Global High Purity Aluminum Fluoride Market Size, Share, and COVID-19 Impact Analysis, By Grade (Industrial Grade, Pharmaceutical Grade, and Others), By Application (Aluminum Production, Glass Manufacturing, Pharmaceuticals, and Others), By End-User Industry (Automotive, Aerospace, Electronics, Chemicals, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Chemicals & MaterialsGlobal High Purity Aluminum Fluoride Market Insights Forecasts to 2033

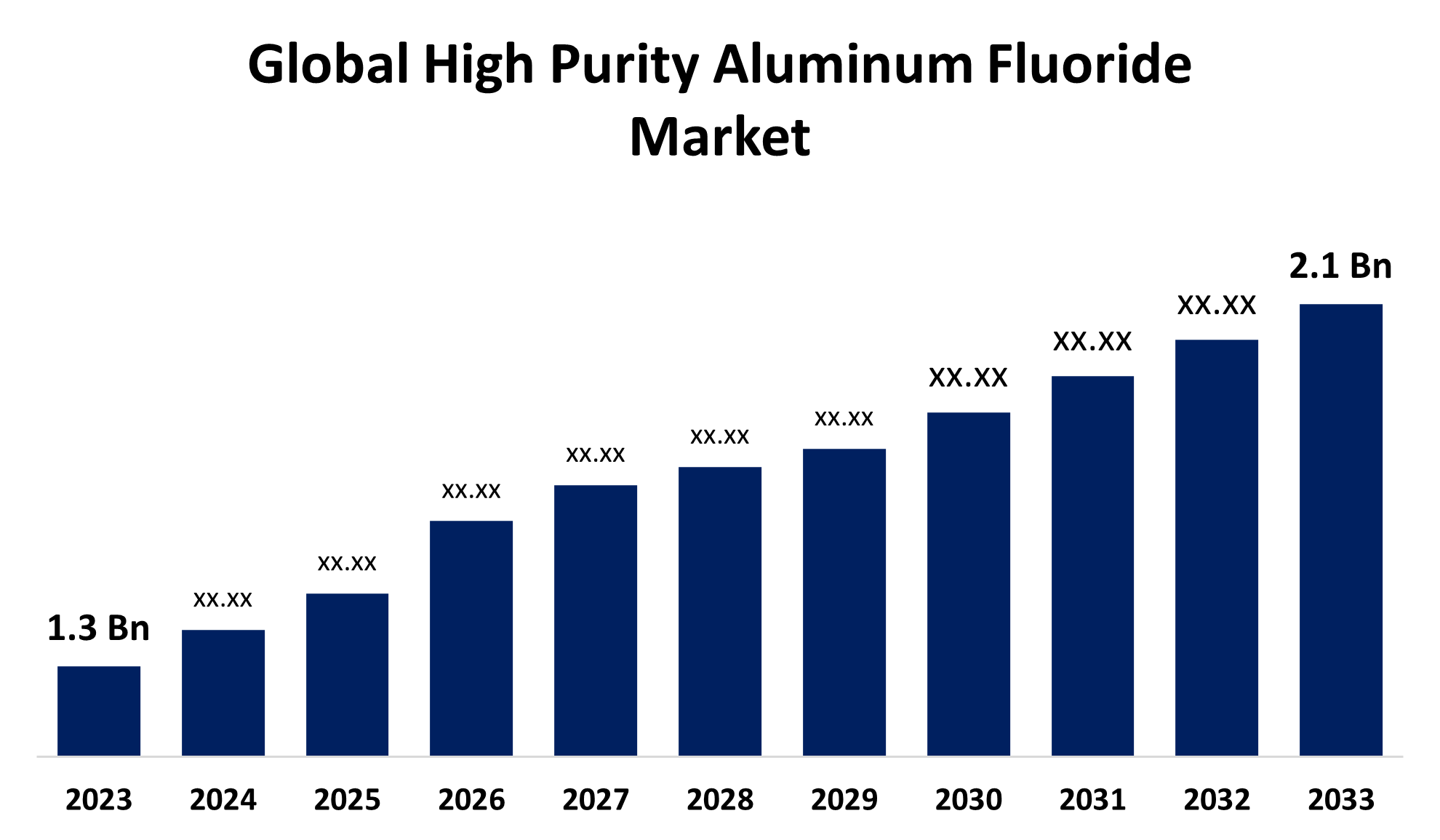

- The Global High Purity Aluminum Fluoride Market Size was estimated at USD 1.3 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 4.91% from 2023 to 2033

- The Worldwide High Purity Aluminum Fluoride Market Size is Expected to Reach USD 2.1 Billion by 2033

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global High Purity Aluminum Fluoride Market Size is expected to cross USD 2.1 Billion by 2033, growing at a CAGR of 4.91% from 2023 to 2033. The high-purity aluminum fluoride market is expanding due to rising demand, driven by its critical role in aluminum smelting and sophisticated electronics production. As enterprises prioritize efficiency and product quality, demand for aluminum fluoride has increased, particularly in areas experiencing an industrial boom. This increased demand is a direct result of sectors realizing the material's important role in improving aluminum manufacturing processes and semiconductor fabrication, cementing its position as a significant market growth driver.

