Global High Nickel Cathode Materials Market Size, Share, and COVID-19 Impact Analysis, By Nickel Content (Up to 85%, >85%-90%, >90%), By Application (Lead-Acid, Lithium-Ion, Nickel-Cadmium, Others), By End-user (Automotive, Consumer Electronics, Power Tools, Energy Storage, Medical, Industrial, Aerospace, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Advanced MaterialsGlobal High Nickel Cathode Materials Market Insights Forecasts to 2033

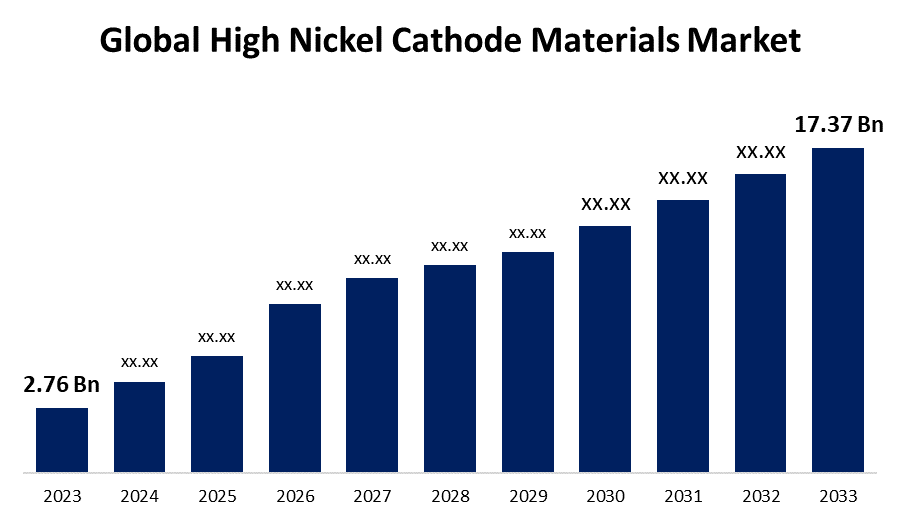

- The Global High Nickel Cathode Materials Market Size was Valued at USD 2.76 Billion in 2023

- The Market Size is Growing at a CAGR of 20.20% from 2023 to 2033

- The Worldwide High Nickel Cathode Materials Market Size is Expected to Reach USD 17.37 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global High Nickel Cathode Materials Market Size is Anticipated to Exceed USD 17.37 Billion by 2033, Growing at a CAGR of 20.20% from 2023 to 2033.

Market Overview

High nickel cathode materials are a type of battery cathode used primarily in lithium-ion batteries. High nickel cathode materials boost energy density and performance in electric vehicles, consumer electronics, and energy storage systems. They also enhance power in aerospace, defense, and medical devices. High nickel cathode materials have longer battery life and reduced size, though they need careful thermal and lifespan management. High nickel cathode materials are propelled due to their ability to enhance energy density, reduce battery size, and extend range and performance, especially in electric vehicles and portable electronics.

The growing demand for high-performance lithium-ion batteries, particularly high-nickel cathodes, is driven by the increasing adoption of electric vehicles and the expansion of renewable energy sources. According to the International Energy Agency 2023, the electric car market is seeing robust growth as sales near 24 million in 2023. The share of electric cars in total sales has increased from around 4% in 2020 to 18% in 2023. Ev sales are predicted to continue strongly through 2024. Over 3 million electric cars were sold in the first quarter, about 25% more than in the same period last year.

In 2023, the demand for EV batteries exceeded 750 GWh, a 40% increase from 2022. The United States and Europe witnessed the most rapid growth among major EV markets, reaching more than 40% year-on-year, followed by China at around 35%. Furthermore, the United States remains the smallest of the three markets, with around 100 GWh in 2023, compared to 185 GWh in Europe and 415 GWh in China. The world, battery demand grew by more than 70% in 2023 compared to 2022, owing to increased EV sales.

In 2023, PHEVs accounted for one-third of total electric car sales in China, contributing to 18% of battery demand. However, Chinese carmakers are marketing extended-range EVs (EREVs), which have a larger battery size and a combustion engine for charging. EREVs accounted for 25% of PHEV sales in 2023, up from 15% in 2021-2022.

Report Coverage

This research report categorizes the market for high nickel cathode materials based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the high nickel cathode materials market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the high nickel cathode materials market.

Global High Nickel Cathode Materials Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.76 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 20.20% |

| 2033 Value Projection: | USD 17.37 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 140 |

| Segments covered: | By Nickel Content, By Application, By End-user, By Region |

| Companies covered:: | BASF Shanshan Battery Materials Co., Ltd., Sichuan Shunying Power Battery Material Co., Ltd., Meishan Shunying Power Battery Material Co., Ltd., Sumitomo Metal Mining Co., Ltd., Elcan Industries Inc., Huayou Cobalt Co., Ltd., POSCO Chemical, Ningbo Ronbay Lithium Battery Materials Co., Ltd., Beijing Easpring Material Technology Co., Ltd., Redwood Materials Inc., and other key companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the high nickel cathode materials market is propelled by the rising demand for electric vehicles (EVs), which require batteries with higher energy densities for longer driving ranges. Technological advancements and improved battery life are enhancing the performance and feasibility of high-nickel materials. Additionally, cost considerations, as high nickel cathodes offer better energy density despite higher material costs and developments in the supply chain for nickel also contribute to market expansion. High-nickel cathode materials are essential for developing advanced lithium-ion batteries for stationary energy storage systems, enhancing grid stability. The market is also shaped by ongoing research and innovation in material science, with collaborations between research institutions and industry players providing a competitive edge.

