Global Hemato Oncology Testing Market Size, Share, and COVID-19 Impact Analysis, By Product (Assay Kits & Reagents, and Services), By Cancer Type (Leukemia, Lymphoma, and Multiple Myeloma), By Technology (Polymerase Chain Reaction (PCR), Next-Generation Sequencing (NGS), Immunohistochemistry (IHC), & Others), By End User (Hospitals, Academic & Research Institutes, & Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032.

Industry: HealthcareGlobal Hemato Oncology Testing Market Insights Forecasts to 2032

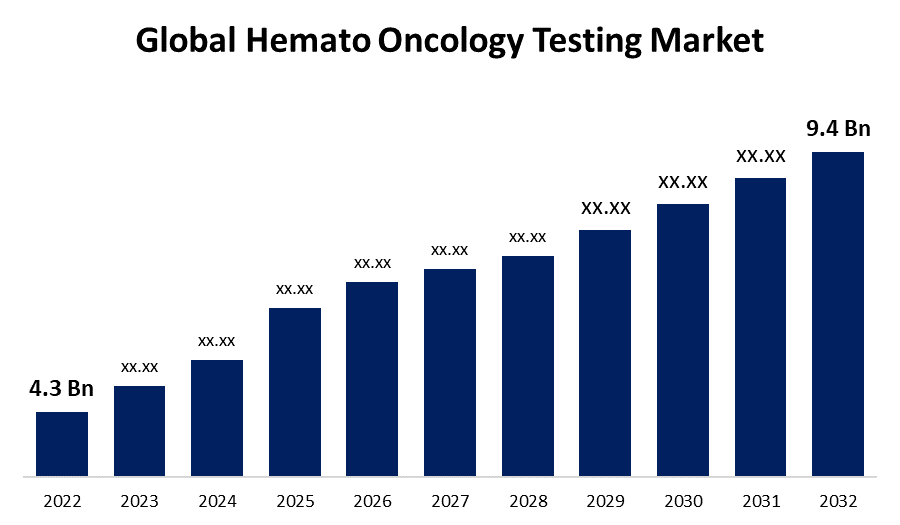

- The Global Hemato Oncology Testing Market Size was valued at USD 4.3 Billion in 2022.

- The Market is growing at a CAGR of 8.13% from 2022 to 2032.

- The Worldwide Global Hemato Oncology Testing Market size is expected to reach USD 9.4 Billion by 2032.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Hemato Oncology Testing Market Size is expected to reach USD 9.4 Billion by 2032, at a CAGR of 8.13% during the forecast period 2022 to 2032.

Market Overview

Hemato oncology testing is a type of medical testing that aids in the identification of blood diseases and cancer. Haemophilia, thalassemia, sickle cell disease, iron deficiency anemia, leukemia, and various organ malignancies are examples of such disorders. Furthermore, it promotes illness treatment and prevention, as well as disease research. In addition, the market is being driven by the increasing prevalence of sequencing technologies such as NGS due to rising development costs and the sequencing of the Human Genome Project in the area of Genomics. Increased investment in R&D efforts by major firms in the precision medicine industry is a key driver driving worldwide market expansion. Furthermore, the increased occurrence of cancers such as lymphoma and myeloma throughout the world is expected to fuel market expansion in the future years.

Report Coverage

This research report categorizes the global hemato oncology testing market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global Hemato oncology testing market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global Hemato oncology testing market. Technological innovation and advancement will further optimize the performance of the product, enabling it to acquire a wider range of applications in the downstream market.

Global Hemato Oncology Testing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 4.3 Billion |

| Forecast Period: | 2022 – 2032 |

| Forecast Period CAGR 2022 – 2032 : | 8.13% |

| 022 – 2032 Value Projection: | USD 9.4 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 249 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product, By Cancer Type, By Technology, By End User, By Region. |

| Companies covered:: | F. Hoffman-La Roche Ltd, Abbott Laboratories, EntroGen, Inc., Qiagen N.V., Cepheid, Thermo Fisher Scientific, Inc., Bio-Rad Laboratories, Inc., Illumina, Inc., and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

One of the primary reasons driving the growth of the hemato oncology testing market is the increased availability of sophisticated molecular methods for hemato oncology diagnosis. The development of improved molecular tools has been critical in resolving concerns about the prognosis, therapy course, and diagnosis of blood cancer. For example, Immunophenotyping is based on the examination of leukocyte cancer cells and assists in the classification of cancer type. Chronic myeloid leukemia can also be diagnosed using cytogenetic approaches such as ABL/BCR gene PCR or FISH. The growing elderly population throughout the world is also a contributing reason to the increased prevalence of hematologic cancer since this demographic segment is more vulnerable to a variety of chronic conditions. The growing elderly population, together with an increase in the occurrence of hematologic tumors, is likely to fuel the expansion of the hemato-oncology testing market.

Restraining Factors

According to an article published in Precision Oncology, an American Society of Clinical Oncology journal, limited medical coverage and low reimbursement remain barriers, and broader reimbursement policies are required to adopt pan-cancer NGS testing that benefits patients in clinical practice. As a result, the worldwide hemto oncology testing market's growth would be hampered over the forecast period.