Market Overview

The global high purity aluminum fluoride market is the industry that produces and distributes high-purity aluminum, a specialty chemical compound with a purity level greater than 99.5%, frequently reaching 99.99% or higher. This molecule is used in many industries, including aluminum manufacturing, semiconductors, lithium-ion batteries, fluorinated chemicals, glass and ceramics, and pharmaceuticals. The market is expanding rapidly, owing to a variety of causes. Its rising utility across industries, such as aluminum production and electronics, is driving market growth. High purity aluminum fluoride is critical for improving metal and semiconductor manufacturing processes. Industry leaders are committed to increasing the quality, adaptability, and sustainability of this material to satisfy the changing needs of various industries, hence reinforcing the market's positive momentum.

The growing investment in pharmaceutical research and development, combined with tight rules governing the purity of ingredients used in pharmaceuticals, is boosting demand for high purity aluminum fluoride. The material's exceptional purity makes it appropriate for a wide range of pharmaceutical applications, including medication manufacture and medical equipment. Furthermore, the increased emphasis on innovative healthcare solutions and the development of new pharmaceutical goods presents potential opportunities for the high purity aluminum fluoride market. The growing usage of high purity aluminum fluoride in specialty chemical manufacturing and other high-tech applications creates tremendous growth potential.

Report Coverage

This research report categorizes the high purity aluminum fluoride market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the high purity aluminum fluoride market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the high purity aluminum fluoride market.

Global High Purity Aluminum Fluoride Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.3 Billion |

| Forecast Period: | 2013-2033 |

| Forecast Period CAGR 2013-2033 : | 4.91% |

| 2033 Value Projection: | USD 2.1 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Grade, By Application, By End-User Industry, By Region |

| Companies covered:: | Navin Fluorine International Limited, Do-Fluoride Chemicals Co., Ltd., Yara International ASA, Boliden AB, Fluorsid S.p.A., Henan Weilai Aluminum Group, PhosAgro Group, Solvay S.A., Industries Chimiques du Fluor (ICF), Mexichem Fluor, Gulf Fluor, Mosaic Company, Honeywell International Inc., Hunan Nonferrous Fluoride Chemical Group, Alufluor AB, Tanfac Industries Limited,and other key players. |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving Factors

The rising demand for aluminum alloys is one of the factors driving the high purity aluminum fluoride market expansion. Automotive and aerospace industries are increasingly using lightweight aluminum alloys to enhance fuel efficiency and lower pollution. High purity aluminum fluoride is an important component in the manufacturing of these alloys because it improves their structural qualities. As a result, the increasing usage of aluminum alloys in a variety of applications directly drives demand for aluminum fluoride, adding to the market's expansion. Furthermore, technological advancements are indeed driving the global high purity aluminum fluoride market, with new uses in semiconductors, EV batteries, fluorinated chemicals, and advanced materials. Purification and automated production technologies have led to high purity levels that are essential for chip manufacturing, lithium-ion batteries, and high-performance coatings. Other growth drivers include 5G, AI, and solid-state batteries, along with fluoride recycling and carbon-neutral processes. As industries advance, high purity aluminum fluoride is of constant importance for efficiency, precision, and environmentally friendly operations.

Restraining Factors

The frequent disruptions in supply chains are a significant restricting issue for the business. These disruptions, which are generally caused by transportation issues and geopolitical uncertainty, can cause changes in the supply of essential raw materials needed in high purity aluminum fluoride production. Such disruptions in the supply chain can cause manufacturing delays and pricing instability, limiting the market's growth potential.

Market Segmentation

The high purity aluminum fluoride market share is classified into grade, application, and end-user industry.

- The industrial grade segment held the greatest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the grade, the high purity aluminum fluoride market is divided into industrial grade, pharmaceutical grade, and others. Among these, the industrial grade segment held the greatest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. This is due to its widespread use in aluminum and glass manufacturing. The industrial grade is recommended because of its low cost and high purity levels, which satisfy the needs of various businesses. The continued expansion of industrial applications, as well as the increased emphasis on energy-efficient manufacturing processes, are projected to fuel demand for industrial grade high purity aluminum fluoride.

- The aluminum production segment accounted for the majority of the share in 2023 and is estimated to grow at a remarkable CAGR during the projected timeframe.

Based on the application, the high purity aluminum fluoride market is divided into aluminum production, glass manufacturing, pharmaceuticals, and others. Among these, the aluminum production segment accounted for the majority of the share in 2023 and is estimated to grow at a remarkable CAGR during the projected timeframe. The widespread usage of aluminum in a variety of industries, including electronics, automotive, and aerospace, is driving the growth of the aluminum production segment. High purity aluminum fluoride is an essential component in the aluminum industry since it helps to reduce energy usage throughout the manufacturing process. The increased demand for lightweight and long-lasting materials is predicted to drive the demand for high purity aluminum fluoride in aluminum manufacturing.

