Global Hedge Fund Software Market Size, Share, and COVID-19 Impact Analysis, By Company Size (Large Enterprises, and Small and Medium-Sized Enterprises (SMEs)), By End-User (Asset Managers, Hedge Funds, Pension Funds, Insurance Companies, and Others), By Deployment (Cloud-Based and On-Premise), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Banking & FinancialGlobal Hedge Fund Software Market Insights Forecasts to 2033

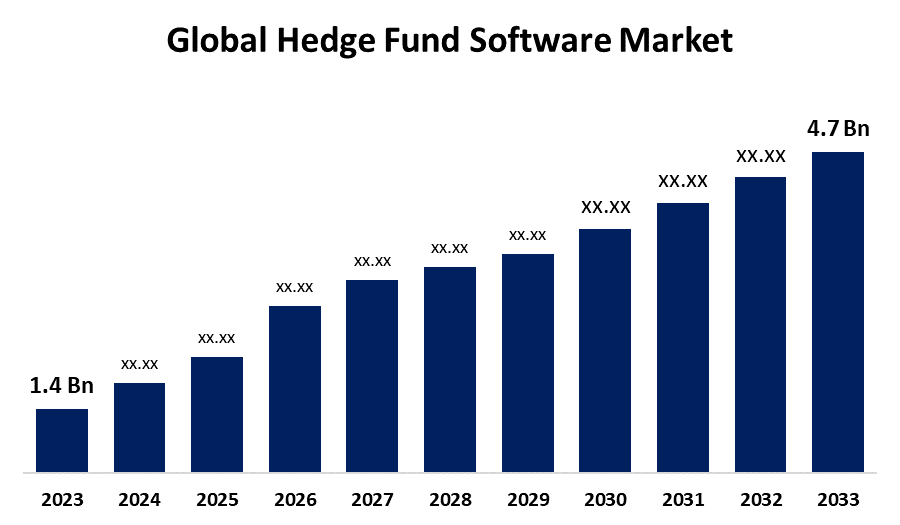

- The Global Hedge Fund Software Market Size Was Valued at USD 1.4 Billion in 2023

- The Market Size is Growing at a CAGR of 12.87% from 2023 to 2033

- The Worldwide Hedge Fund Software Market Size is Expected to Reach USD 4.7 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Hedge Fund Software Market Size is Anticipated to Exceed USD 4.7 Billion by 2033, Growing at a CAGR of 12.87% from 2023 to 2033.

Market Overview

A hedge fund is a limited partnership of investors. The investor’s money is pooled and managed by professional fund managers for investing in securities and other types of investments. This is an investment strategy that uses hedging techniques to reduce portfolio volatility. The hedge funds are organized as private investment partnerships or offshore investment corporations. They are less regulated than mutual funds and have more freedom to pursue investments that might increase the risk of losses. Hedge funds target high-net-worth individuals and large institutional investors like pension funds, or accredited investors who meet certain income or asset requirements. Benefits of hedge funds include expert management, risk hedging, portfolio diversification, and the potential for high returns.

The hedge fund software includes a variety of applications for assisting hedge funds in managing portfolios, analyzing risks, ensuring compliance, and optimizing trading strategies. These software offer benefits, such as enhanced decision-making capabilities, improved operational efficiency, and reduced manual errors. The key driving factors fueling the hedge fund software market include the growing complexity of financial transactions and the necessity for regulatory compliance. With the increasing scale of hedge funds and their transactions, traditional management methods are becoming obsolete, pushing firms towards adopting advanced software solutions.

Report Coverage

This research report categorizes the global hedge fund software market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global hedge fund software market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global hedge fund software market.

Global Hedge Fund Software Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.4 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 12.87% |

| 023 – 2033 Value Projection: | USD 4.7 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 215 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Company Size, By End-User, By Deployment, By Region |

| Companies covered:: | Altreva, FundCount, VestServe, Backstop Solutions Group, FXCM, AlternativeSoft, Northstar Risk, Eze Software, Fi-Tek, Obsidian Suite, PortfolioShop, FinLab Solutions, Imagineer Technology Group, Ledgex, Numerix, Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Several factors drive the growth of the global hedge fund software market. The rapid advancements in technology, like artificial intelligence and machine learning, are transforming the capabilities of hedge fund software improving efficiency and analytical capabilities. Additionally, the increasing complexity and volume of financial transactions necessitate sophisticated software solutions to manage and analyze data effectively. Hedge fund managers rely on these tools to make informed decisions and mitigate risks. Strict financial regulations are another major factor as compliance requirements become more difficult, hedge funds must adopt advanced software systems to ensure accurate reporting and adhere to regulations. Moreover, the growing demand for efficiency and cost reduction drives firms to automate repetitive processes, further boosting the hedge fund software market.

