Global Highway Driving Assist Market Size, Share, and COVID-19 Impact Analysis, By Technology (Adaptive Cruise Control, Lane Keeping Assist, Automated Lane Change, Traffic Jam Assist, Collision Avoidance), By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles), By Component (Sensors, Camera Systems, Control Units, Software, Radar Systems), By End Use (Personal Use, Fleet Management, Ride-Sharing Services), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Automotive & TransportationGlobal Highway Driving Assist Market Insights Forecasts to 2033

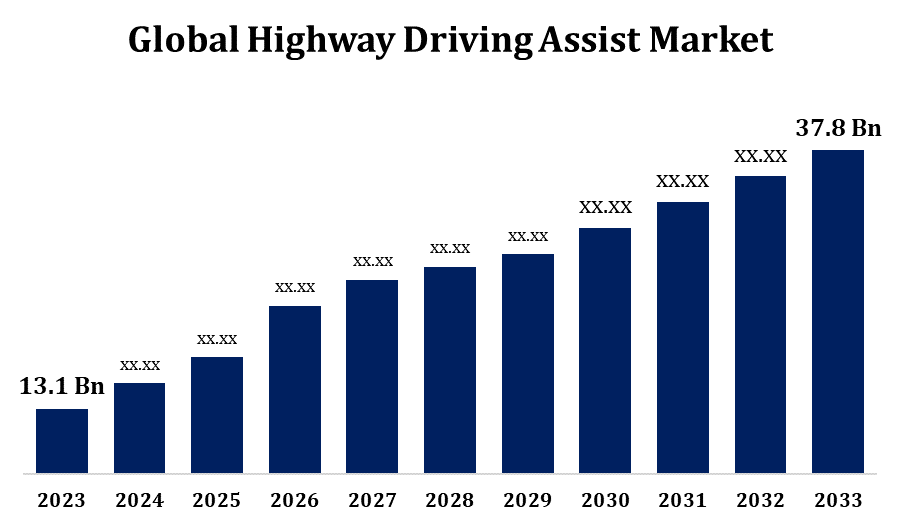

- The Highway Driving Assist Market Size was Valued at USD 13.1 Billion in 2023.

- The Market is Growing at a CAGR of 11.18% from 2023 to 2033.

- The Worldwide Highway Driving Assist Market is Expected to Reach USD 37.8 Billion by 2033.

- Asia Pacific is Expected to Grow the fastest during the Forecast Period.

Get more details on this report -

The Global Highway Driving Assist Market is expected to reach USD 37.8 billion by 2033, at a CAGR of 11.18% during the forecast period 2023 to 2033.

The Highway Driving Assist (HDA) market is witnessing significant growth, driven by the increasing demand for advanced driver assistance systems that enhance vehicle safety and driving comfort. HDA systems combine features such as adaptive cruise control, lane-keeping assist, and collision avoidance to support drivers during long-distance highway travel. These systems help reduce driver fatigue, prevent accidents, and contribute to a more seamless driving experience. Growing consumer awareness, advancements in automotive technology, and the push toward semi-autonomous vehicles are further accelerating market expansion. Leading automotive manufacturers and tech companies are actively investing in research and development to improve system accuracy, reliability, and user experience. Despite challenges such as high implementation costs and cybersecurity concerns, the HDA market holds strong potential due to evolving mobility trends and supportive regulatory frameworks.

Highway Driving Assist Market Value Chain Analysis

The Highway Driving Assist (HDA) market value chain comprises several interconnected stages that contribute to the development, production, and delivery of HDA systems. It begins with raw material and component suppliers providing essential parts like sensors, cameras, radar, and control units. These components are then integrated by system manufacturers who design and develop complete HDA solutions. Automotive OEMs collaborate with technology providers to incorporate these systems into vehicles during the manufacturing phase. Software developers play a crucial role by enabling system intelligence, including algorithms for object detection and vehicle control. The distribution network involves dealerships and aftermarket service providers ensuring product availability and support. Finally, end-users both individual consumers and fleet operators adopt these systems for enhanced safety and driving convenience. Regulatory bodies and standard organizations also influence the value chain by setting compliance guidelines.