Restraining Factors

The high nickel cathode materials market is hindered by several factors including the high cost of nickel, which raises production expenses for batteries. Supply chain risks and environmental concerns related to nickel mining can also impact market stability. Safety issues with high nickel content, such as thermal instability, further complicate adoption. Additionally, technological challenges related to performance and cycle life, coupled with competition from alternative battery materials like lithium iron phosphate (LFP) constrain the market growth worldwide.

Market Segmentation

The high nickel cathode materials market share is classified into nickel content, application, and end-user.

- The >90% segment is estimated to hold the highest market revenue share through the projected period.

Based on the nickel content, the high nickel cathode materials market is classified into up to 85%, >85%-90%, and >90%. Among these, the >90% segment is estimated to hold the highest market revenue share through the projected period. The >90% segment dominance is due to its superior energy density, which is essential for applications like electric vehicle batteries that require longer ranges and improved performance. The growing demand for high-performance, long-lasting batteries fuels the preference for >90% nickel content. Top of FormBottom of Form

- The lithium-ion segment is anticipated to hold the largest market share through the forecast period.

Based on the application, the high nickel cathode materials market is divided into lead-acid, lithium-ion, nickel-cadmium, and others. Among these, the lithium-ion segment is anticipated to hold the largest market share through the forecast period. The dominance of the lithium-ion segment is driven by the superior performance characteristics of lithium-ion batteries, which benefit significantly from high nickel content. High nickel cathodes enhance the energy density and efficiency of lithium-ion batteries, making them ideal for applications such as electric vehicles (EVs), consumer electronics, and energy storage systems.

- The automotive segment dominates the market with the largest market share through the forecast period.

Based on the end-user, the high nickel cathode materials market is categorized into automotive, consumer electronics, power tools, energy storage, medical, industrial, aerospace, and others. Among these, the automotive segment dominates the market with the largest market share through the forecast period. The automotive segment is driven by the growing electric vehicle (EV) market, where high nickel cathodes are essential for enhancing battery performance, including energy density and range. The rise of ride-hailing and car-sharing platforms is transforming the automotive industry, leading to new business models and urban mobility-focused vehicles. Manufacturers are focusing on lightweight materials like steel, aluminum, and composites to improve fuel efficiency and reduce carbon emissions, contributing to segment growth.

Regional Segment Analysis of the High Nickel Cathode Materials Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