Restraining Factors

Some restraining factors are anticipated to challenge the growth of the global hedge fund software market. The high initial costs and technical complexities of deploying advanced hedge fund software solutions present significant barriers, particularly for smaller hedge funds with limited budgets. Additionally, concerns regarding data security and the rising cybersecurity threats discourage some firms from adopting new technologies. Another considerable challenge is integrating new software with traditional systems, which is time-consuming, complex, and resource-intensive. The lack of skilled professionals capable of effectively managing and using this software adds to the challenge of adopting hedge fund software solutions.

Market Segmentation

The global hedge fund software market share is classified into company size, end-user, and deployment.

- The large enterprises segment is expected to hold the largest share of the global hedge fund software market during the forecast period.

Based on the company size, the global hedge fund software market is divided into large enterprises, and small and medium-sized enterprises (SMEs). Among these, the large enterprises segment is expected to hold the largest share of the global hedge fund software market during the forecast period. The dominance of this segment is because they have substantial financial resources, enabling these organizations to invest in such software and skilled professionals. Large hedge funds handle higher volume and complex transactions needing sophisticated analytical and management tools. Large enterprises also need to follow strict regulatory compliance and accurate reporting. Their ability to leverage advanced data analytics and automation contribute to better decision-making and operational efficiency, boosting their leading position in the market.

- The hedge funds segment is expected to hold the largest share of the global hedge fund software market during the forecast period.

Based on the end-user, the global hedge fund software market is divided into asset managers, hedge funds, pension funds, insurance companies, and others. Among these, the hedge funds segment is expected to hold the largest share of the global hedge fund software market during the forecast period. These organizations need advanced tools to manage complex investment portfolios and execute trading strategies quickly. Hedge funds need robust and dependable software to handle high-frequency trading, risk management, and regulatory compliance, ensuring efficient and accurate operations. Additionally, hedge fund strategies are dynamic and involve leveraging and short selling, demanding precise and real-time data analytics provided by these software systems. Their ability to automate various processes reduces operational costs and errors, further highlighting the importance of hedge fund software in maintaining a high success rate and achieving higher performance in the financial markets.

- The cloud-based segment is expected to grow at the fastest CAGR in the global hedge fund software market during the forecast period.

Based on the deployment mode, the global hedge fund software market is divided into cloud-based and on-premise. Among these, the cloud-based segment is expected to grow at the fastest CAGR in the global hedge fund software market during the forecast period. The rapid growth of cloud-based software is due to the advantages it offers over traditional on-premise systems. Cloud-based software provides unparalleled scalability and flexibility, enabling hedge funds to adjust to changing business needs and market conditions without significant infrastructure investments and changes. The low upfront costs and lower maintenance expenses make cloud solutions appealing, especially for small and medium-sized (SME) hedge funds. Cloud-based platforms also allow remote access for users to manage and monitor activities from anywhere and anytime, which is very important in mobile and distributed work environments. The security features and regular software updates ensure that firms stay compliant with regulations, boosting the adoption of cloud-based hedge fund software.

Regional Segment Analysis of the Global Hedge Fund Software Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

