Global High-Tech Paints & Coatings Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Crack Detection Paints, Self-Cleaning Paint, Odor-Absorbing Paint, Waterproofing Paint, and Thermal Insulation Paints), By Resin (Acrylic, Polyurethane, Polyester, and Epoxy), By Technology (Waterborne, Solvent Borne, and Powder Coatings), By End-Use Industry (Marine, Automotive, Architectural, Aerospace, Energy, Electronics, and Healthcare), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032.

Industry: Chemicals & MaterialsGlobal High-Tech Paints & Coatings Market Insights Forecasts to 2032

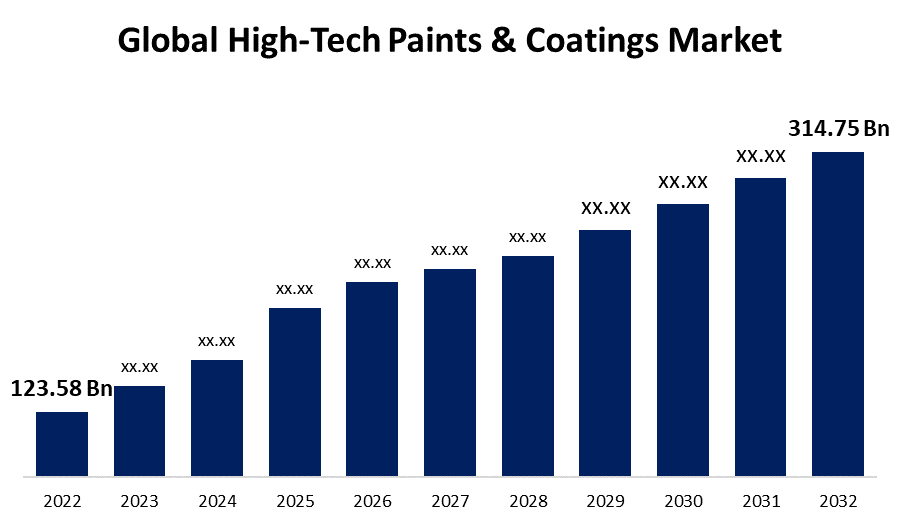

- The Global High-Tech Paints & Coatings Market Size was valued at USD 123.58 Billion in 2022.

- The Market is Growing at a CAGR of 9.8% from 2022 to 2032

- The Worldwide High-Tech Paints & Coatings Market Size is expected to reach USD 314.75 Billion by 2032

- Asia-Pacific is expected to grow the higher during the forecast period

Get more details on this report -

The Global High-Tech Paints & Coatings Market Size is expected to reach USD 314.75 Billion by 2032, at a CAGR of 9.8% during the forecast period 2022 to 2032.

Market Overview

High-tech paints and coatings represent a revolutionary advancement in the field of surface protection and aesthetics. These innovative products leverage cutting-edge technologies to enhance the performance, durability, and appearance of various surfaces. High-tech paints incorporate features like self-cleaning properties, anti-microbial coatings, heat-reflective capabilities, and corrosion resistance, offering superior protection and maintenance. Additionally, they often exhibit eco-friendly characteristics, including low volatile organic compound (VOC) emissions, making them more sustainable choices. These advanced coatings find applications in numerous industries, including automotive, aerospace, construction, and electronics. With their ability to improve functionality, energy efficiency, and longevity, High-tech paints and coatings are reshaping traditional surface treatment methods and driving innovation across sectors.

Report Coverage

This research report categorizes the market for high-tech paints & coatings market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the high-tech paints & coatings market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the high-tech paints & coatings market.

Global High-Tech Paints & Coatings Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022 : | USD 123.58 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 9.8% |

| 2032 Value Projection: | USD 314.75 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Product Type, By Resin, By Technology, By End-Use Industry, By Region |

| Companies covered:: | Abrisa Technologies, AccuCoat Inc., Akzo Nobel N.V., Axalta Coating Systems LLC, BASF SE, Chase Corp, Ferro Corporation, GXC Coatings, Hentzen Coatings Inc., Indestructible Paint Limited, Kansai Paint Co. Ltd., Mankiewicz Gebr. & Co., Nippon Paints Holdings, PPG Industries Inc., RPM International Inc., Shalimar Paints, The Sherwin-Williams Compan |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The high-tech paints and coatings market is driven by several factors that contribute to its growth and demand, due to increasing awareness and emphasis on environmental sustainability have fueled the demand for eco-friendly coatings with low VOC emissions. Additionally, the need for advanced protective solutions for surfaces, such as corrosion resistance and durability, drives the adoption of High-tech paints and coatings in various industries. Moreover, the rapid growth of sectors like automotive, aerospace, and electronics, which require high-performance coatings, acts as a catalyst for market expansion. The rising consumer preference for visually appealing and innovative surface finishes also contributes to the market growth. Furthermore, technological advancements in coating formulations and manufacturing processes, coupled with research and development activities, play a significant role in driving the high-tech paints and coatings market forward.