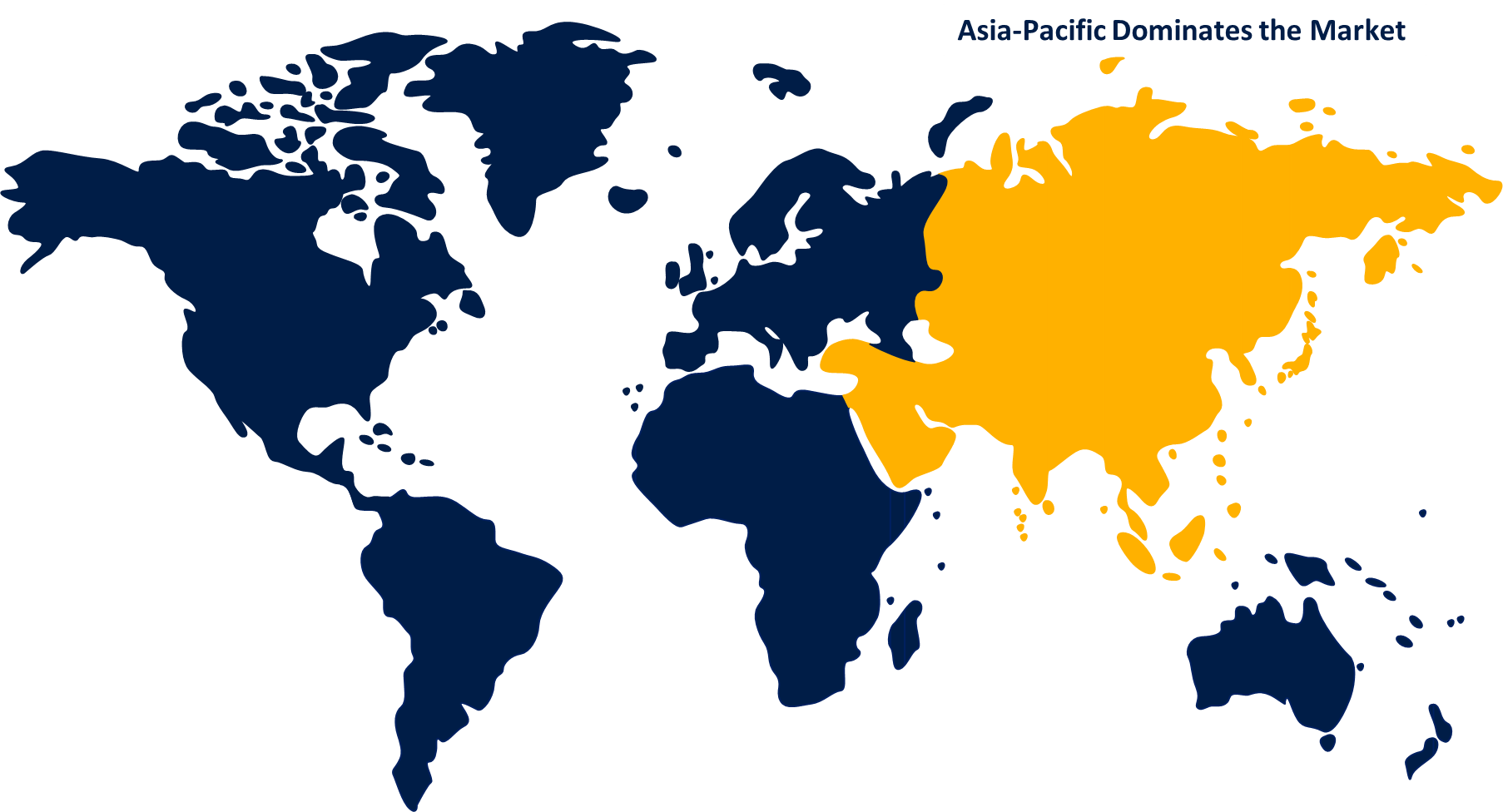

Asia Pacific is anticipated to hold the largest share of the high nickel cathode materials market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the high nickel cathode materials market over the predicted timeframe. Asia Pacific region holds the largest market share is propelled by the region's substantial adoption of electric vehicles (EVs), a robust battery manufacturing sector, and supportive government policies. Major players in China, Japan, and South Korea are fueling demand due to their advancements in battery technology and significant investments in EV infrastructure. The region's focus on technological innovation and green technology further accelerates the demand for high nickel cathodes essential for enhancing the performance and energy density of lithium-ion batteries. Top of Form

Bottom of Form

North America is expected to grow at the fastest CAGR growth of the high nickel cathode materials market during the forecast period. The rapid growth in the North American region is rising due to electric vehicle adoption, supported by government incentives and investments in battery production and technology. Major investments in EV infrastructure and battery manufacturing, along with technological innovations, are fueling demand for high-performance battery materials. Additionally, increasing environmental awareness and a push for sustainable practices are further accelerating the market growth.Top of FormBottom of Form

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the high nickel cathode materials market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BASF Shanshan Battery Materials Co., Ltd.

- Sichuan Shunying Power Battery Material Co., Ltd.

- Meishan Shunying Power Battery Material Co., Ltd.

- Sumitomo Metal Mining Co., Ltd.

- Elcan Industries Inc.

- Huayou Cobalt Co., Ltd.

- POSCO Chemical

- Ningbo Ronbay Lithium Battery Materials Co., Ltd.

- Beijing Easpring Material Technology Co., Ltd.

- Redwood Materials Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2024, Panasonic Energy Co., Ltd., a Panasonic Group Company, announced that it has signed an agreement for joint development with Australia's national research agency, CSIRO. The deal comprises the development of innovative nickel laterite processing technologies for recovering nickel, an important raw ingredient in the manufacturing of lithium-ion batteries.

- In April 2024, LANXESS and IBU-tec Advanced Materials established a groundbreaking research cooperation. The collaboration intends to create high-performance iron oxides for lithium iron phosphate (LFP) cathode materials, which could improve the capacities of batteries used in electric vehicles and stationary energy storage devices.

- In February 2024, Posco Future M Co., Ltd. started building a new high-nickel cobalt aluminum (NCA) cathode material factory in Gwangyang.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the high nickel cathode materials market based on the below-mentioned segments:

Global High Nickel Cathode Materials Market, By Nickel Content

- Up to 85%

- >85%-90%

- >90%

Global High Nickel Cathode Materials Market, By Application

- Lead-Acid

- Lithium-Ion

- Nickel-Cadmium

- Others

Global High Nickel Cathode Materials Market, By End-user

- Automotive

- Consumer Electronics

- Power Tools

- Energy Storage

- Medical

- Industrial

- Aerospace

- Others

Global High Nickel Cathode Materials Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the high nickel cathode materials market over the forecast period?The high nickel cathode materials market is projected to expand at a CAGR of 20.20% during the forecast period.

-

2. What is the market size of the high nickel cathode materials market?The Global High Nickel Cathode Materials Market Size is Expected to Grow from USD 2.76 Billion in 2023 to USD 17.37 Billion by 2033, at a CAGR of 20.20% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the high nickel cathode materials market?Asia Pacific is anticipated to hold the largest share of the high nickel cathode materials market over the predicted timeframe.

Need help to buy this report?