Global High Purity Pumps Market Size, Share, and COVID-19 Impact Analysis, By Type (Bellows Pumps, Diaphragm Pumps, Metering Pumps, and Others), By Application (Chemicals, Food & Beverages, Pharmaceuticals, Semiconductors, Electronics, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Machinery & EquipmentGlobal High Purity Pumps Market Insights Forecasts to 2033

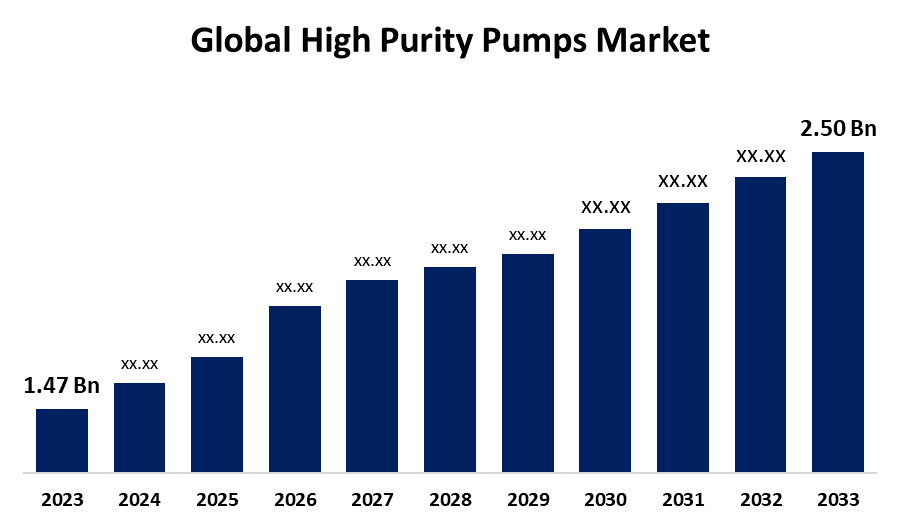

- The Global High Purity Pumps Market Size was Valued at USD 1.47 Billion in 2023

- The Market Size is Growing at a CAGR of 5.45% from 2023 to 2033

- The Worldwide High Purity Pumps Market Size is Expected to Reach USD 2.50 Billion by 2033

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global High Purity Pumps Market Size is anticipated to exceed USD 2.50 billion by 2033, growing at a CAGR of 5.45% from 2023 to 2033. The expansion of the pharmaceutical sector, the growth of life sciences research and development, the creation and use of clinical trials, and the broad use of micro-pump infusion therapy are the main factors driving the rise of the profitable high purity pumps market.

Market Overview

Specialized pumps called high-purity pumps are made for uses where handling high-purity fluids is necessary. High-purity pumps are available for managing concentration and generating chemicals on-tool. They help in the circulation and transport of fluids without adding impurities or pollutants. For instance, Iwaki pumps are perfect for all high-purity applications. In sectors where contamination concerns need to be reduced, like medicines, biotechnology, and food & beverage, high purity pumps are crucial. Pump technology developments, such as the creation of pumps with improved chemical resistance and decreased particle formation, are also driving the growth of the high purity pumps market. The growing demand for diaphragm pumps and their application in the chemical industry are the main factors driving the market for high purity pumps. The use of high purity pumps is being driven by the strict regulatory requirements for guaranteeing product safety and purity in the biotechnology and pharmaceutical industries.

Report Coverage

This research report categorizes the high purity pumps market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the high purity pumps market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the high purity pumps market.