- The automotive segment held the largest share in 2023 and is estimated to grow at a substantial CAGR during the predicted timeframe.

Based on the end-user industry, the high purity aluminum fluoride market is divided into automotive, aerospace, electronics, chemicals, and others. Among these, the automotive segment held the largest share in 2023 and is estimated to grow at a substantial CAGR during the predicted timeframe. The automotive industry is one of the greatest consumers of aluminum, driven by rising demand for lightweight and long-lasting materials. High purity aluminum fluoride is an essential component in aluminum production and the automotive sector. The increased emphasis on energy-efficient and sustainable manufacturing processes is likely to drive up demand for high purity aluminum fluoride in the automobile industry.

Regional Segment Analysis of the High Purity Aluminum Fluoride Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

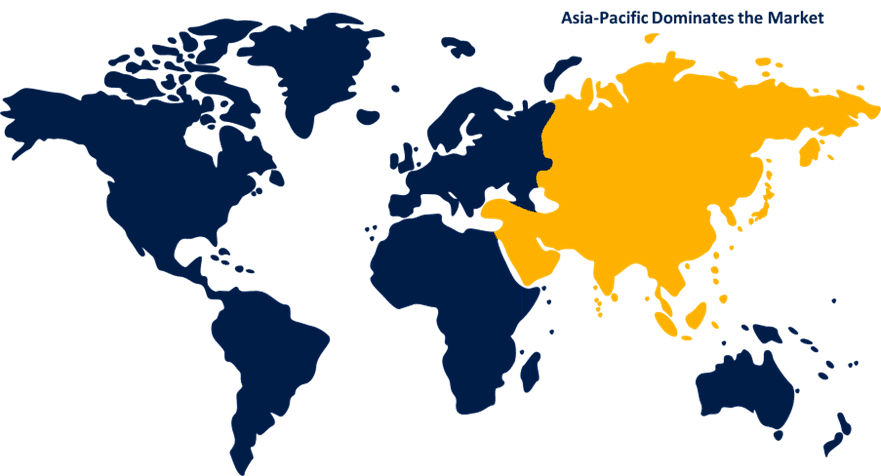

Asia Pacific is anticipated to hold the largest share of the high purity aluminum fluoride market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the high purity aluminum fluoride market over the predicted timeframe. This supremacy is partly due to the region's rapid industrial growth, particularly in China and India. The expanding demand for aluminum and aluminum products in numerous industries, combined with a burgeoning electronics manufacturing sector, has increased the demand for aluminum fluoride in this region. Furthermore, the presence of important manufacturers and a thriving semiconductor industry have contributed to Asia-Pacific's dominant market position.

North America is expected to grow at the fastest CAGR growth of the high purity aluminum fluoride market during the forecast period. The growing demand for lightweight and durable materials in these industries fuels the demand for high purity aluminum fluoride. Furthermore, the region's expanding focus on sophisticated healthcare solutions and pharmaceutical research and development is likely to drive up demand for high purity aluminum fluoride. The North America high purity aluminum fluoride market is expected to increase steadily during the forecast period, aided by continued advances in industrial and medicinal applications.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the high purity aluminum fluoride market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Navin Fluorine International Limited

- Do-Fluoride Chemicals Co., Ltd.

- Yara International ASA

- Boliden AB

- Fluorsid S.p.A.

- Henan Weilai Aluminum Group

- PhosAgro Group

- Solvay S.A.

- Industries Chimiques du Fluor (ICF)

- Mexichem Fluor

- Gulf Fluor

- Mosaic Company

- Honeywell International Inc.

- Hunan Nonferrous Fluoride Chemical Group

- Alufluor AB

- Tanfac Industries Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the high purity aluminum fluoride market based on the below-mentioned segments:

Global High Purity Aluminum Fluoride Market, By Grade

- Industrial Grade

- Pharmaceutical Grade

- Others

Global High Purity Aluminum Fluoride Market, By Application

- Aluminum Production

- Glass Manufacturing

- Pharmaceuticals

- Others

Global High Purity Aluminum Fluoride Market, By End-User Industry

- Automotive

- Aerospace

- Electronics

- Chemicals

- Others

Global High Purity Aluminum Fluoride Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

What is the CAGR of the high purity aluminum fluoride market over the forecast period?The high purity aluminum fluoride market is projected to expand at a CAGR of 4.91% during the forecast period.

-

What is the market size of the high purity aluminum fluoride market?The Global High Purity Aluminum Fluoride Market Size is Expected to Grow from USD 1.3 Billion in 2023 to USD 2.1 Billion by 2033, at a CAGR of 4.91% during the forecast period 2023-2033.

-

Which region holds the largest share of the high purity aluminum fluoride market?Asia Pacific is anticipated to hold the largest share of the high purity aluminum fluoride market over the predicted timeframe

Need help to buy this report?