Global High-Performance Polyamides Market Size, Share, and COVID-19 Impact Analysis, By Polyamide Type (PA6, PA11, PA12, PA46, PA9T, PPA), By Manufacturing Process (Injection Molding, Blow Molding), By End-User (Fine Automotive, Electrical & Electronics, Oil & Gas, Medical Devices, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Chemicals & MaterialsGlobal High-Performance Polyamides Market Insights Forecasts to 2033

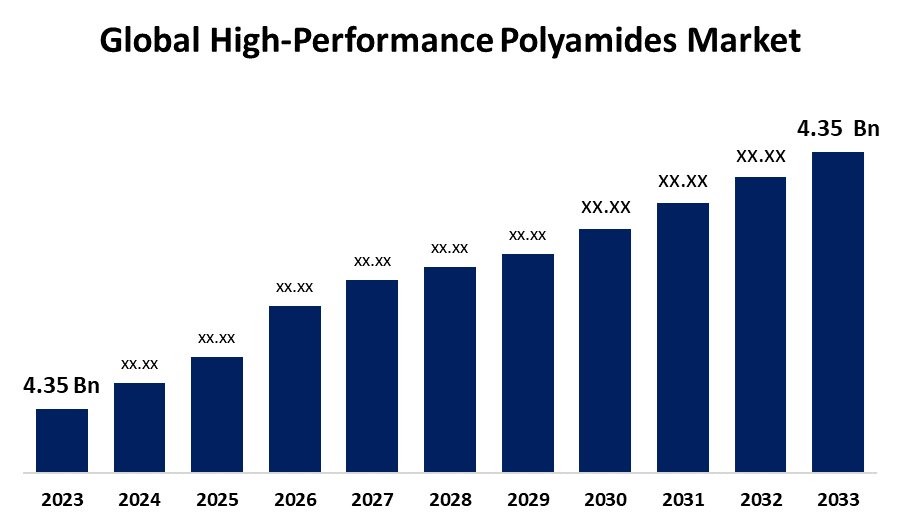

- The Global High-Performance Polyamides Market Size was Valued at USD 4.35 Billion in 2023

- The Market Size is Growing at a CAGR of 7.05% from 2023 to 2033

- The Worldwide High-Performance Polyamides Market Size is Expected to Reach USD 4.35 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global High-Performance Polyamides Market Size is Anticipated to Exceed USD 4.35 Billion by 2033, Growing at a CAGR of 7.05% from 2023 to 2033.

Market Overview

High performance polyamide (HPPA) is a subclass of thermoplastic synthetic resins of the polyamide (nylon) family. It is characterized by the presence of a mix of terephthalic (TPA) and isophthalic (IPA) acids in at least 55% of the carboxylic acid part of the repeating unit in the polymer chain. The class of polymers that might be obtained both naturally and chemically is known as polyamides. The thermoplastic resin from the same family that is artificially manufactured and used in high-performance polyamides integrates polymers and additives to create a composite. It exposes the characteristics of the temperature, mechanical strength, chemical and heat resistance, and light weight material that is used to replace metal parts in cars and increase fuel economy. Numerous industries, including defense, automotive, and electronics, as well as others, use it significantly. The market for high-performance polyamides is expanding rapidly due to rising demand from sectors including electronics and the automobile industry. These polymers are perfect for demanding applications because they have excellent mechanical qualities, thermal stability, and chemical resistance. Growth in the market is also being fueled by developments in material technology, such as the creation of recyclable and bio-based polyamides.

Report Coverage

This research report categorizes the market for the global high-performance polyamides market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global high-performance polyamides market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global high-performance polyamides market.

Global High-Performance Polyamides Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 4.35 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.05% |

| 2033 Value Projection: | USD 4.35 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 234 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Polyamide Type, By Manufacturing Process, By End-User and By Region |

| Companies covered:: | Arkema, Asahi Kasei, BASF SE, SABIC, Solvay S.A., Toray Industries Inc., Evonik, KURARAY, Lanxess, Royal DSM NV, RadiciGroup, E.I. du Pont de and other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for high-performance polyamides is driven by the growing need for strong, lightweight materials in automotive applications to cut emissions and increase fuel economy. Due to their superior mechanical qualities such as strength, stiffness, and resistance to impact high-performance polyamides are a great alternative to conventional metal components in automotive designs. Their ability to deal with high temperatures and severe conditions contributes to their desirability for under-the-hood applications. As car manufacturers struggle to fulfill strict regulatory criteria and consumer demands for sustainability and performance, the use of high-performance polyamides as lightweight, durable alternatives continues to rise. High-performance polyamides have excellent chemical resistance, dimensional stability, and resistance to heat and cold. They are also lightweight. The aircraft sector also favors them since they are effective in preventing fires and produce less smoke.

Restraining Factors

The market for high-performance polyamides is characterized by price volatility, especially for essential components like adipic acid and hexamethylene diamine. Variations in the cost of raw materials can affect the overall production costs for polyamides, affecting manufacturers' pricing strategies and profitability. Supply chain disruptions, geopolitical tensions, and changes in global trade dynamics can exacerbate price volatility. As a result, companies might find it difficult to maintain competitive pricing and profitability, which might restrict market growth and investment opportunities in the high-performance polyamides sector. Growth in the industry is further hampered by the high cost of production, which makes it difficult for small and mid-level companies to enter the market.

