |

| Companies covered:: | Two Sigma Investments, Renaissance Technologies, Citadel Enterprise Americas, Elliott Investment Management, Millennium Management, Davidson Kempner Capital Management, Man Group, Bridgewater Associates, AQR Capital Management, BlackRock, TCI Fund Management, D.E. Shaw Group, Farallon Capital Management, Ruffer Investment Company, Winton Capital Management, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, and Analysis |

Get more details on this report -

Driving Factors

Several factors drive the global hedge fund market. A major factor is the increasing investments in digital assets, as investors seek diversification beyond traditional asset classes like stocks and bonds. Hedge funds have varied strategies and focus on uncorrelated returns, offering compelling alternatives, especially when conventional fixed-income assets fail to deliver attractive returns. Additionally, advanced data analytics, machine learning algorithms, and artificial intelligence (AI) enable managers to extract insights from vast datasets, identify hidden patterns, generate trade signals, and predict future moves of assets. High-tech software streamlines portfolio management, risk analysis, and compliance, improving efficiency and reducing operational costs.

Enhanced regulatory scrutiny and transparency boost investor confidence, attracting “smart money”. They promote fairness in the market, benefiting smaller and niche hedge funds. Furthermore, the rise of quantitative and systematic investment strategies is opening new opportunities for market expansion.

Restraining Factors

Some of the challenges anticipated to restrain the growth of the global hedge fund market, including regulations and compliance, impose significant administrative burdens, often increasing operational costs for fund managers. High investment is required for hedge funds, discouraging prospective investors. Market volatility is another hurdle, as unpredictable economic conditions can lead to asset value fluctuations. Limited disclosure of strategies and holdings by hedge fund firms might reduce investor confidence.

Market Segmentation

The global hedge fund market share is classified into investment strategies and types.

- The multi-strategy segment is expected to hold the largest share of the global hedge fund market during the forecast period.

Based on the investment strategy, the global hedge fund market is divided into long and short equity, macro, event-driven, credit, relative value, niche, multi-strategy, managed futures/CTA strategies, and others. Among these, the multi-strategy segment is expected to hold the largest share of the global hedge fund market during the forecast period. This approach benefits from its flexibility, it combines various investment strategies within a single fund, such as long and short equity, macro, event-driven, and relative value. This diversification allows multi-strategy funds to adapt dynamically to changing market conditions, which optimizes returns while reducing risks associated with any single strategy. It offers a balanced risk-reward ratio, as these funds aim to achieve steady performance by leveraging the strength of multiple strategies. The ability to shift capital between different strategies according to the economic and market trends improves their resilience.

- The offshore hedge funds segment is expected to hold the largest share of the global hedge fund market during the forecast period.

Based on type, the global hedge fund market is divided into offshore, offshore hedge funds, fund of funds, and domestic. Among these, the offshore hedge funds segment is expected to hold the largest share of the global hedge fund market during the forecast period. Offshore hedge funds are generally established in jurisdictions with favourable regulatory and tax environments, such as the Cayman Islands or Bermuda. These locations offer benefits such as reduced tax liabilities, greater operational flexibility, and fewer regulatory constraints, making them attractive to global investors. Additionally, offshore hedge funds can cater to a wider range of international investors, including institutional investors and high-net-worth individuals who seek diversification and strategic exposure across multiple geographies.

Regional Segment Analysis of the Global Hedge Fund Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global hedge fund market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global hedge fund market over the predicted timeframe. The presence of a well-established financial infrastructure and several hedge fund firms, especially in financial hubs like New York and Connecticut, drives the regional market. The region benefits from investment from institutional investors, including pension funds, endowments, and insurance companies, seeking portfolio diversification and asset management solutions.

Additionally, the robust regulatory framework provides transparency and investor protection that boosts confidence in hedge fund investments. Furthermore, the mature capital market, strong investor appetite for alternative investment strategies, and quick technological adoption for trading and risk management boost the North American hedge fund market.

Asia Pacific is expected to grow fastest in the global hedge fund market during the forecast period. This rapid growth is driven by the region's booming economies, increasing wealth, and an expanding base of high-net-worth individuals seeking diverse investment opportunities. The regulations in key financial centres like Hong Kong and Singapore are becoming more robust and transparent, fostering greater investor confidence. There is also a rising interest among global hedge fund managers for a presence in Asia, attracted by the untapped potential investments. The region's technical advancements in hedge fund software further support its accelerated growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global hedge fund market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Two Sigma Investments

- Renaissance Technologies

- Citadel Enterprise Americas

- Elliott Investment Management

- Millennium Management

- Davidson Kempner Capital Management

- Man Group

- Bridgewater Associates

- AQR Capital Management

- BlackRock

- TCI Fund Management

- D.E. Shaw Group

- Farallon Capital Management

- Ruffer Investment Company

- Winton Capital Management

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2024, the University of Houston System’s endowment management committee approved a $20m investment in the Broad Reach Master Fund, an emerging markets-focused global macro hedge fund, according to a report by Pensions & Investments.

- In August 2024, Hilbert Group AB, through its asset management division, Hilbert Capital formed a strategic partnership with Xapo Bank, a prominent global financial institution, to launch a new $200m bitcoin-denominated hedge fund.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global hedge fund market based on the below-mentioned segments:

Global Hedge Fund Market, By Investment Strategies

- Long and Short Equity

- Macro

- Event-Driven

- Credit

- Relative Value

- Niche

- Multi-Strategy

- Managed Futures/CTA Strategies

- Others

Global Hedge Fund Market, By Type

- Offshore

- Offshore Hedge Funds

- Fund of Funds

- Domestic

Global Hedge Fund Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.Which are the key companies that are currently operating within the market?Two Sigma Investments, Renaissance Technologies, Citadel Enterprise Americas, Elliott Investment Management, Millennium Management, Davidson Kempner Capital Management, Man Group, Bridgewater Associates, AQR Capital Management, BlackRock, TCI Fund Management, D.E. Shaw Group, Farallon Capital Management, Ruffer Investment Company, Winton Capital Management, and Others.

-

2.What is the size of the global hedge fund market?The Global Hedge Fund Market is expected to grow from USD 4.47 Trillion in 2023 to USD 6.3 Trillion by 2033, at a CAGR of 4.84% during the forecast period 2023-2033.

-

3.Which region is holding the largest share of the market?North America is anticipated to hold the largest share of the global hedge fund market over the predicted timeframe.

Need help to buy this report?