Market Segmentation

- In 2022, the services segment is dominating the largest market share over the forecast period.

Based on product, the global hemato oncology testing market is bifurcated into different segments such as assay kits & reagents, and services. Among these segments, the services segment is expected to have significant development potential during the forecast period due to the rapidly increasing frequency of non-Hodgkin lymphoma, myeloma, and leukemia, as well as the growth in the development of numerous new and improved diagnostics for the detection of these illnesses. Furthermore, rising knowledge about the availability of numerous novel treatment options, including customized pharmaceuticals, is likely to drive sector market expansion in the future years.

- In 2022, the lymphoma segment is dominating the market with the largest market share during the forecast period.

On the basis of cancer type, the global hemato oncology testing Market is segmented into various types such as leukemia, lymphoma, and multiple myeloma. Among these segments, the lymphoma segment is dominating the market with the largest revenue share during the forecast period due to the increased frequency of non-Hodgkin and Hodgkin lymphoma worldwide, as well as the fast increase in the global elderly population, which can be contributed to the category market's rise. Factors such as immune system insufficiency, decreased immunity, and increasing occurrences of autoimmune illnesses are major causes of lymphoma cancer in the elderly population, resulting in a growing demand for oncology testing and driving the market into the future.

- In 2022, the polymerase chain reaction (PCR) segment is influencing the market with the largest market share during the forecast period.

Based on the technology, the hemato oncology testing market is segmented into various types such as polymerase chain reaction (PCR), next-generation sequencing (NGS), immunohistochemistry (IHC), & others. Among these segments, the polymerase chain reaction (PCR) segment is influencing the market with the largest revenue share during the forecast period owing to the wide use of this technology due to its ease of use, as well as the rapid availability of test kits, which are some of the reasons projected to drive market development for the PCR technology sector. Furthermore, NGS technology is expected to advance at a rapid pace throughout the anticipated timeline. This is owing to its benefits such as sensitivity and accuracy, which are the primary reasons for the industry's expected development.

- In 2022, the hospital segment is dominating the market with the largest market share during the forecast period.

Based on the end users, the global hemato oncology testing market is segmented into various types such as hospitals, academic & research institutes, & others. Among these segments, the hospital segment is dominating the market with the largest revenue share during the forecast period due to the increasing prevalence of blood malignancies, the availability of specialized laboratory settings, and the significant presence of healthcare experts for conducting diagnostic tests are important factors driving the category market's growth. Furthermore, rising investment in healthcare infrastructure development, particularly in emerging nations such as India and China, is expected to boost market growth in the future years.

Regional Segment Analysis of the Hemato Oncology Testing Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America led the market with the largest market share during the forecast period

Get more details on this report -

North America is influencing significant market growth over the forecast period. This is attributable to the presence of big market rivals, favorable reimbursement rules, and high healthcare spending. Furthermore, increased personalized medication acceptability and technical advancements in genetic testing are boosting market revenue growth in this area. Also, the increase in the number of leukemia and lymphoma patients, increased awareness of personalized care, an increase in the adult age population, and increased collaboration for creating new assay kits.

Asia Pacific is expected to experience high revenue market growth during the forecast period due to increased cancer prevalence and healthcare infrastructure in nations such as India and China. Furthermore, the availability of low-cost testing services, rising healthcare spending, and expanding cancer diagnostic awareness are likely to fuel market revenue growth in this area.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the global hemato oncology testing market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- F. Hoffman-La Roche Ltd

- Abbott Laboratories

- EntroGen, Inc.

- Qiagen N.V.

- Cepheid

- Thermo Fisher Scientific, Inc.

- Bio-Rad Laboratories, Inc.

- Illumina, Inc.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In December 2021, QIAGEN N.V. (Germany) and Denovo Biopharma LLC (US) cooperated to create a blood-based companion diagnostic (CDx) test for the treatment of diffuse large B-cell lymphoma (DLBCL), one of the most frequent lymphoid tumors. GRAIL (US) was purchased by Illumina, Inc. (US). QIAGEN cooperated with DeNovo to create a blood-based companion diagnostic (CDx) test for the treatment of diffuse large B-cell lymphoma (DLBCL), one of the most frequent lymphoid malignancies.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2022 to 2032. Spherical Insights has segmented the Global Hemato Oncology Testing Market based on the below-mentioned segments:

Global Hemato Oncology Testing Market, By Product

- Assay Kits & Reagents

- Services

Global Hemato Oncology Testing Market, By Cancer Type

- Leukemia

- Lymphoma

- Multiple Myeloma

Global Hemato Oncology Testing Market, By Technology

- Polymerase Chain Reaction (PCR)

- Next-Generation Sequencing (NGS)

- Immunohistochemistry (IHC)

- Others

Global Hemato Oncology Testing Market, By End User

- Hospitals

- Academic & Research Institutes

- Others

Hemato Oncology Testing Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?