Highway Driving Assist Market Opportunity Analysis

The Highway Driving Assist (HDA) market is poised for significant expansion, driven by advancements in autonomous vehicle technologies and increasing consumer demand for enhanced road safety. Opportunities in this sector are bolstered by the integration of sophisticated sensors, cameras, and artificial intelligence, enabling features like adaptive cruise control and lane-keeping assistance. The growing emphasis on semi-autonomous driving solutions presents avenues for manufacturers to innovate and cater to safety-conscious consumers. Additionally, supportive government regulations mandating advanced driver-assistance systems further stimulate market growth. However, challenges such as high implementation costs and regulatory complexities persist. Nonetheless, the continuous evolution of autonomous technologies and the rising trend toward connected vehicles position the HDA market as a promising domain for future developments.

Global Highway Driving Assist Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 13.1 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 11.18% |

| 023 – 2033 Value Projection: | USD 37.8 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 245 |

| Tables, Charts & Figures: | 113 |

| Segments covered: | Technology Analysis, Vehicle Type Analysis, Component Analysis, End Use Analysis |

| Companies covered:: | Continental AG, Robert Bosch GmbH, Valeo, ZF Friedrichshafen AG, Magna International, Toyota Motor Corporation, and Hyundai Motor Company |

| Pitfalls & Challenges: | COVID-19 Impact Analysis and Forecast 2023 - 2033 |

Get more details on this report -

Market Dynamics

Highway Driving Assist Market Dynamics

Rising Need for Enhanced Driver Support Technologies

The rising need for enhanced driver support technologies is a key driver of growth in the highway driving assist (HDA) market. As road safety concerns escalate and long-distance travel becomes more common, drivers are increasingly seeking systems that reduce fatigue and improve situational awareness. HDA systems, which include features like lane centering, adaptive cruise control, and collision avoidance, offer a safer and more comfortable driving experience. This demand is further fueled by the global push toward semi-autonomous vehicles and growing consumer interest in smart mobility solutions. Automakers are integrating these technologies into a broader range of vehicle segments, making them more accessible. As awareness of driver assistance benefits increases, and governments implement safety-focused regulations, the HDA market is expected to expand steadily, supported by continuous innovation and improved system capabilities.

Restraints & Challenges

Technical limitations are prominent; for instance, adverse weather conditions and low-light environments can hinder sensor performance, leading to inaccurate object detection and system responses. Additionally, the high costs associated with developing and integrating HDA systems may deter manufacturers and consumers, especially in cost-sensitive markets. Regulatory and legal complexities also pose significant hurdles, as varying standards across regions complicate compliance and deployment. Consumer acceptance remains a concern, with studies indicating that a substantial number of drivers disable or underutilize advanced driver-assistance features due to a lack of trust or understanding. Furthermore, cybersecurity threats present risks to system integrity, necessitating robust protective measures. Addressing these challenges is crucial for the sustainable advancement of the HDA market.

Regional Forecasts

Get more details on this report -

North America is anticipated to dominate the Highway Driving Assist Market from 2023 to 2033. The North American Highway Driving Assist (HDA) market is experiencing significant growth, driven by increasing consumer demand for advanced safety features and stringent regulatory standards. The region's strong automotive industry and rapid technological advancements contribute to the widespread adoption of HDA systems. Key components such as adaptive cruise control, lane-keeping assist, and collision avoidance are becoming standard in many vehicles. Major automotive manufacturers and technology firms are investing heavily in research and development to enhance these systems. However, challenges like high implementation costs and varying state regulations persist. Despite these hurdles, the North American HDA market is poised for continued expansion, supported by ongoing innovations and a growing emphasis on vehicle safety and automation.

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The growth is driven by increasing demand for advanced driver assistance systems (ADAS) and a heightened focus on vehicle safety. Key applications fueling this expansion include adaptive cruise control, lane-keeping assist, and collision avoidance systems. Technological advancements, supportive regulatory frameworks, and rising consumer awareness are further propelling market development. Countries such as China, Japan, and India are at the forefront, with China leading in market dominance. Major industry players, including Bosch Group, Continental AG, and Mobileye, are actively investing in research and development to enhance system capabilities.