Market Segmentation

The global high-performance polyamides market share is classified into polyamide type, manufacturing process, and end user.

- The PA6 segment is expected to hold the largest share of the global high-performance polyamides market during the forecast period.

Based on the polyamide type, the global high-performance polyamides market is divided into PA6, PA11, PA12, PA46, PA9T, PPA, and others. Among these, the PA6 segment is expected to hold the largest share of the global high-performance polyamides market during the forecast period. The market for high-performance polyamides is seeing a notable surge in growth due to Polyamide 6 (PA6), which is gaining popularity across several sectors due to its exceptional mechanical qualities and adaptability. PA6 is a lightweight, very durable polymer that is being used more and more in the industrial, automotive, and electrical and electronics industries. PA6's strong chemical resistance, thermal stability, and recyclability all contribute to its demand and support sustainability goals. Furthermore, novel PA6 formulations such as bio-based and reinforced variants address changing market demands. Performance and sustainability are becoming more and more important to industries, and PA6 is one of the major players in the high-performance polyamides industry.

- The injection molding segment is expected to hold the largest share of the global high-performance polyamides market during the forecast period.

Based on the manufacturing process, the global high-performance polyamides market is divided into injection molding and blow molding. Among these, the injection molding segment is expected to hold the largest share of the global high-performance polyamides market during the forecast period. The automobile industry is putting more and more pressure on components to be lightweight and strong, and injection molding provides affordable production methods to meet this requirement. The performance of polyamide-based products has been improved by developments in material compositions, mold design, and process optimization, which has increased their use. Injection molding is favored by the trend toward customization and downsizing in a variety of applications, which makes it possible to produce functional components and complex geometries.

- The fine automotive segment is expected to hold the largest share of the global high-performance polyamides market during the forecast period.

Based on the end user, the global high-performance polyamides market is divided into fine automotive, electrical & electronics, oil & gas, medical devices, and others. Among these, the fine automotive segment is expected to hold the largest share of the global high-performance polyamides market during the forecast period. High-performance polyamides, like PA6 and PA11, are highly preferred over traditional materials like metals due to their exceptional strength-to-weight ratio and design flexibility. These polymers are used in various fine automotive components, including engine parts, structural components, interior trims, and electrical connectors. As automotive manufacturers strive for sustainability and performance, high-performance polyamides continue to play a pivotal role in driving innovation in the fine automotive industry. The fine automotive applications are witnessing a significant trend towards lightweighting to enhance fuel efficiency and reduce emissions.

Regional Segment Analysis of the Global High-Performance Polyamides Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the global high-performance polyamides market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the global high-performance polyamides market over the predicted timeframe. Asia Pacific is a major driver of the global high-performance polyamides market due to its rapid industrialization, urbanization, and expanding automotive and electronics sectors. Countries such as China, Japan, and India with their growing manufacturing industries and infrastructure development investments, are major contributors to the market expansion. The region's growing demand for high-strength, lightweight materials in automotive, electrical, and electronics applications drives the adoption of high-performance polyamides. The region's favorable government policies, growing consumer awareness of sustainability, and technological advancements further propel market growth in the Asia Pacific, positioning it as a key player in the global high-performance polyamides market.

North America is expected to grow at the fastest pace in the global high-performance polyamides market during the forecast period. Due to the popularity of electric cars, the market is being pushed by the expansion of the main end-use sectors, including consumer products, automotive, and electrical and electronics. In shortly, rising consumer electronics demand and the expansion of the construction sector in the United States, Mexico, and Canada are expected to support market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global high-performance polyamides market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Arkema

- Asahi Kasei

- BASF SE

- SABIC

- Solvay S.A.

- Toray Industries Inc.

- Evonik

- KURARAY

- Lanxess

- Royal DSM NV

- RadiciGroup

- E.I. du Pont de

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2024, Baltex, also known as Balashovsky Textile Plant in Saratov, Russia, invested over 800 million rubles to enhance polyamide fabric manufacturing. The first phase, surpassing 300 million rubles, entailed installing sophisticated equipment and optimizing operating procedures, which was finished in 2023.

- In April 2024, Formerra has announced the acquisition of the distribution rights for Evonik's sustainable materials and PA12 polyamides in the US, Canada, and Puerto Rico. This is a significant strategic alliance for Formerra. Evonik is a leading global player in the PA12 and high-performance polyamide markets.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global high-performance polyamides market based on the below-mentioned segments:

Global High-Performance Polyamides Market, By Polyamide Type

- PA 6

- PA 11

- PA 12

- PA 46

- PA 9T

- PPA

Global High-Performance Polyamides Market, By Manufacturing Process

- Injection Molding

- Blow Molding

Global High-Performance Polyamides Market, By End User Industry

- Automotive

- Electrical & Electronics

- Oil & Gas

- Medical Devices

- Others

Global High-Performance Polyamides Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?