Global High Purity Pumps Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.47 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.45% |

| 2033 Value Projection: | USD 2.50 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 245 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By Application, By Regional Analysis |

| Companies covered:: | Iwaki Co., Ltd., Graco Inc., Flowserve Corporation, AxFlow Holding AB, Viking Pump, Inc., Tuthill Corporation, Yamada Corporation, IDEX Corporation, KNF Neuberger GmbH, Sundyne Corporation, SPX Flow, Inc., Lutz Pumpen GmbH, Tapflo Group, Verder Group, Others, and |

| Pitfalls & Challenges: | COVID-19 Impact Analysis, Challenges and Forecast 2023 - 2033 |

Get more details on this report -

Driving Factors

The increasing need for fluid transfer methods free of contamination in vital sectors like biotechnology and pharmaceuticals is one of the key factors propelling the market. Due to the growing demand for fluid handling systems free of contamination across a range of industries, the market for high purity pumps is expanding significantly. High purity systems are being used by producers in response to the growing customer preference for organic and minimally processed food products, which is driving market expansion. The need for high-purity solutions is driven by regulatory bodies' requirements for strict hygiene standards.

Restraining Factors

The market for high purity pumps can be restricted by the high cost of these pumps and the upkeep required for their operation.

Market Segmentation

The high purity pumps market share is classified into type and application.

- The diaphragm pumps segment is estimated to hold the largest market revenue share through the projected period.

Based on the type, the high purity pumps market is classified into bellows pumps, diaphragm pumps, metering pumps, and others. Among these, the diaphragm pumps segment is estimated to hold the largest market revenue share through the projected period. High-purity applications in diaphragm pumps are especially well-suited for them due to their capacity to withstand caustic and abrasive fluid without being contaminated.

- The pharmaceuticals segment is anticipated to hold the largest market share through the forecast period.

Based on the application, the high purity pumps market is divided into chemicals, food & beverages, pharmaceuticals, semiconductors, electronics, and others. Among these, the pharmaceuticals segment is anticipated to hold the largest market share through the forecast period. Pharmaceutical businesses place a great priority on quality control and contamination avoidance, which makes high purity pumps a crucial part of their manufacturing processes.

Regional Segment Analysis of the High Purity Pumps Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the High Purity Pumps market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the high purity pumps market over the predicted timeframe. When businesses collaborate to increase oil production and establish themselves in the region, local players can have the opportunity to expand their product ranges and provide superior customer service. One of the primary factors propelling the Asia Pacific market is the growth of the industrial and infrastructure sectors.

North America is expected to grow at the fastest CAGR growth of the high purity pumps market during the forecast period. The established pharmaceutical and biotechnology sectors in North America are the main drivers of the region's dominance in the high purity pump industry. The need for high purity pumps is being driven by the existence of large pharmaceutical businesses and significant investments in research and development.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the high purity pumps market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Iwaki Co., Ltd.

- Graco Inc.

- Flowserve Corporation

- AxFlow Holding AB

- Viking Pump, Inc.

- Tuthill Corporation

- Yamada Corporation

- IDEX Corporation

- KNF Neuberger GmbH

- Sundyne Corporation

- SPX Flow, Inc.

- Lutz Pumpen GmbH

- Tapflo Group

- Verder Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2024, Sulzer announced the official opening of a brand-new test and assembly center in Mexico City that was constructed next to its current pump production site. A 10-meter-deep hydraulics test bed for huge pumps, a digital monitoring system, and a separate packaging room are all aspects of the brand-new, cutting-edge facility.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the high purity pumps market based on the below-mentioned segments:

Global High Purity Pumps Market, By Type

- Bellows Pumps

- Diaphragm Pumps

- Metering Pumps

- Others

Global High Purity Pumps Market, By Application

- Chemicals

- Food & Beverages

- Pharmaceuticals

- Semiconductors

- Electronics

- Others

Global High Purity Pumps Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the high purity pumps market over the forecast period?The high purity pumps market is projected to expand at a CAGR of 5.45% during the forecast period.

-

2. What is the market size of the high purity pumps market?The Global High Purity Pumps Market Size is Expected to Grow from USD 1.47 Billion in 2023 to USD 2.50 Billion by 2033, at a CAGR of 5.45% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the high purity pumps market?Asia Pacific is anticipated to hold the largest share of the high purity pumps market over the predicted timeframe.

Need help to buy this report?