Segmentation Analysis

Insights by Technology

The Adaptive Cruise Control segment accounted for the largest market share over the forecast period 2023 to 2033. This technology automatically adjusts a vehicle’s speed to maintain a safe following distance from other vehicles, enhancing both safety and comfort during long highway journeys. As traffic congestion and safety concerns continue to rise, the demand for Adaptive Cruise Control is increasing across various vehicle segments. Its integration with other systems like lane-keeping assistance and emergency braking strengthens its value in semi-autonomous driving. Technological advancements in radar, lidar, and camera systems have further improved its accuracy and responsiveness. Moreover, government safety regulations and consumer demand for advanced driver assistance features are encouraging automakers to include Adaptive Cruise Control as a standard offering, thereby boosting its adoption and driving market growth.

Insights by Vehicle Type

The passenger cars segment accounted for the largest market share over the forecast period 2023 to 2033. Increasing consumer demand for advanced safety and convenience features has led automakers to integrate HDA systems into a broader range of vehicles, including mid-segment models. Technological advancements have enhanced the accessibility and affordability of these systems, making them more appealing to a wider customer base. Additionally, regulatory mandates promoting vehicle safety have accelerated the adoption of HDA features in passenger cars. The expansion of electric vehicles has further bolstered this trend, as many EVs come equipped with advanced driver-assistance technologies. Overall, the passenger car segment is poised to drive substantial growth in the HDA market through increased adoption and continuous innovation.

Insights by Component

The sensors segment accounted for the largest market share over the forecast period 2023 to 2033. Advanced sensors including radar, LiDAR, cameras, and ultrasonic devices are essential for enabling features like adaptive cruise control, lane-keeping assistance, and collision avoidance systems. Technological advancements have significantly improved sensor accuracy, reliability, and cost-effectiveness, facilitating broader integration into various vehicle models. The increasing adoption of semi-autonomous and autonomous driving technologies further propels demand for sophisticated sensor systems. Additionally, regulatory mandates emphasizing vehicle safety and the rising consumer preference for advanced driver-assistance systems contribute to the expansion of the sensors segment within the HDA market. Collaborations between automotive manufacturers and sensor technology companies are accelerating innovation, ensuring that sensor solutions meet the evolving requirements of modern vehicles.

Insights by End Use

The personal use segment accounted for the largest market share over the forecast period 2023 to 2033. As individual consumers increasingly prioritize vehicle safety and convenience, there is a heightened demand for advanced driver-assistance systems. Features such as adaptive cruise control and lane-keeping assistance are becoming more prevalent in personal vehicles, enhancing the driving experience during highway travel. Automakers are responding by integrating these technologies across a broader range of models, including mid-segment vehicles, making them accessible to a wider audience. Additionally, advancements in sensor technology and software solutions have improved the reliability and affordability of HDA systems, further encouraging adoption among personal vehicle owners. This trend is expected to continue, contributing substantially to the expansion of the HDA market.

Recent Market Developments

- In June 2019, Robert Bosch showcased its fifth-generation radar unit designed for advanced applications like cross-traffic assistance and high-speed adaptive cruise control, supporting functions up to highly automated driving.

Competitive Landscape

Major players in the market

- Continental AG

- Robert Bosch GmbH

- Valeo

- ZF Friedrichshafen AG

- Magna International

- Toyota Motor Corporation

- Hyundai Motor Company

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Highway Driving Assist Market, Technology Analysis

- Adaptive Cruise Control

- Lane Keeping Assist

- Automated Lane Change

- Traffic Jam Assist

- Collision Avoidance

Highway Driving Assist Market, Vehicle Type Analysis

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

Highway Driving Assist Market, Component Analysis

- Sensors

- Camera Systems

- Control Units

- Software

- Radar Systems

Highway Driving Assist Market, End Use Analysis

- Personal Use

- Fleet Management

- Ride-Sharing Services

Highway Driving Assist Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Highway Driving Assist Market?The global Highway Driving Assist Market is expected to grow from USD 13.1 billion in 2023 to USD 37.8 billion by 2033, at a CAGR of 11.18% during the forecast period 2023-2033.

-

2. Who are the key market players of the Highway Driving Assist Market?Some of the key market players of the market are Continental AG, Robert Bosch GmbH, Valeo, ZF Friedrichshafen AG, Magna International, Toyota Motor Corporation, Hyundai Motor Company.

-

3. Which segment holds the largest market share?The passenger cars segment holds the largest market share and is going to continue its dominance.

Need help to buy this report?