Restraining Factors

The high-tech paints and coatings market also faces certain restraints that can hinder its growth. One significant restraint is the higher cost associated with these advanced coatings compared to conventional options. This price differential can limit their adoption, particularly in price-sensitive industries. Additionally, the complex nature of high-tech coatings may require specialized application techniques and skilled labor, adding to the overall cost and potential limitations. Moreover, stringent regulations and compliance requirements related to VOC emissions and hazardous substances can pose challenges for manufacturers and restrict market expansion. Overall, the market's reliance on raw materials availability and price fluctuations can impact the profitability and supply chain dynamics of high-tech paints and coatings.

Market Segmentation

- In 2022, the self-cleaning paint segment accounted for around 37.3% market share

On the basis of the product type, the global high-tech paints & coatings market is segmented into crack detection paints, self-cleaning paint, odor-absorbing paint, waterproofing paint, and thermal insulation paints. The self-cleaning paint segment has emerged as the leader, capturing the largest market share in the high-tech paints and coatings market. This dominance can be attributed to several factors, the self-cleaning paints offer significant advantages in terms of maintenance and cost savings. These coatings incorporate innovative technologies that repel dirt, dust, and other contaminants, allowing surfaces to stay cleaner for longer periods, reducing the need for frequent cleaning and maintenance. The growing awareness and demand for hygiene and cleanliness, particularly in sectors such as healthcare, hospitality, and residential applications, have propelled the adoption of self-cleaning paints. Additionally, advancements in self-cleaning paint formulations, such as the integration of photocatalytic or hydrophobic properties, have enhanced their efficacy and durability. Moreover, the aesthetic appeal and convenience offered by self-cleaning paints make them highly attractive to consumers. With their ability to simplify maintenance and improve cleanliness, the self-cleaning paint segment continues to dominate the market.

- In 2022, the architectural segment dominated with more than 53% market share

Based on the end-use industry, the global high-tech paints & coatings market is segmented into marine, automotive, architectural, aerospace, energy, electronics, and healthcare. The architectural segment has emerged as the dominant force in the high-tech paints and coatings market, capturing the largest market share. This segment's dominance can be attributed to several factors, the architectural sector encompasses a wide range of applications, including residential, commercial, and institutional buildings. The demand for high-performance coatings in these applications, driven by factors such as aesthetics, durability, and protection, contributes to the segment's market share. The growing construction industry, particularly in developing economies, has significantly boosted the demand for architectural coatings. As urbanization continues and infrastructure projects expand, the need for advanced paints and coatings in construction and renovation activities further strengthens the segment's dominance. Moreover, the architectural segment benefits from technological advancements in coating formulations, offering features like thermal insulation, anti-microbial properties, and self-cleaning capabilities, catering to the evolving needs of the architectural sector. Overall, the architectural segment's widespread applications and the construction industry's growth propel its domination in the high-tech paints and coatings market.

Regional Segment Analysis of the High-Tech Paints & Coatings Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia-Pacific dominated the market with more than 62.5% revenue share in 2022.

Get more details on this report -

Based on region, Asia-Pacific has emerged as the dominant region in the high-tech paints and coatings market, capturing the largest market share due to increased industrialization and infrastructure development. The automotive and construction sectors in Asia-Pacific are experiencing rapid expansion, creating a substantial market for high-tech paints and coatings. Additionally, the region's large population and rising disposable incomes have resulted in increased consumer spending on aesthetically pleasing and durable surface finishes. Moreover, advancements in manufacturing capabilities, research and development initiatives, and the presence of major market players in the region further bolster market growth. Overall, these factors have positioned Asia-Pacific as the leading market for high-tech paints and coatings.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global high-tech paints & coatings market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- Abrisa Technologies

- AccuCoat Inc.

- Akzo Nobel N.V.

- Axalta Coating Systems LLC

- BASF SE

- Chase Corp

- Ferro Corporation

- GXC Coatings

- Hentzen Coatings Inc.

- Indestructible Paint Limited

- Kansai Paint Co. Ltd.

- Mankiewicz Gebr. & Co.

- Nippon Paints Holdings

- PPG Industries Inc.

- RPM International Inc.

- Shalimar Paints

- The Sherwin-Williams Company

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2022, PPG has recently finalized the acquisition of Arsonsisi's powder coatings manufacturing business, an industrial coatings company located in Milan, Italy. With this acquisition, PPG expands its product portfolio and gains access to Arsonsisi's advanced manufacturing capabilities. The integration of Arsonsisi's business into PPG enhances its ability to offer innovative powder coating solutions to customers in various industries.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global high-tech paints & coatings market based on the below-mentioned segments:

High-Tech Paints & Coatings Market, By Product Type

- Crack Detection Paints

- Self-Cleaning Paint

- Odor-Absorbing Paint

- Waterproofing Paint

- Thermal Insulation Paints

High-Tech Paints & Coatings Market, By Resin

- Acrylic

- Polyurethane

- Polyester

- Epoxy

High-Tech Paints & Coatings Market, By Technology

- Waterborne

- Solvent Borne

- Powder Coatings

High-Tech Paints & Coatings Market, By End-Use Industry

- Marine

- Automotive

- Architectural

- Aerospace

- Energy

- Electronics

- Healthcare

High-Tech Paints & Coatings Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?