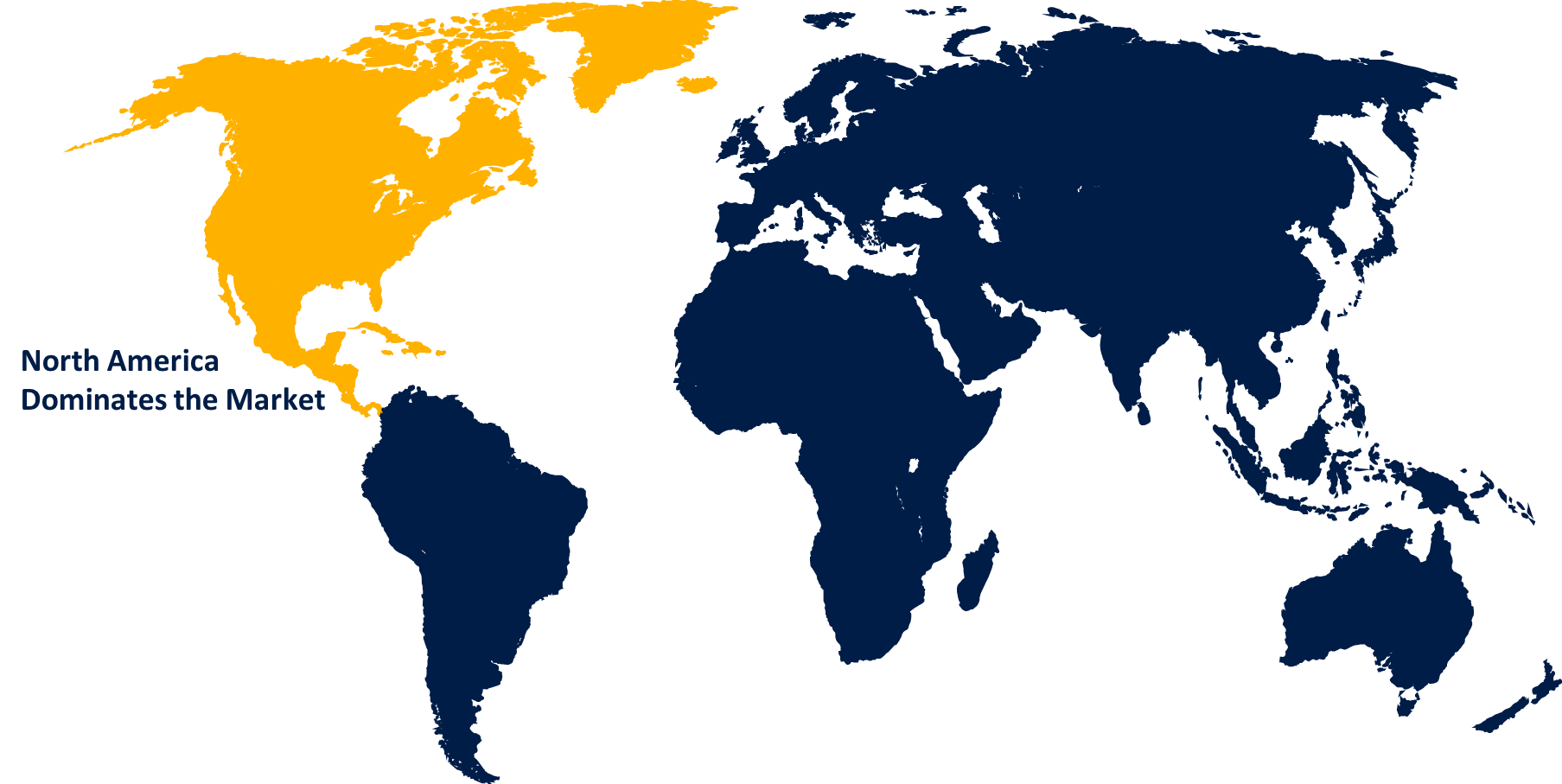

North America is anticipated to hold the largest share of the global hedge fund software market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global hedge fund software market over the predicted timeframe. This is due to the region's well-established financial sector and the concentration of leading hedge fund firms, particularly in the United States. The advanced technological infrastructure in the North American region supports the rapid adoption and integration of new software solutions. Furthermore, the stringent regulatory requirements in the U.S. force firms to follow robust compliance and reporting mechanisms, driving the demand for advanced hedge fund software. The high level of innovation and research in financial technologies, availability of skilled professionals, and widespread awareness about the benefits of automated and analytical tools further boost the market growth in this region.

Asia-Pacific is anticipated to be the fastest-growing region in the global hedge fund software market. The rapid growth of this region is driven by the growing demand for financial services and the increasing number of hedge funds, particularly in countries like India, China, and Japan. The region's rapid economic expansion and rising interest in alternative investment instruments are leading to the adoption of hedge fund software. Additionally, advancements in technology infrastructure and a growing focus on digital transformation among financial institutions support this growth. The increasing regulation for the financial sector in Asia-Pacific also fuels the adoption of sophisticated compliance and risk management using hedge fund software.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global hedge fund software market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Altreva

- FundCount

- VestServe

- Backstop Solutions Group

- FXCM

- AlternativeSoft

- Northstar Risk

- Eze Software

- Fi-Tek

- Obsidian Suite

- PortfolioShop

- FinLab Solutions

- Imagineer Technology Group

- Ledgex

- Numerix

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2024, the Office of Financial Research (OFR) introduced its new Hedge Fund Monitor, an interactive data visualization tool that consolidates data on hedge fund activity from multiple sources into a single interface. The Hedge Fund Monitor is open to the public, and data can be downloaded using an application programming interface (API).

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global hedge fund software market based on the below-mentioned segments:

Global Hedge Fund Software Market, By Company Size

- Large Enterprises

- Small and Medium-Sized Enterprises (SMEs)

Global Hedge Fund Software Market, By End-User

- Asset Managers

- Hedge Funds

- Pension Funds

- Insurance Companies

- Others

Global Hedge Fund Software Market, By Deployment

- Cloud-based

- On-premise

Global Hedge Fund Software Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.Which are the key companies that are currently operating within the market?Altreva, FundCount, VestServe, Backstop Solutions Group, FXCM, AlternativeSoft, Northstar Risk, Eze Software, Fi-Tek, Obsidian Suite, PortfolioShop, FinLab Solutions, Imagineer Technology Group, Ledgex, Numerix, and Others.

-

2.What is the size of the global hedge fund software market?The Global Hedge Fund Software Market is expected to grow from USD 1.4 Billion in 2023 to USD 1.4 Billion by 2033, at a CAGR of 12.87% during the forecast period 2023-2033.

-

3.Which region is holding the largest share of the market?North America is anticipated to hold the largest share of the global hedge fund software market over the predicted timeframe.

Need help to buy this report?